#35 - Random Thoughts

Last updated: Nov 1, 2022

Some random thoughts about value vs growth, NFTs, and Canadian politics.

You probably know by now that the right framing is not “value vs growth”, as value is part of growth.

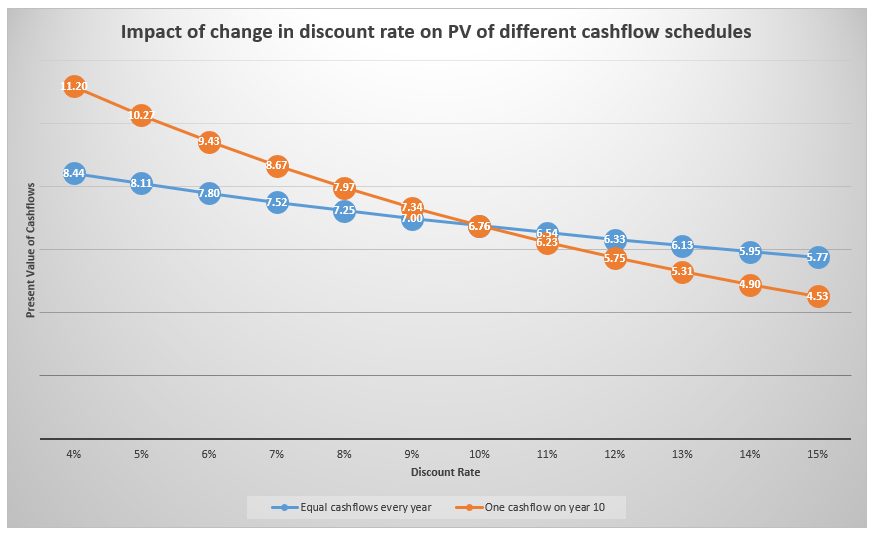

Instead, we should be talking about different cash flow schedules and how they react to changes in the discount rate.

For example, let’s consider a cash flow schedule that pays us $1 every year for 10 years, and another schedule that pays nothing until year 10 on which it pays us $15.94.

Using a discount rate of r=10%, these two cash flow streams have the same value today.

Now let’s see what happens when we change the discount rate:

Both present values are a decreasing function of the discount rate, but the “growth” stock (the one that pays us nothing until year 10) has a much steeper slope than the “value” stock (the one that pays us back every year).

I hope this explains why, as the discount rate keeps going down, “growth” stocks crush “value” stocks and why, when the discount rate shoots back up, “value” stocks keep more of their value than “growth” stocks.

But looking at the numbers on the chart, we see that the present value of a growth stock would go down from 5.77 to 4.53 or -21.4%, if the discount rate went from 10% to 15%.

While a significant drop, it’s not the 40%-50% we have seen lately in the stock market. Why is that?

I believe the market is not punishing the so-called “growth” stocks solely because of their sensitivity to the discount rate. Remember that everyone expects the interest rates to go up because of inflation. But what happens when there’s inflation? Every business reacts by trying to increase their prices in order to maintain their margins. And here’s the problem: not all of them are able to. The ones who don’t have a real moat and face strong competition will either lose revenues or lose market share. And the market will punish them in both cases. The honeymoon is abruptly ended.

In one of his YouTube recent videos, MeetKevin shared that his stocks portfolio was 95% in cash, in advance of the interest rate hikes that are coming in March. I respect that. The guy is nimble and changes his posture when the facts change, good on him.

But the real problem is not the interest rate hikes. The problem, in my view, is liquidity and leverage.

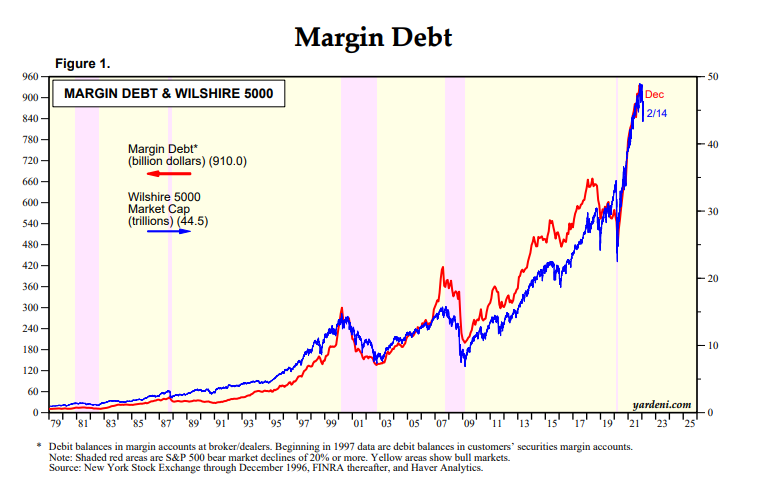

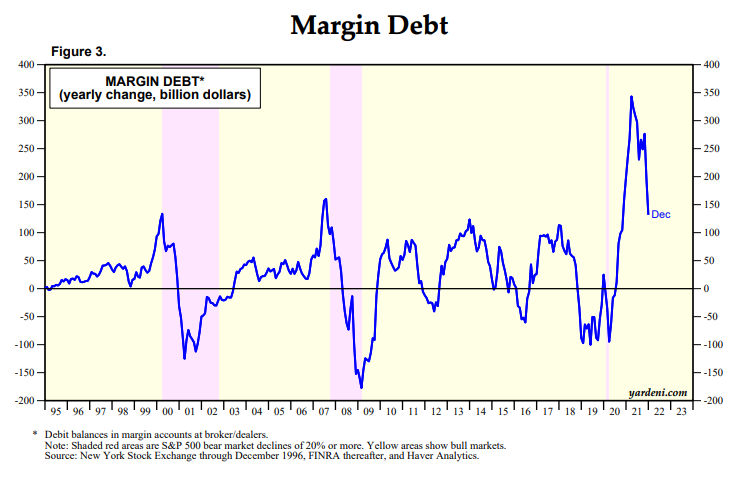

Take a look at these two charts from Yardeni:

It is my belief that whether or not we come out of this without too many bruises is strongly linked to how smoothly that margin debt goes back down to reasonable levels before or while the interest rates go up. Notice how leverage cratered as the two previous recessions were taking place.

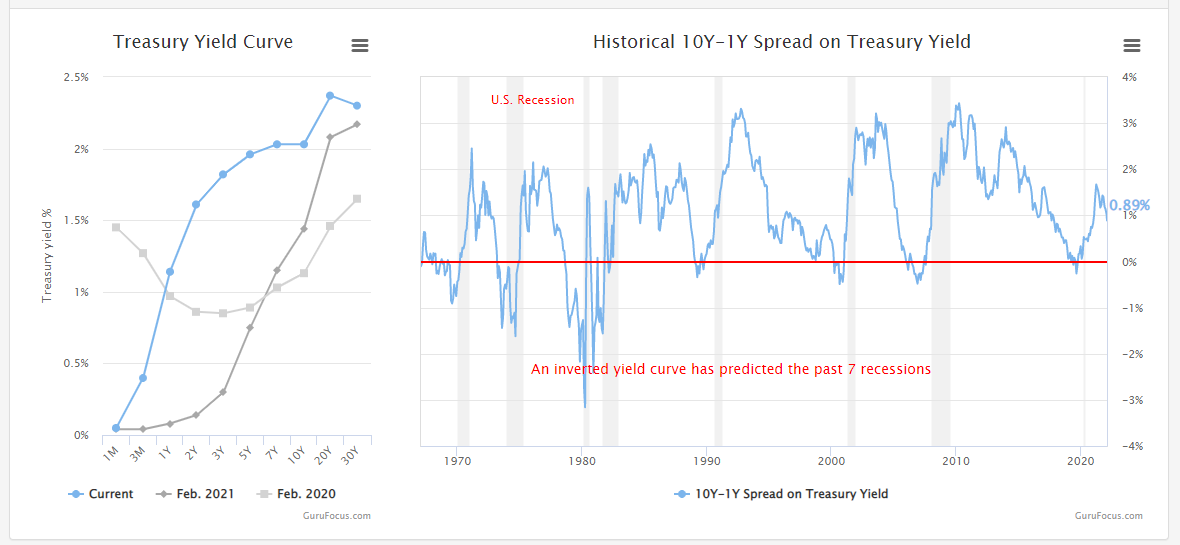

The other well-known indicator of a future recession is the Treasury yield curve inversion. We’re not there yet but we don’t have a big margin of safety:

Every one of the last eight or so recessions was preceded by a yield curve inversion, but not every yield curve inversion is followed by a recession (there are some false positives). If you don’t know, a yield curve recession means that investors think shit is about to hit the fan and they start hoarding cash because they think they’ll need it soon, pushing up the short-term yields.

I don’t socialize much, generally speaking, but I recently had a family thing to attend, and I had the pleasure of hearing about an NFT project called Eagle Club, by Gal Yosef, an Israeli painter and 3D artist who according to some is “becoming one of the most influential digital artists of our lifetime.”

So this project allows users to buy NFTs blind, meaning they don’t know what they’re buying at the moment they’re making the purchase. Then on some future date, the NFTs are revealed and everyone gets to see what they bought. Exciting stuff.

But here’s where it gets even more interesting. In order to get in on the fun, you have to be a “level 55”. To accumulate points and get to higher levels, you have to engage with the community in the Discord channel. A LOT. The person who was telling me about this project described how he was staying up all night chatting with random people about random crap just to get to level 55. Do you see the trick they’re pulling on these clueless people?

That’s still not the best part. I asked the guy, how did you come across this project? It took a bit of probing, but he finally remembered: he saw an ad on Instagram. That Gal Yosef dude and his acolytes have a business running ads on Instagram to attract fishes who are willing to pay real money to buy something they can’t see, hoping it’s a better-looking eagle or cow or whatever the fuck than their neighbor’s, so they can then flip it to an even bigger fool.

And that’s why we haven’t hit bottom yet. The crypto and NFT scam worlds are not hurting - they are flourishing. The bottom will come after everyone will have maxed out their credit cards on this shit.

Trudeau, who will be remembered as The Big Fool (you can bet on it), has invoked the Emergencies Act for the first time ever.

This will allow financial institutions to freeze the accounts and cease providing financial services if they suspect someone to be financially helping the Freedom Convoy protestors. “Suspect” is the keyword here.

Canada is now Chinada. Or worse. But maybe we should not be surprised. Back in 2013, he had expressed his admiration for China’s dictatorial ways:

How did we get here?

It all started when he called the truckers and participants to the convoy (all of them) a “fringe minority” with “unacceptable views”:

When you’re the leader of a country that has been suffering through two years of a pandemic and all the related restrictions, you just don’t do that. You keep your mouth shut. You understand that people are on edge, you avoid adding fuel to the fire, and most importantly, you leave yourself options.

But he didn’t do any of that. He ran his mouth. And now, we’re here.

Disqus comments are disabled.