#0 (old) - NuRAN, what's the dealio?

Last updated: Aug 4, 2023

One of my sizeable investments gambles has reached a new low of $1.37. My average cost is $2.40 and my initial position (at cost) was about 40% of my portfolio. Trust me, I know how stupid this looks.

I remember a few months ago someone said “$1.25 is coming”. At the time the stock price was around $1.7ish, and I remember thinking: “What a fool! $1.25? Get outta here!”.

And here we are today. $1.25 is in sight, and with the sentiment around the stock, I hope we don’t go lower.

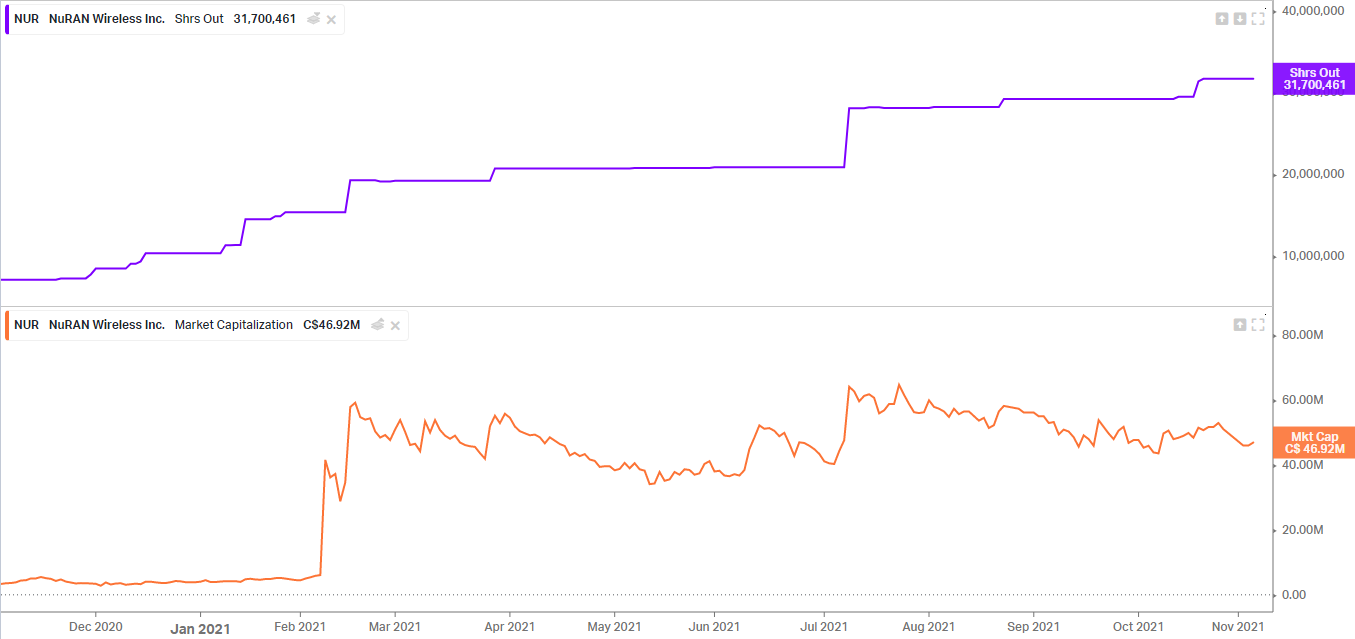

Wanna know how to lose half your money? Easy. Keep a constant market cap, and double the number of shares outstanding.

Hindsight is so easy. It’s easy for me today to see how and why we got to the current price.

There have been hiccups and not every promise has materialized yet, but that is irrelevant now. I’d rather focus on the data and the valuation.

The story

In August 2020, the company essentially went bankrupt after defaulting on its senior secured convertible debentures and failing to reach an agreement with the creditors. All board members and officers of the company resigned, except for Francis Letourneau who became the CEO and CFO of the Company. Mr Letourneau had been VP of Sales and Marketing at Nuran since 2011. Technically speaking though, the entity that was bankrupt was not NuRAN itself but its wholly owned subsidiary Nutaq.

In October 2020, NuRAN somehow managed (this time) to get the support of its creditors to resume the entire operations of Nutaq. This might have been thanks to a 10-year contract with Orange in Cameroon (announced at the same time) for a 122 sites and a total of CAD$20M over the contract’s duration. The agreement features a revenue sharing structure with guaranteed minimum monthly fee to cover each site’s opex and financing costs.

In February 2021, the company announced a big ass $500M 10-year contract with Orange for 2,000 towers in DRC. In case you didn’t know, DRC is a country in Central Africa with a population of 90M, USD$560 GDP per capita, and ranked 170/180 on corruption.

The buildout phase for the 2K sites in DRC is expected to take 40 months. The company and Orange agreed on a buffer period of 3 months to get the ball rolling following the contract signature, which brings us to mid-May 2021 as the start of the period. From there, assuming a cold start period of 10 months, the company needs to be able to build between 50 and 100 sites per month to reach the target.

As well, the company announced that the Cameroon contract with Orange was extended to 242 sites.

The stock pretty much 10x-ed overnight, from $0.3 to $3. The lucky convertible debenture holders received 2.0 million shares to settle a total debt of $1.9M.

The business

Nuran builds and operates rural cellular towers which they monetize by allowing mobile network operators (called MNOs, such as Orange, MTN, or Vodacom) to use them in exchange of a revenue split or a fixed recurring fee. This model is called network as a service because it allows the MNOs to access the network with minimum upfront capex.

Nuran claims that its offsite solar-powered low-consumption cellular site costs about $25K or 5x less in CAPEX and 3x less in OPEX than a traditional towerco cellular site, which would not be economically viable in these poor areas.

Based on what the company describes as conservative assumptions, which include an estimate of the population per site, the penetration rate (assumed to be around 25%) and the ARPU (annual revenue per user), the revenue per tower is expected to be around CAD$20K, annually.

Using these assumptions, the payback period for each site is about 19 months. Using the minimum guaranteed monthly fees, the payback period is about 60 months.

The company also estimates EBITDA margin to be around 50%.

Let’s do some quick math: 2000 sites, times $20K, times 50% margin = CAD$20M/year of EBITDA.

Important detail: there is an asset transfer that occurs midway through the contract. That is, although NuRAN gets payed for the full duration of the contract, at the end of it, the towers belong to Orange. So the revenues are for 10 years exactly, no more.

The initial 2K sites are estimated to cover 10M people. There is 45M people yet to be connected in DRC (half the country) and the company estimates that this could mean 5K to 7K additional sites (on top of the 2K under contract).

The company estimated the required financing for the 2K sites to be around CAD$50M. But it also has a 5-year target of 10,000 sites, for which it will require CAD$150M of financing. This financing will come in the form of debt and equity financing, but the equity will be raised at the African subsidiaries, which can be done at a higher valuation than if it was done at the parent company. Nevertheless, it means the parent company will not receive 100% of the revenue and EBITDA of the local projects.

2021 so far

The company’s intial target was to deploy 122 sites in Cameroon by the end of the year. In February 2021, the company published a corporate video assuring us that the financing was already well under way and that the company had already received a lot of interest from both local banks and international development banks, and had even received multiple term-sheets. The company also promised (near the end of the video) that they were on everybody’s lips in the industry and that a lot of of other operators and other countries would be coming soon.

In March 2021, in this video, Francis shared that he expected the first 48 sites in Cameroon to be built by September, and the full batch of 122 by the end of the year.

In April’s corporate video, Francis was still targetting 120 sites by the end of the year. In the company’s progress report, the following language is used: “The company continues to take steps in the delivery of the project with Orange in Cameroon now implementing the first 48 sites with the first shipments of equipment arriving in country and being cleared through customs.” Several ongoing RFPs with Tier-1 and Tier-2 operators in several countries in Africa were also mentioned.

For the first batch of 122 sites, based on initial survey data, the company has estimated a higher population density and penetration rate than originally expected, potentially leading to 50% higher revenue.

On June 29, the company made a private placement at a price of $1.53 per unit (1 share + 1 warrant @ $2.40) for a total of $11M, $4M of which came from Amos Spacecom, a satellite operator which became NuRAN’s defacto exclusive satellite provider, as the lead order. The private placement was offered at a significant discount, somewhere between 15% and 20% to the stock price at the time when the deal was locked. On the other hand, the company now has an aligned partner for all its satellite needs.

On July 15 and July 20, the company announced several MOUs with different operators in Africa, inlcuding MTN.

In August 2021, NuRAN published a corporate update where it reiterated that the initial 48 sites in Cameroon should be completed and live by the end of October, while the remaining batch of 74 should be delivered before the end of the year. For DRC, the company shared that the target was 50 sites in 2021.

In September’s corporate update, we learned that the first site in Cameroon went live, with penetration rate of 47% in the first few days of operation. In this video update, Francis reiterated the target of 122 sites in Cameroon and 60 sites in DRC by year end.

In October’s corporate update, we learned that there were only 5 sites live by the end of October, with penetration rates around 35%. The update also shared that “the first 122 selected sites in Cameroon showed an average of 5500 inhabitants per village for a total of 678K population. With a 24% forecasted penetration rate and a regional average ARPU of approximatively 2.80$ CAD, the potential yearly revenue for NuRAN for those sites is now over 3.8M.” However, the target for the full batch of 122 sites has now been moved to “early 2022” (this update sent the stock 7.43% down). On the positive side (I guess), the company has secured a tiny financing of US$2.3M to fund the first batch of Cameroon sites. We are told that this financing was contracted with a pan-African bank, which hopefully could help with DRC as well. The only happy people at the end of October are the remaining debenture holders, which received 2,259,091 NuRAN shares (price of $1.60/share) in exchange for their $745,000 of principal and interest owing. Not a bad return for them!

Valuation

EV/EBITDA approach

Disclaimer: everything below is just my own opinion and estimates.

Here’s what I think can be expected regarding Cameroon and DRC. I will focus only on these two and ask what is the fair price we should pay today for these contracts, assuming the plan goes as expected but using some conservative assumptions.

-

I expect the first batch of 122 sites to be live somewhere in H1 2022, and the full 242 sites by end of 2022

-

I’m not sure what to expect for DRC, since we don’t have a single tower live yet. We know the company has burned 5 months already out of the budgeted 40, which leaves 35 months. Let’s just round it to 3 years and say that we need to have 2000 sites live by end of 2024. I will push it back by 1 full year and say that we will have the full 2000 sites only in 2025. So the total will be around 2250 sites in 2025

Each site should generate $20K of revenue on average. I will assume a conservative EBITDA margin of 35% instead of the 50% mentioned by the company.

So this brings us to: (2250 sites) x ($20K / site) x (50% ownership) x (35% EBITDA margin) ~ CAD$7.875M EBITDA/year

There are 31.7M shares outsdanding as of today, according to the CSE, and about 11.5M more reserved for issuance. I think 7.2M of those are warrants from the private placement, and the remainder is probably performance bonuses for the CEO. Let’s assume the warrants never exercise and say the fully diluted count is 36M. Let’s also assume 15% dilution per year for the next 4 years. That should bring us to about 63M shares by the end of 2025.

Company debt should stand around $CAD 50M by then, and let’s assume no cash at the end.

Now the last question: what multiple should we slap on this recurring EBITDA? (we have to take into account it’s not recurring forever but only for 10 years for each site from the deployment date). I don’t know, let’s say 15?

So EV = 15 x EBITDA = 15 x $8M = $236.25M

Minus the debt: $160M - $50M => MC = $186.25M

=> Price per share (end of 2025) = $1105M / 80M = $2.96

=> Price per share now (with a 15% discount rate) = $2.96 / (1.15)^4 = $1.69

We have to add back current net cash, which should stand around $7M as per the Q3 financials. Divided by 36M shares, that’s 0.19$/share.

=> Fair price as of today = 1.69 + 0.19 = $1.89, based on 2250 sites by end of 2025.

Note: the company has shared here that it will most likely need to raise some equity at the African subsidiary level to finance the project, at a higher valuation than on the public market. This means it will give away up to 49% equity (and EBITDA) at the project level. Maybe a way to incorporate this would be to say that it would lower the discount rate? In the analysis above, I have simplified by assuming the company would retain 100% of the project’s EBITDA.

DCF approach

Maybe we can circumvent the need to find the right EBITDA multiple by using a simple DCF approach.

We know that each tower requires $25K of CAPEX and generate $20K of revenues per year for 10 years, and let’s assume 35% EBITDA margin of $8.75K.

With a 15% discount rate, that gives us a present value of about $68.9K per tower.

Assuming 560 towers per year between 2022 and 2025, we can again actualize all that at 15% which gives us a total present value of about $110M.

Given that the last batch will be built in 2025 (4 years from now) and generate cashflow for 10 years, we have to account for 14 years of company-level OPEX.

In the most recent 10Q, we can see about $1.5M of SG&A expenses and $3.5M for share-based compensation. So about $5M per year, which I’ll keep these constants for the next 14 years, giving me a present value for OPEX of $28.6M.

So excluding taxes, we get $110M - $28.6M = $81.5M in net present firm value.

We then have to bring debt and cash into the picture. If the $50M of debt is layered in four tranches of $12.5M per year, the present value of debt is $35M.

Add $3.5M of net cash as of today and we get $81.5 - $35M + $3.5M = $50M in present equity value.

=> Price per share now = $50M / 36M = $1.39 per share

I personally prefer this approach as it buypasses the need to choose an EBITDA multiple, and it also takes into account the limited economic life of the towers. Based on this price, it appears the market believes the company can execute on the current contracts, but no value is attributed to optionality.

A word on the jockey

Francis, the CEO, seems a like a good guy and I think he executed well enough. But it’s his first rodeo as CEO of a publicly traded company and I think the company would have benefitted from being more conservative in their timeline.

I get it. I worked in a startup and was fairly close to the founders. It’s a delicate balance between inspiring the troops, keeping them fired up and not overpromising.

Conclusion

Based on this and the current share price of ~$1.40, there is not much margin of safety. It remains a speculative bet in my opinion.

However, we’re not paying much for optionality, which could be fairly big. I haven’t touched on LATAM, but it could be a potential expansion opportunity down the road. I just think it’s too soon to think about that.

All in all, the thesis relies heavily on the company’s ability to secure additional contracts with other MNOs and in other countries. Achieving such milestones would significantly derisk this bet. It is also possible that some of my assumptions were too conservative (in particular the revenue per site).

I will hold for now.

Had I done this analysis before, I would not have jumped in as quickly as I did, and I’d have avoided a tremendous amount of pain. No better teacher than pain, though.

Lesson learned.

2021-11-06

It seems that while only 5 towers are live in Cameroon as of today, more have been built and the hold up is because of batteries that have not been delivered (due to whatever logistic fuck up happened in China…we heard of a fire on a tarmac, but whatever). I wish the company at least communicated how many towers have been built so far. Anyway, not a huge deal.

2021-11-12

Disqus comments are disabled.