#12 - Glacier Media

Full disclosure: I own shares in this company. This is for informational purposes only and is not intended as investment advice. Do your own due diligence.

The ticker is $GVC.TO. This company came into my radar thanks to a tweet from Clark Square Capital:

Wrote up Glacier Media ($GVC.TO) a couple of months ago, but I think the risk/reward has gotten even better at this price. Would love any feedback on the idea. Thoughts, comments, pushback welcome. Thanks in advance!https://t.co/D3D5vIq6HL pic.twitter.com/0SSrpPZhlu

— Clark Square Capital (@ClarkSquareCap) December 13, 2021

His writeup is available here and is the best way to understand the company. The other specialist on this company is Sean in microcaps.

When I first looked into the company, I was a bit spooked by the overshadowing presence of Sam Grippo, Chairman at Glacier Media and chairman at Madison Venture Corp.

The reason this made me uncomfortable is that Madison already owns 53% of the outstanding shares of GVC, and I’m afraid of a takeunder.

Moreover, in July 2020, Glacier sold 45% of their environmental information business to Madison in a friendly deal that helped Glacier raise liquidity during COVID. The deal included a clause whereby GVC would retain profits for two years following the transaction and had an option to buy the assets back at fair market value in the future.

For the record, Madison paid 0.92x revenues of the environmental information business for 45% of that business. I think that was extremely cheap.

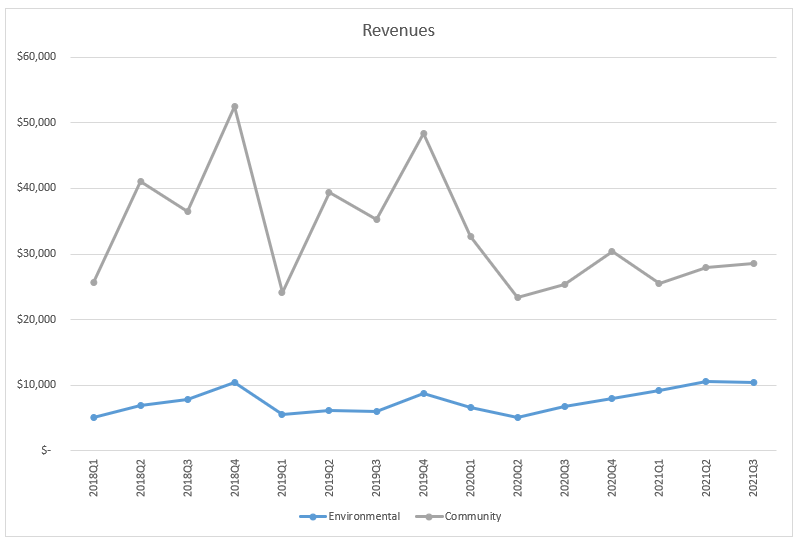

Since then, the business has bounced back nicely, and so did the community news business:

The community business can be split into legacy newspapers, which is a dying (but still cash flowing) business as you can expect, and digital media, which is thriving.

While the environmental information segment grew by a whopping 54.9% YoY in the first nine months of 2021, the digital media business is the gem hidden within and consists of:

-

Glacier Media Digital (digital marketing services)

-

Castanet Media (Kelowna local news)

-

Vancouver Is Awesome (Vancouver local news)

-

a partial interest in Village Media (community-based journalism and marketing), Eastward Media (targeting the Asian market) and many others

From 2016 to 2019 (prior to covid), the digital media was grew at a 44% CAGR! In 2020, it grew by 7%, and in the first nine months of 2021, it grew by 30.9% YoY. Clark Square Capital estimates that the digital media segment currently represents about 27% of the company’s revenues.

Finally, there’s the Company’s residential real estate portal (rew.ca) which is small but growing fast! The website just had a facelift as of this week. They’ve got BC well covered already (REW is the number one in traffic and audience in BC, above other platforms such as realtor.ca and Zillow, according to Clark Square Capital), and they are moving into Alberta and Ontario.

Now here’s the kicker (again, I’m starting to sound like a broken clock, but checkout the writeup linked above for more details).

It’s hard to say for sure how much extra revenue this will generate for GVC, I’d say somewhere between +5% and +10% seems reasonable, based on previous deals in Australia between Google/FB and News Corp. And the best thing about this extra revenue is that it would flow almost entirely to the bottom-line.

Now on to some valuation.

In the nine months ended September 30, 2021, GVC generated $7.1M of EBITDA, exclusing CEWS (Canada Emergency Wage Subsidy). So I think it’s fair to assume ~$8M EBITDA for 2021, and that is probably a on the conservative side.

My estimation of EV is $60M, giving us a 7.5x EV/EBITDA multiple.

[Koyfin is showing a multiple of 2.8x currently. Hey if I’m wrong and they’re right, I’m happy with that!]

In his activist letter on $LEE, a local news and information business in the US, Harris Kupperman argues that such a business should trade at 15x EBITDA minimum, given the growth (+48.3%) and proportion (33.4%) of its digital segment.

I believe it is not unreasonable to assign a similar multiple to GVC.TO, leading to a double in price before any boost from earnings growth.

There’s one last piece of the puzzle that is worth mentioning. GVC is in a legal battle since 2014 with the Canadian Revenue Agency over tax losses applied from a business acquisition. The total amount in dispute is $60.6M, of which Glacier has already deposited $22M with the government.

According to Sean, and I’m quoting him here:

The tax losses applied at that time were completely within the CRA law. A couple years after the losses were claimed, CRA changed the law (I believe through bill C-208), which no longer allowed tax losses from acquisitions to be applied. The tax losses applied by GVC at the time were completely legal and within the CRA rules.

If they win this case (best case scenario), the company would be swimming in cash and owning rapidly growing digital assets. In the worst case scenario, they would owe the CRA the remainder of the debt, but still owe the fantastic digital business. Between the $21.8M they currently have in cash and the cashflow they’ll be able to generate, I think it would be bad, but not catastrophic.

My calculation of EV above is the base case where the CRA would keep the $22M deposit but not get anything on top.

Final note: the insiders have been scooping shares around $0.40: