#26 - Wildbrain Peanuts

Last updated: Nov 1, 2022

As per the news release of June 2017:

WildBrain acquired the entertainment division of Iconix Brand Group, which includes 80% controlling interest in Peanuts and 100% of Strawberry Shortcake. The remaining 20% interest in Peanuts will continue to be held by members of the family of Charles M. Schulz. The purchase price was US$345M.

In July 2018:

the “Company” closed its previously announced sale of a minority stake in Peanuts to Sony Music Entertainment (Japan) Inc. (“SMEJ”). SMEJ has indirectly purchased 49% of DHX Media’s 80% interest in Peanuts for C$235.6 million in cash. DHX Media now owns 41% of Peanuts, SMEJ owns 39%, and the members of the family of Charles M. Schulz retain their 20% interest.

C$235.6M in July 2018 converts to US$179M (exchange rate 0.76), which values the whole 80% stake at 80 / 39 * 179 = US$367M. So the realized profit is $22M in a year, or 6.4%. It’s acceptable. But wait…we forgot about Strawberry Shortcake!

A better to frame the story is that within a year, the value of Peanuts alone grew by an amount equal to: $22M + [the entire value of Strawberry Shortcake].

Now let’s see…how much could Strawberry Shortcake be worth anyway?

In October 2021:

A wildly popular line of toys and consumer products in the early 1980s, Strawberry Shortcake was then licensed annually across US $500 million worth of consumer products. It went on to sell over five million dolls and has generated more than US $4 billion at retail to date.

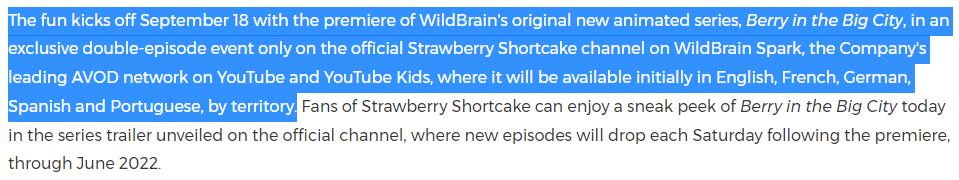

But before reviving the consumer product, WildBrain is revitalizing the brand through WildSpark:

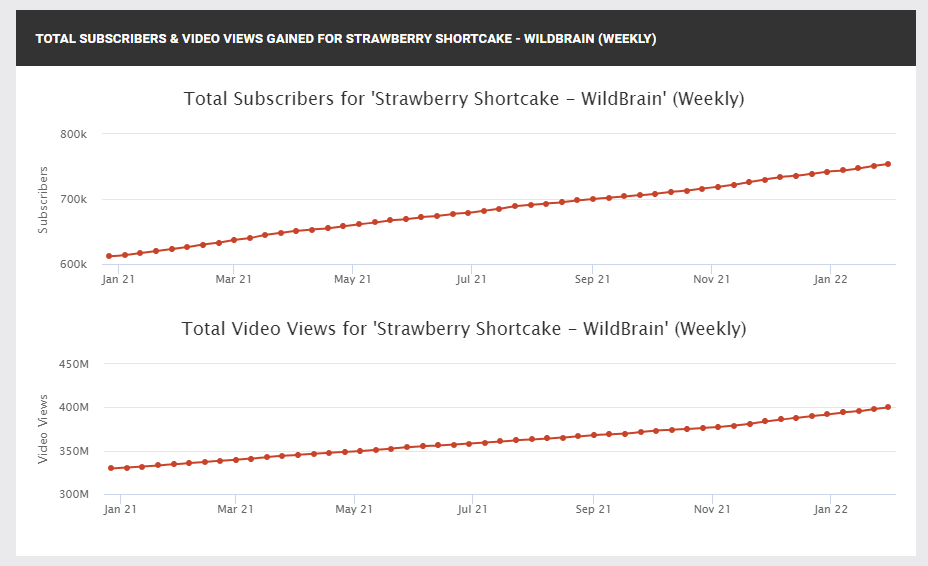

I looked up the monthly trends for Strawberry Shortcake’s channel on YouTube, which contains 800+ clips:

In November 2021, secured licenses for both the new and classic Strawberry Shortcake brand, as well as four brand-new CG-animated seasonal specials (4 x 44’) to be made available on Netflix worldwide, with the series launching Spring 2022 and specials to follow in 2023.

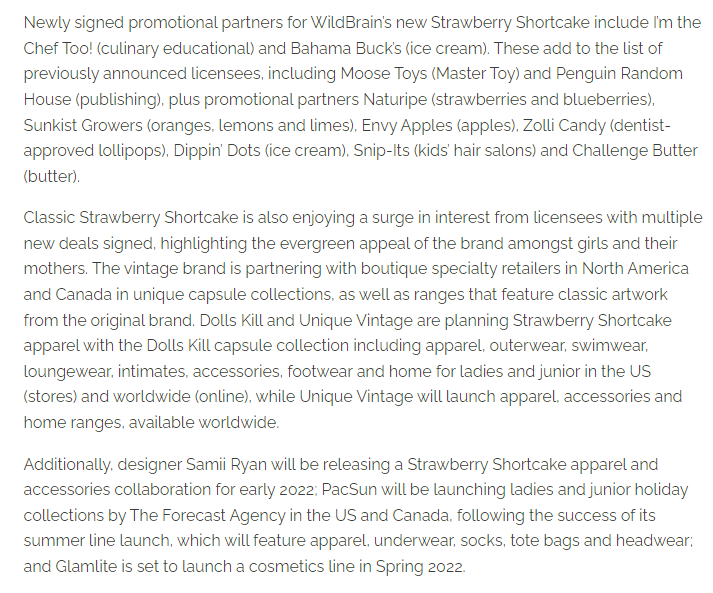

More details on the CPG licensing deals:

As well, in October 2021, the company launched a new Robolox game based on the Strawberry franchise, called Baking with Strawberry Shortcake. I haven’t been able to find stats on how this game is performing.

We’ll have to wait and see how all these developments translate into revenues and EBITDA in 2022 and beyond.

Reminder: WildBrain’s current enterprise value is currently around $1.30B and I am long the stock.

Update (2022-01-31):

WildBrain doesn’t report the gross margin of the Consumer Product segment separately, but I believe it could be around 49%, much higher than Spark (my estimate: 34%) and Content Production and Distribution (my estimate: 37%). I derived these estimates from the Content Business gross margin and the three segments’ revenues.

If Strawberry Shortcake was able to get back to its former glory, the US$500M of licensing revenues (CA$635M) could translate into $CA311M of gross profit, compared to the CA$193M of actual ttm gross profit for the entire company, as of Sep 2021.

Disqus comments are disabled.