#117 - Ramblings July2024

Last updated: Jul 31, 2024

Jack Dorsey on turning an idea into a reality.

Video: link

Hermes

The family behind the luxury brand has succeeded by sticking to what it does best: timeless elegance.

Full article: link.

How Can You Negotiate VC Funding Round?

Reproduced without modification from the Venture Curator newsletter:

Fundraising is a learned skill

And VCs almost always have the upper hand because they deal with it all day, every day.

In reality, knowing what to expect from VCs – the negotiation dynamics Founders are likely to encounter – is half the battle.

The Portfolio Trap

VC: “I’d like you to meet with one of our portfolio companies in your space. They can provide valuable insights, and we’d appreciate their perspective on your venture.”

This request often puts founders in a tricky position. Sharing your plans with a potential competitor can be risky, and the existing portfolio company has little incentive to endorse your startup. They may tell the VC they’re planning to expand into your area, making it challenging for the investor to back you. While VCs might have good intentions, this practice can sometimes backfire or be used to gather intelligence for their existing investments.

Founder’s Reply: If the suggested company is too close to your business, politely decline:

“I appreciate the offer and value your network. However, given the significant overlap between our business and this portfolio company, I’m not comfortable sharing our strategic plans. Perhaps we could meet with other industry experts who aren’t directly in our space?”

If the portfolio company isn’t a direct competitor, consider accepting:

“Thank you for the introduction. I’d be happy to meet with them. It would be valuable to hear about their experience working with your firm and get their industry insights.”

Remember, your goal is to protect your business interests while maintaining a positive relationship with the potential investor. If you do meet, use it as an opportunity to learn about the VC’s support and working style from an existing portfolio founder’s perspective.

The Valuation Conversation

VC: “What valuation are you looking for in this round?” or “What’s your target price for the company?”

This question is a common tactic used by VCs to gauge your expectations and potentially anchor negotiations at a lower point. While it’s a legitimate inquiry, it can be a pitfall for founders who, in an attempt to appear reasonable, might suggest a valuation below their company’s true worth. Remember, any figure you mention could become the ceiling, not the floor, for further discussion.

Founder’s Reply: Unless you’re dealing with a priced extension round or a convertible note with predetermined terms, it’s wise to defer to market dynamics. A tactful response might be:

“We’re open to letting the market determine our valuation. We’re more focused on finding the right partners who can add value beyond just capital.”

If you’ve had a previous funding round, you can provide context without committing to a specific number:

“Our last round valued the company at $X million post-money. Since then, we’ve achieved significant milestones, including [brief mention of key metrics or achievements]. We believe these developments have substantially increased our value, but we’re eager to hear the market’s perspective.”

This approach demonstrates confidence in your company’s progress while leaving room for negotiation and avoiding the trap of undervaluing your startup prematurely.

Turn Into Home Run

VC: “Based on our analysis, we’d like to offer you $X million at a valuation of $Y million.”

This initial offer might seem disappointingly low. It’s a common strategy in VC negotiations, often serving as a starting point rather than a final stance. Inexperienced founders sometimes react emotionally, potentially derailing a deal that could have been salvaged with the right approach.

Founder’s Reply: The key is to remain composed and professional. A strategic response might look like this:

“Thank you for your offer. We appreciate your interest in our company. While this valuation is considerably below our expectations, we’d like to take some time to review it in detail. We’ll get back to you soon with our thoughts.”

This response acknowledges the offer without accepting or rejecting it outright. It buys you time to explore other options and potentially leverage them.

If you receive more attractive offers later, you can circle back:

“We’ve had some time to consider your offer and explore the market. We’ve received interest at significantly higher valuations that better align with our growth trajectory and potential. We value our relationship and wanted to allow you to revisit your offer if you’re interested. If not, we completely understand and hope to stay in touch for future opportunities.”

This approach keeps the door open while signalling that you have other options. It gives the VC a chance to improve its offer without burning bridges. Remember, maintaining positive relationships in the VC world can be beneficial for future funding rounds or networking opportunities.

Deflect the Friendly Lowball

VC: After a warm, engaging meeting filled with enthusiasm and positive feedback, the VC follows up with a surprisingly low offer. This unexpected contrast between their friendly demeanour and the underwhelming valuation can catch founders off guard.

This scenario often leads founders to doubt their judgment or feel pressured to accept a subpar offer due to the perceived rapport. It’s a subtle tactic that leverages the positive connection established during the meeting.

Founder’s Reply: The key is to maintain your composure and separate your emotions from the business decision at hand. A balanced response might look like this:

“Thank you for the offer. We truly enjoyed our meeting and appreciate your enthusiasm for our vision. However, the proposed valuation is significantly lower than what we believe reflects our company’s current value and potential. We’d like to take some time to carefully consider this offer in the context of our market research and growth projections. We’ll get back to you soon with our thoughts on how we might bridge this gap.”

If the VC doesn’t adjust their offer, you can follow up with:

“We’ve given your offer careful consideration. While we greatly value the potential of working together, we feel that this valuation doesn’t align with our company’s trajectory and the current market. We’re open to further discussion if there’s room for adjustment. If not, we hope to keep the door open for future opportunities as our company grows.”

This approach maintains a positive relationship while firmly asserting your company’s value. It leaves room for negotiation without committing to an undervalued deal. Remember, a good partnership should be mutually beneficial, balancing enthusiasm with fair terms.

Focus on Pre-Money Valuation

VC: “We’re looking at investing $2M at an $8M post-money valuation.”

VCs often frame discussions in post-money terms, which can lead to confusion and potentially reduced founder ownership if the round size changes.

Founder’s Reply: “Thank you for the offer. To ensure we’re on the same page, let’s discuss this in terms of pre-money valuation. Based on your proposal, we’re looking at a $6M pre-money valuation. Is that correct? We prefer to focus on pre-money valuation as our fundraising target may adjust.”

ESOP Negotiations

VC: “We’d like to see a 20% ESOP allocation before the round.”

VCs often push for large ESOP pools to reduce their future dilution. They may request excessive allocations, sometimes up to 20% or more, which can significantly impact founder ownership.

Founder’s Reply: “We’ve analyzed our hiring needs until the next funding round. Based on our projections, a 10% post-round ESOP pool should suffice. This includes 2% for a key hire we’ve identified and 5% for additional team members over the next 18 months. This aligns with market standards for seed rounds and ensures we have enough to attract top talent without over-diluting existing shareholders. We’re open to discussing specific concerns you may have about our hiring plan.”

Distinguish Genuine Interest

VC: “We’re interested in investing, but we’d need you to find a lead investor first,” or “We’d like to commit, contingent on you raising the rest of the round.”

VCs often use these tactics to keep their options open without fully committing. They’re expressing interest but aren’t ready to take the lead or make a firm commitment.

Founder’s Reply: “We appreciate your interest in our company. We’re currently focusing on investors who are ready to commit without contingencies. Once we secure our lead investor, we’ll reach out if there’s still room in the round. In the meantime, would you be open to introducing us to any potential lead investors in your network?”

This response politely acknowledges their interest while prioritizing more committed investors. It also leaves the door open for future participation and potentially leverages their network.

If you’re frienzied, it’s you

By Jamie Dimon: link

The Almanack of Good Life

By Safal Niveshak.

I liked this as well:

Each small act of patience or discipline, no matter how insignificant it may seem, builds upon itself. It’s a gradual process of reinforcement, where tiny victories accumulate into significant change over time.

Turning Stocks

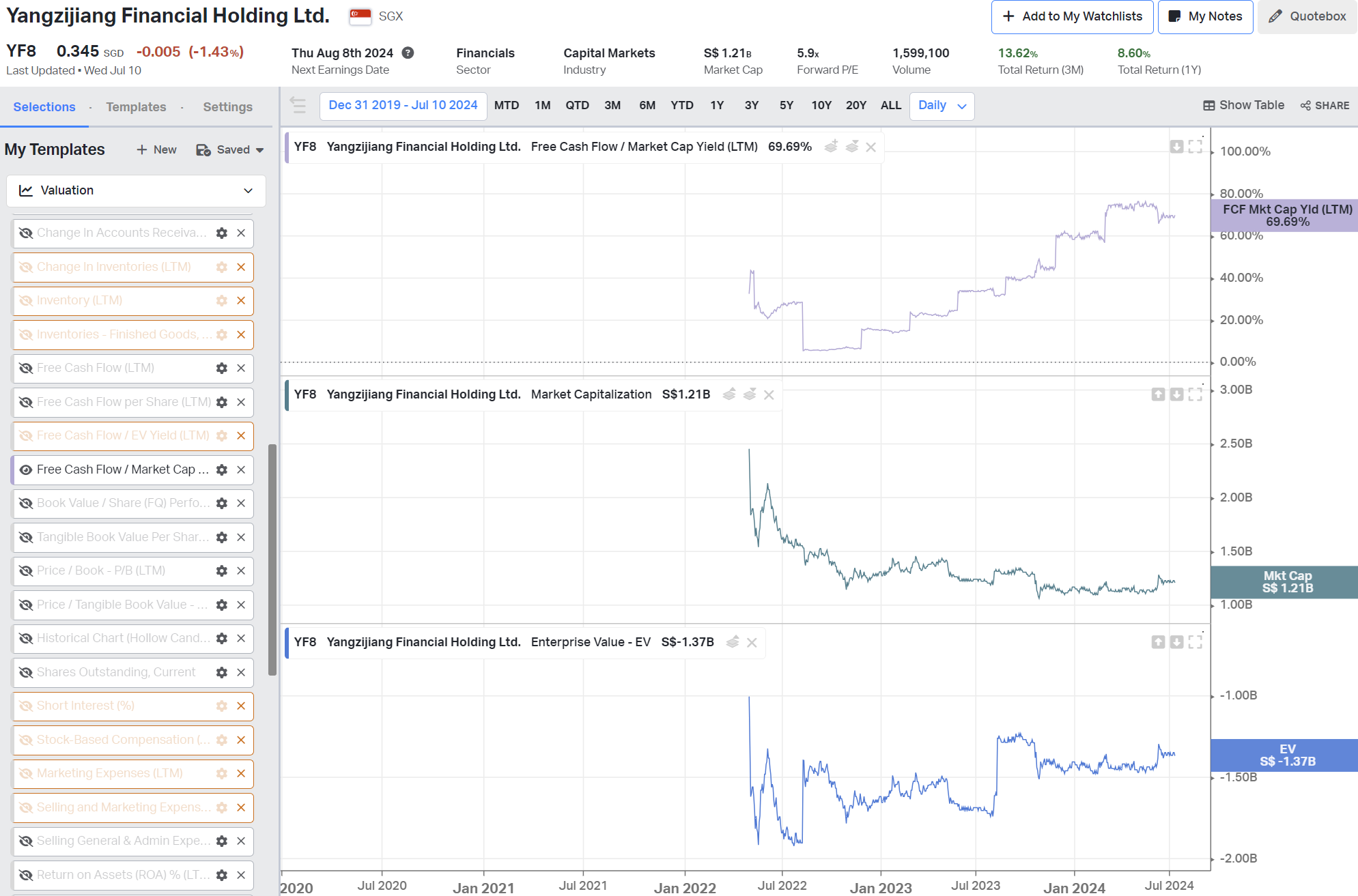

$YF8.SI

Something is not adding up here:

Very low return on equity though so I’m confused.

From their website:

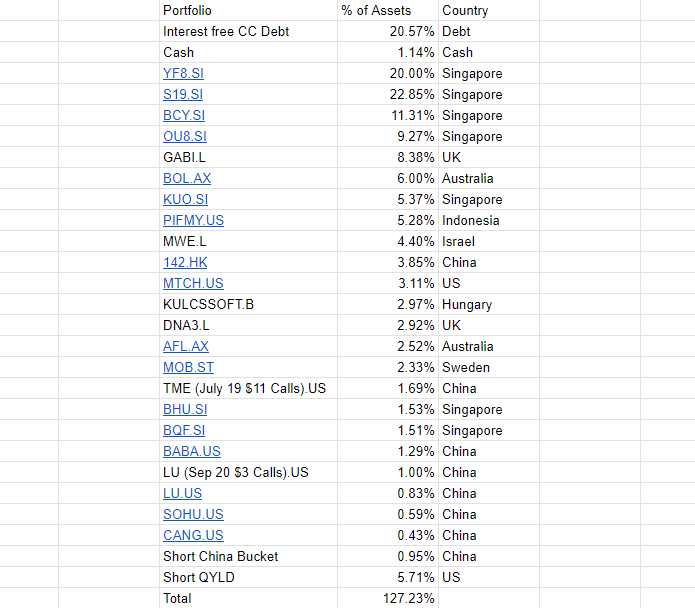

Found initially in this thread.

Full portfolio of the poster (@finphysnerd):

Disqus comments are disabled.