#105 - Ramblings Jan2024

Last updated: Feb 29, 2024

Shared by @MnkeDaniel on X (archive).

From Atai Capital website:

In an ideal scenario, I’ll get to purchase a company for much less than its current value today, and I won’t have to rely on overly optimistic assumptions to generate significant returns.

Wow! Found a really interesting guy: Jacob McDonough - can’t believe he only has 2.5k followers; he deserves 100x that!

Jacob wrote a book called Capital Allocation - The Financials of a New England Textile Mill, which I can’t wait to read (yes, it’s about Warren Buffett).

If that was not interesting enough, Jacob has written THREE writeups on his largest holding: Beenos INC., a Japanese holding company, where the most interesting subsidiary is an e-commerce called Buyee, connecting foreigners with Japanese businesses.

Here are the three writeups: writeup 1 (archive), writeup 2 (archive), writeup 3 (archive).

Before I read his writeups, I looked at the numbers on Koyfin and - holyshit, this is looking REALLY good!

I think I can take a position right away.

JP Morgan CEO on the U.S. Economy

Shared by David Senra of the Founders Podcast.

What are you doing Sammy?!

I had to save it: archive.

“He will remember this moment for years”

Shared by Brad Kaellner

Jack Duffley (from PunchCard Investing) shared this candid recount of his steam cleaning business venture, to date.

From this tweet:

The steam cleaning business I bought about 1 year ago has been a disaster.

I’ve sunk nearly $300k into the thing.

No profit.

And more losses expected.

Here’s what I’ve learned so far and what I plan to do to stop the bleeding:

- DON’T UNDERESTIMATE THE PREVIOUS OWNER’S ROLE

I did not appreciate the amount of effort the previous owner must have been spending towards generating business.

Sales are about 50% lower than the previous couple of years, and that’s with even more ad spending than what the previous owner was doing.

That hurts.

The previous owner was fairly well connected in town. He got a lot of his acquaintances to use the service.

The problem is, I’m not as well connected and I wasn’t planning on taking an active role in the business.

I knew I had to do something about that.

But, have no fear, I had a plan to address that!

- NO LEADER = NO PROGRESS

I hired a general manager right from the get go.

I was working in big law at the time and knew I wasn’t going to spend too much time towards this business.

Problem: I did not offer this manager equity and allowed for a largely part time arrangement. He had another job to worry about in the meantime.

We agreed that, once sales grew past a certain point, he’d switch to full time.

I was naïve in waiting for that to happen.

If someone isn’t incentivized like an owner, why would he or she act like one?

How would sales increase that much without someone really driving things forward?

While I greatly appreciate the work he has done, it has not been enough given the crushing sales situation.

We need someone in there who has equity [or at least the explicit ability to earn some].

That someone will be motivated to push things along every day.

I did not align incentives here properly. Going forward, I’m going to focus much more on that and won’t be too scared of giving up equity.

After all, 100% of a perpetually money losing operation is worth a lot less than 60% of a highly profitable enterprise.

But it will take even more investment to turn things around.

That said…

- THROWING MONEY AT IT IS NO GUARANTEE OF SUCCESS

We “tried” a few things this year to boost sales.

It mostly involved hiring a bunch of contracted sales help and bumping up ad spend (with very limited marketing materials).

It was a fairly lazy attempt to try and turn things around immediately.

Unfortunately, that doesn’t work.

A sales team needs months to work out what is and isn’t effective.

Leads take time to nurture.

Ad campaigns need quality copy to work very well at scale.

Spending a bunch of money one month before switching to the next thing doesn’t give much time to learn how to improve. And it’s expensive.

I know this business can be profitable. It’s not rocket science. It’s steam cleaning.

There are plenty of steam cleaners in our area making fine money.

I need to give properly incentivized people time to work and test things out.

WHERE WE’RE AT NOW

We’re bringing on a new manager this month.

He has an opportunity to earn a large chunk of the business’s equity as financial progress is made.

He has experience running teams and working in and around home services.

And this is expected to be his main focus.

I’m optimistic that we can turn things around this year, but it will take time.

I can’t expect a turn around in a month or two.

It might take beyond this year to get things where I’d like them to be.

I need to focus on making sure incentives are in the right place for each person and then be OK with time passing.

Trying to sell the business to someone else is another option, but I can’t expect a very lucrative sale given how rough things look on paper.

And if I really can’t stomach things anymore, I could always shut the whole thing down and call it a day.

But momma didn’t raise no quitter (famous last words).

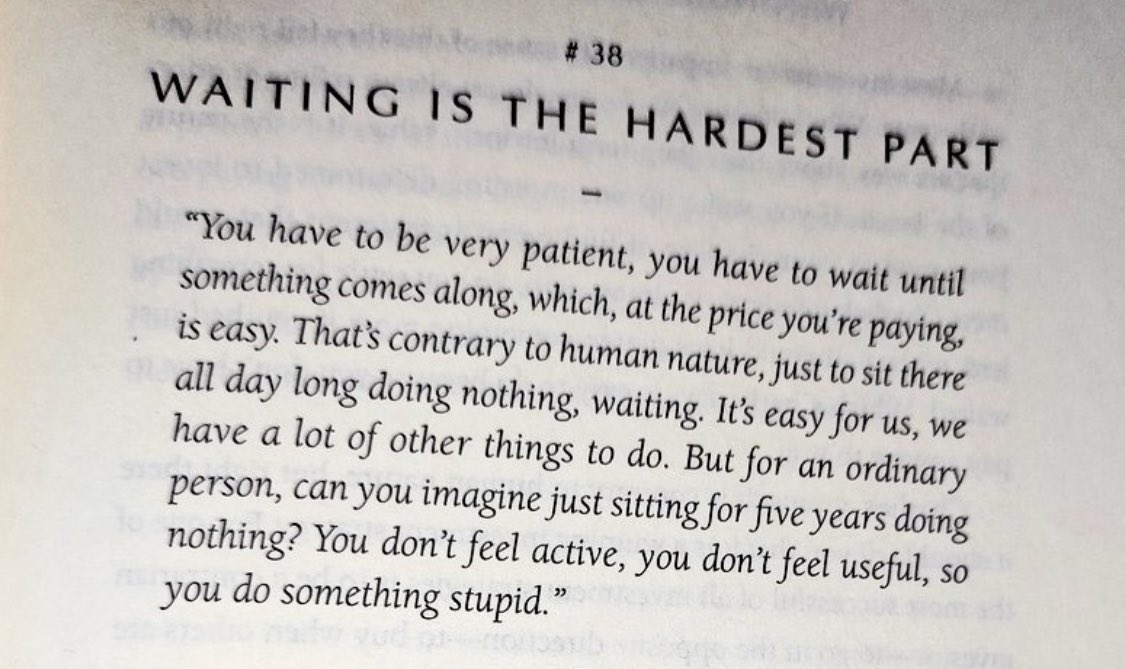

From Focused Compounding:

They write about it or talk about it. And this is something that people won't want to admit but here's the thing.If you own a stock, a lot of times times the answer is just it’s cheap, something will happen. That’s actually a good bet to make in markets, most of the time.

You’re not allowed to make that bet if you talk about it. You have to make up a story about why it will go up in the next 6 months. I have no idea why it will go up in the next 6 months or if it will go up or what will happen in the world and stuff. But…something could happen. And that often is the right bet in terms of what you should be doing.

If you could find many many different ones to make, some of them will pay off that way - instead of having a very narrow answer to what you need to invest in.

End-to-end (front, mid and back-office) revenue cycle management for hospitals (collecting money from insurance companies, Medicare, patients).

Pitched by Voss Capital on YAVB.

Interesting writeup here on No Deep Dives (archive).

I intend to listen to a couple of earnings calls.

Red flags: EV seems high (debt) and free cash flow isn’t looking great (negative most of the time).

Maybe more of an asset play (rather than earnings)?

Also featured on Seeking Alpha (archive).

And here’s an interview with Aengus Kelly, the CEO, from 3 weeks ago: link.

I don’t know what I’m missing but this one doesn’t look particularly cheap to me on first glance (i.e. looking at Koyfin or even QuickFS).

A couple of videos I’m going over:

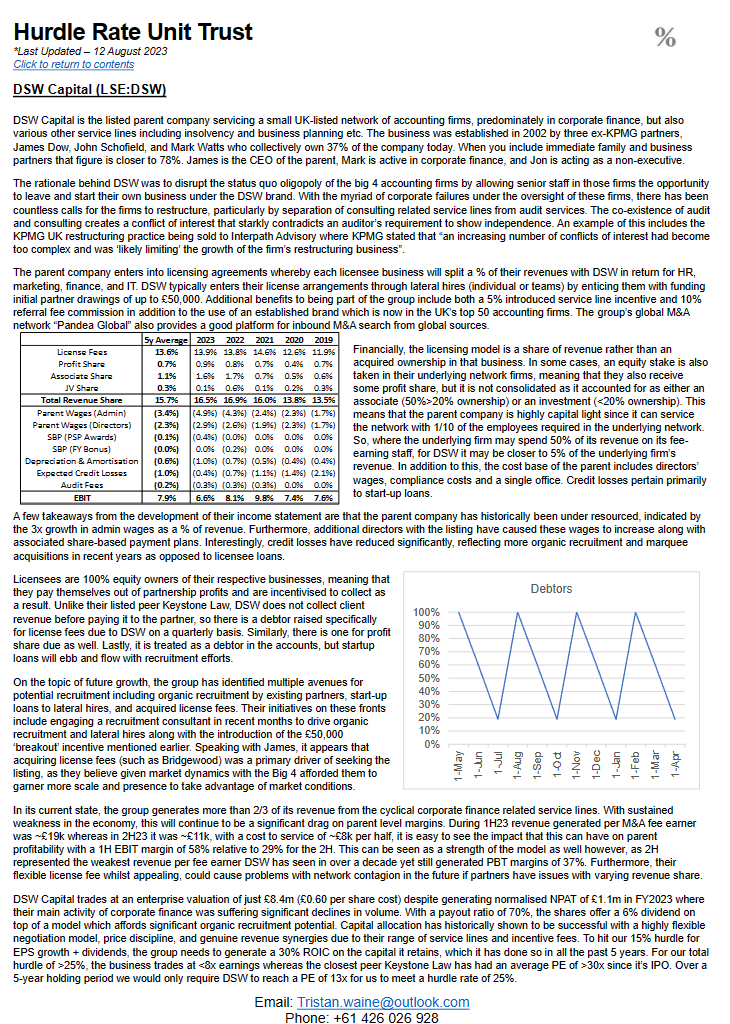

The original write-ups from Feathertop Capital (archive)

The new ticker is $5GN.AX.

The presentation of the acquisition can be found here (archive).

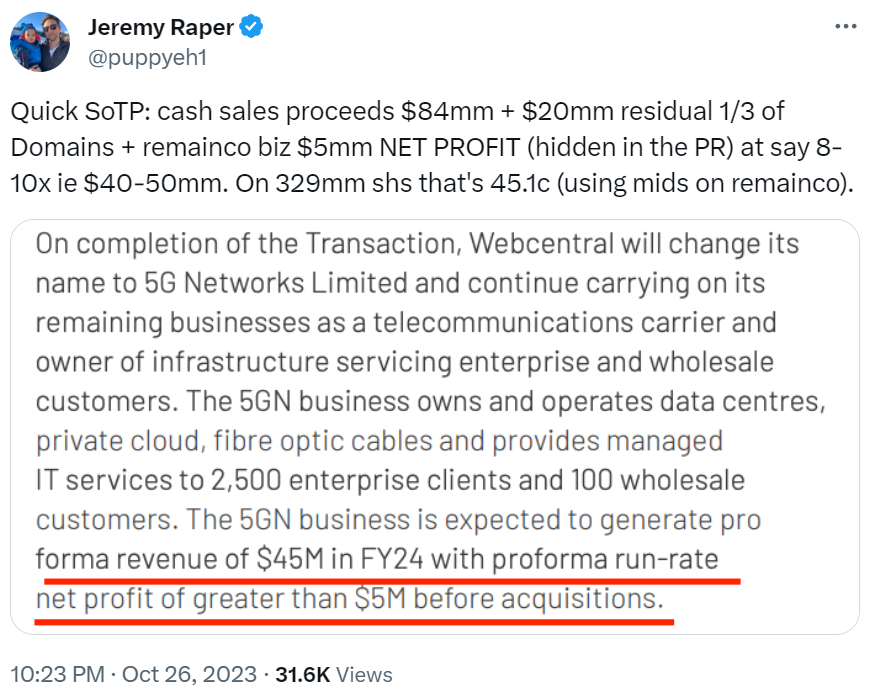

This tweet caught my attention today.

It was written up by Jeremy Raper before.

Clark Capital has a comprehensive writeup) (archive).

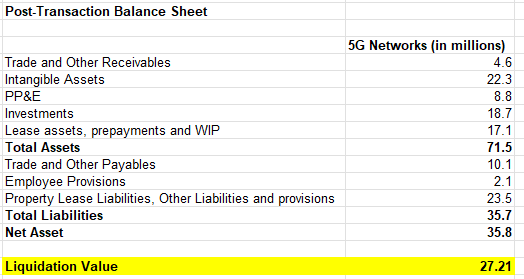

He used liquidation value for the remainco (80% of book value): $27m.

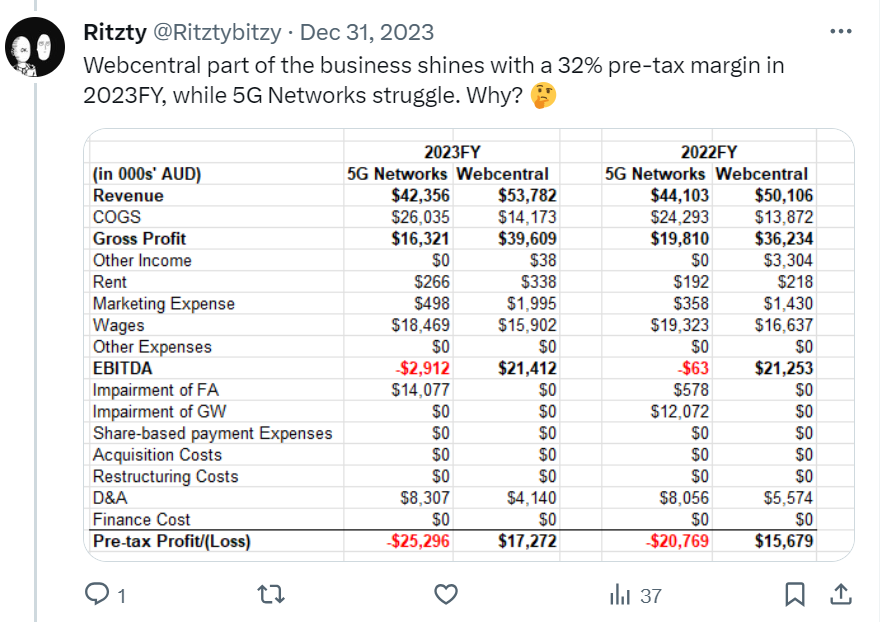

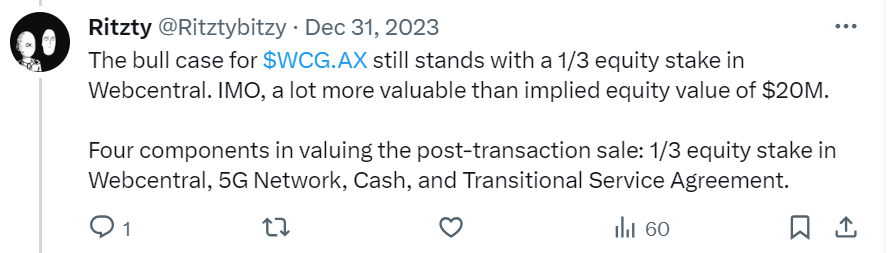

A more recent deep dive by @Ritztybitzy: thread.

The full writeup can be found on his website (archive).

The company will distribute a special dividend of $0.02 (current share price: $0.24).

A timeline of significant events:

- July 2020: Web.com to acquire Webcentral for A$0.10 per share.

- August 2020: Keybridge aquires 5% of Webcentral and votes against the acquisition, against the opinion of the board of Webcentral.

- Sep 2020: proposal from 5GN to acquire all shares of Webcentral, 1 5GN share for every 12 Webcentral shares, which is considered superior to the offer of Web.com.

- Sep 2020: counter-proposal from Web.com of $0.155 (then revised to $0.18) per Webcentral share.

I found this Youtube video on $5GN.AX from 3 years ago.

Also found their FY2019 AGM (archive) as well as their 2018 annual report (archive).

From their 2023 Annual Report (archive), adj EBITDA in 2023 for remainco (data centres + managed services) was -$3M. Not great, but not catastophic.

Here’s my calculation:

- 400m shares full diluted

- $75m cash

- $20m equity (growing)

- remainco at 55% of book value = $20m

Total: 75 + 20 + 20 = $115m / 400m shares = $0.2875

Some serious, serious insider buying in the past year by James Pattison, a Vancouver billionaire.

From 247wallst:

Westar Management Ltd., a subsidiary of the Jim Pattison Group, provides management services to Westshore LP, which runs the business for Westshore Terminals. Westar has done so since 1993.[…]

Jim Pattison and his related entities must keep their ownership stake above 33.3% to continue providing management services.

The company announced a new acquisition yesterday: announcement: acquisition of “Security Shift Pty Ltd and associated entities for $4m representing a 3 times EBITDA multiple or 1 times revenue.”, 69% with cash and and the rest in shares.

A bit annoying that they would use shares at such a low valuation…

“Mr Chris Wright, CEO of Security Shift will continue in his role and will also join the 5GN executive team.”

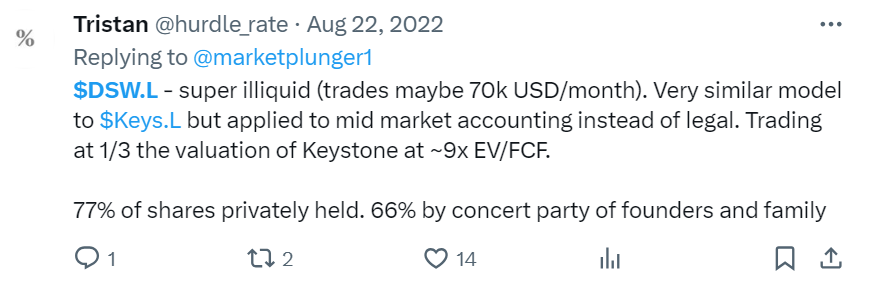

I see this ticker pop up on twitter from time to time, here for example.

Looking at the stock performance, it is pretty sad that I sold this to buy more of tinybuild.

Mikro Kap David had published a deep dive back in October: here (archive).

I should have paid more attention. The stock is up quite sharply since then. I remember thinking that it was not that cheap. Yet…here we are. And the one that was seemingly much cheaper…well, I marked it down to a donought.

Meh - if I didn’t have access to stock prices, I can’t say I would have any regrets based on the business performance alone (FCF yield and growth).

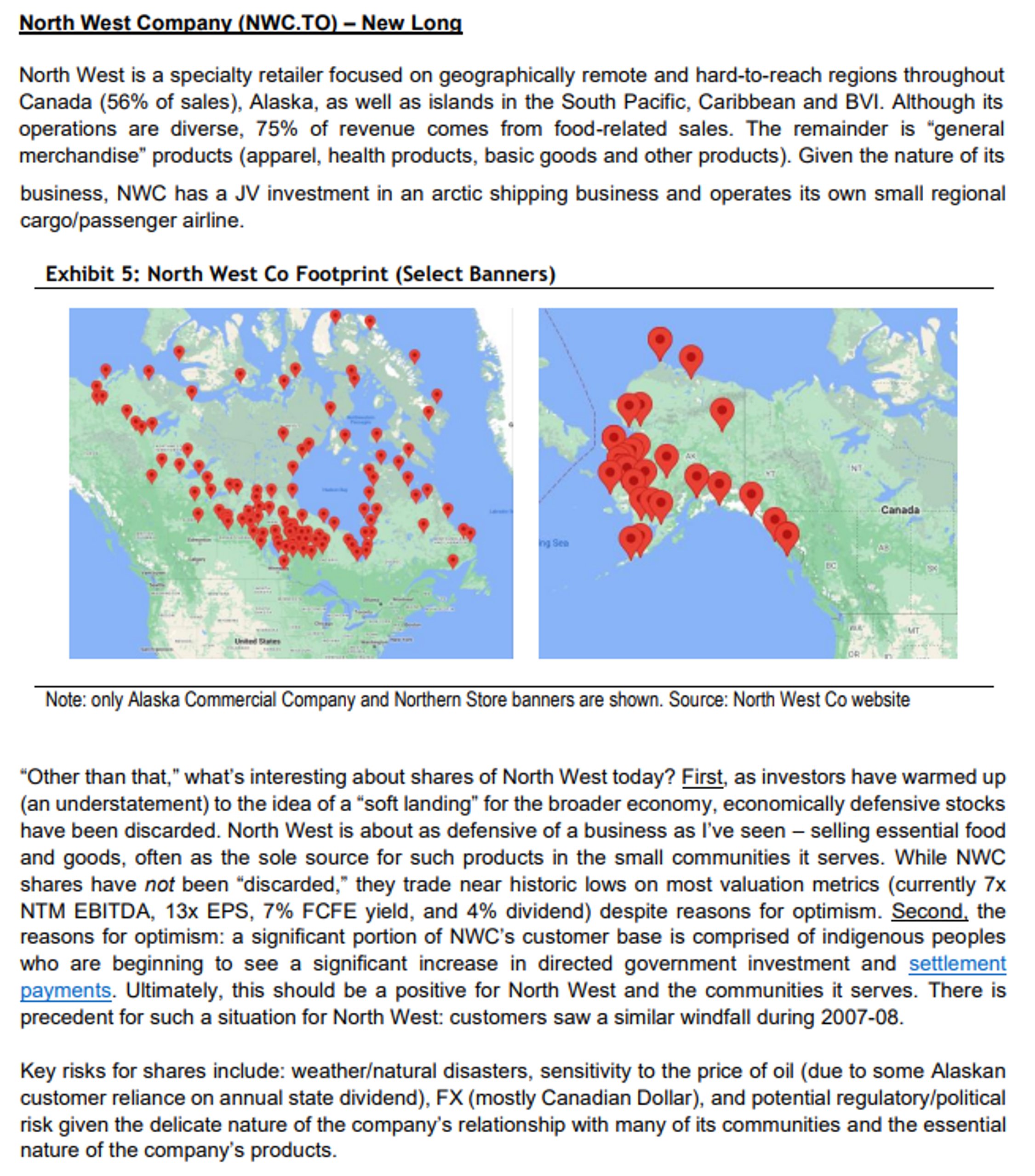

Upslope Capital on North West Company $NWCQuote $NWC (extract from their Q4 letter):

From Chris in Montreal:

Here’s TD’s take:

I like both the chart and the valuation is not awful:

An interview with the CEO here.

But it’s a $100B+ company. I’m not in a rush to buy it.

From this tweet: Aucnet operates multiple Digital B2B auction platforms currently focused on Auto, Consumer goods, and electronics.

I like what I’m seeing here:

Gross profit margin not as good:

Their investor relations are in english too: link

I’m almost certainly putting a bit of mone on this one.

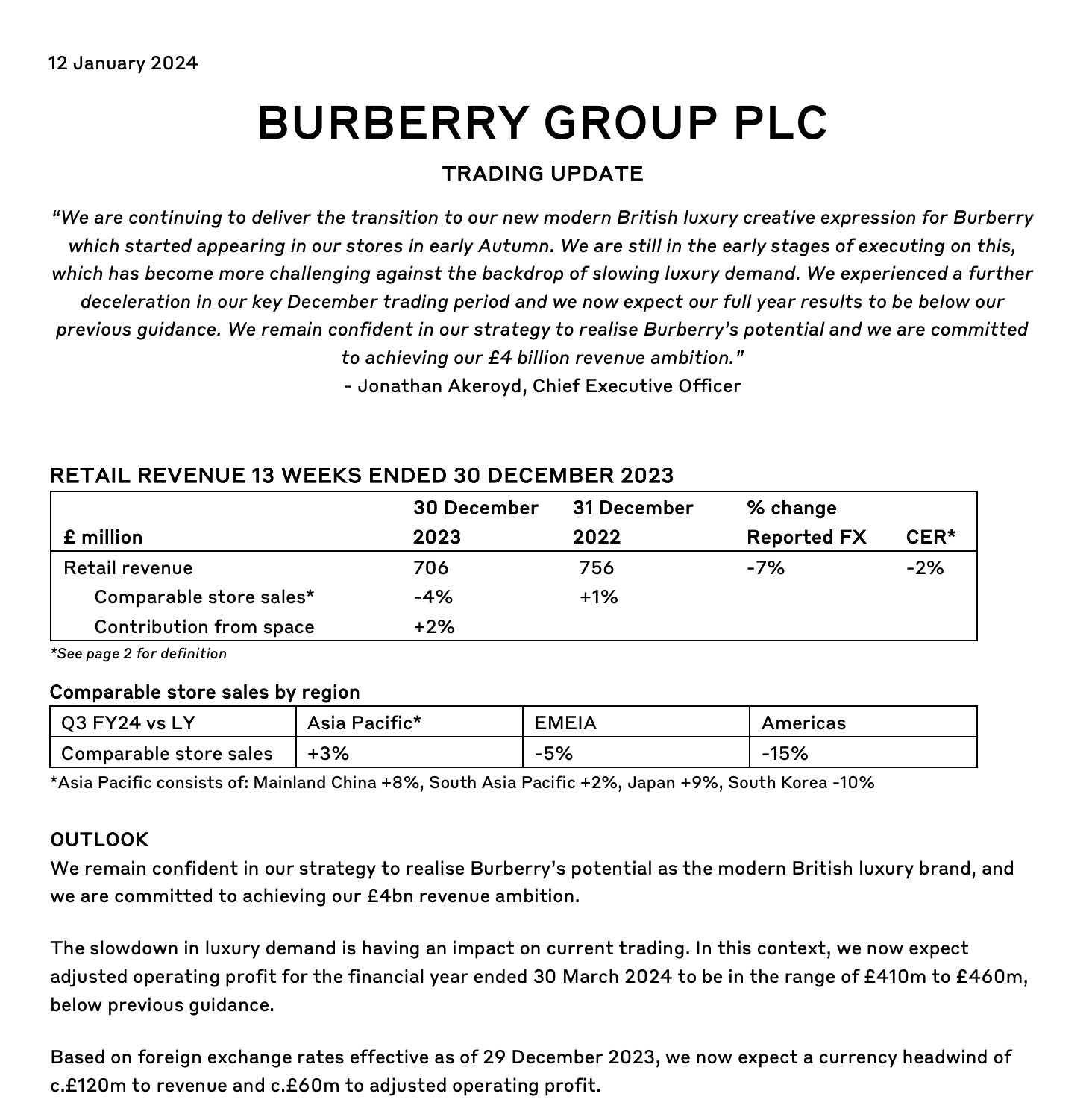

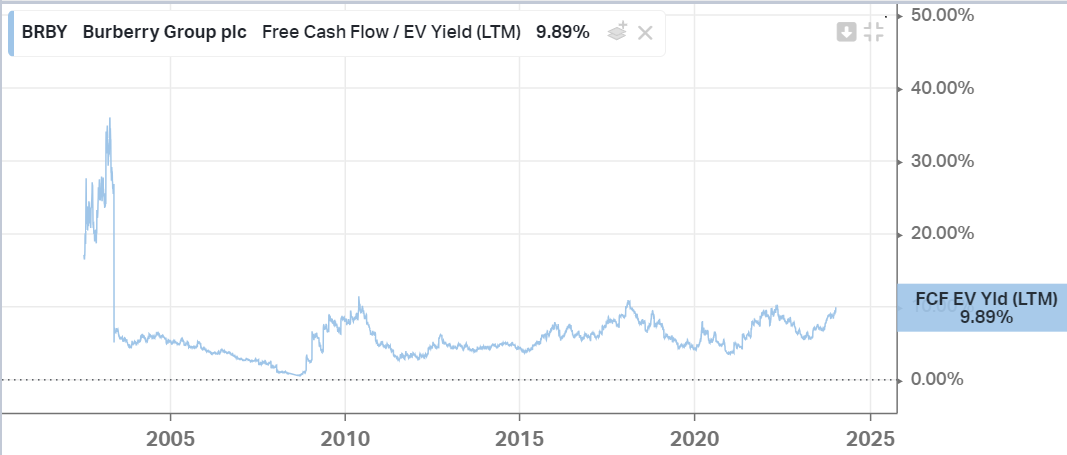

Burberry CEO: “We experienced a further deceleration in our key December trading period and we now expect our full-year results to be below our previous guidance”

Valuation seems interesting!

However I compared it with $DOCS.L and it seems to me that Docs has grown much faster in the last 10 years.

A cheap business: Smiths News, written up by Value Zoomer (arhive).

~20-ish% FCF yield and 4.x P/E with declining revenues but relatively stable profitability!

- apparently returning capital to shareholders?

A nice article from edisongroup (archive).

The presentation for FY'23 can be found here (archive) and their 188-page annual report is here.

They have £37.3m cash vs £40.2 of debt, so £2.9m of net debt (excluding lease liabitlies).

Market cap is £115m, so EV ~ £118m (Koyfin shows £141m, I think they include lease liabilities).

FCF reporeted in ‘23 was £21.8m (again different from Koyfin’s number).

=> FCF/EV yield ~ 18%

Ahhhh…just got completely turned off:

The portfolio of @HariSeldomRight. I need to take a look at some of these:

I guess Alpha Pro Tech $APT looks decent but I’d have to know more about the business.

@DataDInvesting shared a post on $SOFI (i.e. they beat guidance everytime) but after looking at the numbers I wasn’t too enthused. Too far away from profitability. PASS.

A bunch of Italian stock here shared by @LionCubsFund.

- Diasorin $DIA.MI: interesting; EV/EBIT ~ 20x, very nice growth

- Recordati $REC.MI: same

- Moncler $MONC.MI: same

- Cembre $CMB.MI: growing and cheap at EV/EBIT ~ 12x but FCF yield is below 5%

- Carel Industries $CRL.MI: a tiny bit too expensive

- Sesa $SES.MI: looking good

- Davide Campari $CPR.MI: also growing fast but FCF took a hit recently

- Technoprobe $TPRO.MI: too expensive

See Jacob McDonough

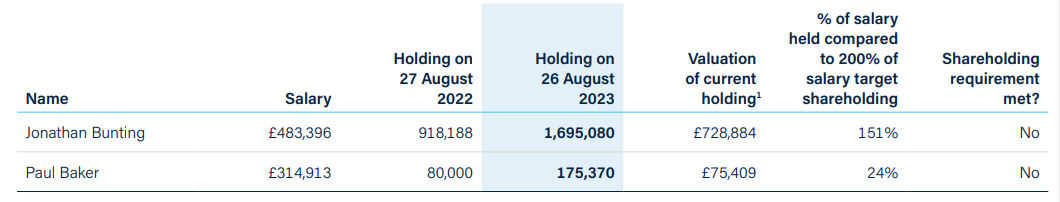

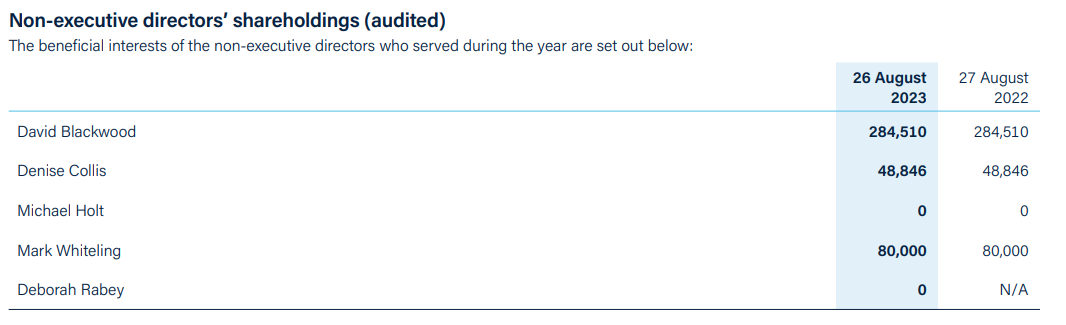

Market cap is 16.6B JPY. Forecasted operating income 2024 is 2.8B JPY. 10.6B JPY in cash and 5.2B JPY in total debt (net cash = 5.4B JPY). EV = 11.2B JPY. EV/OpIncome(2024) = 4x.

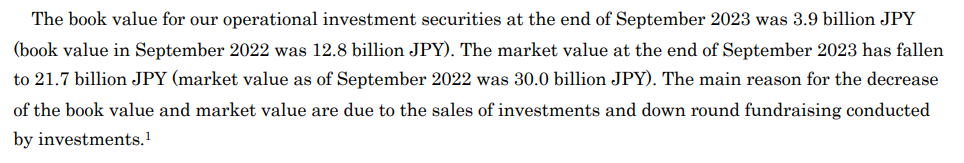

When I read the writeups for the first time, I didn’t consider the importancce of this piece:

The firm disclosed that the market value of its ‘operational investment securities’ was ¥24.5 billion

Here’s the corresponding section from their 2023 annual report (archive):

This is mind-blowing!

Total liabilities are ~ JPY$15b

If we offset that with just the operational investment securities (JPY$21b) and the cash (JPY$10b) we get JPY$16b…which is the current market cap.

I don’t know if I’m missing something but if this is correct…and if the value of the operational investments is either stable or realizable…then doesn’t it mean we get the ENTIRE Buyee business for free?!

Their investor centre is quite rich: link.

Some relevant docs:

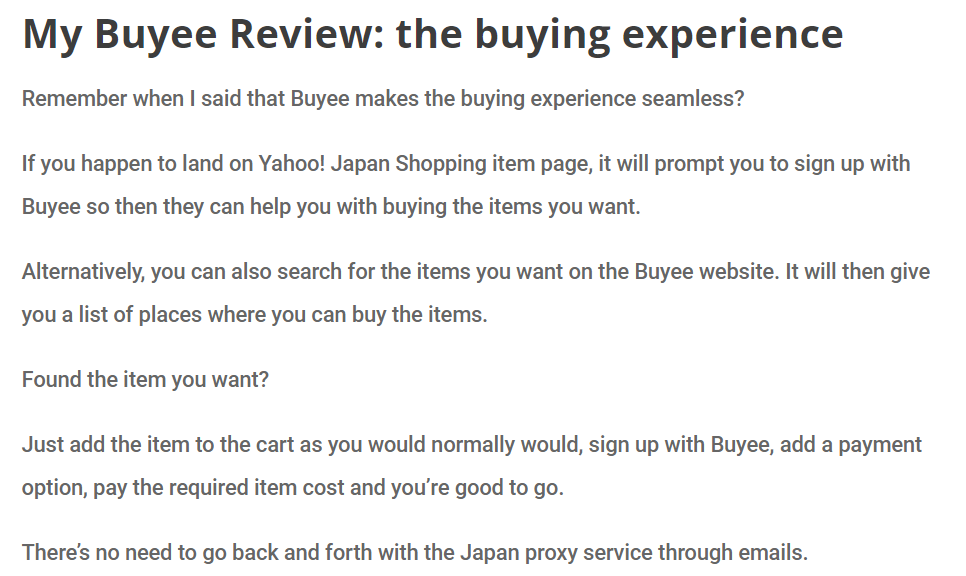

Here’s a reddit page of users that compre Buyee to competitors: fromjapan and Zenmarket.

It isn’t clear to me at all that this is a good business.

Here’s another page listing all the competitors of Buyee (forwarders and proxys). Checkout this page to understand the difference between proxies and forwarders. Buyee is a proxy service.

A user describing his negative experience on Youtube: link and many of the comments are of in a similar direction.

Overall, the poor customer service seems to be a recurring theme among reviewers. See yet another one here.

I’ve also seen a lot of users mention that they use Buyee for Mercari and Yahoo! Auctions, and other proxies for website.

For a more positive review of Buyee and additional of how the site works, see here.

If you don’t want to be scouring the web and trying to translate web pages, this can be your best option.

Yet another review that emphasizes “ease of use”:

Big insider purchase:

Looking at Koyfin, the stock does look kinda cheap at EV/EBIT ~ 7x and GP/share increasing sharply - but book value per share seems to have decreased lately and return on capital & equity on a steady decline since 2019.

Might be worth a deeper look…

Salona Global Medical Device Corporation TSXV:SGMD is pleased to announce its corporate name change to Evome Medical Technologies Inc. on January 22, 2024. Trading of the Company’s common shares on the TSX Venture Exchange will commence under the ticker symbol “EVMT”.

This is a turnaround story that seeing solid growth. But they have to deleverage.

Their most recent quarterly report is here.

For the last 9 months:

- revenue: $46.9M

- gross profit: $17M

- Operating loss: $4.2M, mainly driven by SG&A

- $2M of cash used in operating activities

As of Sep 2023:

- Cash: $1m

- Debt: $9.5M (st) + 0.7M (lt) = $10.2M

- Net debt: $9.2M

- Earn-out consideration: $9.3M

- Other liabitlies: $2.1M

- Operating lease: $1.5M + 7.7M = $9.2M

Today:

- Market cap: $17.2M

- EV: $46.8M

- EV/GP: 46.8 / 17 * 3 / 4 = 2x

Not expensive, not cheap. But it is growing fairly fast. Worth keeping an eye on.

They will need an influx of capital soon.

A fantastic writeup on The Progressive Corporation by (archive).

Clearlt articulates Progressive’s many source of competitive advantage.

On one hand, P/B has been around or above 3x since 2020 so I’m not sure I would have purchased it at any time. On the other hand, P/E was around 12-13x during the same time.

I need to improve my understanding of the relationship between those two!

Here’s one reason why the E in the P/E ratio might be misleading (source):

Now, as unrealized gains & losses from its investment activities are not reported in its earnings, an insurance company may be compounding book value at a healthy rate, but that would not be picked up if an investor was only to value the company with a P/E ratio.

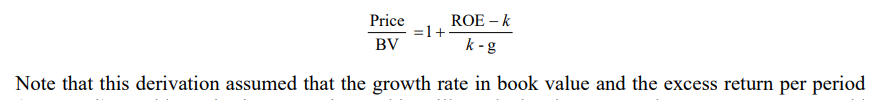

On the P/B ratio, some simplifying assumptions (e.g. constant growth rate) can lead to the following formula (where k is the discount rate, g the growth rate):

Here are some examples:

Source: P&C Insurance Company Valuation (archive).

The Motley Fool has a nice article on how to value insurance companies, that goes over some of the basic concepts.

Pitched by Maran Partners in mutiple letters going back to 2021:

- 2021 Q2 letter: I believe Clarus is currently generating $70mm+ of annualized EBITDA, which should grow to $80mm+ next year and, conservatively, to $100mm+ in 2024.4 Despite Clarus’s success over the past few years, I continue to underwrite the stock as a three-year double, with further upside to $70+/sh in three to five years.

- 2021 Q3 letter: Given meaningful progress on apparel, footwear, retail stores, the company’s sporting segment, and capital allocation (including the recent acquisition of Rhino-Rack, with more to come), I now believe the stock could climb above $60 per share over the next three years.

- 2022 Q4 letter: As changing tides in August lifted the stock for seemingly non-fundamental reasons, I took advantage of the upward volatility to sell the majority of our position. Of course, I should have sold all of our position in mid-August rather than just most of it (another lesson from 2022), but hindsight is 20/20 and I never would have expected the stock to fall as far is it ultimately did.

- 2023 Q2 letter: I believe Clarus remains a highly asymmetric stock. Downside is perhaps around $7/sh, while upside could be to well over $20/sh over the next few years. I think Clarus’ bullet business is worth $200-300 million. Rhino Rack and the overlanding businesses could be worth over $200 million. And Black Diamond is probably worth somewhere in the range of $250-$500 million. This gets us $600 million on the low end and $1 billion on the upper end, or $13 to $24 per share.

- 2023 Q3 letter: Clarus received an offer of $160 million for its bullet and ammunition segment from Clarus’ chairman, Warren Kanders. […] Clarus’ market cap is $210 million, and the company should have net debt of around $105 million at yearend, before contemplating the aforementioned transaction. Post-transaction, the company would have net cash of approximately $55 million (25% of the market cap) and an enterprise value of $155 million. If in the next few years Black Diamond can generate this double-digit EBITDA margin on $225-250 million of sales, that segment would produce around $25 million of EBITDA. Similarly, Rhino Rack could potentially generate $18-20 million of segment EBITDA, as it approaches a 20% margin on $100 million of sales. Less cash corporate expenses, Clarus would generate ~$40 million of EBITDA in this scenario. This implies the stock is trading for less than 4x normalized EBITDA (and under 0.5x sales). This seems far too low.

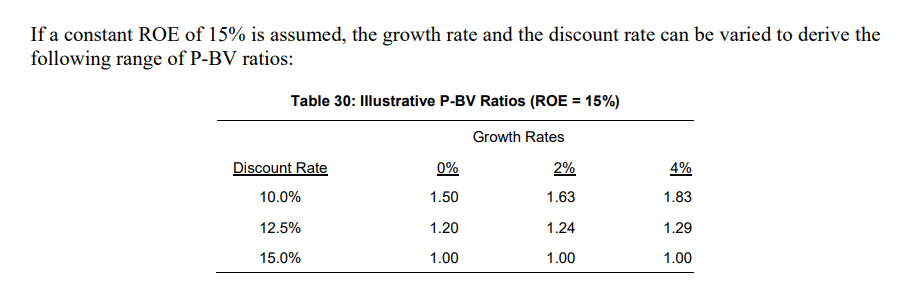

And in 2023Q4:

A more tempered view on the company can be found on SeekingAlpha (archive). There we can read that the remaining businesses might be trading at fair value (around 7x EBITDA on EV of ~$190M post-transaction), unless the growth resumes.

I notice a difference in the pro-forma EV from the article above and the one estimated by Maran Partners ($160M). But even with that, this pitch doesn’t strike me as a potential homerun. Obviously if history is any guide, I will be proven wrong in short order.

Found in Maran Partners while reading about Clarus.

From their 2023 Q3 letter:

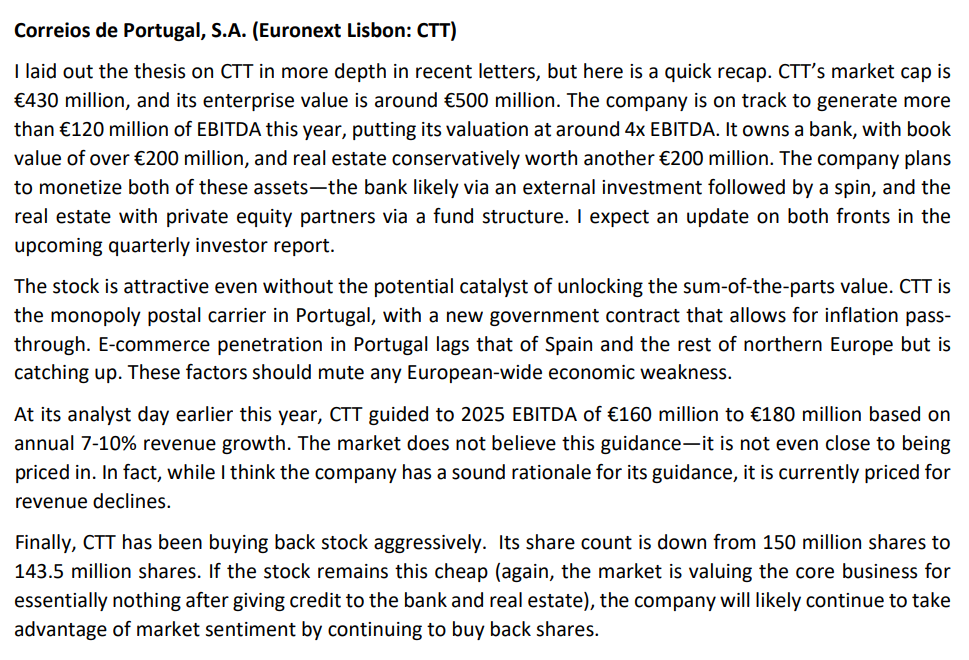

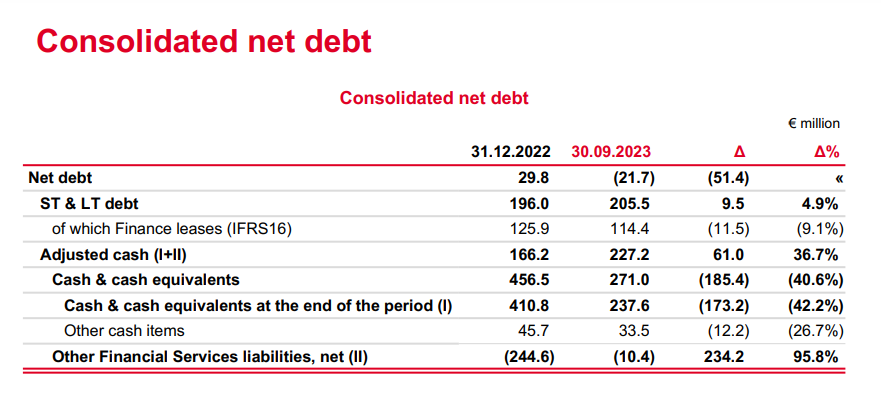

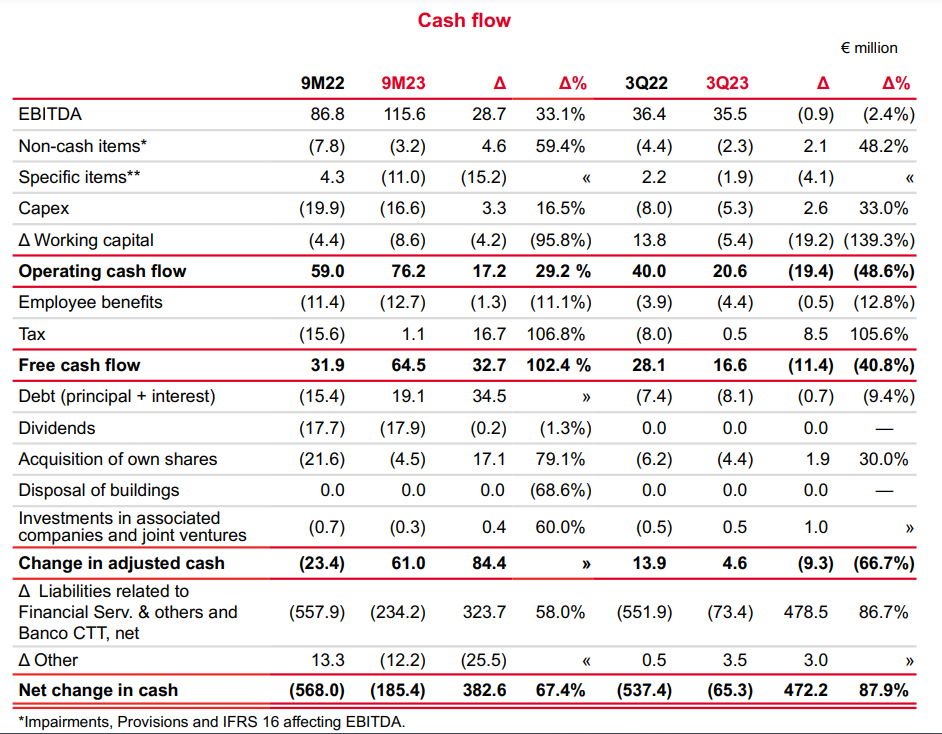

CTT was victorious in its arbitration proceedings against the Portuguese government and was awarded approximately €25mm, or 6% of CTT’s market cap. This is a meaningful windfall, especially in light of CTT’s ongoing share buyback, which it continues to execute daily. Given my belief that the company’s enterprise value, after considering the value of its bank and excess real estate, is close to zero, share buybacks are extremely accretive. This windfall will only increase the amount of capital CTT can apply toward buying back its shares.

The 2023 Q2 letter (archive) goes into a lot more detail and is worth a read.

Excerpts:

While many sum-of-the-parts stories in smaller markets may be [value traps], I gain comfort in the aligned management team who have clearly demonstrated that they are doing the right things to unlock and grow value. Absent the plans to monetize the bank, monetize the real estate, buy back shares, cut costs, renegotiate the company’s government postal contract to allow for inflation passthroughs and volume decline offsets, and commit to a long-term plan predicated on double digit EBIT growth, this could be a value trap. But given all of those catalysts in place, I’m not worried about this stock being ignored for too long.

Yes, this company is trading at around a 10% free cash flow yield on just first half results! [EDIT: my own estimate is 12% FCF/EV yield on first 9 months results]And that is despite having almost all of its market cap covered by its real estate and bank holdings.

And here’s the original thesis from the 2022 Q3 letter (archive):

(link)

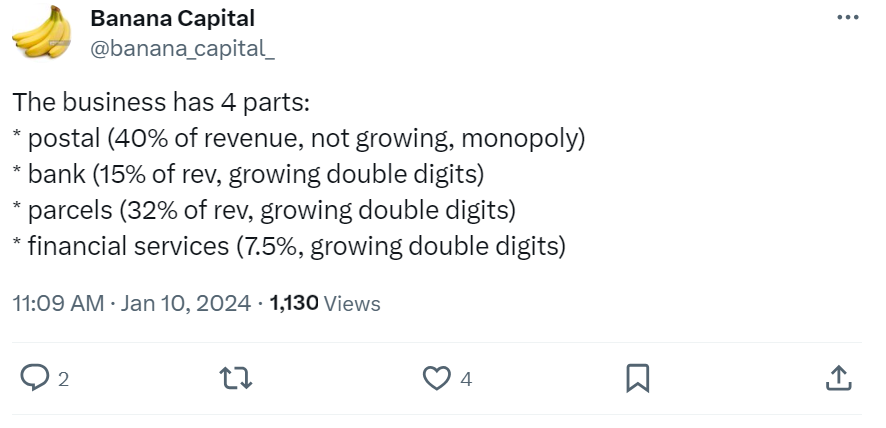

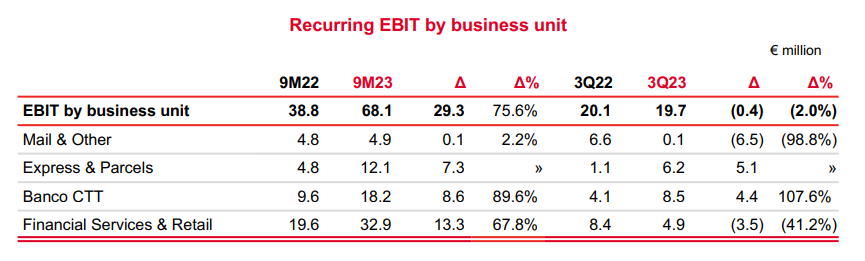

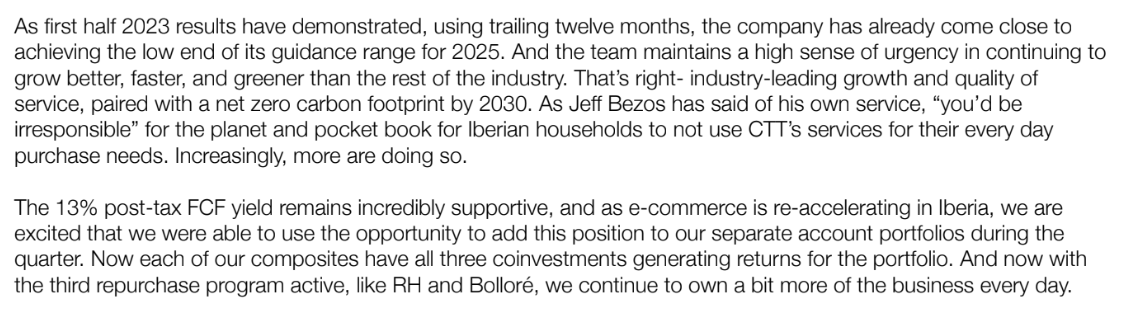

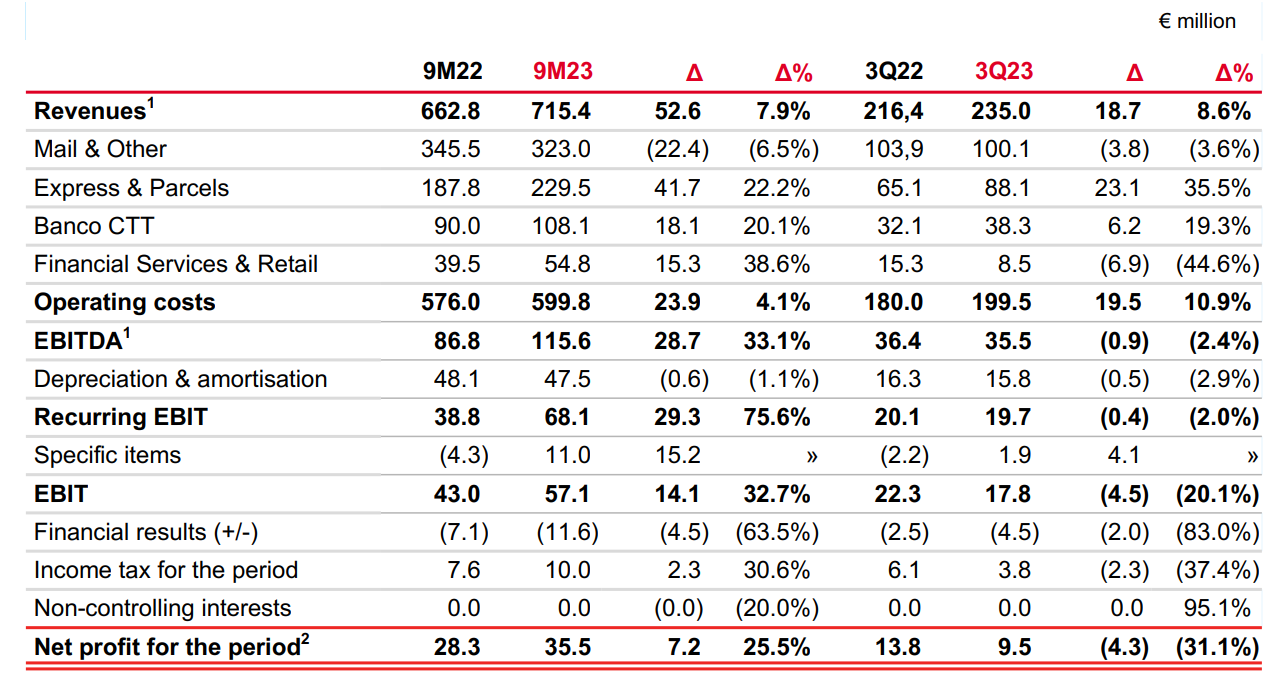

The 2023Q3 report can be found here.

Express & Parcels grew +35.5% mainly thanks to the performance in Spain.

Banco CTT grew +34.8% thanks to the growth of its consumer credit portfolio (auto) and mortgage loans and benefited from the favourable evolution of interest rates.

Greenwood Investors are shareholders.

Here’s a letter where they talk about $CTT.LS, among other things: link.

From the consolidated statements for the first 9 months of ‘23, page 14:

Market cap (as of 2024-01-26): $523M

EV ~ $501.3 (including finance leases of $114.4M)

EBITDA (annualized): 115 * 12 / 9 = $153M (note: this is less than ttm, 2022Q4 EBITDA=42.5M)

EV/EBITDA ~ 3.3x

Looking at EV (excl finance lease) / EBT:

386.9 / (45.4 * 12 / 9) = 6.4x

Finally, free cash flow yield to equity (FCF/MC) based on trailing 9 months only is 64.5/523 = 12%.

The presentation for 2023Q3 is here (archive).

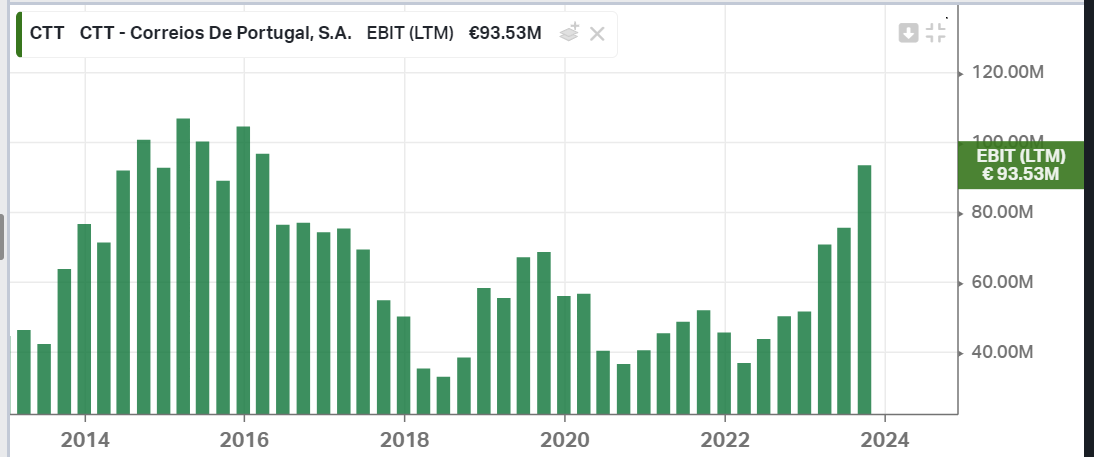

Management was guiding to $80M recurring EBIT for the year but they are already at $68.M ($90M annualized).

IMPORTANT NOTE: the Koyfin numbers for this stock are completely wrong and should not be relied upon. For example, LTM EBITDA is shown at $103M, but just the first 9 months are actually already at $115M.

The report for the 1st half of 2023 is here (archive).

Here’s the AGM22 Presentation (archive) and the Capital Markets Day 2022 video.

I also found an interesting case study titled Privatising CTT: Factors behind the success (archive).

Some positive recent news: a partnership with the Temu e-commerce platform.

Now maybe the best thesis I’ve read on the company was the initial one from the 2020Q1 Greenwood Capital letter published on ValueWalk (archive).

Links:

- Webcast - 9 months 2023 Results

- Results Presentation – 9 months 2023

- Results Presentation – 9 months 2023 (Appendix)

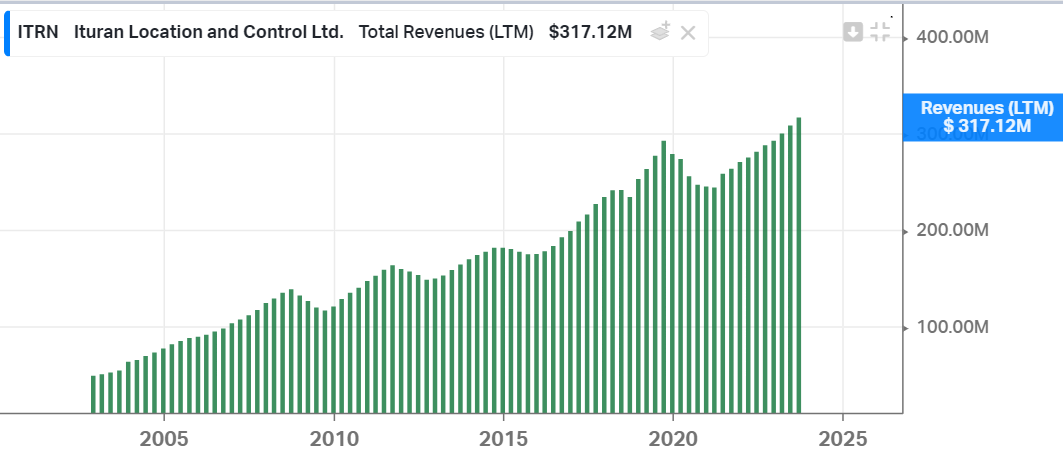

Looking at the numbers, I like what I see.

Under 8x EV/EBIT, ~10% revenue growth, 11% FCF/EV yield.

The company operates mainly in Israel and is expanding to South America:

A writeup on SeekingAlpha: Ituran Location and Control, A Hidden Gem That Keeps Performing (archive).

This one first flashed on my twitter. Then it went up 18% today (January 26th). Then I remembered that someone mentioned Smoak Capital wrote it up in their 2023 annual letter (archive).

This is how fast you gotta be these days - pouncing on signals like these instantly. Oh well, can’t get them all! But I will remember the lesson!!!

This thing seems to be trading around 5x PE, astonighingly cheap. It’s probably a double.

The more important lesson for myself is this: READ THE LETTERS!! QUICKLY TOO!!!

This is another company from Smoak Capital’s letter. He says it is currently trading at 3x EV/FCF while growing the topline. I have to check this one out!

As of 4/30/2023, I see a cash & shor-term investments balance of 23.2 + 39.8 = $63M vs $44.8M of deferred long-term liabilities, so $18.2M of net cash.

Current market cap is $40.8M (up 13% today), so EV = $22.6.

Operating cash flow for the year was $28.8, $0.3 of CAPEX, so $28.5 of FCF.

I proobably have a mistake somewhere…

Quickfs says EV/EBIT is 1.7x

I couldn’t find the quarterly statements of the company…

Alluvial Capital (Dave Waters) is another fund manager I enjoy reading. His Q4 ‘24 letter can be found here (archive).

He owns a lot of interesting (by which I mean cheap, boring, and simple) businesses, such as Seneca, Hammond Manufacturing, and Supremex.

Supremex seems indeed supremely cheap. I have to dig deeper.

Supremex was also mentioned by Mathieu Martin on Stocks & Stones (archive]]).

Disqus comments are disabled.