#3 - WildBrain

Disclaimer: I own shares of this company. None of this is investment advice. I do not know your particular situation and I am not qualified to give you advice. Please do your own due diligence.

This will probably be the first in a series of posts on WildBrain. My goal here is just to give a taste of what I like about the company, but there’s much more to the story.

WildBrain is a kids content company that owns the largest library of children’s television programming, including brands such as Peanuts, Teletubbies, Strawberry Shortcake, Yo Gabba Gabba! and many others.

It monetizes these assets by:

-

distributing them through its multi-channel network (including linear television, Subscription Video On Demand such as Netflix or Apple TV+, and Advertising-based Video On Demand such as Youtube).

-

selling related consumer products (e.g. toys).

On AVOD, the company uses WildBrain Spark, a multi-channel network that produces and distributes both WildBrain’s children’s video content as well as content of other IP owners looking to connect with global audiences, and provides brands and media agencies access to this network for high-performing advertising.

An example of such partnerships is this one with the emoji brand that was announced on May 2021:

Under the partnership, WildBrain’s leading AVOD network and digital studio, WildBrain Spark, has teamed up with emoji company to co-develop and co-produce emojitown, a 52 x 2′ 2D series, which is targeted at teens and young adults.

Spark is the hidden gem in this company, but I’ll come back to this.

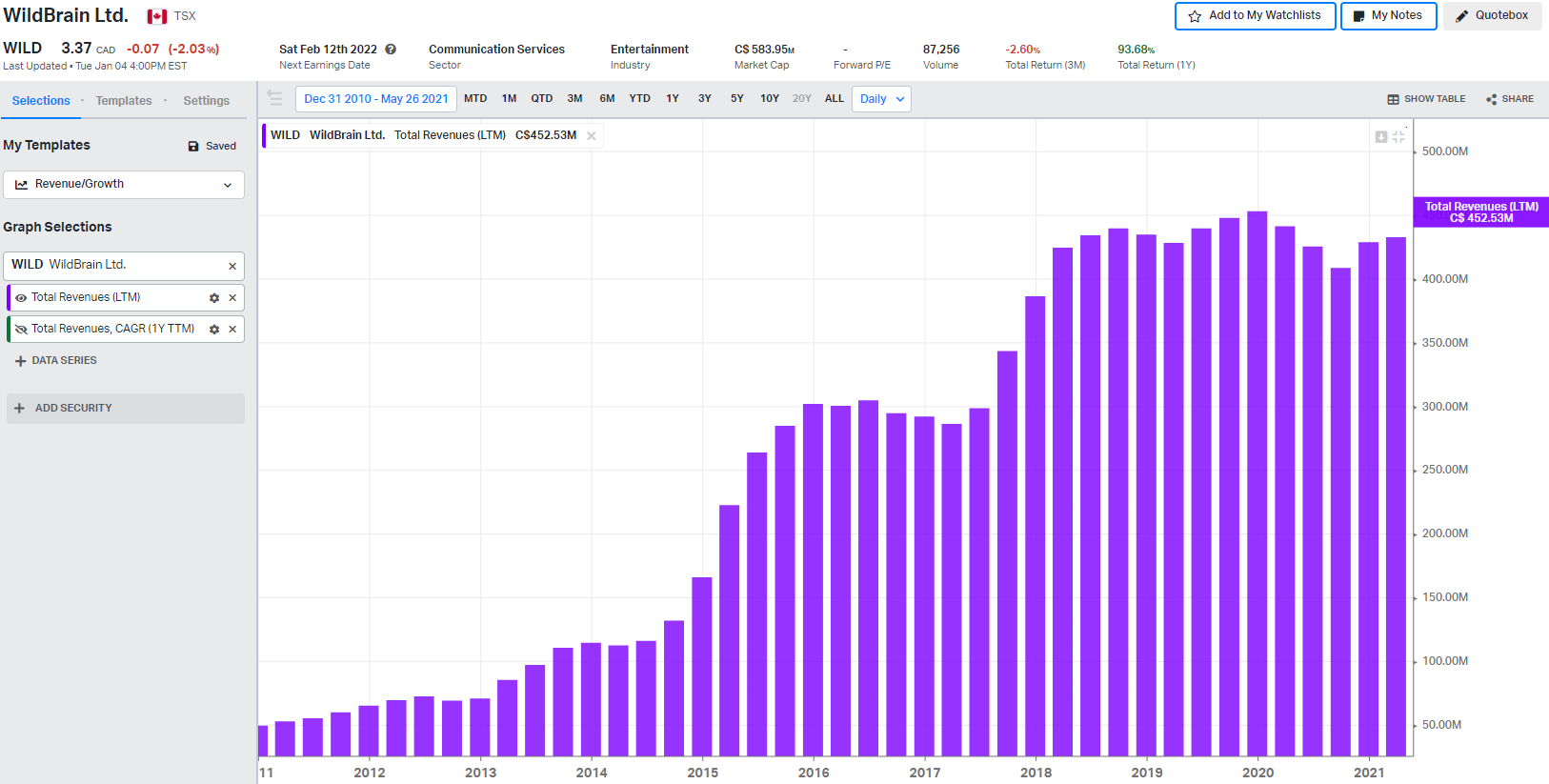

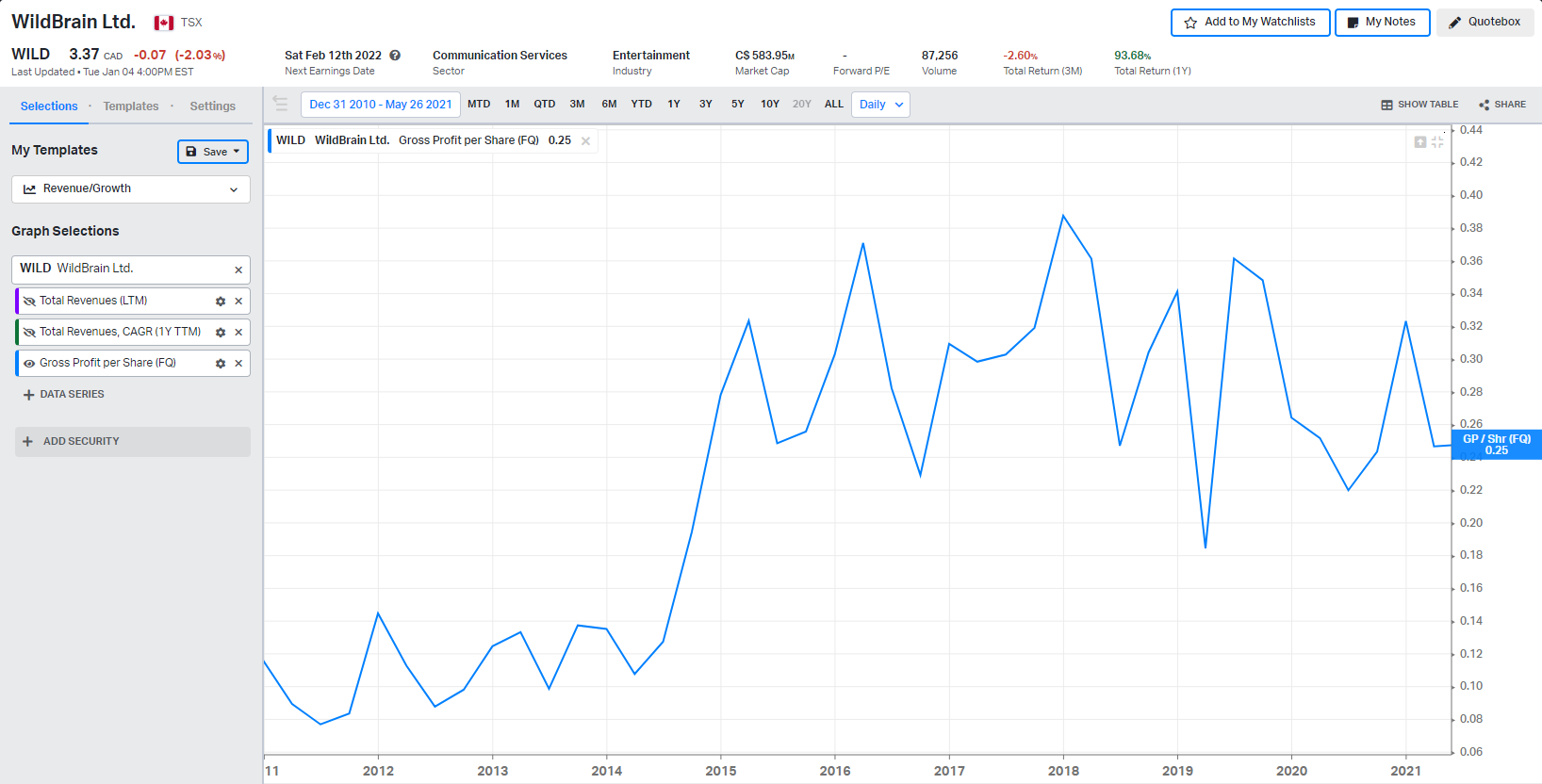

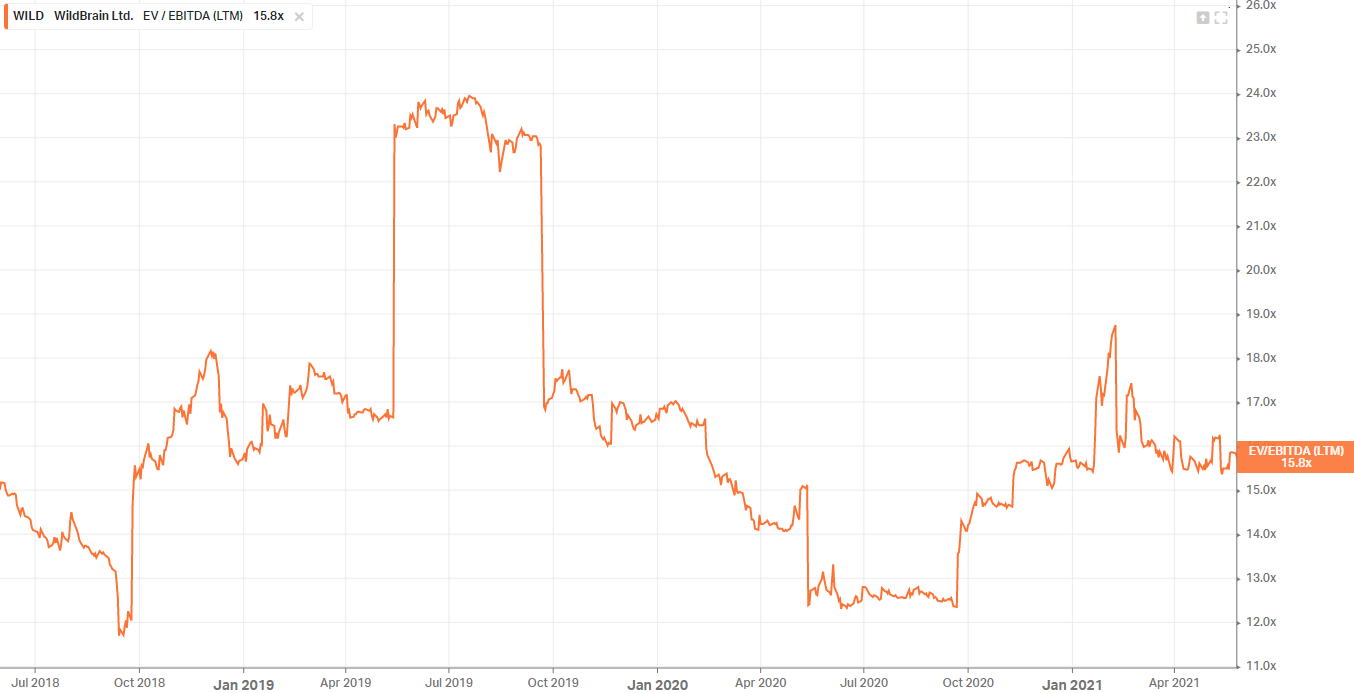

Let’s look at a few financial metrics first (note: these are taken from Koyfin).

Here are the historical revenues:

The gross profit per share:

And valuation (current EV/EBITDA(ltm) is ~15x):

Looking at these charts, honestly, it’s not compelling.

But I own shares, so there must be another reason. As I hinted to, that reason is Spark.

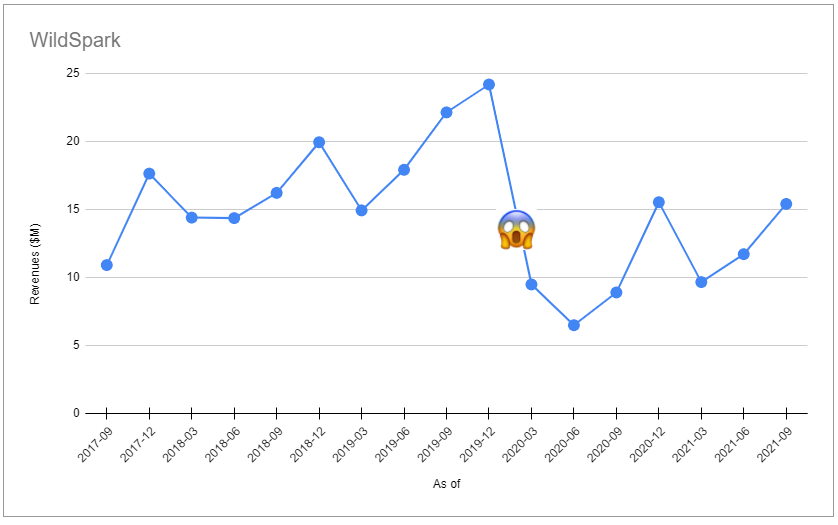

Let’s look at the revenues of Spark alone for the past quarters:

The drop in 2020Q1 is explained by the following (excerpt from the company’s 10Q):

WildBrain Spark’s viewership continues to grow, however as a result of changes made by YouTube in January 2020 to eliminate targeted advertising on kids’ content, we are experiencing downward pressure on advertising rates in the near-term.

In January 2020, YouTube introduced new rules and policies on ‘Made for Kids’ content, including how that content is managed and monetized, and the features available or limited on that content. We expect these changes will create a more positive environment, and ultimately, improved monetization, as a result of the curated environment, which will reward quality content. We are ideally positioned to benefit from this change. Advertising will continue to be sold based on the content itself (“contextual advertising”). This is similar to the advertising model for linear TV in which we have considerable experience.

What is interesting is the trend both before and after the drop. There is some serious growth taking place there, that is invisible in the aggregate revenues as of yet, but that will soon be more obvious.

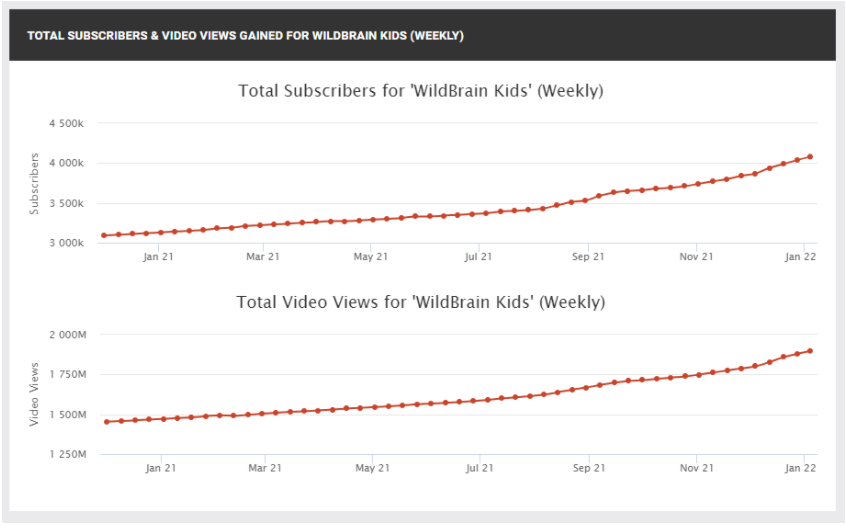

Here’s why. The screenshots below were taken from socialblade.com:

The growth in subscribers and viewership has never stopped! And because Wildbrain serves premium content only, revenues are quickly returning to pre-2020 levels.

There are other catalysts, such as the revival of the Peanuts franchise and consumer products brand, but enough for one day.

I will leave you with this. My goal for 2022 is to invest in companies with a strong moat that I can understand intuitively.

What is the moat here? Simple: the scale of the AVOD network, which was obtained thanks to the depth and quality of the IP the company owns.

Why is it a moat? Because the space is littered with companies that went bankrupt trying to achieve similar scale, and the CEO Eric Ellenbogen knows a thing or two about that (a story for another day).

Why is any of this important? Because scale means reach and data, which means advertising expertise and performance, which leads to Youtube being happy and to more partnerships (such as this one with Gamefam on Roblox or that one with Azerion in the metaverse), both of which lead to bigger scale.

We just might have a compounder here, folks.

Update (2022-01-26): more details

Top properties:

- Caillou

- Chip and Potato

- Degrassi

- Inspector Gadget

- Johnny Test

- Peanuts

- Strawberry Shortcake

- Teletubbies

- Yo Gabba Gabba!

Kids’ and family content travels across cultures and consists largely of animated series, which can be easily dubbed into multiple languages. Such content is timeless and therefore can be licensed into numerous markets repeatedly for many years.

13,000 half-hours of children’s content.

Four monetization avenues:

-

Production and distribution of shows to streaming services and linear broadcasters worldwide

-

Advertising and sponsorship revenues through WildBrain Spark (AVOD channel on YouTube: 35.1 billion views, 215.9 billion minutes in 2021)

-

Royalties from sales of consumer products based on owned IP + representing third-party brands through licensing agency business (WildBrain CPLG)

-

Own and operate the Family suite of linear specialty kids channels in Canada (monthly subscription fees + advertising)

When WildBrain produces content for an SVOD (e.g. Netflix or Apple), the SVOD pays for the cost of production, while WildBrain retains underlying IP, linear distribution rights (after a hold back or 24 to 36 months), and all consumer products revenues.

In January 2020, YouTube introduced new rules and policies for ‘Made for Kids’ content that limited the kind of advertising that was allowed for that type of content.

Specifically, personalized ads, which leverages a user’s interests based on previously collected data on the sites they visit or the apps they use, was banned.

Contextual ads on the other hand are still allowed, which are bsaed on the content being viewed or the current query terms as well as coarse geogrpahic data (city-level). Contextual advertising is similar to the advertising model for linear TV.

In other words the ads that are served to the kids are not specifically targetted to that child given his personal inferred preferences, but they are selected based on the content that is being viewed.

On top of the monetization impact, some changes also had a negative impact on subscriber growth. For example, features like channel notifications and saving a video to a playlist (or watch later) are all deactivated for kids channels.

I believe this has a two-pronged impact on WildBrain and the whole kids content YouTube ecosystem.

On one hand, everyone’s CPM (earnings per thousand views) will decline. Some low quality Made For Kids might even have been killed all together.

On the other hand, it means that if an advertiser wants to reach kids on YouTube, they will have less choices.

I think this move has helped reinforce WildBrain’s moat as THE #1 kids content network on YouTube.