#33 - Poker and Investing (1)

Last updated: Nov 1, 2022

I used to play poker for a living. I often make links between poker and investing, so this is probably going to be the first of a series.

There was a saying among poker players that “In real life, women are the rake.” Few will understand this. Bezos probably does. Maybe not though, I mean at some point, not sure that $50B or $100B makes any difference in someone’s life.

Anyway, that’s not what I want to talk about.

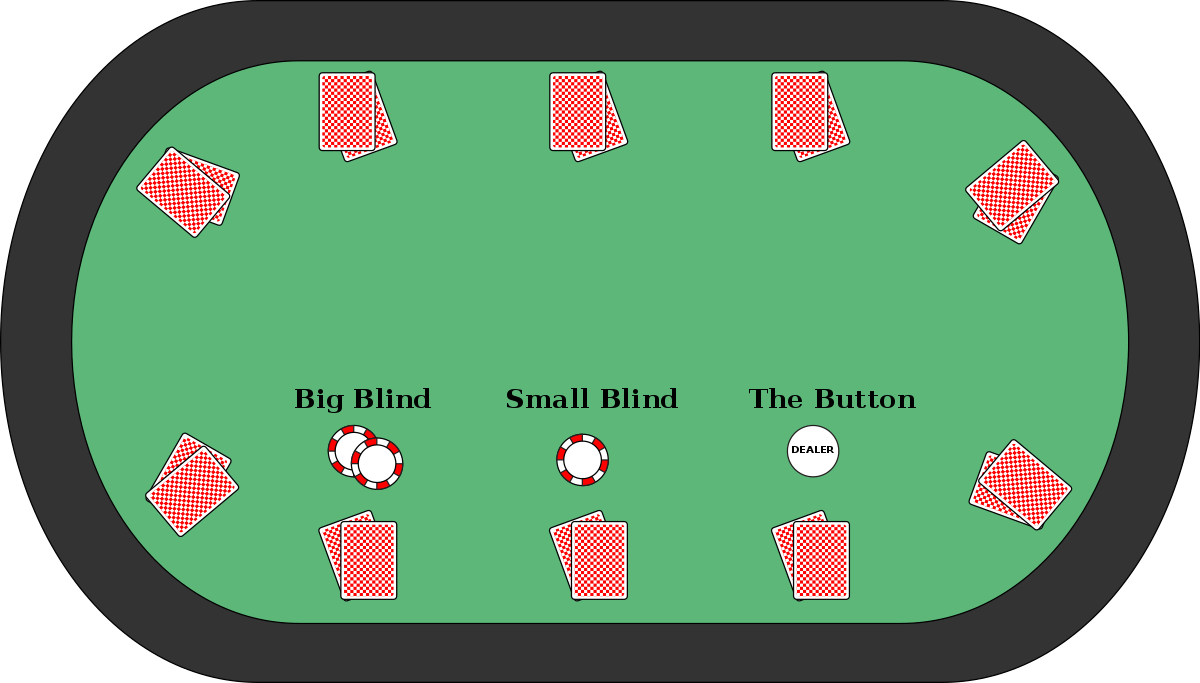

In a game of poker, there’s this thing called “the blinds”. Every hand, the guy to the left of the dealer has to post the small blind, and the guy to his left has to post the big blind. The small is half the amount of the big.

When you are in the small or big blind position, you have to post the “blind”, meaning before you even get to see what your hand is. It’s the first price you have to pay to play the game.

The second price you have to pay is when you win a hand. On every hand, no matter who the winner is, the casino takes its cut, called the “rake”. It’s a percentage of the total pot, typically around 5%. So every time you win a hand, before pushing the chips your way, the casino charges you 5%.

By now, if you’re an investor, you might have recognized the usual 2/20 hedge fund structure: 2% of the assets under management as flat fees, and 20% performance fees based on returns.

Why does any of this matter?

When you’re at a poker table, you can’t just sit there and do nothing. If you’re playing 6-handed, you’re paying 1.5 blinds every round. So if you initially sat down with 100 blinds, if you don’t play any hand, your stack is gone after 66 rounds.

So the blinds are there to force the action. You have to do something to beat the blinds.

Going back to the investing world, imagine you pay a fund manager 2% to invest your money. That 2% is an incentive for them to do something with the money. Otherwise, you’d be paying 2%…for nothing! The 2% fund fees are the blinds. They are an incentive to do something.

Buffett (and Greenblatt) talked about this ad-nauseam, but hopefully, the poker analogy helped distill the idea.

As an individual retail investor, you get to play the game without playing any blinds.

You get to sit there and wait for a pair of aces before you even touch your chips.

But that’s a problem for a casino. If everyone just sits there for free and waits for Kings and Aces, the rake won’t even cover the dealer’s salary. So the casino has to find a way to entice you into action, even though you’re really not forced to do anything. So instead of forcing you, which they can’t, they’ll seduce you into it. They’ll make fun and easy. They’ll give you quarterly results, analysts’ expectations, research reports, news releases. Anything that will make it into a dopamine-driven gambling mania.

But you don’t have to fall for it.

The single biggest advantage any individual investor has is the ability to do nothing for extended periods of time, at no cost.

Disqus comments are disabled.