#111 - Ramblings Apr2024

Last updated: Apr 30, 2024

No ramblings this month, mea culpa!

These are gold producers. I looked at $CERT.V a bit deeper, but I really can’t buy miners anymore. Just too far out of my circle of competence.

Thesis from Kreuzmann and archive.

Another (older) thesis: writeup.

Both from this fintwit space recording.

https://www.youtube.com/watch?v=az97SZXP7Ls

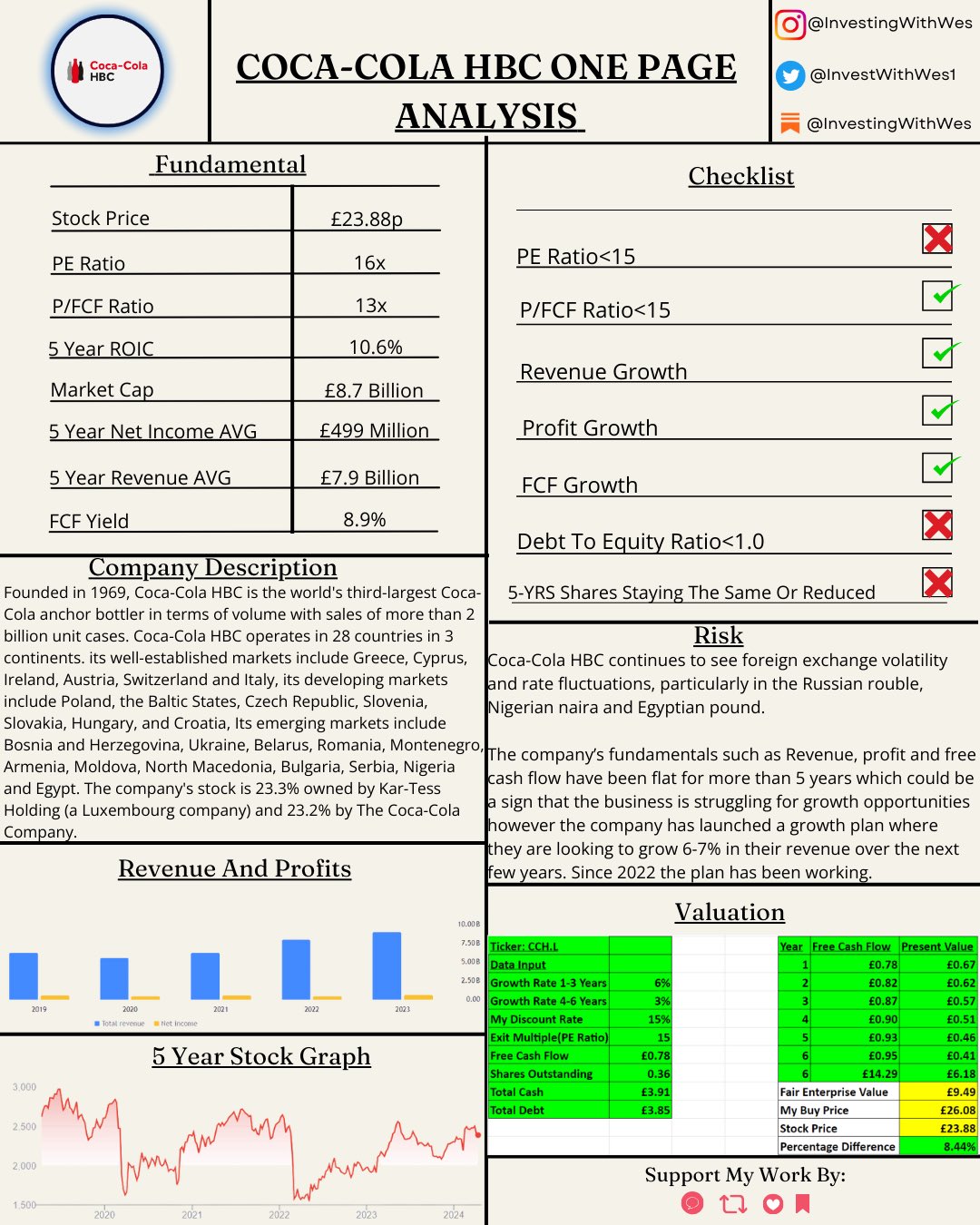

Another Coca-Cola bottler. Operating in western & central Europe.

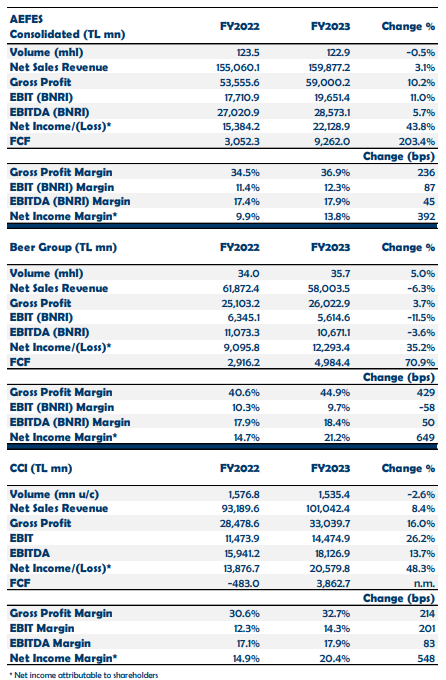

Now just as a reminder, Anadolu Efes owns ~50% of the Coke bottler $COLZF COCA COLA ICECEK, market value of US$5.3B. Therefore the stake of Efes in Coca Cola Icecek is worth about US$2.6B.

Efes current market cap is $3.3B.

I believe they have ~TRY$37.7B or US$1.2B of net debt (includng leases and deferred tax liabilities), putting their EV around US$4.5B.

Mohnish said that Efes beer business normalized PAT is $200M.

From their 2023Q4 financial statements, Efes total profit attributable to parent was TRY$22.1B or US$680M, meaning Efes is trading at under 5x (20% earnings yield).

If we go with EBIT instead: TRY$19.6 or $610M USD…putting EV/EBIT ~ 7.3x (13.6% yield).

EBITDA (BNRI) was TRY$28.5B in 2023, or US$880M, on revenue of TRY$160B or US$4.9B.

EBITDA (BNRI) was TRY$4050M in 2019, or US$729M (exchange rate back then was 0.18 vs 0.031 now) on revenue of TRY$23.3B or US$4.2B.

=> CAGR of 4% for revenue, 4.8% for EBITDA.

For 2023 (tweet from Andrew Wilkinson):

-

$185M Revenue (had our acquisitions of WeCommerce and Clean Canvas occurred on Jan 1, 2023, we estimate revenue would have totalled $206M)

-

EBITDA of $46M

-

Recurring Revenue of $29.5M (does not include $8.4M of recurring revenue from WeCommerce in Q1 due to merger timing - combined this would be $37.9M)

-

Q4 cash from operations of $9.9M

Note: None of these results include the businesses within our $150M USD private fund, of which Tiny Ltd owns the GP and is a 20% LP.

Copy-paste of a post from Viking on thecobf:

What do board members think… Do we collectively have a good handle on Fairfax today? How about the more general investment community? Or, in another 12 months will we look back and say… ‘boy, was i ever off in my analysis of the company.’ Just like what has happened in each of the past 4 years.

—————

Fairfax - 4 Years Later - Are We Really Any Smarter?

Fairfax’s stock has compounded at 40.1% for each of the last 4 years. Lots of investors missed participating in the run-up of the stock because they misunderstood and mis-judged the company.

Fast forward to today. Most investors think they have a much better understanding of Fairfax and the opportunity it currently presents.

I am not so sure. I think Fairfax remains a misunderstood company. And that is because:

The fundamentals at Fairfax have been improving at a faster rate than investors generally understand or recognize. Driven by the reinvestment of $4 billion in annual earnings, profit growth over the next couple of years will likely exceed investors expectations. So investors continue to materially underestimate the potential of the company and the growing earnings it will be able to generate in the coming years.

—————

At the 15th Annual Fairfax Financial Shareholders Dinner on Wed April 10 there were a number of different events. One event was a Q&A on Fairfax moderated by Trevor (Tidefall Capital) with 2 panelists: me and Asheef @SafetyinNumbers.

Below are my opening comments:

I want to start by saying thanks to Rob and the rest of the people involved for getting this event organized on short notice. It is a real privilege for me to be here.

I also want to give thanks to the board members of the investing forum ‘Corner of Berkshire and Fairfax’. Much of what I have written on Fairfax over the past 3 years was inspired and augmented by members on this investing forum. A special thanks to Tarn for making the trip all the way from Australia.

Thanks to Asheef and Trevor for joining me for this session.

A quick message from the legal department

Nothing discussed tonight is intended to be financial advice. It is intended to educate and entertain. Consult your financial advisor before buying any stocks.

————

OK, let’s get at why we are all here… to discuss that scrappy, unloved, misunderstood P/C insurance company called Fairfax Financial. Yes, make no mistake, it is still unloved and misunderstood.

————

Let’s start with a quick review of a few things.

Over the past 4 years Fairfax’s stock has delivered a total return of 286%.

That is a 4 year CAGR of 40.1%.

How does that compare to the market averages?

at the 15th Annual Fairfax Financial Shareholders Dinner on Wed April 10

The S&P500 is up a total of 89%. The TSX is up a total of 60%. Bottom line, over the past 4 years Fairfax’s absolute and relative return has been outstanding.

Ok, with a show of hands… 4 years ago, who in this room saw Fairfax delivering a CAGR of 40% per year over the following 4 years? Don’t be shy…

No one. (No one in the room raised their hand.)

That, I think, is super interesting.

—————

Let’s fast forward to today. We are all so much smarter now when it comes to understanding Fairfax. Right?

Me? I am not so sure.

—————

So where are we at with Fairfax today? That’s what everyone here really wants to know.

The stock is up 286% over the past 4 years… so it must be overvalued today… right?

What’s the problem with this ‘analysis’? Well, it’s not actually ‘analysis’. The fact that Fairfax is up 286% tells us very little about the current valuation of the stock.

And that is because price, on its own, is a terrible way to value a stock.

—————

Ok. So what measures should we use to value Fairfax?

Let’s look at two simple ones: PE and P/BV

Fairfax’s:

PE is under 7 x my estimate of normalized earnings, which is about $160/share P/BV is 1.1 x my estimate of book value at March 31, 2024 What do both of these two valuation measures tell us?

Fairfax’s stock is crazy cheap. Yes, even after a 286% increase over 4 years. That is nuts.

—————

How is this possible?

First: Starting point matters. Fairfax was a hated stock in back in April of 2020. So Fairfax’s stock was much, much cheaper than any of us realized back in 2020.

Second: Since 2018 the management team at Fairfax has been executing well. And since 2021 their execution has been exceptional.

Here are 5 examples:

Hard market in insurance. Over the past 4 years, net premiums written have increased from $13.3 billion to $22.9 billion or 73%. The CR has averaged 95.2%. The purchase of total return swaps in late 2020/early2021 has so far delivered about $1.4 billion in investment gains. The buyback of 2 million shares of Fairfax in December 2021 at $500/share. That is almost a 50% discount to current book value. And we know intrinsic value is much higher than book value. Sale of the pet insurance business in 2022 - which delivered a $1 billion after tax gain. This was like finding a pile of gold in your back yard - no one even knew they owned this business. Active management of the average duration of the fixed income portfolio. The move to 1.2 years in late 2021 and then the pivot to more than 3 years in late 2023. The financial benefit to Fairfax from these two moves can be measured in the billions.

I’m just scratching the surface with these 5 examples. I could easily list another 10 examples of decisions made by Fairfax in recent years that have had a positive and meaningful impact on their financial results.

Bottom line, the fundamentals at Fairfax have been not just getting better - they have been literally exploding higher. I have never seen anything like it in my 25 years of investing.

As Peter Lynch would say ‘The story just keeps getting better’. But kind of on steroids.

—————

Let’s try and summarize things:

Where are we at with Fairfax today?

The stock trading at a crazy cheap valuation.

Fairfax has three of economic engines:

Insurance investments - fixed income Investments - equities All three are performing at a high level at the same time - for the first time in the company’s history.

As a result, Fairfax is poised to generate historically high earnings of $4 billion (more?) in each of the next 3 years. It should also deliver an average ROE of about 15%.

The management team is best-in-class. When it comes to capital allocation, in Buffett’s words, the management team at Fairfax is hitting the ball like Ted Williams. In Druckenmiller’s words, the management team at Fairfax is on a hot streak.

This highly performing team is about to get $12 billion in earnings over the next 3 years. Think of the value creation that is coming.

—————

OK. So after all that… What is an investor to do?

If you don’t know the answer to this question… well, you might want to stick to investing in index funds.

From Parthenos Capital Q1 2024 letter.

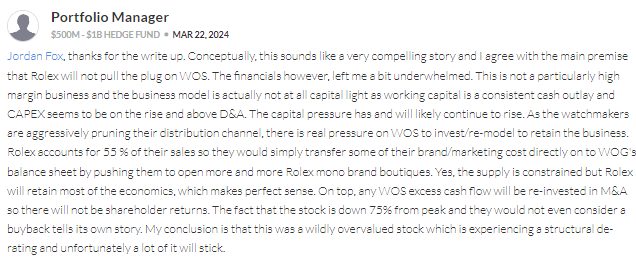

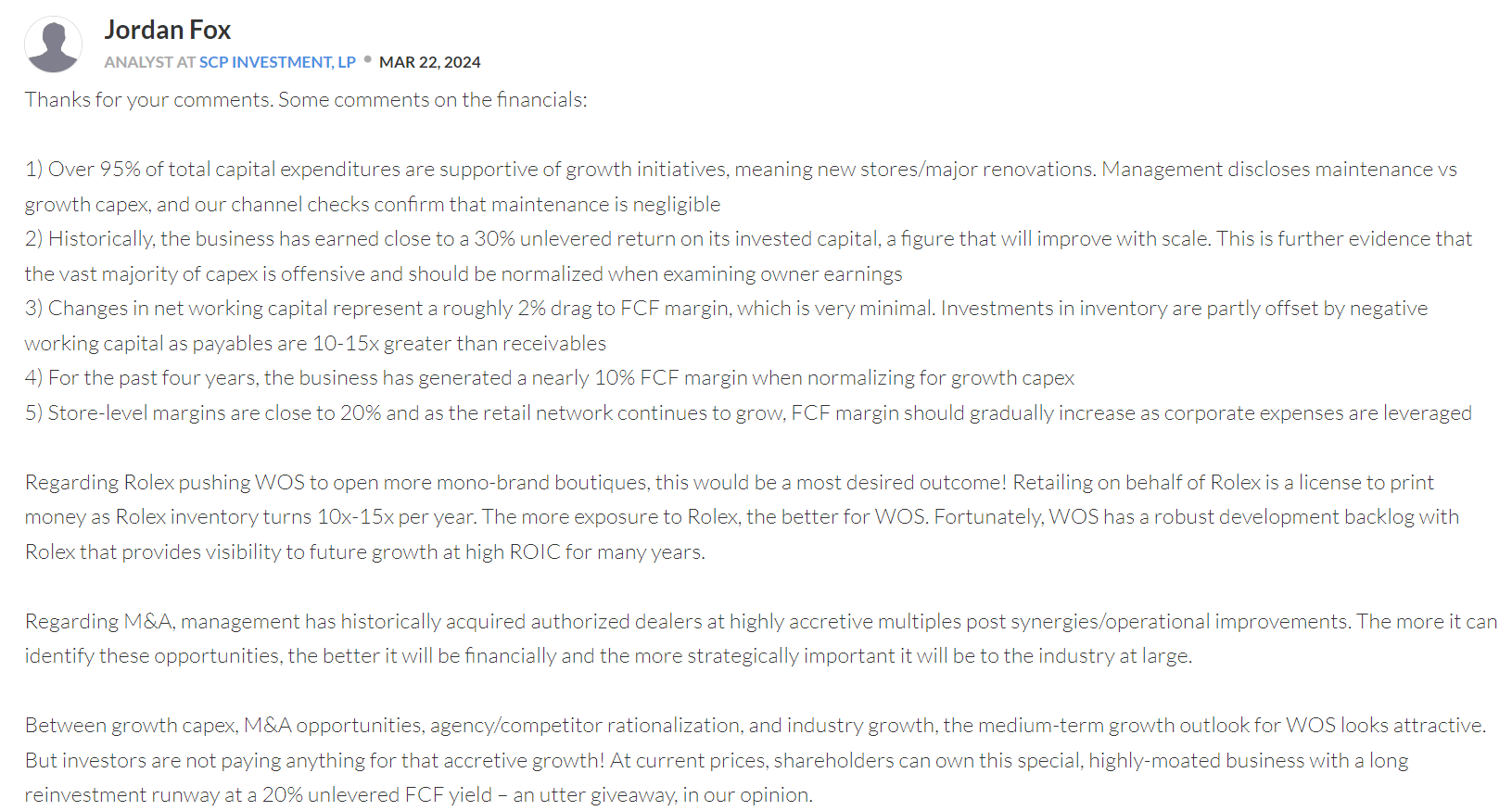

Watches of Switzerland Group ($WOSG.L)

I mentioned in our last letter that after year-end the partnership had initiated a position in WOSG after falling second-hand watch prices, an unexpected acquisition by Rolex and a poor trading update had reduced the share price by more than 70%. It was recently shared with me that the WOSG share price has almost identically tracked the price index for luxury second-hand watches despite second-hand watch sales only accounting for ~5% of their business, this is an interesting narrative and certainly one to keep an eye on so I have attached the graphic for you to see below. Demand for WOSGs top brands remains higher than ever, prices are steadily increasing, and they are growing their store footprint and allocations across all major geographies. I believe looking back this will be a classic example of price and narrative wildly fluctuating (to both the upside and downside) around a steadily rising business value.

Over the last couple of months, our conviction for the long-term outlook of the company has only grown stronger and I am confident that this high-quality compounder will remain a fixture in our portfolio for many years to come with a clear (and conservative) path to triple our money over the next 5 years. We have reallocated the majority of our wins from the first quarter to increase our position and at our average cost of 352p, WOSG now makes up 23% of the portfolio and is your largest position as a partner. At our cost, WOSG is trading for a little over 4x LTM EBITDA as compared to its peak of ~27x LTM EBITDA back in late 2021. The road for WOSG may be bumpy in the short-run (and we welcome that as it has allowed us to add to our position at extremely favorable prices) but we believe the destination will be more than worth it.

I discussed my view on the Bucherer situation in the last letter and on this front the news has been extremely positive with an almost unanimous agreement amongst those in the industry that this acquisition does not pose an existential threat to WOSG. So the stock is obviously cheap, but what is the opportunity for the business? WOSG have positioned themselves perfectly to capitalise on the enormous opportunity to consolidate the US Authorised Dealer market over the next 5 years, whilst continuing to maintain their share and improve their allocation in their core UK market. The US market has around 10 ADs with a reasonably large storefront presence and ~300 ADs with less than 3 dealerships – these 300 ADs are typically family-owned, poorly operated and underinvested operations. The watch brands expect continuous improvement from their retail partners and reward those who invest in their stores with better allocations which results in significantly higher sales per store.

Allocations for the largest ADs have continuously outpaced the increase in production whilst there has been a clear trend of consolidation post-covid to reduce the number of ADs (not just amongst Rolex but all major watch brands) as you can see in the graphic to the right.

WOSG’s growth opportunity here is tremendous – they have an incredibly long runway to continuously improve existing stores and receive better allocations (virtually 100% of Rolex watches are now on a waitlist so supply is the key constraint and demand is almost infinite) or to pursue their M&A strategy with the blessing of Rolex to improve and consolidate the extremely fragmented US store base. I believe this provides them with a multi-year opportunity to grow US sales and FCF at 20%+ whilst continuing to organically grow their core UK & European markets at HSDs. As I mentioned earlier, I believe they have a clear and conservative path to triple the share price over the next 5 years without having to do too much right, but if they execute well (as they have over the last 6 years since their entry into the US) they have the capability to deliver significantly more shareholder value than that. And the best part is at these prices you are not paying for any of this growth, if they are unable to capture this incredible consolidation opportunity, WOSG will still have almost exclusive access to sell a portfolio of the most desirable brands in the world with enormous pricing power and the ability to significantly improve sales per store through their store investments over time.

I am currently extremely happy with the portfolio composition but in my mind, the WOSG opportunity and misunderstanding of the industry stands out as particularly exciting so the question always becomes, do we own enough? You rarely an asymmetric opportunity such as this where there is the potential to make many multiples of your money coupled with an extremely defensible business and protected long-term downside. Nevertheless, a lot has happened in the watch industry in a very short time and market prices can always become even more irrational. I am happy with our current positioning and look forward to hearing more colour from management in their Q4 results next month, if our investment thesis is reaffirmed then I believe there may still be room to significantly increase our position size.

On X.com:

The response:

Disqus comments are disabled.