#2 - Semler Scientific

The bull argument

Last week, I listened to an interview of Yen Liow on The Equity Mates podcast. What a fascinating character, the passion for finding and investing in great companies exudes out of him.

Here’s the interview if you’re interested:

He was generous enough to pitch two stocks during the interview, one of them being Semler Scientific $SMLR.

Semler Scientific owns a product called QuantaFlo, which is a cloud-supported easy-to-use PAD test kit that delivers fast and accurate results in less than 5-minutes at the point-of-care. PAD stands for Peripheral Arterial Disease. It’s a circulatory problem in which narrowed arteries reduce blood flow to your limbs and it affects almost 20 million U.S. citizens, mostly among the elderly. However it is often undiagnosed as clinical signs and symptoms are not typically present during the early stages of the disease (source).

The company basically makes money by licensing its tool and platform to a range of health professionals, not just vascular doctors.

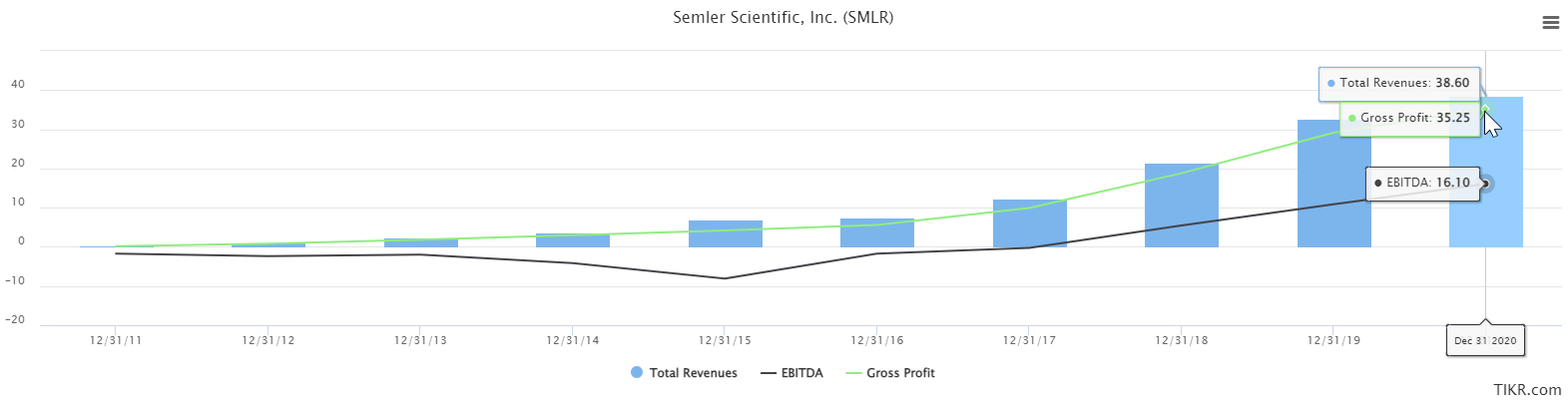

Here are some historical financial metrics for this business:

High-growth business with very high SAAS-like margins

It is currently trading for 25x EV/EBITDA(ttm) and 35x P/E(ttm), following a big drop after their Q3 earnings release, with revenues up 30%, gross profit up 27% but net income per share down 16%, mainly due to higher operating expenses (up 69%).

Price drop

According to Yen, Semler has penetrated less than 5% of its target market for QuantaFlow, as of today. As well, he thinks the company has 2 or 3 additional products in the pipeline that it could launch soon (the 2nd one actually has just been launched).

What makes me hesitate

This is a MedTech business, and I have almost no hope of being able to understand in depth how their gizmo works, or assess whether some genius is likely to wake up one day and find a way to make another one that would be even faster and cheaper. Technological obsolescence is a real risk.

For example, FlowMet-R is another noninvasive portable device from Laser Associated Sciences (LAS), a medical device company based in Irvine, California, that detects PAD, and it was granted FDA 510(k) clearance in October 2019. I found an article on this device that seems to imply a similar accuracy to QuantaFlow.

In other words, I’m unable to assess the durability of the moat. It might be stronger than I think, and maybe part of it is the relationships with the healthcare practitioners and insurance companies, but I currently have no visibility on that.

Questions I will try to answer in the short-term:

- Who are Semler’s customers and why are the top-2 so big?

- Are there switching costs for Semler’s customers?

- Are there other incentives for these customers to stay with Semler?

- Does Semler have any “secret sauce” that does not rely on its technology?

For now, Semler will remain on my active watchlist, meaning I will keep researching the name. I’m also interested in seeing whether the growth resumes in the next quarter, and how their 2nd product performs (they announced that they just launched it during last quarter’s conference call).