#32 - Avante Logixx

Last updated: Nov 1, 2022

I’ve been intending to write something about Avante for some time. This is not a deep dive or a bullish thesis. I’m just writing down my thoughts so I can come back to them later.

Avante Logixx is a security services company, catering to the residential high-net-worth market (Avante) as well as to commercial and enterprise clients (Logixx Security). I discovered the company through an interview of the CEO on SmallCap Discoveries.

The CEO is Craig Campbell who has been in the security busines his entire professional life, starting as a securit officer at 17. He was the founder and CEO of Total Security Management (TSM), a provider of full-service security solutions to Canadian financial institutions, which he sold to GardaWorld in 2013.

Mr. Campbell was appointed CEO of Avante Logixx in 2018.

The stock trades for $1.05 as of today with 21.192M shares outstanding or about a $22.2M market cap.

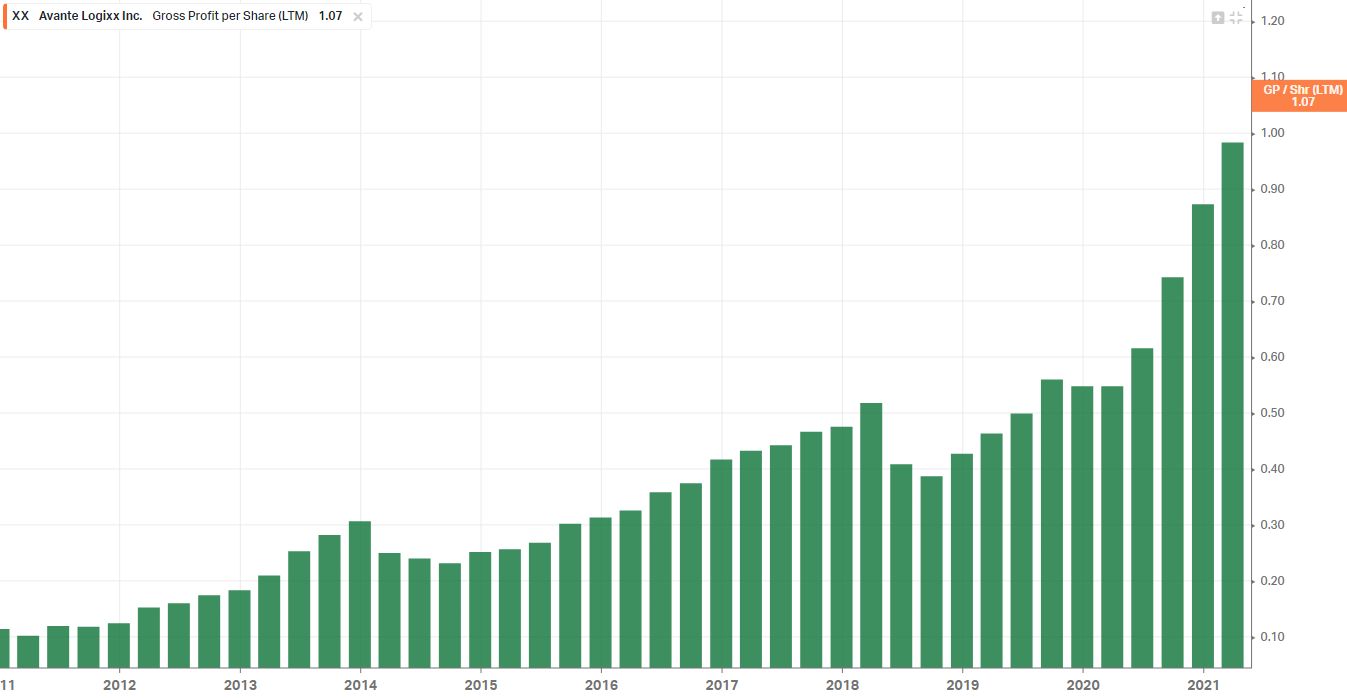

Let’s take a look at some figures, starting with my favorite one, gross profit per share (thank you Koyfin):

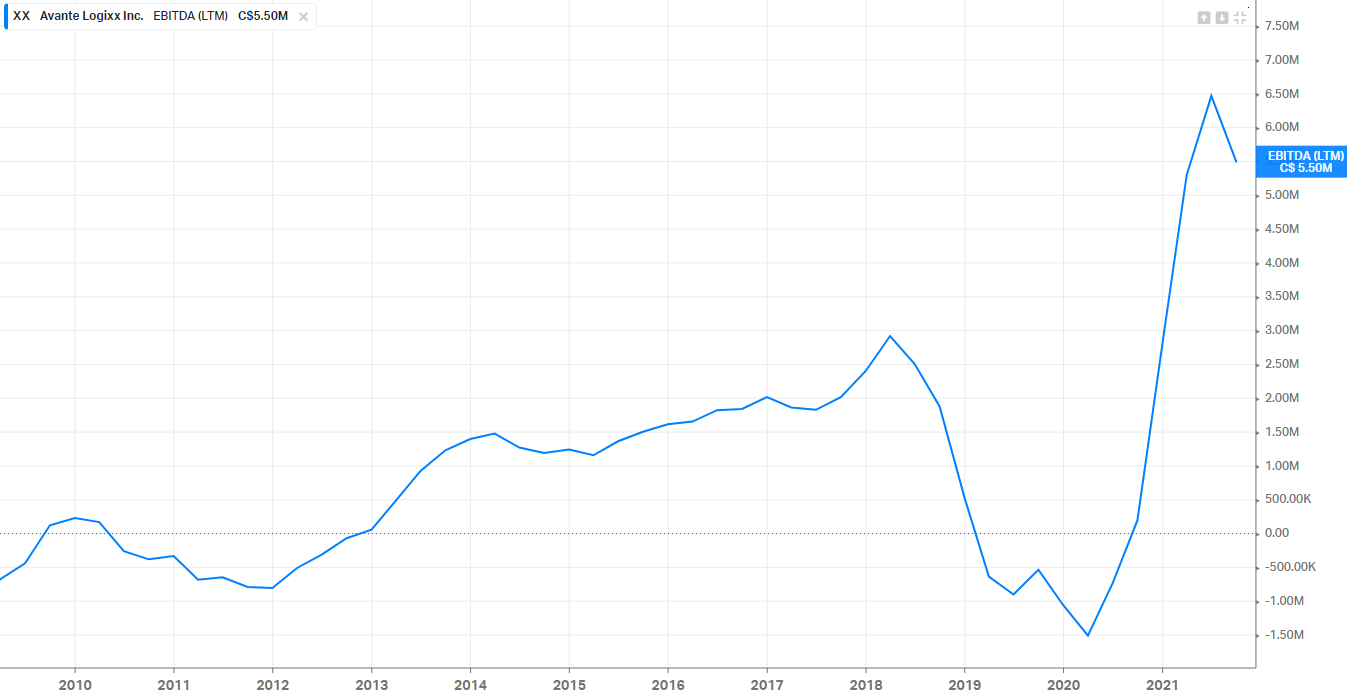

EBITDA:

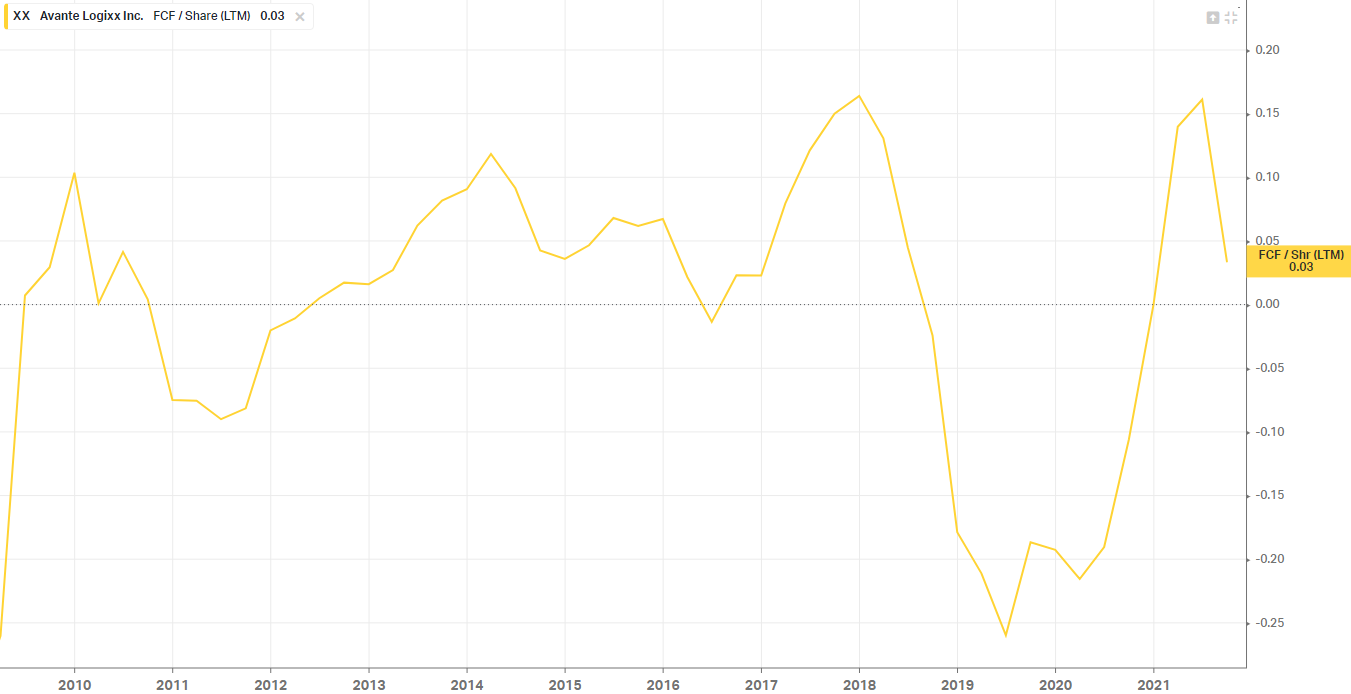

Free Cash Flow per Share:

Current Valuation (EV/EBITDA, ltm) is ~6.0x, and EV/GP is ~1.8x.

In November 2021, the company reported a less than stellar second fiscal quarter ended Sep 30, 2021 with revenues, gross profit and EBITDA lower than the previous year. Here’s what the CEO said:

“It is a difficult operating environment, driven by inconsistent re-opening and return to work policies and implementation, coupled with a tight labour market and supply chain constraints resulting in significant increases in our labour costs as a percent of revenue.”

The stock was subsequently cut in half:

At the start of the year, I had a 2.2% position in Avante Logixx XX.V. Since then I have increased it to 3.7%. I’m probably biased by what I’ve been reading (Contrarian Investment Strategies) and watching (Bruce Greenwald) recently.

I doubt that the company will surprise to the upside in the third fiscal quarter ended Dec 31, 2021, because of the Omicron mess, so I expect the price to stay low for a little while. On the other hand, I feel like the company is well positioned for the inevitable reopening. More importantly, (I hope that) it would benefit from a troublesome and disorderly reopening, which at this stage, seems at least possible to me, if not probable.

About a week ago, I stumbled on this (french) article describing the surge in thefts in grocery stores. I believe this is a consequence of the inflation and the rising inequalities between the haves and the have nots. When those inequalities are not kept under control, bad shit tends to happen. Avante is a way to implement a bet on the social consequences of political ineptitude (looking at you, Trudeau). That being said this macro view is not required, it’s just a bonus.

Avante Logixx has announced in August 2021 that its Board of Directors was considering and evaluating various strategic initiatives available to the company. We didn’t have any updates since, I believe the strategic review is still on-going. I hope there won’t be a sale before the price recovers.

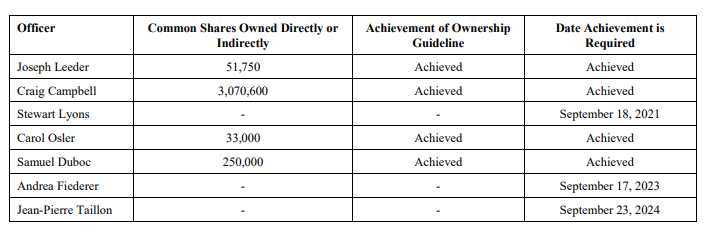

Craig Campbell owns 3.07M shares (which he purchased on the open market as an investor before becoming CEO) and is the largest individual shareholder (14.5% of shares). Fairfax Financial Holdings owns convertible debentures convertible at $1.45 per share, equivalent to 5.3M shares, following a Debentures Offering in Nov 2019. Emmanuel Mounouchos (the founder of Avante Logixx) is the 2nd biggest shareholder with more than 2.7M shares. George Rossolatos, the previous CEO, also owns a lot of shares & options.

Sam Duboc is the Chairman of the Board at Avante Logixx, albeit not a big shareholder. The guy is a seasoned business executive. He is, among other things, Executive Chair at MindBeacon, which was recently acquired by CloudMD (at 50% premium). He was also a cofounder of the Loyalty Group Inc, the parent company of the AIR MILES Reward Program, among a bazillion other things.

Another interesting board member is Joseph Leeder, who was a director and CFO at Park Lawn Corporation, a highly successful Canadian roll-up public company in the funeral and cremation business.

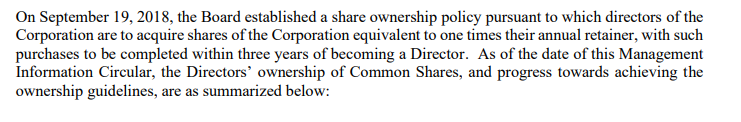

As far as the board is concerned, here’s another interesting tidbit:

$0.52 per Avante Share in cash + 0.4155 of an SSC Share for each Avante Share held.

Doug Emsley, Chairman, President & Chief Executive Officer of SSC, commented: “This is our third acquisition in just over a year, giving us critical mass across the country in the security business. This acquisition represents a critical step towards solidifying our position as a national player in both physical and cyber security services across Canada, coast to coast.”

The stock is up 38% so far on the news. Not unhappy about that and about the fact that I was adding recently. I don’t know yet whether I want to stay invested in SSC, have some work to do.

Disqus comments are disabled.