#115 - Ramblings June2024

Last updated: Aug 12, 2024

Mikhail Lomtadze, CEO of Kaspi.kz: YouTube interview.

Hard not to like this guy.

Couple of quick take-aways:

- Kaspi is really product oriented

- They

surveytalk to 300,000 customers per month across different products to understand what’s working and what isn’t - Each product has its own owner and its own small team (developers, designers, etc.)

- The teams’ metrics are based on NPS and product excellence

- If they have a product in mind with 4 features, they first release it with the most important feature, and allow the team to grow and learn with the product

- Every new product idea starts with a 3-pager that explains what it’s about and why the consumer should care

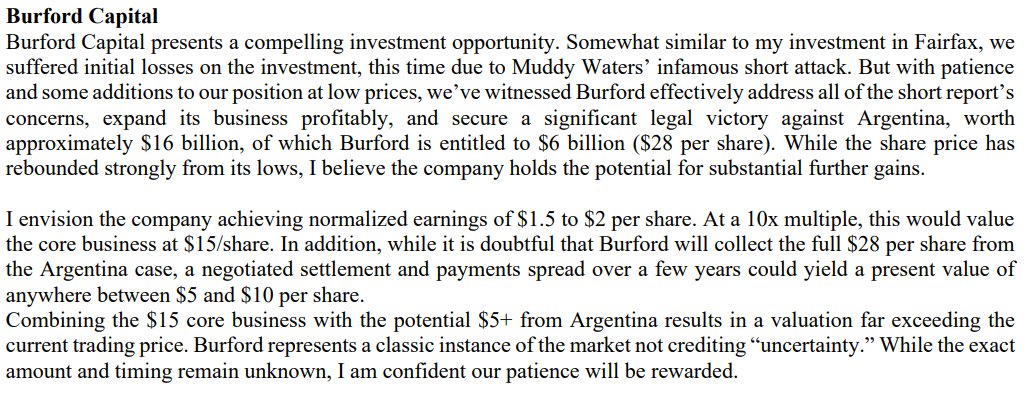

Artem estimates Burford’s $BUR earnings power to be in the range $1.20 to $1.70 (if correct, translates to a P/E of 9x at the mid-point).

The first section consists of generally undervalued securities where we have nothing to say about corporate policies and no timetable as to when the undervaluation may correct itself. Over the years, this has been our largest category of investment, and more money has been made here than in either of the other categories. Sometimes these work out very fast; many times they take years. It is difficult at the time of purchase to know any specific reason why they should appreciate in price. However, because of this lack of glamour or anything pending which might create immediate favorable market action, they are available at very cheap prices.

(thread)

$TFII.TO $ATD.TO $CNQ.TO $CSU.TO $NA.TO $EQB.TO $TVK.TO $TOI.V $MEQ.TO $GSY.TO $CNR.TO

Today (June 8th) is the man’s birthday.

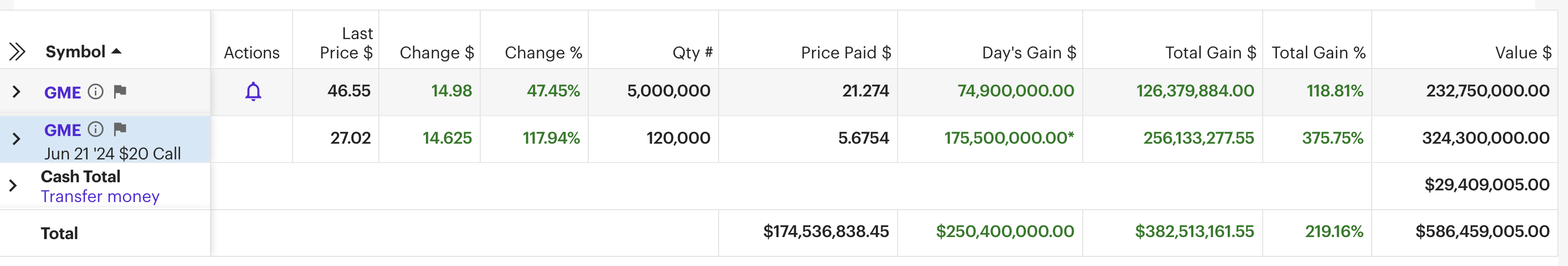

From $50K to $500M+:

Shared by Sahil S:

As of May 29, 2024 (podcast episode):

Again from ToffCap:

Met my buddy Chris yesterday. He always amazes me.The guy has been generating ~18% returns pa over the past 15 years. This is in itself a fine result, but very impressive if you consider:

He spends on average 5 hours per quarter (!) researching stocks

His universe (not portfolio) is a diversified basket of only 50 or so large cap stocks.

Always makes me think. Imagine these returns compared to the time and effort he puts in.

I think about the time I spend researching stocks. While I’ve been able to generate better results he has a MUCH higher return / effort ratio.

How does he do it?

The short answer is that he just found the philosophy that best resonates with him. And he never, ever deviates from it.

Chris prefers to have a universe of roughly 50 stocks, all larger cap quality stocks. The kind @QCompounding and @CompTortoise regularly flag.

These might not be your typical high growth stocks (though you’d be surprised how much many can grow their EPS) but have relatively stable earnings (growth).

His focus is not positioning for max growth but minimum risk. The focus is strongly on the downside. The classic, ’take care of the downside and the upside will take care of itself’ (or something like it).

Every quarter he rebalances, buying the laggards in his universe of 50 stocks and sells the winners in his portfolio. He spends a few hours assessing whether the long term stories are still the same and perhaps also looks at a few new companies.

He also ‘blindly buys’, as he calls it, when markets correct.

Lastly, he repeats this process over and over, no matter the market circumstances.

I just wanted to share this story because it always amazes me how well he does while spending so little time. I always leave impressed.

It’s of course also a matter of character - I could never do this. I HAVE to constantly look for new, weird stocks and situations.

But it always make me think about how much drag my ‘philosophy’ has on overall results, and how much easier my life would be if I would just have more patience.

From Yet Another Value Blog.

Youtube: clip.

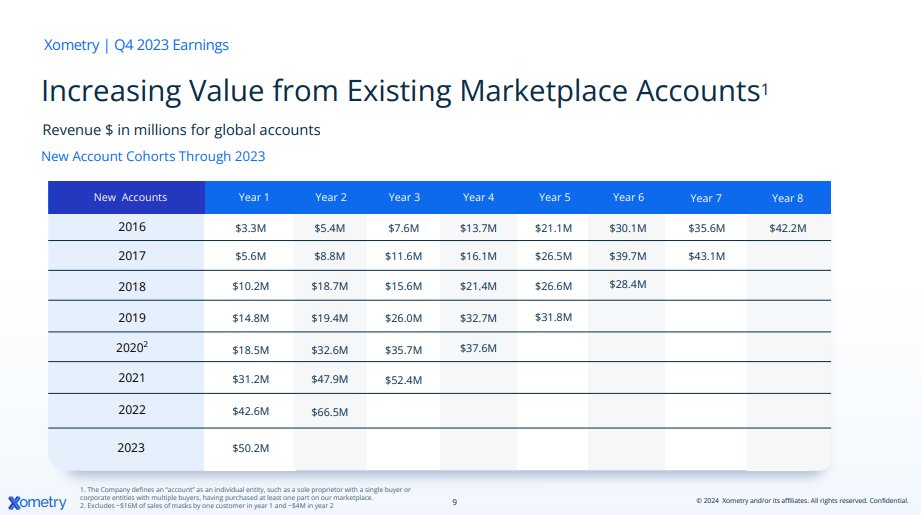

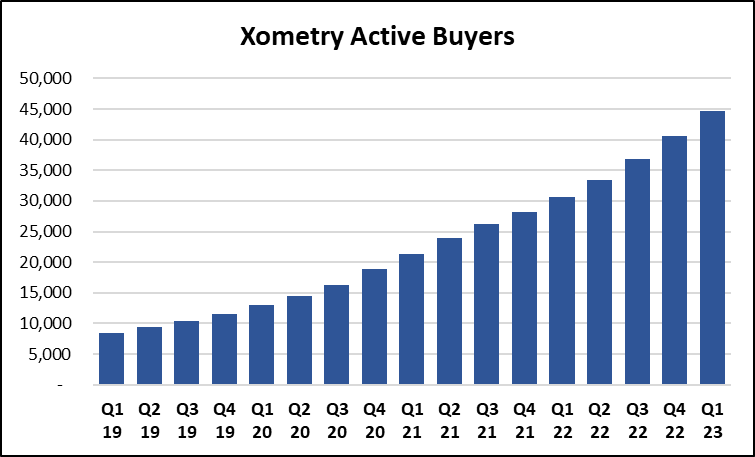

The most important slide of the $XMTR investor deck:

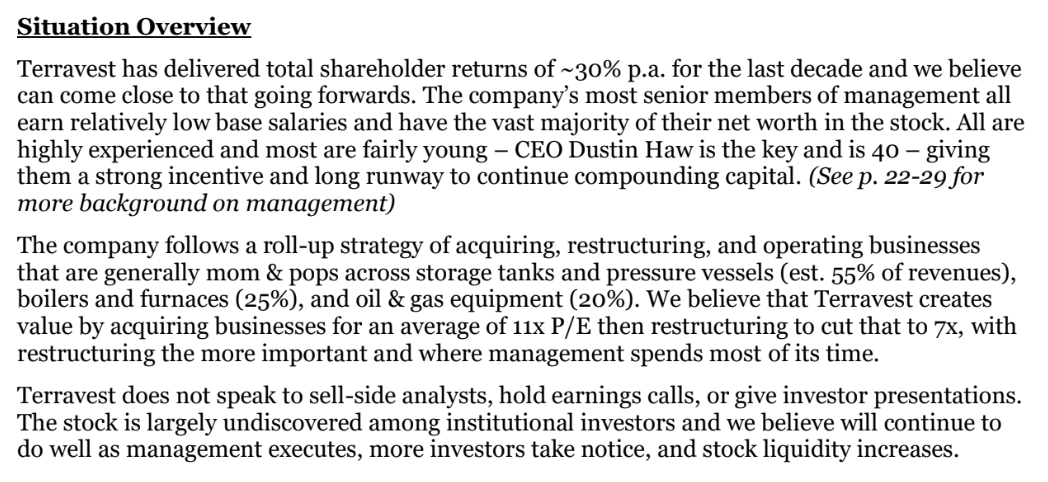

Thesis from Unconventional Value.

Writeup by Pernas Research (archive).

Short thesis from Culper Research (archive), who calls Xometry the “Pets.com Manufacturing”.

Stock Talk Podcast Episode 220.

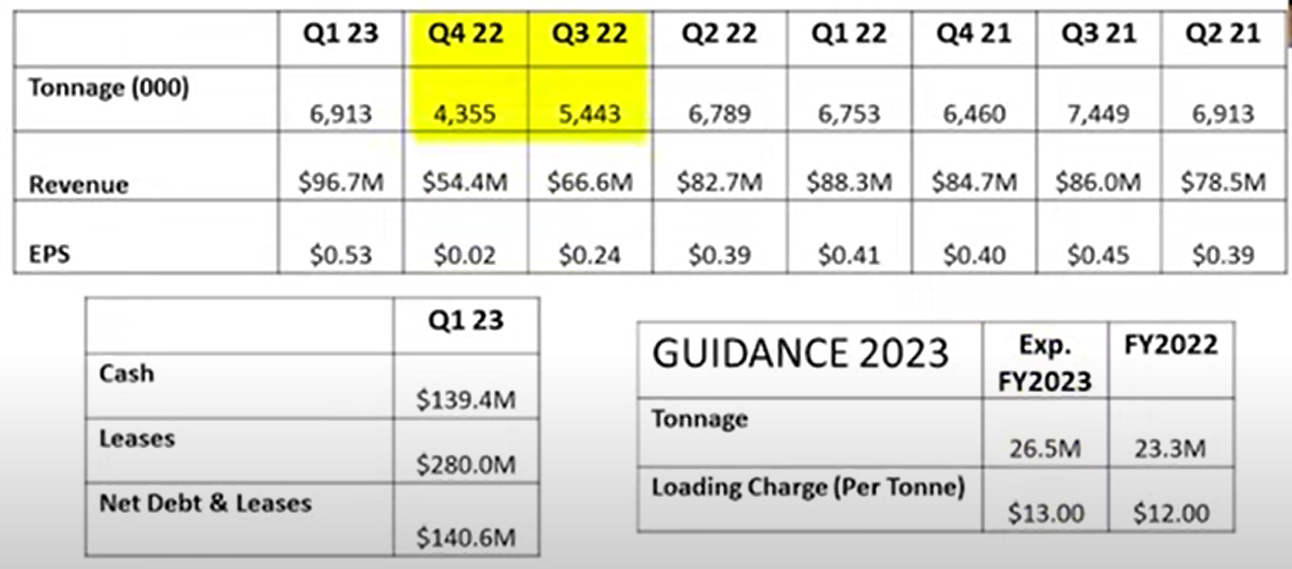

The company currently operates a coal storage and operating terminal in BC, Canada - the largest coal loading facility on the west coast of the Americas. Revenue is derived from rates charged from loading coal onto sea-going vessels. The coal is delivered to the terminal in trains and then unloaded to a ship, and shipped to multiple countries accross the world, with the majority heading to Japan, Korea and China.

The company is investing significant capex to allow the terminal to handle potash from Saskatchewan (phase 1 expected to start in 2026 - 4.5M tonnes of potash handled annually).

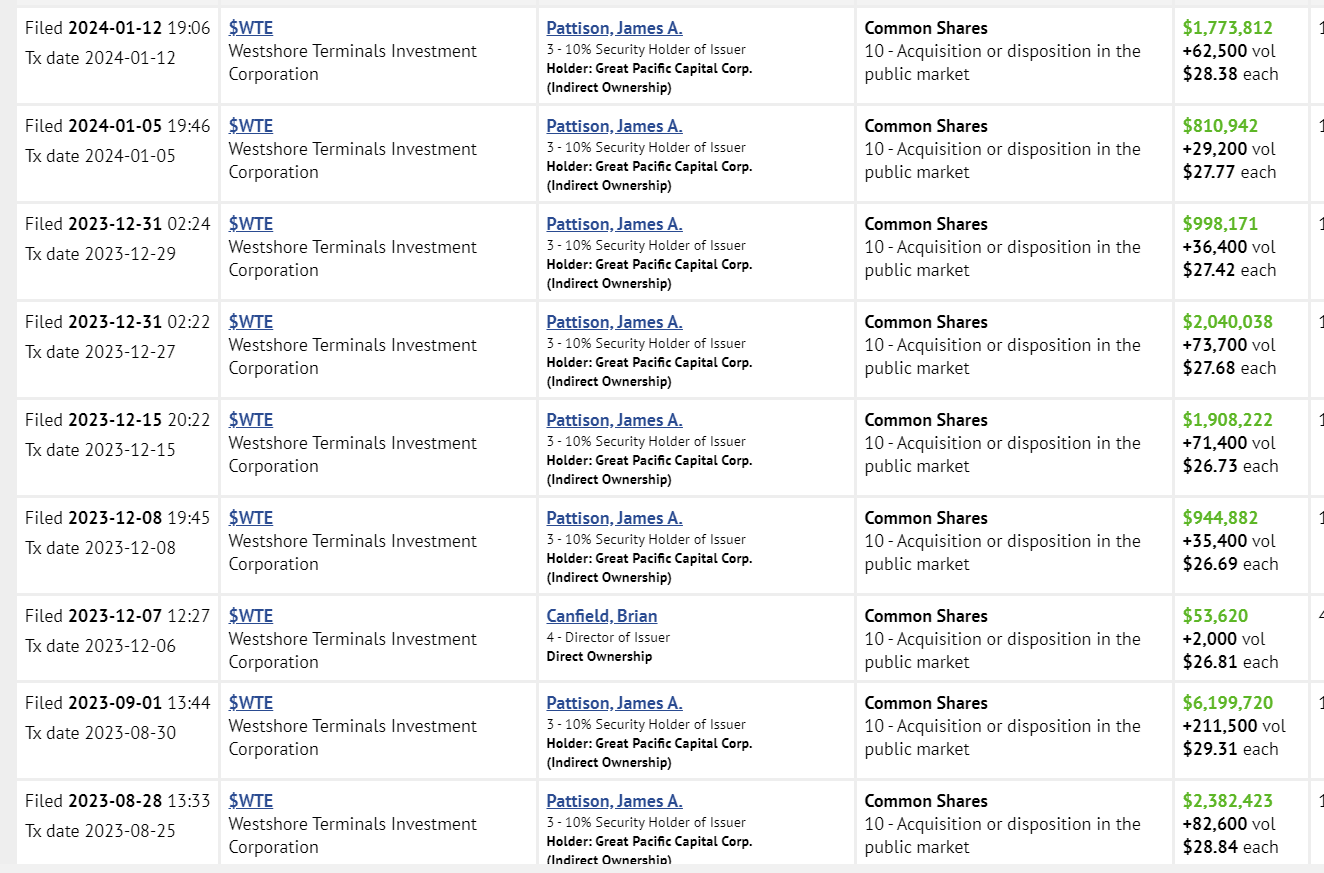

Jim Pattison has been buying a SHITLOAD of shares recently.

Some stats from the clip above:

Unfortunately, I don’t find the price enticing enough.

Caro-kahn full thesis from 2018.

Also mentioned in Greenhaven Road 2023Q1 letter.

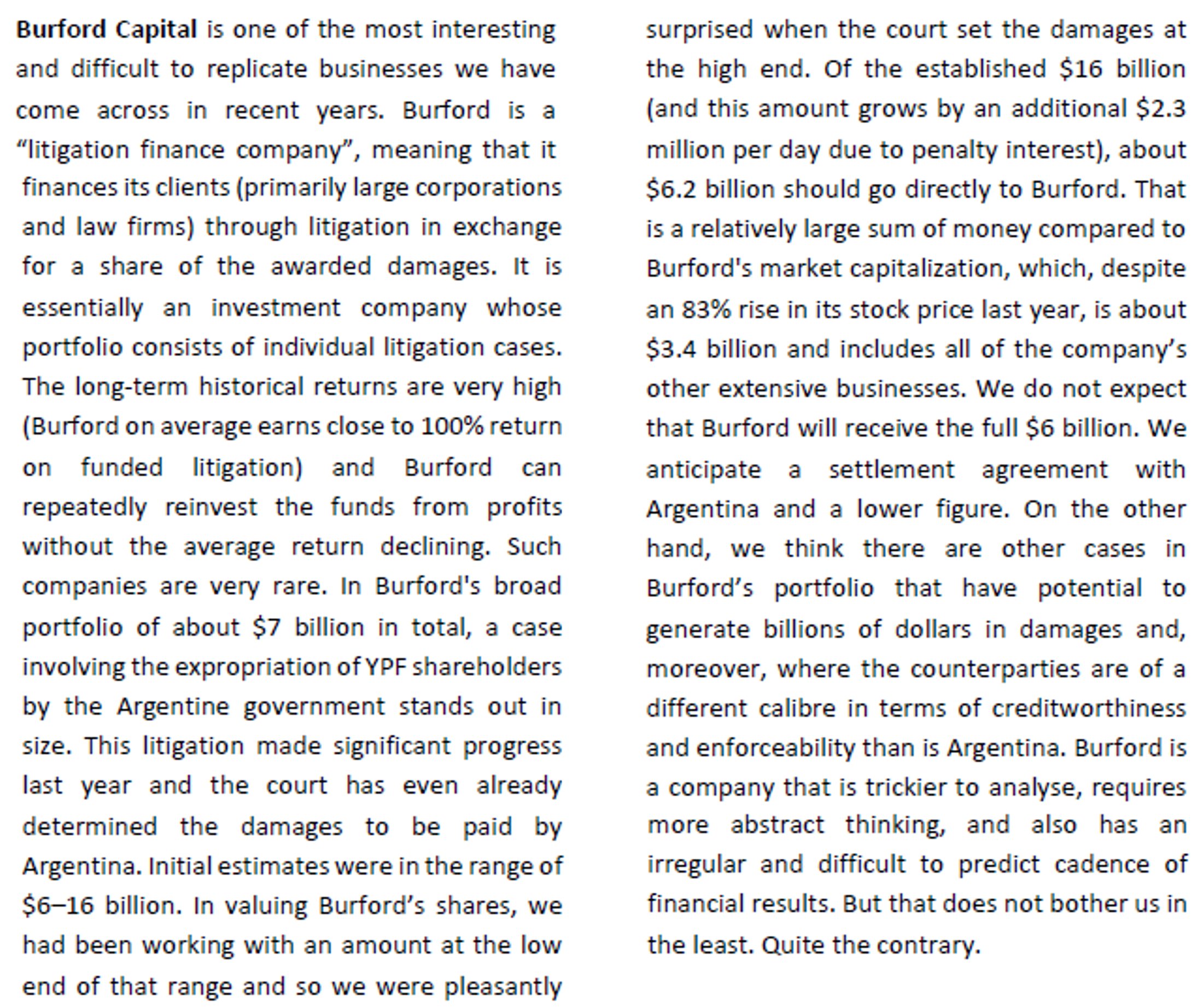

Vltava Fund on Burford Capital:

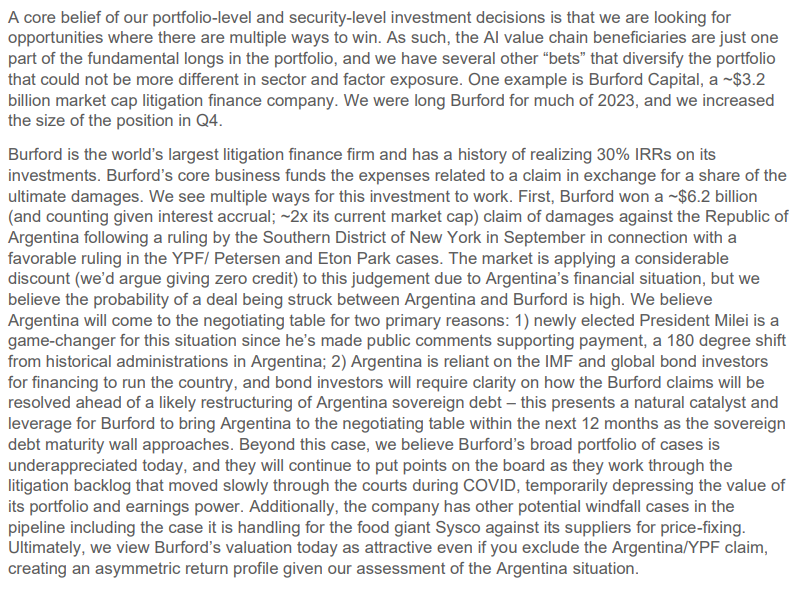

From Jackson Peak Capital:

From Alphyn Capital:

Excerpt from their recent shareholder letter:

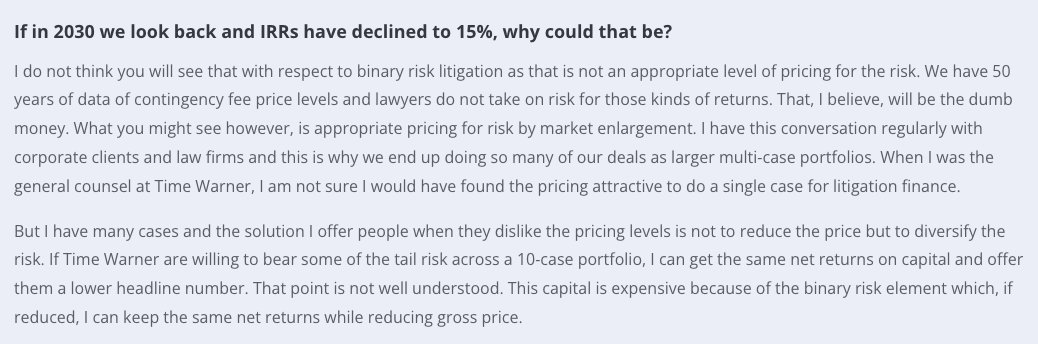

The CEO answer to a hypothetical on why IRR’s may decline to 15% by 2030:

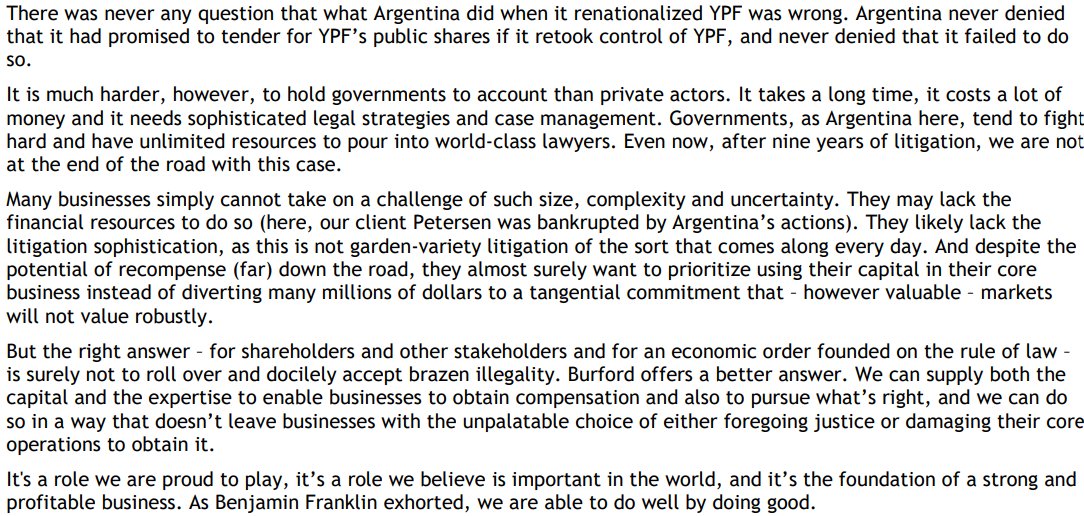

Some noteworthy takeaways from the 2023 $BUR shareholder letter (thread):

Some noteworthy takeaways from the 2023 $BUR shareholder letter (besides the obviously fantastic results and positive YPF commentary):i) Scale now permits the company to a) take on more Peterson-like cases with moderate capital outlay and potential for ten-figure outcomes and b) reduce the use of 2/20 fund capital in favor of reclaiming more investments for equity shareholders

ii) The goal is to provide a long-term ROE of 20% or more

iii) Old matters are still alive. One set of matters financed in 2010 has just successfully concluded and is expected to generate $360 million cash on a group-wide basis in the next 18-24 months (0.8x ROIC but low IRR due to passage of time)

iv) Re OpEx increase: mostly non-cash accruals associated with increase in PF valuation. Accrued compensation expenses only become payable with cash receipts from underlying matters, thus protecting shareholders and aligning management

v) BUR will report 10-K as a full US issuer in 2024 and expects to become eligible for US index inclusion

Giuliano wrote a 60-pages equity report on a quite obscure business.

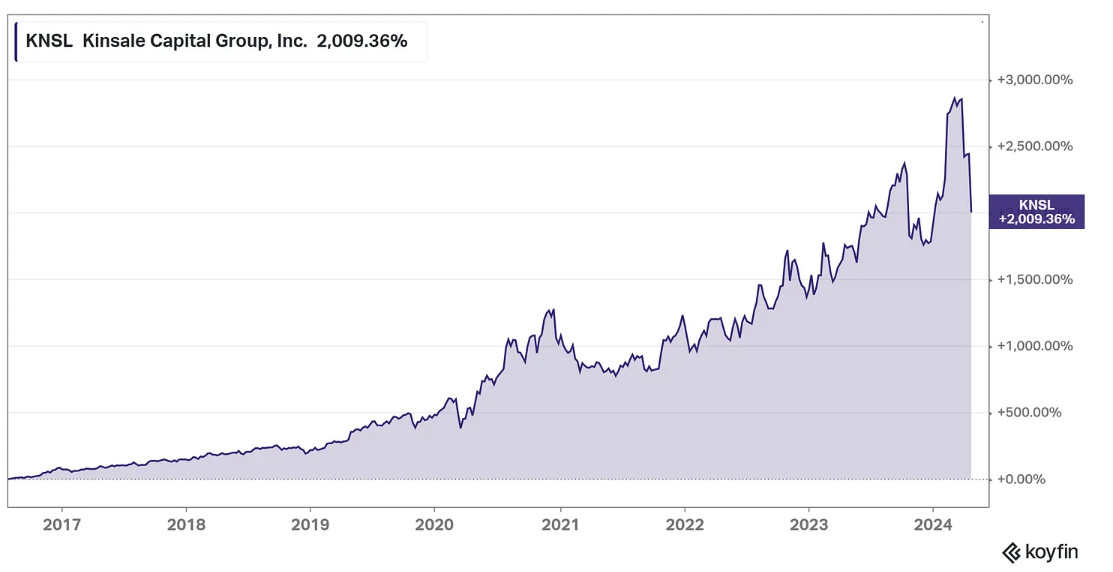

Writeup on Kinsale from Fundasy.

Twitter thread: link.

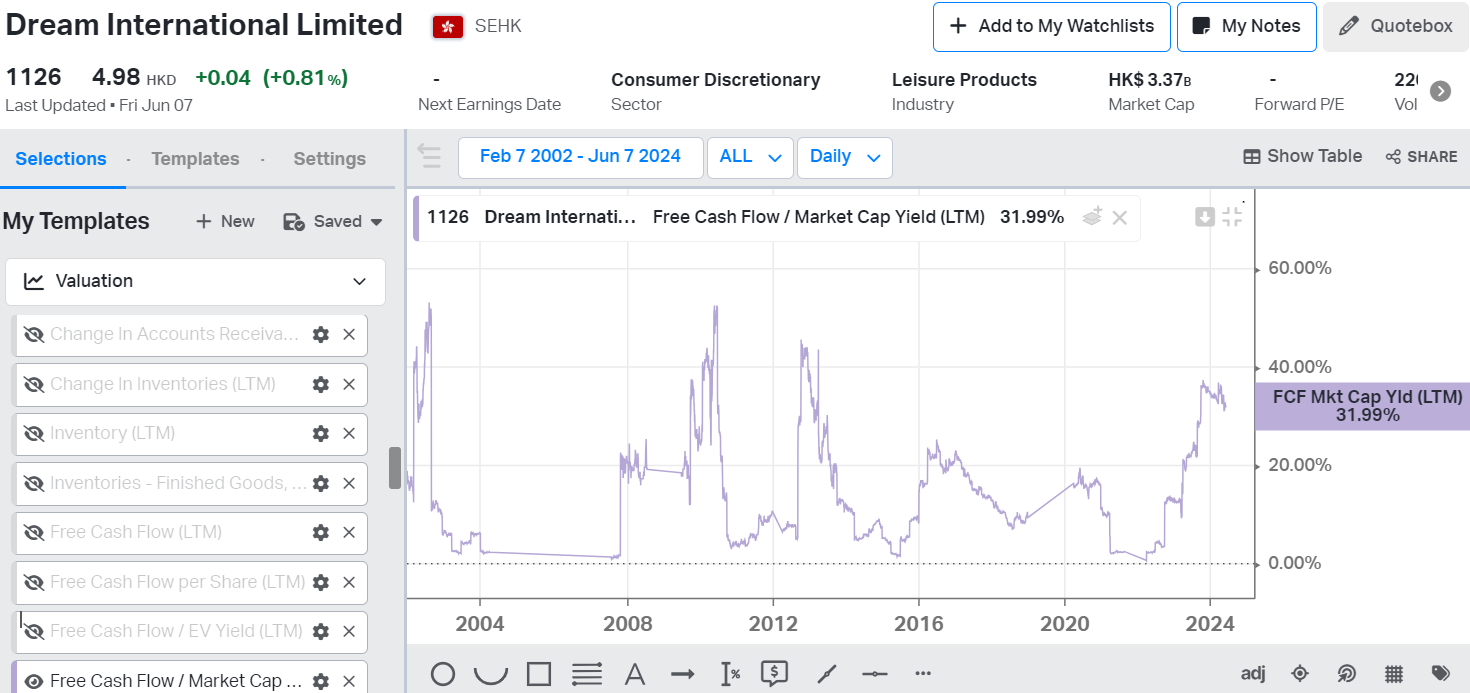

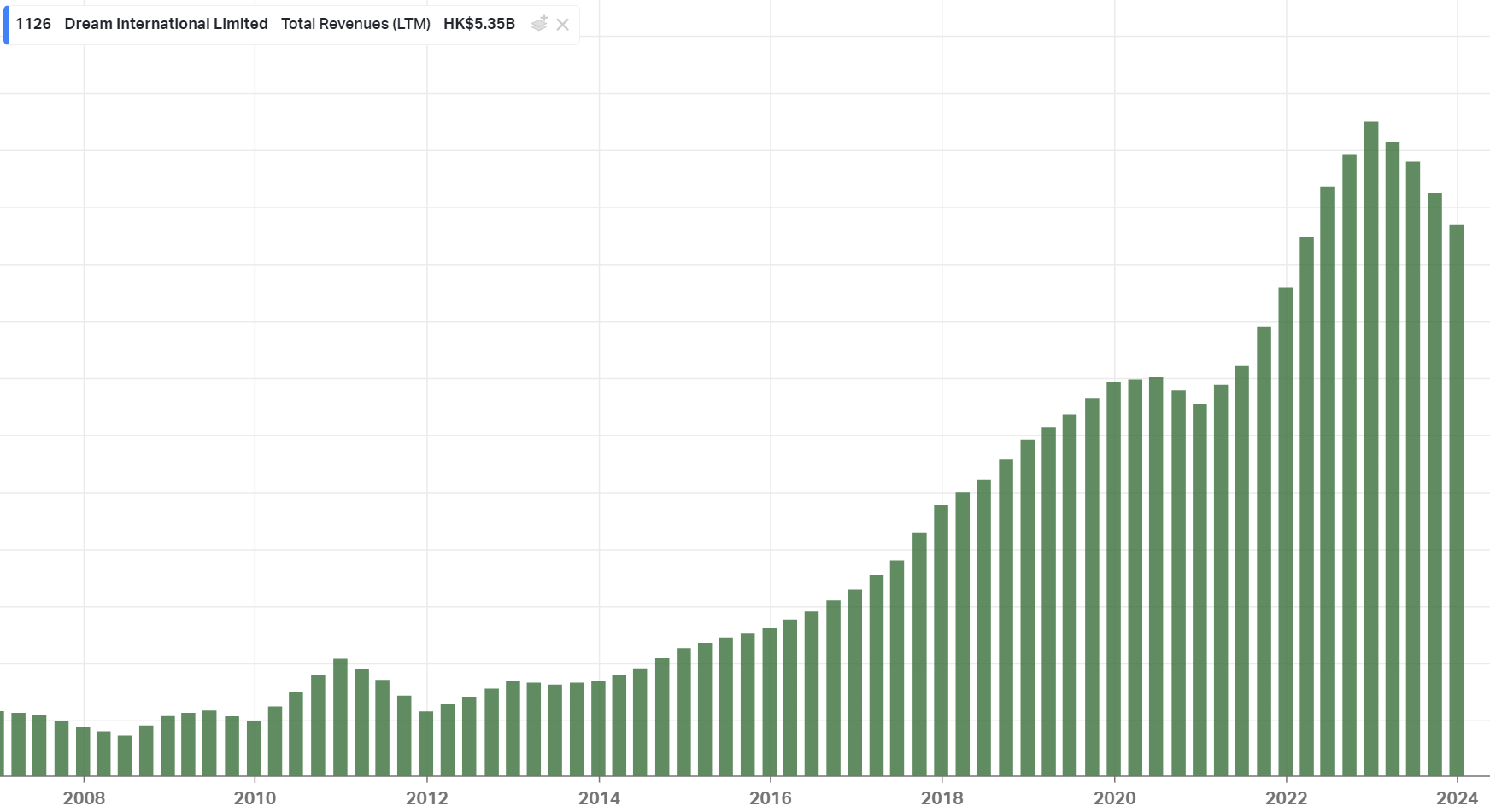

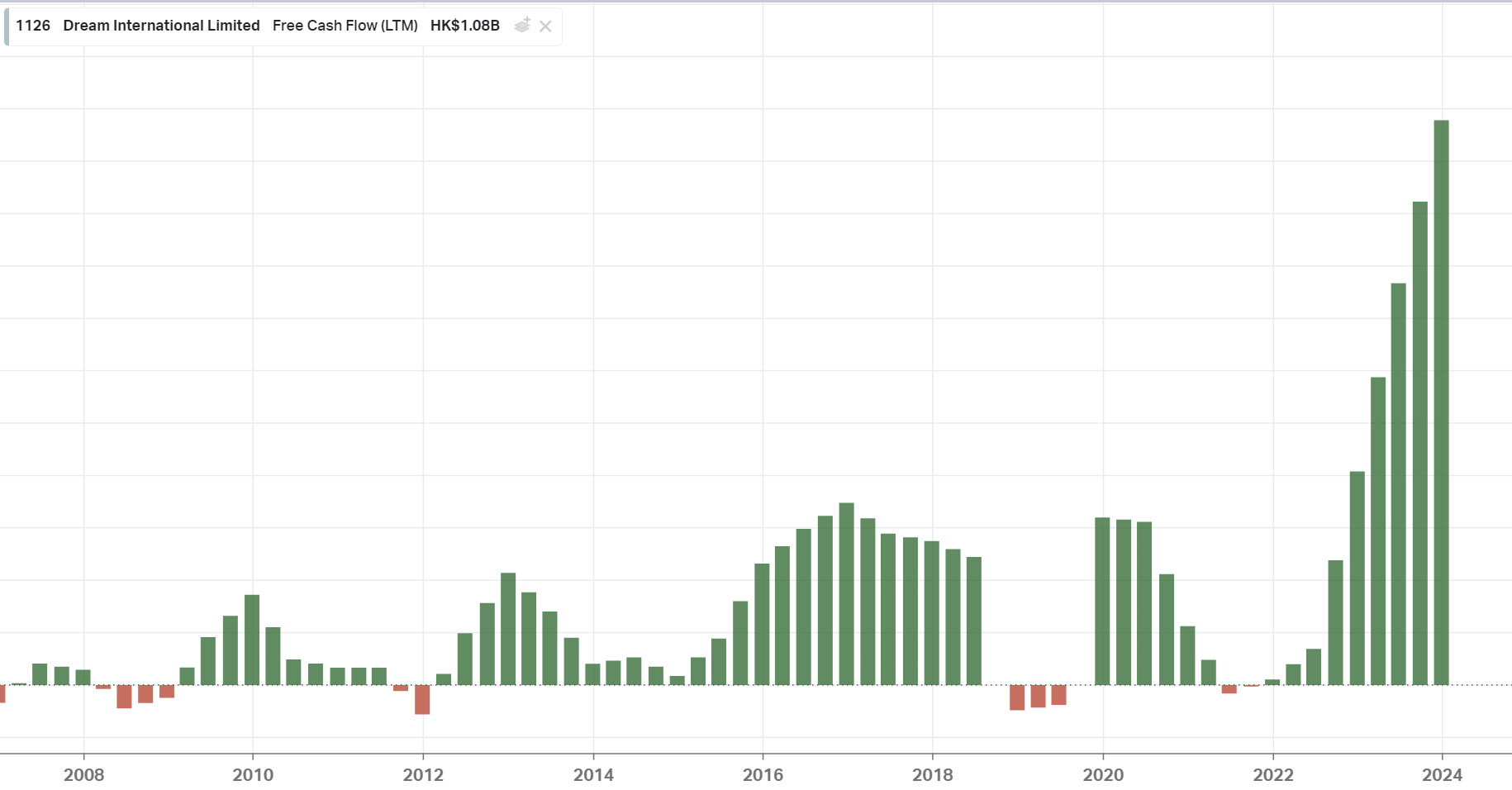

Manufactures plushed stuffed toys and plastic figures (mainly) out of Vietnam and China. Builds for Shanghai Disney and Oriental Land (which operates the Tokyo Disney Resort).

$1.2B net cash, 12% dividend yield. The chairman and family owns +70% of shares.

Twitter thread: here.

Initial source: GabelliTV

(thread)

A thorough writeup on Alex’s Investment Memo:

I ended up not keeping this one. Didn’t have a good customer experience with them.

Seems I’m not the only one: reddit thread.

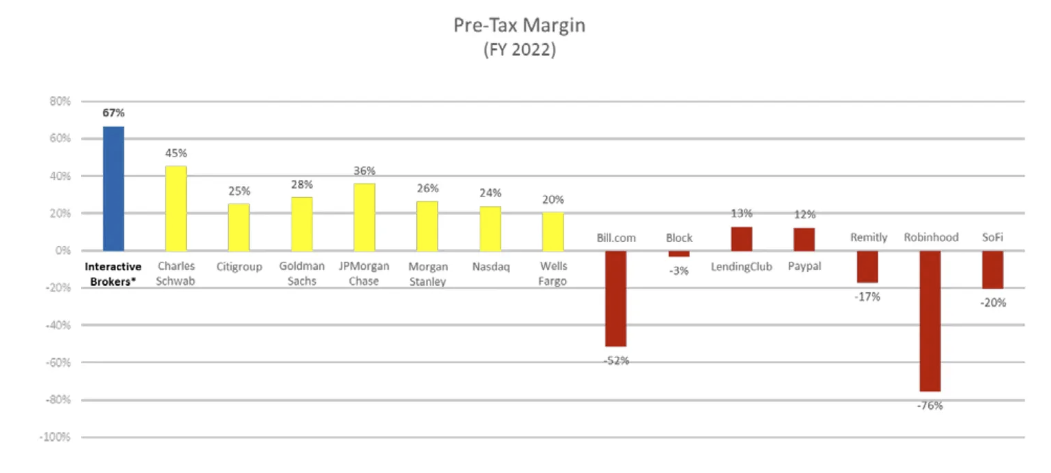

A deep dive into Interactive Brokers, just because I’m a customer.

Their insane operating margin, stemming from their focus on IT and automation, allows them to offer the highest interest rate to customers and charge the lowest interest rates on margin loans.

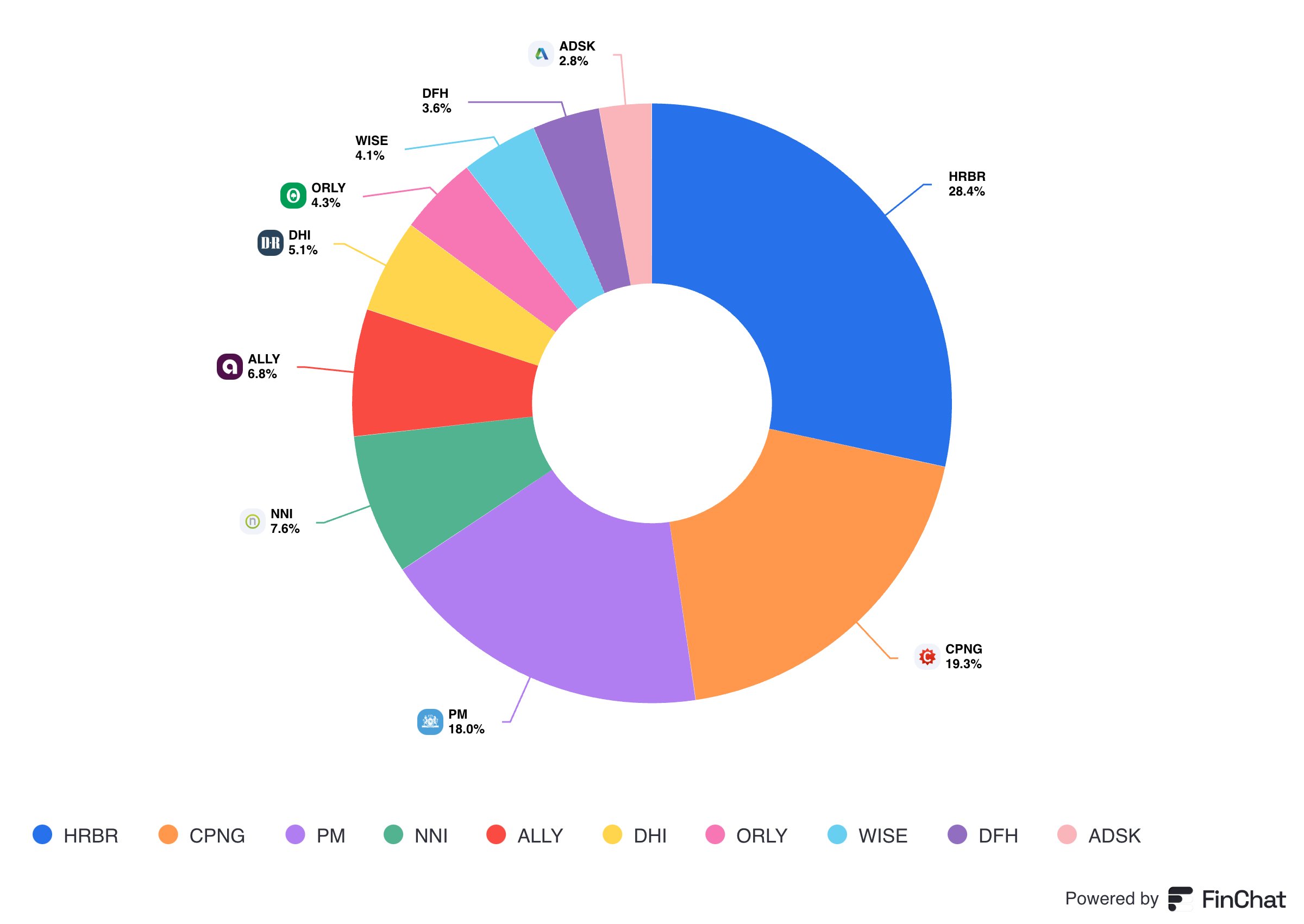

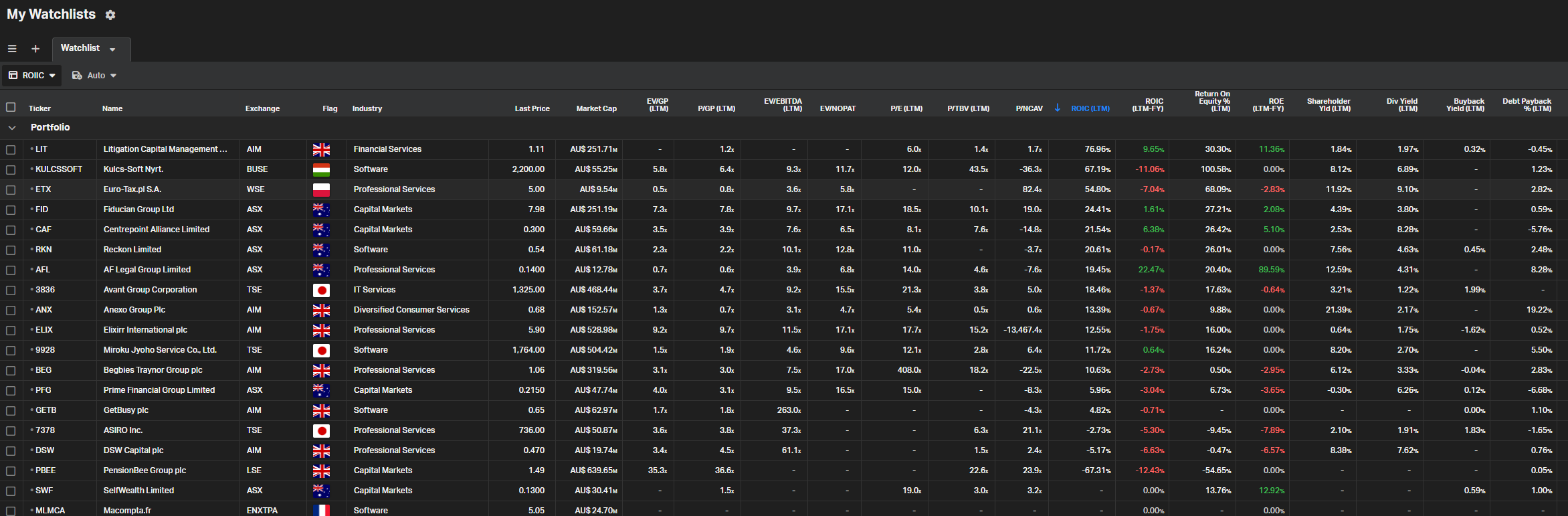

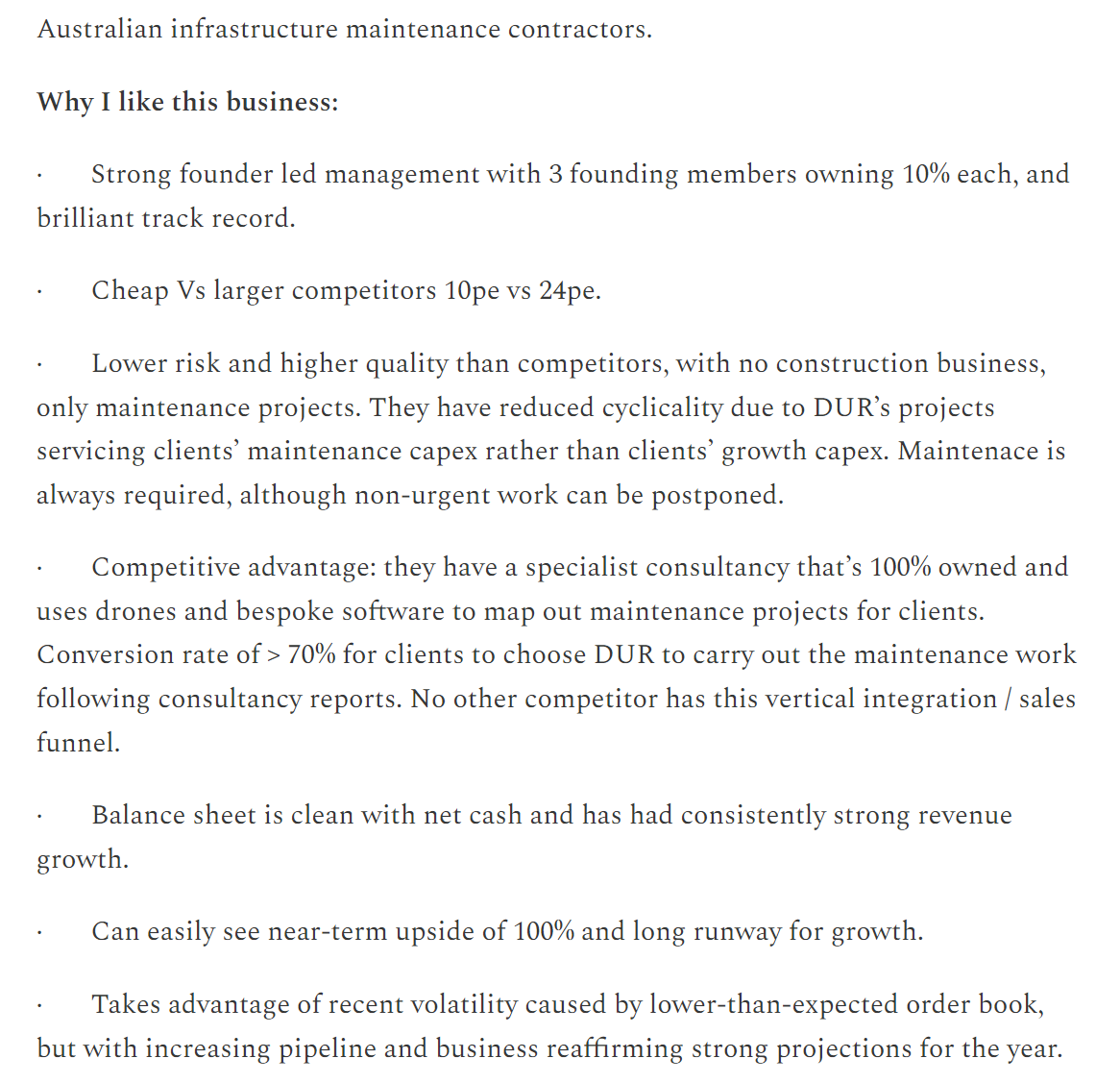

From the Hurdle Rate Unit Trust.

The final purchase I made was a new one in the French accounting software business Macompta (PAR:MLMCA), a new listing in March 2024, Macompta is listed on the Euronext Access, an unregulated exchange. Furthermore, with the CEO owning 71% and CIO owning 10% in addition to the non-dilutive oƯering there is essentially zero free float to begin with. Despite this the business listed to provide its employees with liquidity, liquidity which the Hurdle Rate Unit Trust is happy to take oƯ their hands as I believe the business trades at a valuation of ~15x forward earnings (not including net cash) and has compounded in the mid-30s over the past 5 years without dilution or debt. There is more information on this in the pitch provided after this letter.

Tristan: “The primary thing i’m looking out for is positive changes in returns on capital”

The metrics he looks at:

Not crazy expensive. Here’s an update on the company.

Special Situations Global Equities substack.

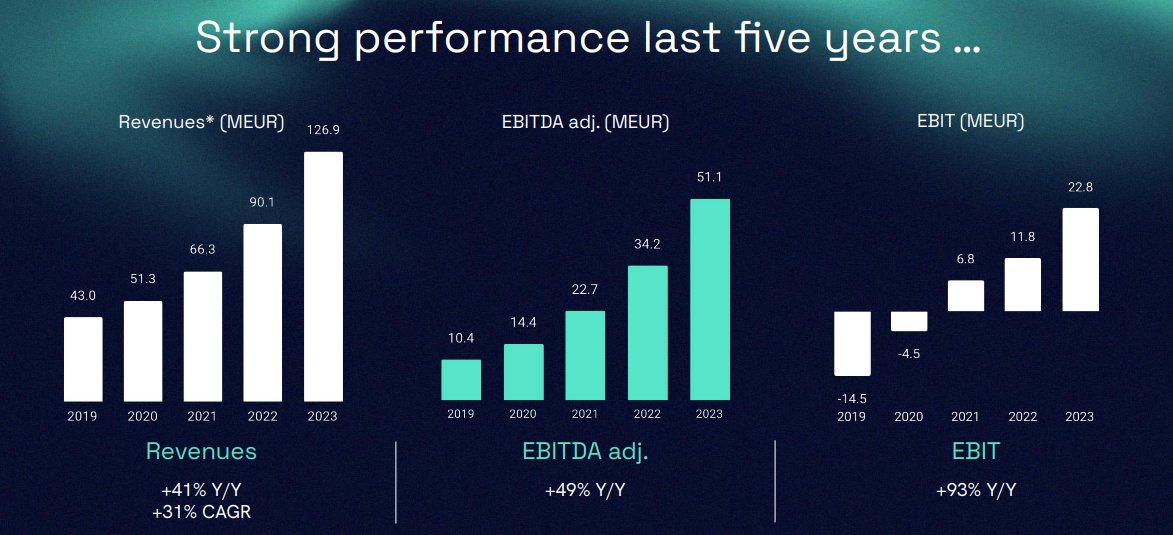

From ToffCap: “Despite the strong run, I believe there’s still multi-bagger potential left here and that the story will accelerate going forward.”

Thread: here.

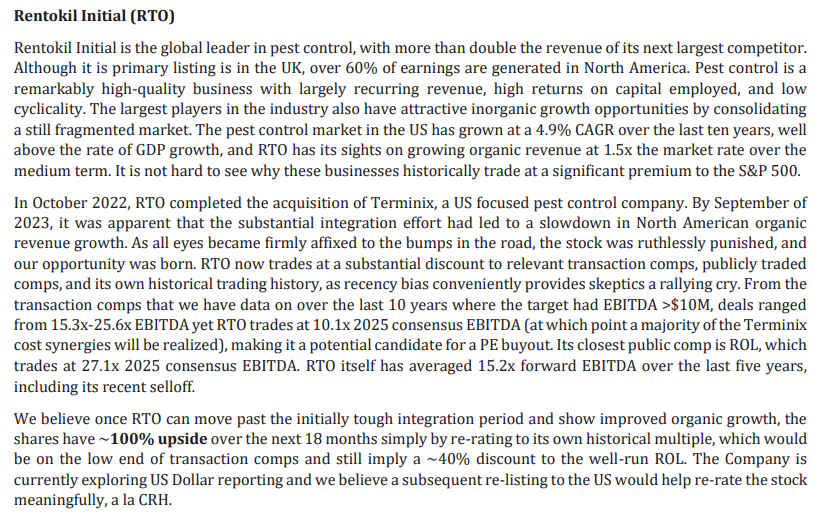

Voss Capital on Rentokil Initial:

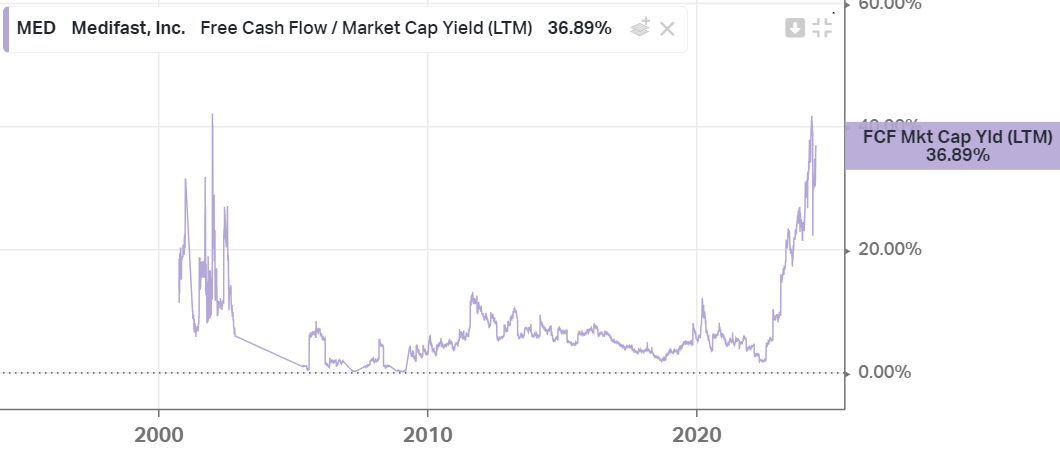

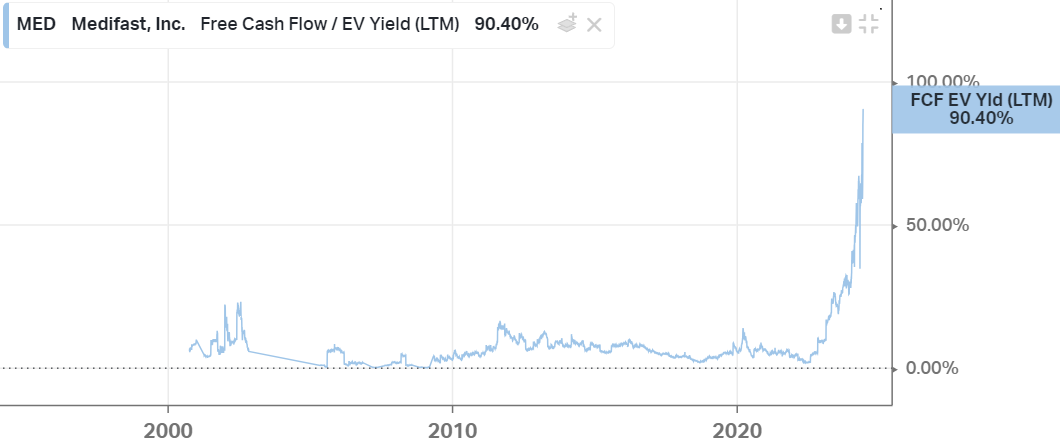

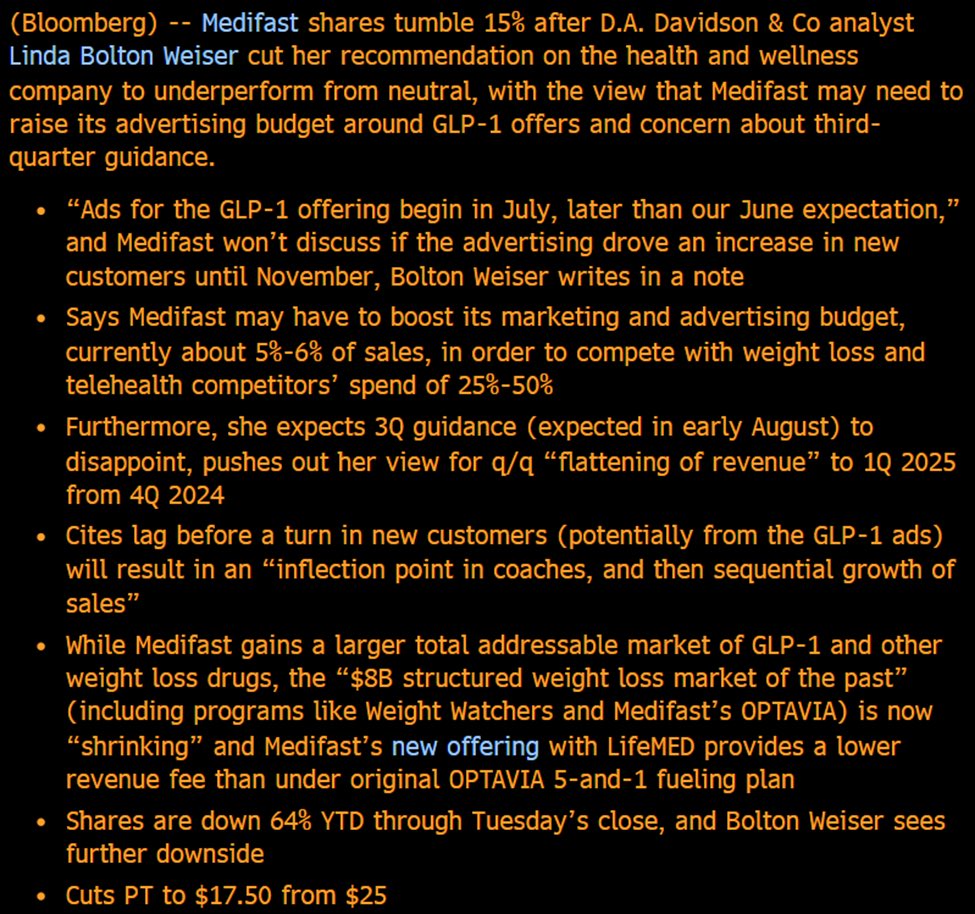

$MED has been a perfect recent example for a value trap with $NVO $LLY introducing weight loss drugs.

Medifast Continues Business Transformation.

Medifast pivoted at the end of 2023, partnering with $LFMD to bundle telehealth prescriptions of GLP-1 with its Optavia program. Will it work? Time will tell, but even the company admits that GLP-1 patients will order lower quantities of food:“We expect that our newly acquired customers using medically supported weight loss products will have a lower order size, but will use our OPTAVIA coaching services and nutritional support products for longer as we expand our reach beyond weight loss into maintenance and other healthy habits such as exercise and sports nutrition.”

Medifast: Significant Undervaluation Even As Struggles Persist.

I really enjoyed this thesis from vic (archive).

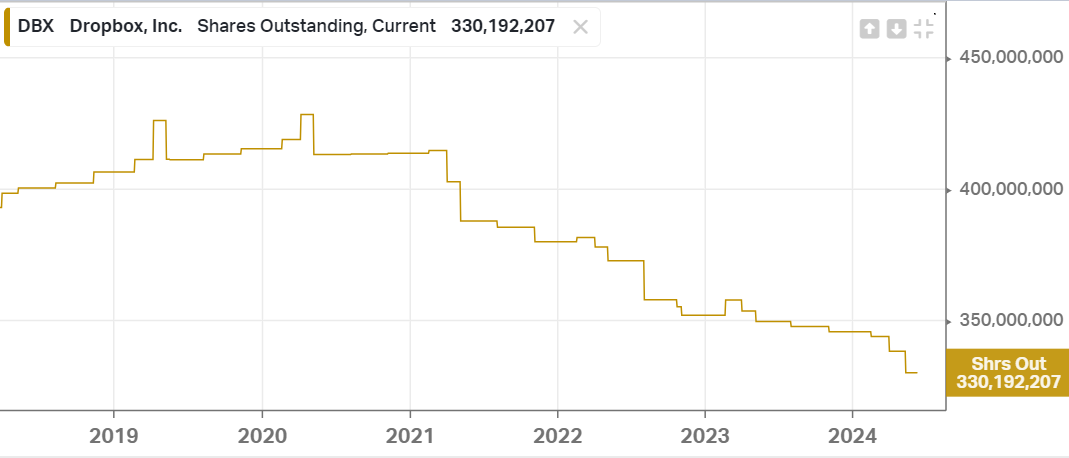

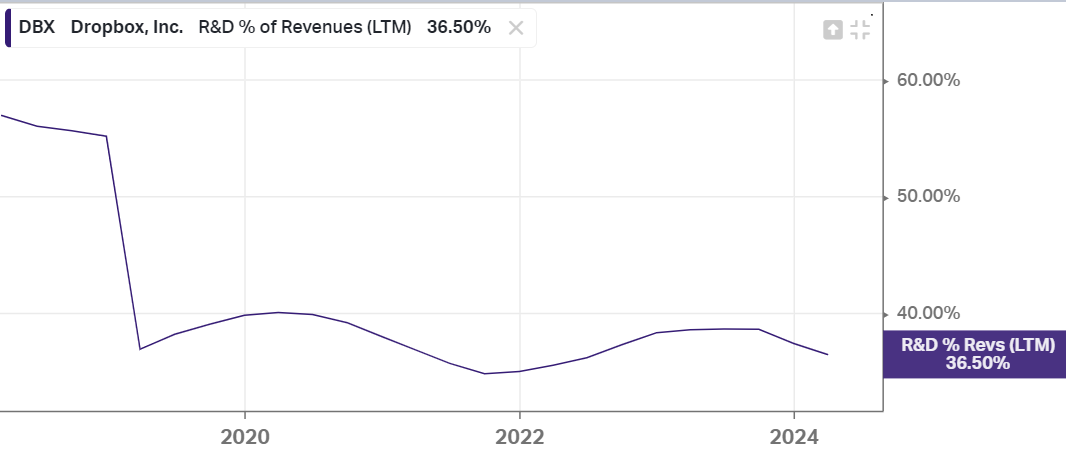

LTM FCF is $780M. SBC is $340M. So $440M of real FCF, on a market cap of $7.07B and EV of $7.9B.

So FCF/EV is ~ 5.5%, too low for a mature non-growing business.

But it is a sticky business, and they’ve been buying back shares at a decent clip.

R&D expenses are a staggering 36% of revenue. For context, that’s higher than Google, Tesla, Nvidia, AMD, or Apple.

Could be interesting, but with SBC at 19% of revenue, FCF is nil post-SBC. Pass.

Update:

The 19.7% stake in $BGEO.L is now worth: GBP 342M.

$CGEO’s market cap is: $375M GBP.

Net debt is GBP 93M, and we said previously that the porftolio of large companies is worth (conservatively) $200M.

So:

- BGEO + large portfolio - debt = 450M

- Market cap = 375

This is getting cheap…

(thread)

Bear case:

Another bear perspective:

(thread)

I’m realizing this is a weak to average investment. I should gtfo.

(link)

Scandinavian Tobacco: an update from the tobacco King: What is normal?.

Initial writeup: The Artisanal Serial Acquirer

Azeus Systems, written up by dirtcheapstocks (archive).

Although he says this type of opportunity doesn’t screen well, I have to disagree. It did trade for less than 4x EV/FCF.

That being said there are some goodies in this writeup; notice that it’s not enough for the business to cheap. It still needs to be a good business, or at least have a bood business within.

Let’s screen for cheapies!

Disqus comments are disabled.