#17 - Canaf Investments

Last updated: Nov 1, 2022

Two wholly-owned subsidiaries in South Africa:

-

Quantum, owns 70% of Southern Coal, operates three kilns near Newcastle, KwaZulu Natal (South Africa), and produces calcined anthracite, which is primarily sold as a substitute to coke mostly to steel and ferromanganese manufacturers.

-

Canaf Estate Holdings – Property Investments, focused on acquiring, redeveloping, and renting properties primarily within the suburbs of the old Johannesburg CBD. CEH made its first property acquisition in August 2019.

Revenue from the sale of calcine and coal has historically been derived from two customers and as a result, the company is dependent on these customers for its revenue. These two customers are ArcelorMittal (Newcastle steel facility) and BHP Billiton.

Through its customers, the company is HIGHLY dependent on the global demand for steel and manganese.

In 2016, when global commodity prices were depressed, one customer closed down for 7 months of the year, and the other reduced demand by 50%, leading to a 50% drop in the company’s revenues. That same year, the company put in operation its 3rd calciner, which was purchased in 2015. This calciner is autogenous (self-sustaining), environmentally compliant, and significantly more efficient. It does not use electricity as its source of heat, reducing electricity consumption by 95% for each tonne of calcine product produced.

In 2017, sales were back up to previous levels and remained elevated ever since.

In 2018, the company sold 30% of Southern Coal to Amandla Amakhulu (Pty) Ltd, (“AAM”), a 100% black, privately owned, and ringfenced, company incorporated in South Africa, as part of the Broad-Based Black Economic Empowerment (“B-BBEE”) program launched by the South African government to address the inequalities of apartheid. This allowed Southern Coal to achieve a Level 4 B-BBEE rating, enabling it to engage in long-term (24 months) supply contracts with its customers. In exchange for the 30% stake in Southern Coal, the company received redeemable preference shares in AAM that provide preferential dividends.

In 2019, Canaf Estate Holdings made its first property acquisition for an overall cost of approximately US$125,000. The property is expecting to yield a net return of in excess of 10% per annum.

As of July 2021, the company was in the process of applying for environmental authorizations which would allow for the construction of further calcining facilities. The company also committed to acquiring another property worth R850,000 (US$55,500). The growth in revenues during the year was primarily due to a new customer ramping up its own production. However, the company was not yet able to transition into long-term agreements with its customers and is still operating on short-term agreements.

The majority of Quantum’s feedstock anthracite is supplied by the neighboring Springlake Colliery mine, which has reserves in excess of 15 years, or until 2030.

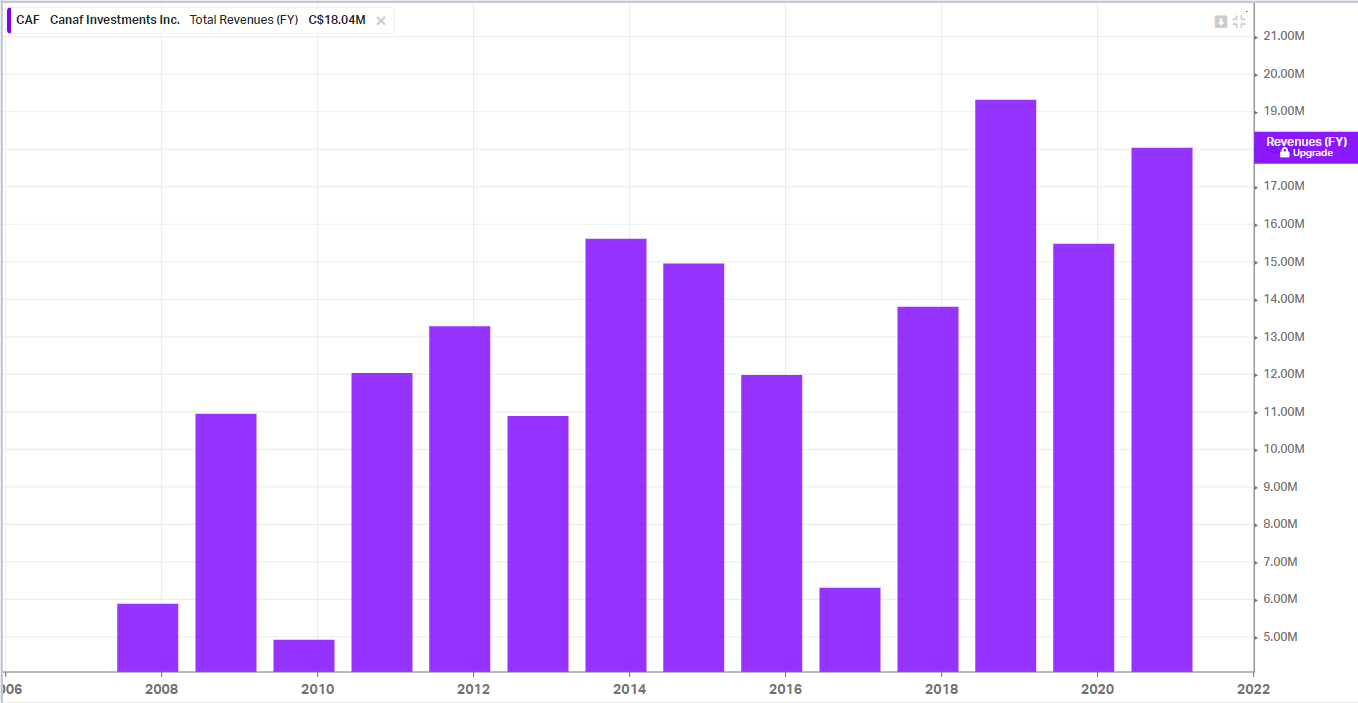

(source: Koyfin)

Revenues

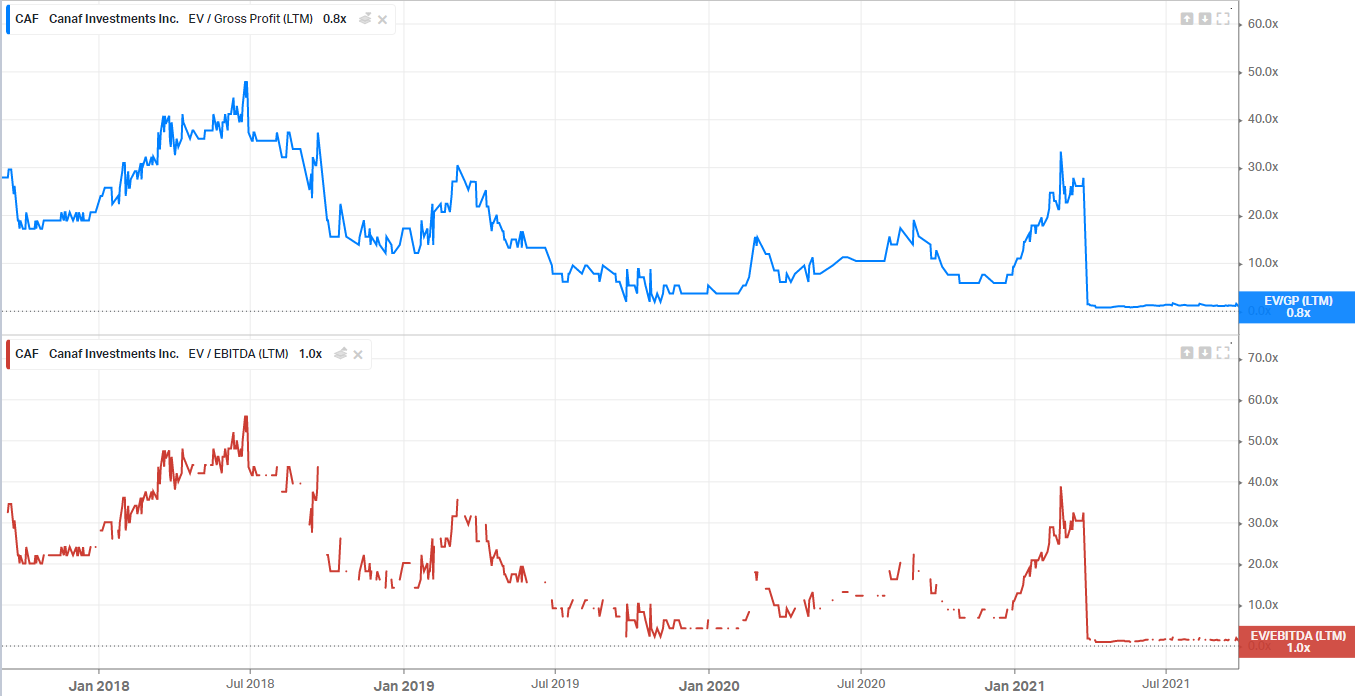

EBITDA

Valuation

The valuation metrics I typically look at are:

EV/GP ~ 0.8x

EV/EBITDA ~ 1.0x

Looking cheap. The CAPEX expenses are low as well.

The share price as of the day of this writing is CA$0.11 and the market cap is CA$5.22M.

The company has CA$4.23M in cash (subject to forex fluctuations, as I expect most of this cash to be held in RAND), and no debt. In other words, 81% of the market cap is in cash.

EV is CA$1M.

On top of this, the company has an amount due from non-controlling interest (corresponding to the Cumulative Redeemable Preference Shares of AAM) totaling US$1.24M as of July 2021, or CA$1.55M. I haven’t been able to find anything about this Amandla Amakhulu company though, so to be conservative, I will ignore this CA$1.55M asset completely.

Note: the annual dividends received amounted to CA$269K in 2019 and CA$135K in 2020.

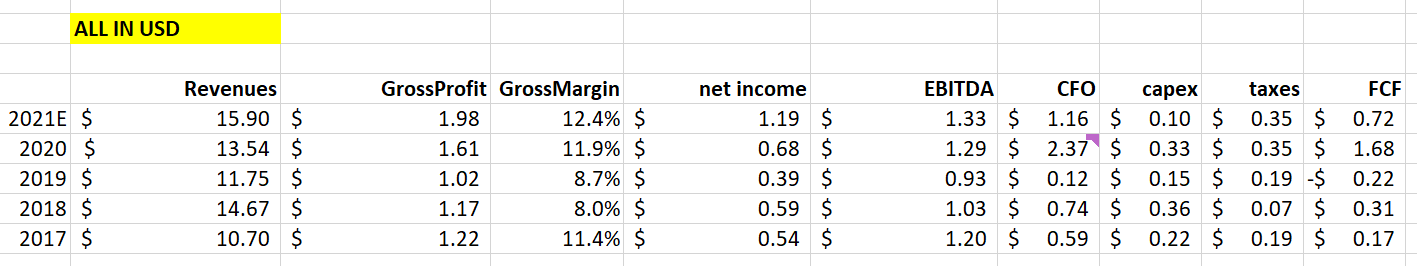

Let’s take a look at the past 5 years of financials (all in USD dollars):

Average free cash flow for the past 5 years is US$0.50M, or CA$0.63M.

In other words, we can buy this company (enterprise value) for about one year and a half of the average 5-year historical FCF.

There are customer and supplier concentration risks. I don’t know how easily Canaf can secure supply beyond 2030 (they don’t own a mine) but if prices remain elevated for a few more quarters, maybe I don’t care. On the customer front, they deal with two large customers mainly, with all the issues it entails.

The bigger risk though (for any met coal play) is obviously the sensitivity to steel production (and therefore inventories). I’ve seen a few signals lately that would point to this risk being material at the moment.

The company has announced that it expects a reduction in sales during 2021Q4, due to a major breakdown from one customer.

I already have a small position. In the next earnings release, I’ll be looking for a couple of things:

- company guidance for 2022

- income from property investments

- gross margin (12.4% for the last nine months)

Note: I tried contacting management but was not successful.

Disqus comments are disabled.