#119 - Ramblings Aug2024

Last updated: Oct 5, 2024

The Brain Really Doesn’t Like Chaning Its Mind

Hence commitment bias, anchoring bias, etc.

Clip: link

InPractise Top20 Free Interviews

- [TransDigm: Value-Based Pricing Strategy w/ Former President at TransDigm](https://inpractise.com/articles/tdg-pricing-operations

- The Ferrari Way w/ Former CEO Ferrari, China

- The Danaher Business System Mindset w/ Former Director at Danaher

- Burford Capital: Pioneering Litigation Finance w/ Co-Founder and CEO of Burford Capital

- Wayfair, Amazon, and Building Global Ecommerce Supply Chains w/ Former Chief Global Supply Chain Officer at Wayfair

- Tesla, Waymo, & Lyft: Hurdles to Autonomous Driving w/ Current EVP, Autonomous Driving at Lyft and Former VP Street View at Google

- Bergman & Beving: The Original Serial Acquirer w/ Current CEO of Bergman & Beving

- Online Food Delivery: A Restaurant’s Perspective w/ Former Domino’s UK CEO & Current Burger King UK CEO

- Google & Travel Value Chain Structure

- Datadog, Open Telemetry, & A History of Observability w/ Former Senior Google Engineer and Current Principal Developer Advocate at Honeycomb

- Röko: Building a Leading Serial Acquirer w Founder and CEO of Röko and Former CEO at Lifco

- SDI Group: Niche Manufacturing Serial Acquirer w/ Former CEO of SDI Group

- Copart: Running a Salvage Yard w/ Former Yard Manager at Copart (Spotify / Apple)

- Aldi: Hard Discounter Business Models w/ Former CEO Aldi, UK

- Evolution of the Advertising Media Holding Company

- Netflix and Global Video Streaming w/ Former Vice President, Head of International Originals, at Netflix

- The Early Days of Scaling GFL Environmental w/ Former VP and Right Hand Man to Patrick Dovigi

- From WPP to S4 Capital: Rewriting the Advertising Industry w/ Sir Martin Sorrell, Former CEO of WPP and Founder and CEO of S4 Capital

- The Gym Group: Low Cost Economies of Scale w/ Founder and Executive Chairman of The Gym Group

- Vertu Motors & UK Franchise Auto Dealers w/ Chairman of Vertu Motors

- Upwork, 99designs & Horizontal vs Vertical Marketplaces w/ Former Chief Operations Officer at 99designs

Keep Going

Porn Insights

Turning Stocks

$WISE.L

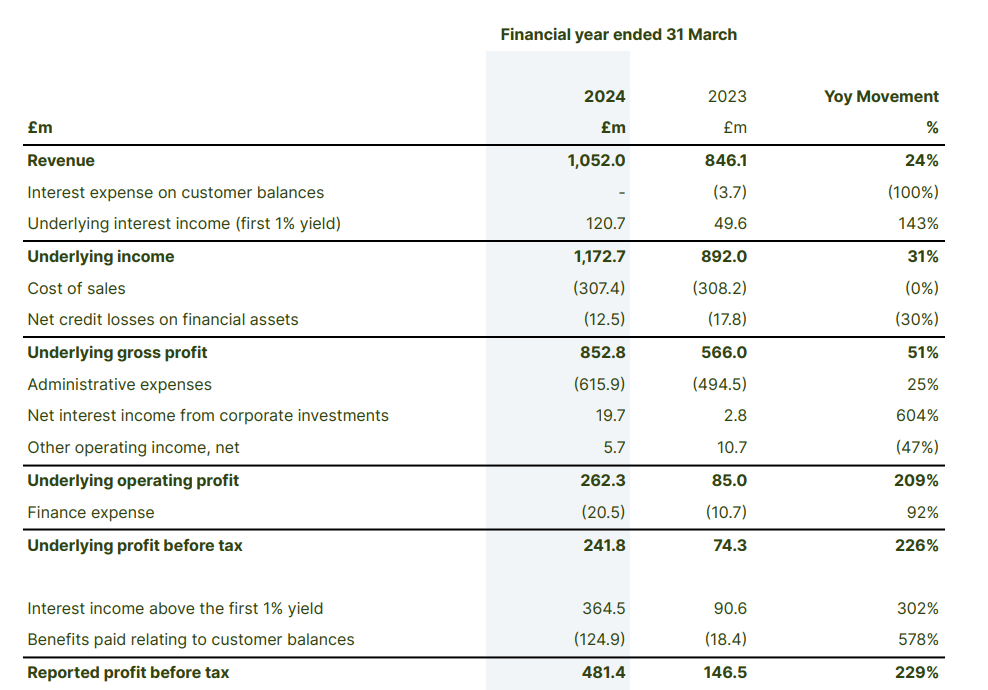

For FY24 (ended 31 March 2024) they had ~£800m of net cash (200m of debt and £1b of coporate cash, excluding customer deposits and such).

Market cap: £7173m

=> EV: £6373m

Underlying adj EBITDA: £333m (vs adj EBITDA of 573m)

EV/EBITDA (adj underlying) ~ 19x

But it doubled from 2023 to 2024, with the help of interest income and strong operating leverage.

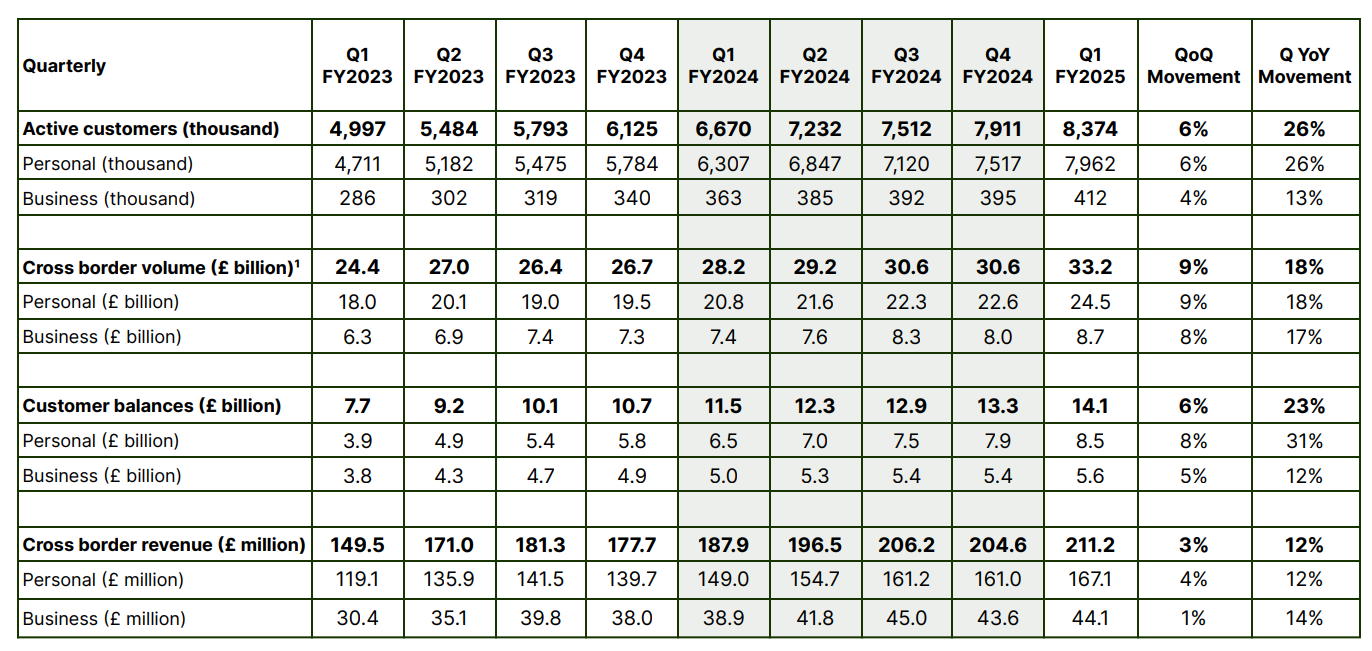

From their 2025 Q1 report:

From: MoneyFlow Research:

Founders Taavet Hinrikus and Kristo Käärmann pioneered ‘Mission Zero’, a term that embodies their steadfast dedication to driving customers’ costs toward zero for cross-border transactions, encompassing FX markups and fees. Every facet of Wise, from its internal processes to its cross-functional teams, is aligned and dedicated to fortifying this objective.

The conclusion from this fantastic writeup:

It is hard to go wrong with a 5% yield growing at a 20%+ growth rate.

MoneyFlow has updated their thesis inAugust 2024 here. (archive). This by the way is one of the best writeups I’ve read on Wise so far. The only part that worries me a bit is that at the end of the writeup he arrives at a CAGR of (only) 15%. Good not great.

Some additional thoughts; in 2024:

- underlying PBT was £241.8M

- interest income above the first 1% yield was £364.5

- benefits paid relating to customer balances was £124.9M

- reported profit before tax = 241.8 + 364.5 - 124.9 = 241.8 + 239.6 = £481.4M

- if we use the 20% target instead (of retained interest income above the first 1% yield), the reported profit before tax would have been = 241.8 + 20% * 364.5 = 241.8 + 72.9 = £314.7M

- UFCF (underlying FCF, which I think excludes tax expense) was £247M, pretty much the same as underlying PBT

- FCF was £486.6M, very close to reported PBT

- if we use the 20% target, FCF would have been close to £310M

- this represents an FCF yield of ~ 4% (for 2024), most likely 5% in 2025

On second thought, while I still like the company (a lot), I’m just not as much in love with the valuation at the moment.

In a nutshell, I think the business is currently fairly valued, meaning my expected CAGR from here will be the growth rate of the company’s earnings. Can they grow at ~20% in the next few years? Not impossible, but not guaranteed. I wouldn’t mind a couple of extra percentage points from a valuation rerate. I’m undecided as to whether I should trim a bit and wait for another entry point.

$IAC

In the 2024Q1 Shareholder letter (link):

- MGM FCF in 2024Q1 = $400M (IAD owns 20%)

Adj EBITA guidance (2024, low end):

-

DDM: $280M

-

Angi: $120M

-

Search: $20M

-

Corporate: -$100

-

Total: $340M

-

SBC: -$130M

-

$Net: $210M

Stake in $MGM:

Fair value in my opinion: 7x EBITDA = 7 x $210M = $1.5B

-

stake in $MGM (20% x $10B market cap = $2B)

-

stake in Turo (30$ of $1B or $300M)

= $3.8B

Vs current market cap: $4B

Still overvalued in my eyes, unfortunately.

$COST.L

I’m fairly certain I will sell my Costain position to buy more $WISE.L.

The triggers to sell Costain were the following, from their 2023 FY presentation:

- p13: “We expect our FY 24 year-end net cash position to be broadly similar to that at the end of FY 23, as the underlying adjusted net free cash flow from the business is likely to be offset by the unwinding of cumulative working capital timing benefits of around £25.0m at the end of FY 23.”

This makes it sound like the FCF for year 2024 will be just $25M?! (vs $164M for 2023)

- p18: “We have an increasingly broad customer base and have already secured >£1bn of revenue for 2024.”

This is compared to $1.3B revenue for 2023 (down from $1.4B in 2022).

Overall, this doesn’t sound like a growing business to me. I’ve already benefitted from multiple expansion. I have no idea what this business does and to be honest. No need to overstay my welcome.

Update [2024-08-15]: sold.

Update [2024-08-24]: the company reported decent earnings (I guess) and the stock ripped higher, but I tried listening to the call and fell asleep after 10mins. No regrets.

$GIGSEK.ST

From Symmetry 2023 annual shareholder letter:

GiG is ready to split their “Media” and “Platform&Sport” segments in June 2024. We still believe that the value of the Media business is approx. SEK 80 per stock. The platform business is more uncertain, but we do not think it is worthless. The new management has launched all the right initiatives to accelerate growth and utilize the strong technology that GiG has built up. Regardless, there should still be over 100% upside from here with the stock below SEK 35. The company’s insiders seem to agree with us that the stock is significantly undervalued. They have been the biggest buyers of the stock over the past 12 months:

$FC

Another holding of Symmetry: Franklin Covey. The valuation lookes appealing enough at first sight, and the company seems to be buying back shares.

Worth a deeper look.

$AEBZY

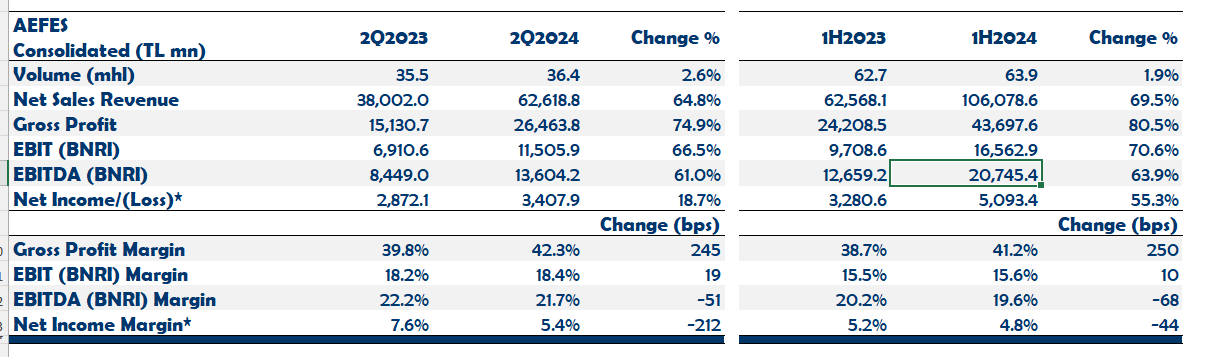

Anadolu Efes just reported:

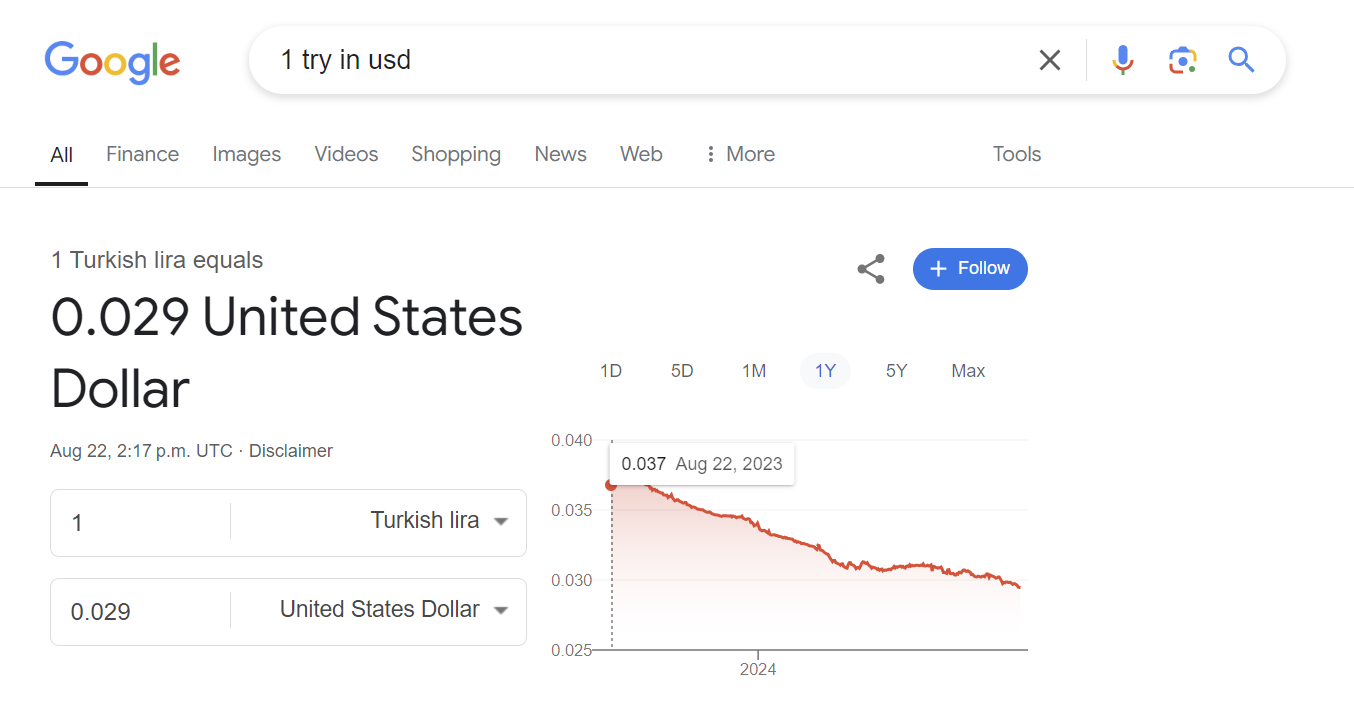

70% growth in EBIT looks very good at first sight, but this is in Turkish Lira! So not real money, no offense to anyone:

Growth in $USD was closer to 1.7 x (0.029 / 0.037) = 1.29 or 29%.

Still good.

2024H1 EBIT in $TRY was $16.5B or $490M in $USD (0.029x exchange rate). 2023H2 EBIT in $TRY was ($19.6 - $9.7B = $10B) or $340M in $USD (0.034x exchange rate as of Jan2024).

Assuming no growth in $USD in 2024H2, we get a conservative annualized 2024EBIT of 490 + 340 = US$830M.

Current market cap in TRY is $138B, or $4.1B in $USD.

Net debt as of 2024H1 is TRY$22B or US$650M.

=> EV = TRY$160B or US$4.75B

=> EV/EBIT = 4.75 * 1000 / 830 ~ 6x

Note however that the company reports numbers both before and after TAS 29 (which derives from IAS 29).

TAS 29 Financial Reporting in Hyperinflationary Economies standard is applied to all basic financial statements, including consolidated financial statements, of enterprises whose current currency is the currency of a hyperinflation economy.

Including TAS 29, EBIT (BNRI) has actually decreased from $12.5B to $12.8B and EBITDA from $19.8B to $18.5B (all in $TRY).

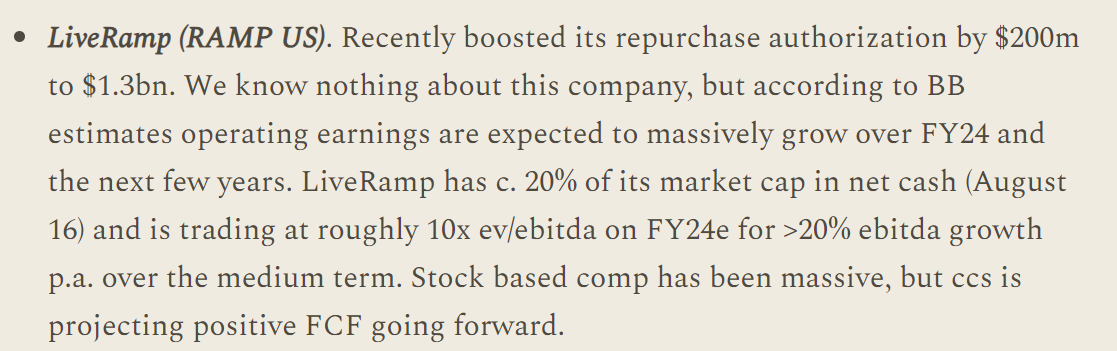

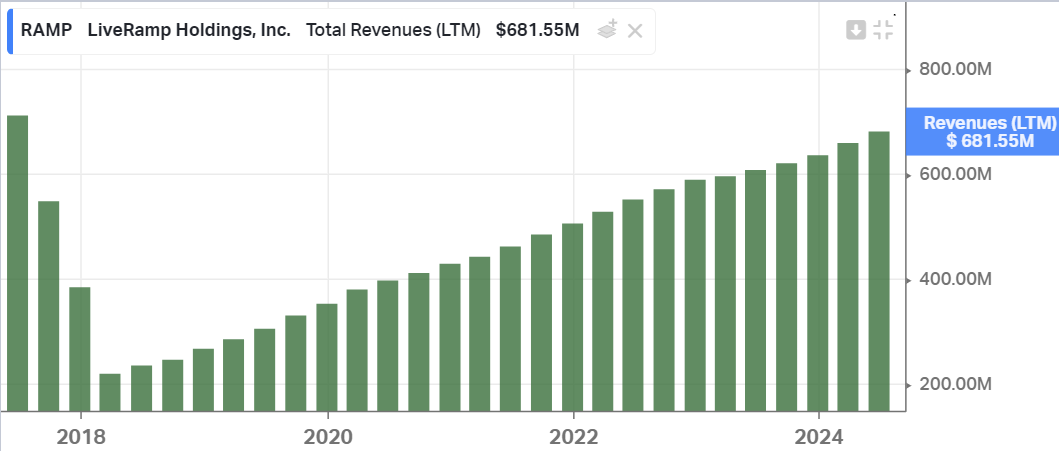

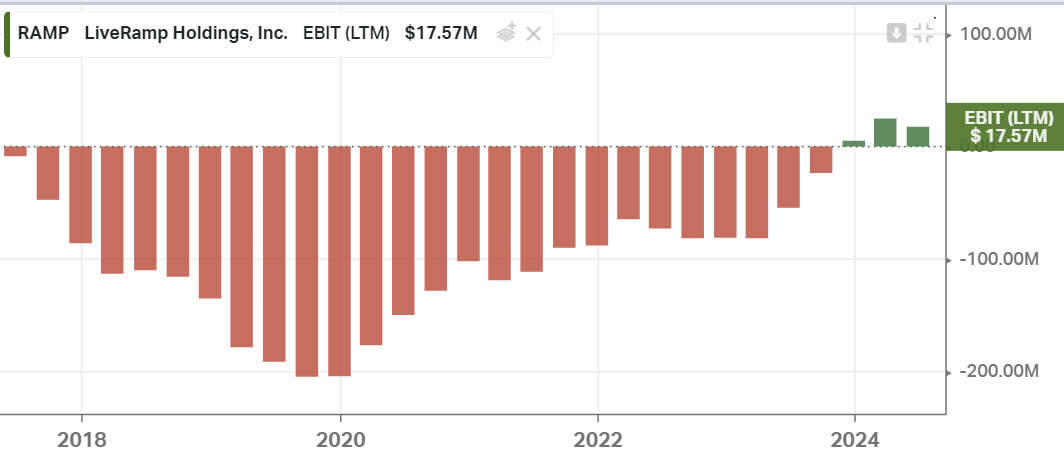

$RAMP

Found on ToffCap’s Monday Monitor.

I remember this company from my time at Meta. Meta partners with them to get a unique ID on offline customers.

The numbers and the timing look good:

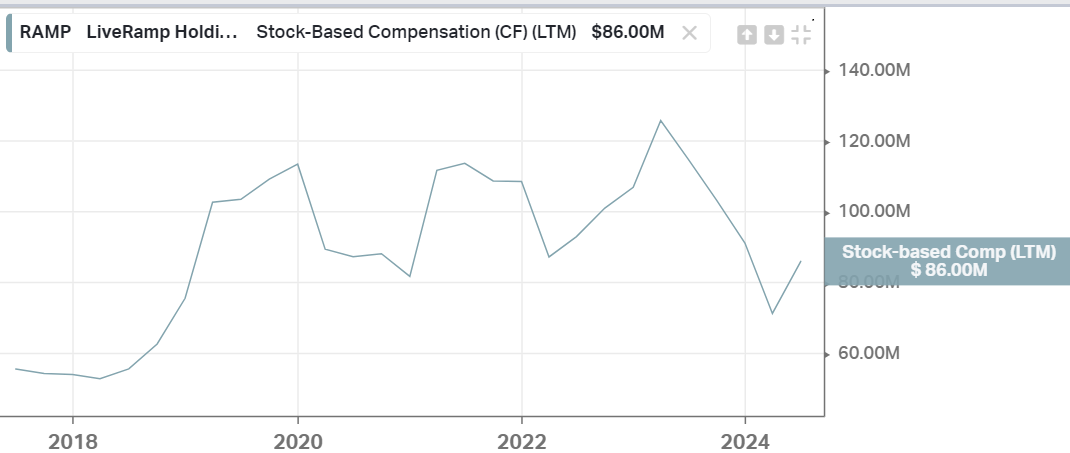

Unfortunately, SBC is massive (~$90M vs $500M gross profit) and FCF after SBC is negative:

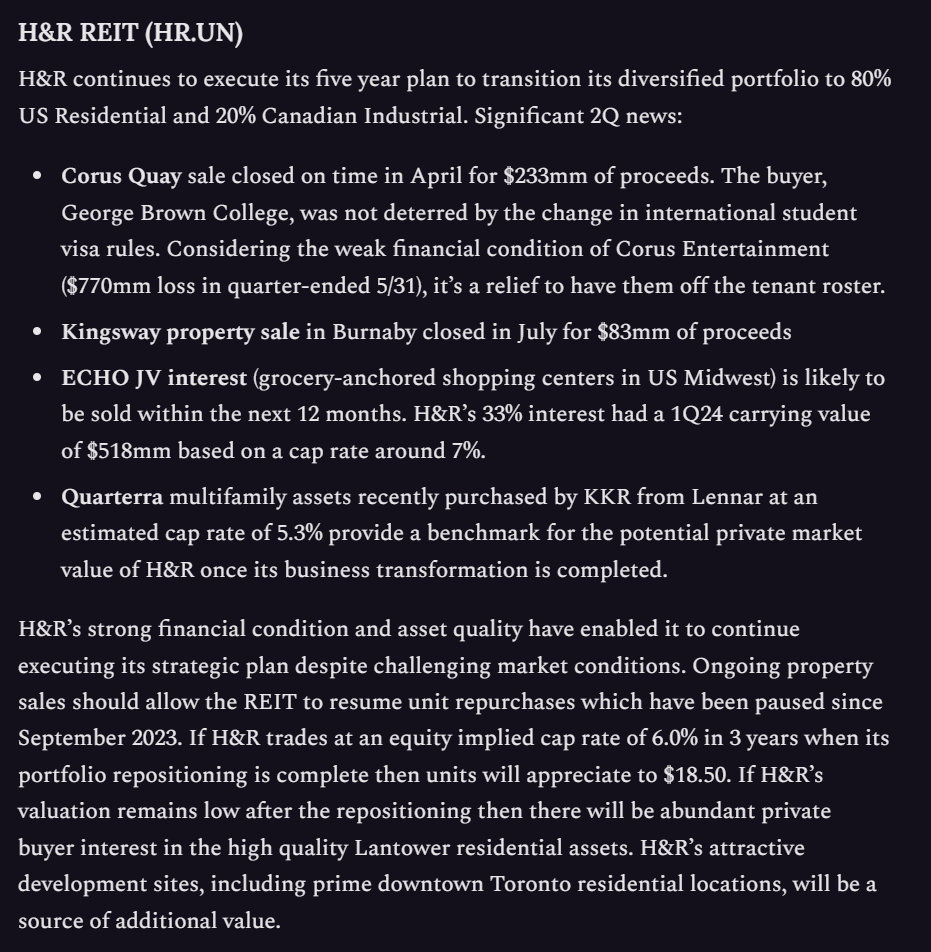

$HR-UN.TO

A fantastic overview of Canadian REITs on Koneko Research substack (archive).

$WED.V

Dollar figures in $USD.

Westaim market cap = $375M. Owns 4.8% of the outstanding Skyward Specialty common shares.

SKWD market cap = $1610M.

4.8% of $1610 ~ $75M ($69.5M as of June 30, 2024).

Westaim’s cash position ~ $285M.

No debt.

$285 + $75 = $360M.

Remainco is trading for $15M. Remainco is Arena and Arena FINCOs (book values: $30M and $150M).

Disqus comments are disabled.