#15 - Even God would get fired as an Active Investor

Last updated: Nov 1, 2022

Published in 2016.

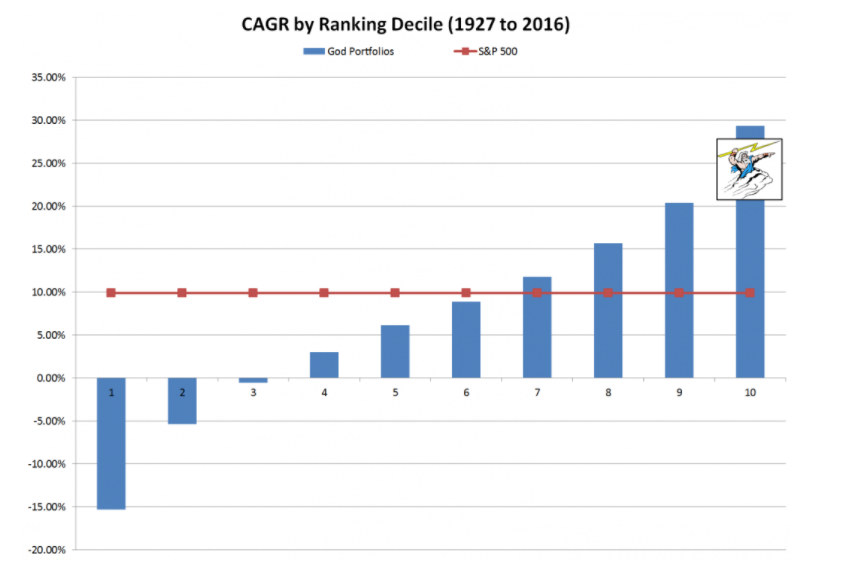

We compute the 5-year “look ahead” return for all common stocks for the 500 largest NYSE/NASDAQ/AMEX firms.

Next, we create decile portfolios based on the forward five-year compound annual growth rate (CAGR).

We rebalance the names in the portfolio on January 1st of every fifth year.

Decile 10 portfolios represent value-weighted portfolios composed of future top 5-year performers.

Decile 1 represents value-weighted portfolios composed of future bottom 5-year performers.

The “God” strategy is represented by the Decile 10 and has a CAGR of 29%.

Note: I was expecting “God” to have a far better CAGR than 29%!! I wonder if this is due to the universe being limited to the 500 largest firms…

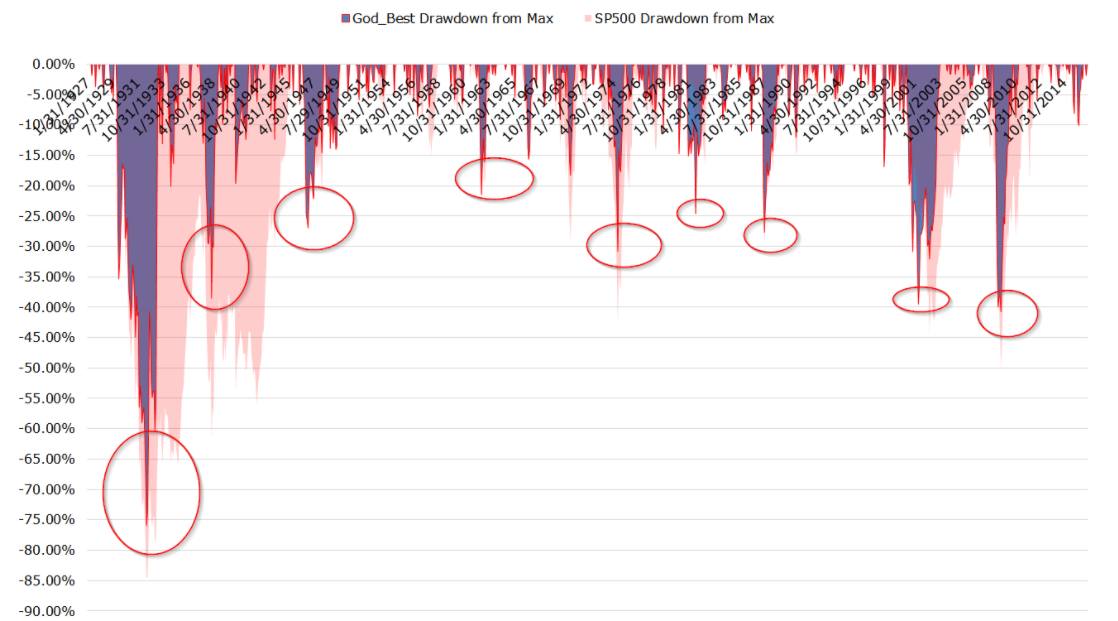

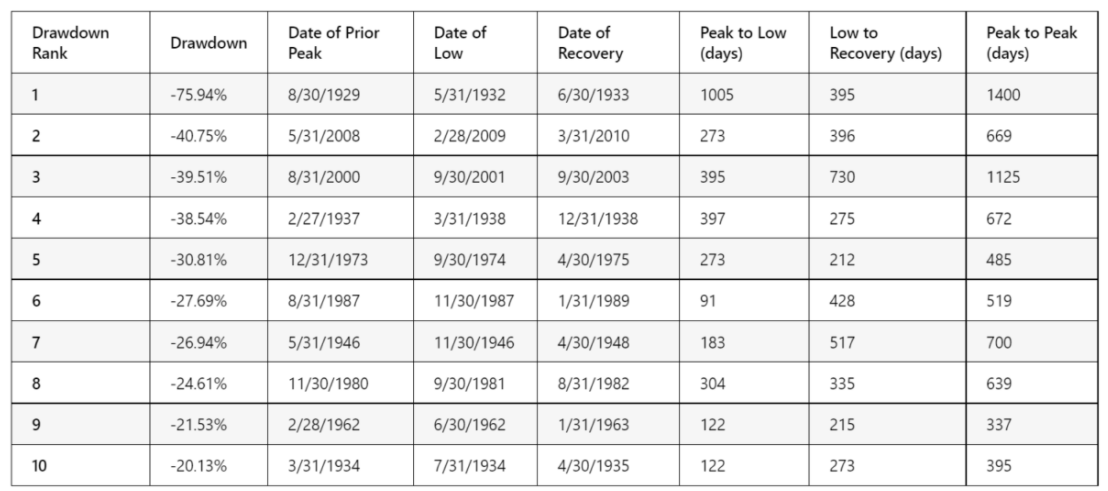

Takeaway: even with a “perfect” strategy, you can have some pretty brutal years!

Disqus comments are disabled.