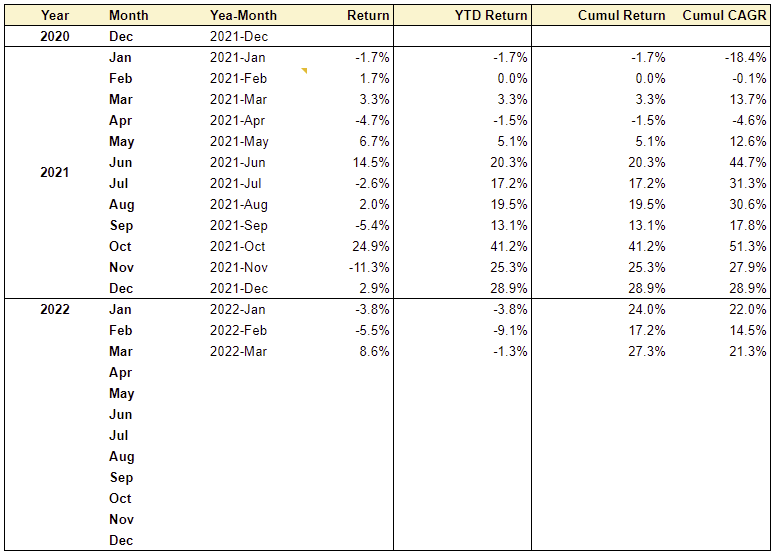

#46 - Portfolio Update - Mar 2022

Last updated: Nov 1, 2022

Just chugging along, but hey - it could be worse 😅

I am disgusted with myself.

Both my temper and focus have been very short as of late, and I believe it shows in my YTD performance.

I have failed real deep work, chasing instead the next new shiny opportunity, time and again. I’ve been very shallow and unfocused. Exactly the contrary of Charlie Munger’s most valuable advice: “Take one idea at a time, and take it seriously.”

The most recent exemple is GreenForest $GFP.TO. I remember exactly what my thought pattern was when I bought, if I can call it a thought.

“I missed the oil opportunity, but I can still ride the lumber run-up.”

Not sure what to call this pattern, it’s not exactly greed and it’s not exactly envy. It’s a sort of catch-up FOMO, and I’m quite at risk for it.

It’s not so much the result of GFP’s earnings that bothers me, and I’m not saying that the stock isn’t a good long-term investment either, rather it’s the fact that I gambled serious money on it with a short-term, speculative, and story-driven approach.

I made a ton of moves this past month, a lot of decisions, and I don’t have much to show for it.

So something needs to change, and I know what it is.

I can feel that my frequency is way too high. I need to slow the fuck down and do some deeper work, one idea at a time. I truly enjoy understanding businesses and look for the special ones. That’s what I need to go back to.

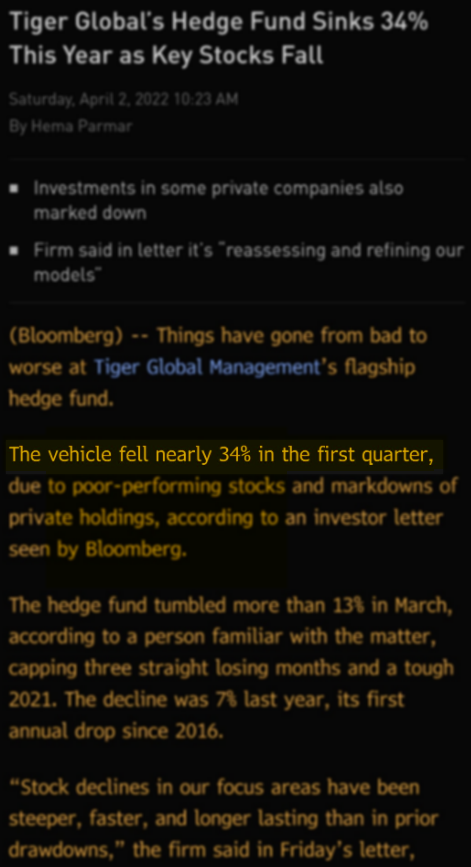

I’m no Emil B: this guy makes even more moves than me but he is up 80% YTD.

I don’t have the brainpower or the capacity (with the family/kids) for this style. I want to find companies I admire at a decent price and do nothing after I buy them.

Just as importantly, I need to reset my expectations, in terms of performance and timeline. My horizon is 20-30 years old and I should be way more patient and grateful for an above average return at a reasonable risk.

As the After Dinner Investor said: I need to be more effective, not more efficient. Compound my time and effort instead of a scattered spray-and-pray approach.

Finally, I should remember that I am a business picker, not a stock picker. Terry Smith (I love this guy) hammered this point in his latest shareholder meeting:

A potentially deeper problem is that I haven’t selected what style works for me. Initially, it was on purpose, because I noticed that many investors are hindered by the style they have chosen to follow and the restrictions that come with it.

So I thought I would be different (and smarter) and allow myself to surf any type of wave, as long as I thought it would be profitable.

While it sounds good in theory, in practice I run the risk of getting lost in a sea of clashing waves. Entropy enventually gets too strong and I find myself overloaded, unable to focus my attention on one north star.

So while I still believe that at a very high level, all styles merge into one (call it “Intelligent Investing”), in order to get there, I need a compass or headlight to guide the way.

This clip from Deep Value Co again resonated with me, where he thinks out loud about what style works for him and the type of companies he is happy to sit on and give time to compound.

There are a few super-investors I look up to and I could see myself focusing my efforts on learning from them: Charlie Munger, Chuck Akre, Terry Smith, Howard Marks, Nick Sleep, and Joel Greenblatt come to mind. I think my natural style, the one that works for me, is some kind of blend of these guys. Note that in terms of CAGR, these superinvestors are not equal.

Work in progress - but at least I’m a bit more humble and I know what I need to change.

There’s a company that has been on my radar for some time. It’s called Voxture Analytics, ticker $VXTR.V, trading on the TSX Venture.

I just watched a youtube clip from Deep Value Co (a very smart investor)) on it. The company itself is interesting and has a lot of potential. I’ve been very tempted to invest in it.

But the truth is, it would be yet another speculative bet. Which doesn’t make it a wrong bet, but I’m starting to realize that it might be wrong for me.

The company isn’t profitable yet, and even worse in my personal opinion, I’m not feeling fuzzy about management and I have no clue what they might do in the future. Finally, there’s a little bit of a buzz around the stock, which is the reason why I heard about it in the first place.

What I have come to realize is that these setups are neither good or bad per se, but I am just unable to figure out which are good and which are bad.

So I’m happily passing on this opportunity.

I’ve been hearing about fertilizer shortages since mid-2021. I never paid attention to it because I didn’t feel like putting in the work to learn about that topic.

I decided to change that and to take an interest. I binged on a few youtube videos. Here’s my favorite:

I’ve combed through stocks in this space over here in Canada and I found two that piqued my interst: $IFOS.V and $ERTH.CN.

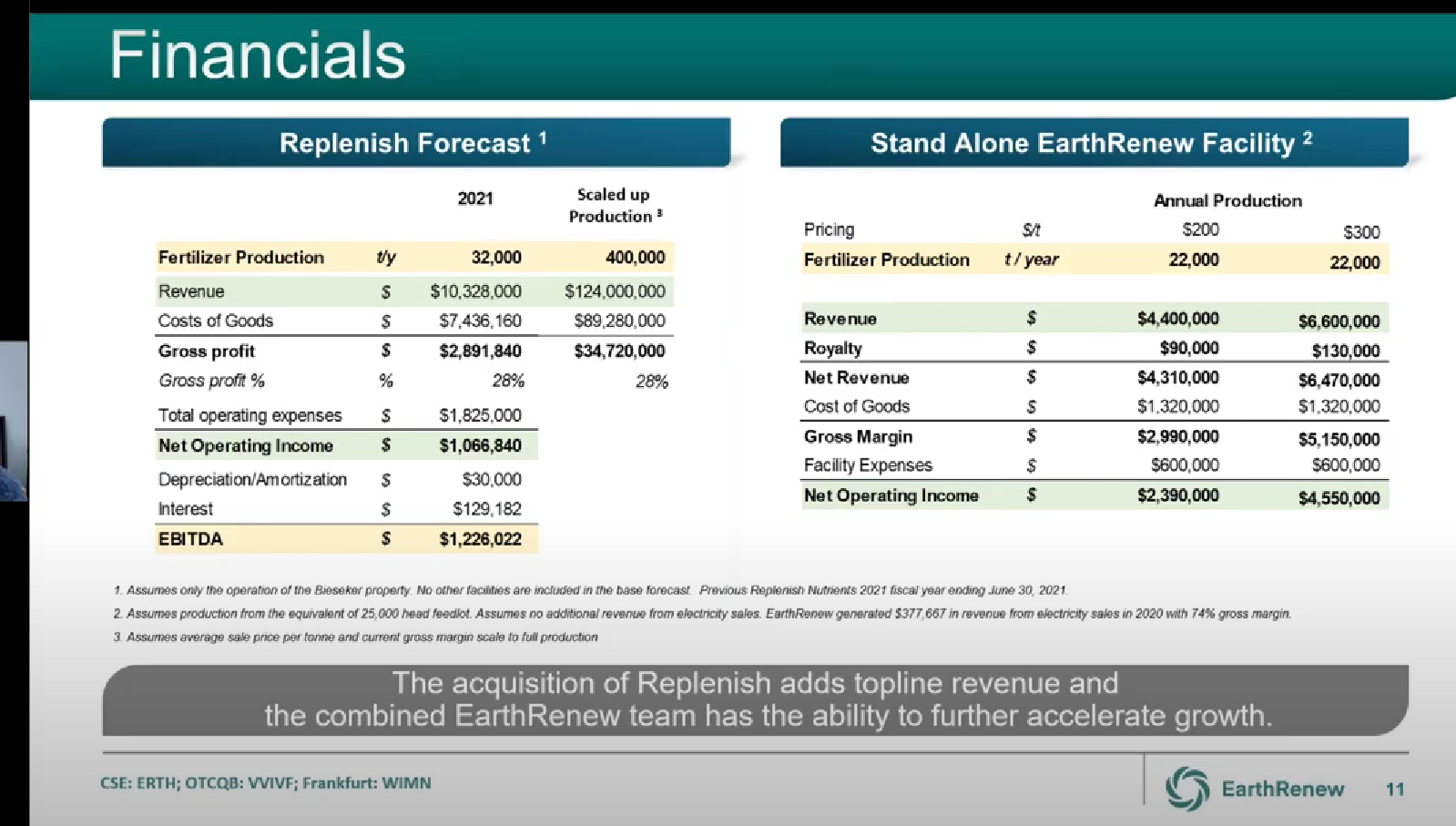

I’ll talk about the second one (EarthRenew) since I’ve put more work on it so far. They produce and sell organic regenerative fertilizer from manure.

I’ve watched every interview of the CEO and I like what I saw. The strategy is clear, the execution has been very good, and from a macro perspective, it seems to me that the stars are aligned for the whole sector.

Valuation-wise, I think the downside is hedged, based on the most recent Beseiker expansion. If they can execute on their plans in Bethune, this is an easy multibagger. Then there’s a path to even higher valuations based on an expansion down south towards California. It’s a copy-paste recipe, they don’t have to invent any new technology, they just need financing to build the plants.

With projected 2022 revenues of $25M and 15% gross margin, it currently trades at ~5x EV/GP, which is cheap enough given the upside potential.

In the spirit of going deeper into the topics I’m interested in, I’ve picked up this book (in French) about agricultural science from the local library: Fertilisation et environnement. - La science agricole.

I’ve tried to come up with some personal investing principles in the past, unssucessfully. But I think I’m better poised to do it now.

I am convinced that everyone needs to come up with their own principles, ones that work and resonate strongly with them.

Here are mine:

1. "I don't need to own this piece of shit"I want to treat stocks like cattle. By default stance should be “No”. Most businesses suck, most management teams suck, and most stocks are overpriced.

2. "The rule of 4/5/6"My golden metrics are EV/GP, EV/EBITDA, and EV/EBIT and I’m looking for values of 4/5/6 on the trailing twelve months financials. This is what Buffett paid for Apple in 2016 and it’s the golden standard against which everything will be compared.

3. "Knowledge = wealth, ignorance = poverty"This is the tricky part. While I will not get fomo’ed into any investment “opportunity”, I will keep an open mind and a highly curious attitude about businesses, industries, and life in general. I will be constantly learning and expanding my circle of competence. That is how money is made.

4. "Slow is smooth, smooth is fast"I will be patient. Crazy patient. I will wait for the price to come to me. It’s crazy how much alpha there is in just waiting for a good enough entry point, as well as waiting for a good enough exit point. Patience is probably 80% of this game.

5. "A rising tide lifts all boats"I’ve seen it in tele-medecine stocks, meme stocks, oil stocks, you name it. This game is just so much easier to play with the wind in your sails. Find the easy path. There’s no point in fighting an uphill battle. If I can find them at or near the inflection point, even better!

About patience: something weird just happened with one of the stocks I used to own, Avante Logixx $XX.V.

I sold it a few weeks ago after they announced they would be acquired by SSC Security Services Corp. (SECU.V), because I didn’t know the latter company and I didn’t like what I read about the new management.

But just a few days ago, the deal was cancelled/modified.

Instead of selling the whole company, it was decided that only Logixx (the commercial/enterprise portion) would be sold. It looks like Fairfax Holdings (potentially in agreement with the founder) was behind this suprising move. The stock is down 32% since ($1.35 to $0.92).

The details of the transaction can be found here. The whole board has been changed, and the founder has been brought back in as co-CEO.

Avante will receive a cash consideration of $24M for the sale of Logixx.

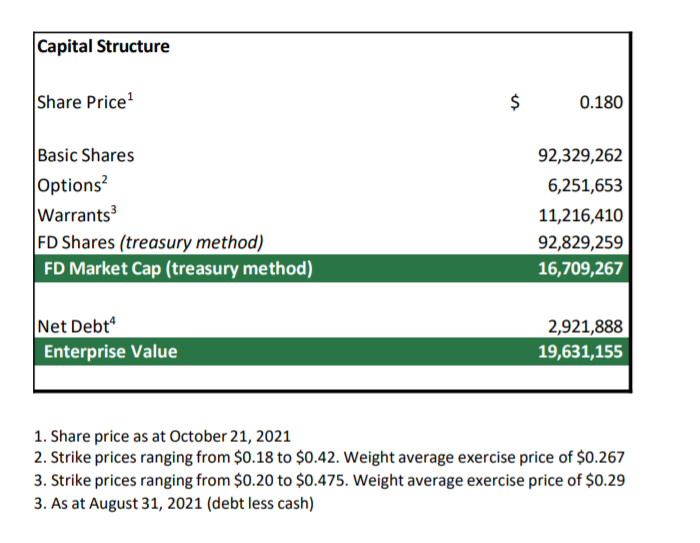

Based on the most recent filings (as of Dec 31, 2021):

- shares outsanding = 21.192M

- Fairfax converted debentures = 5.297M shares

- options = 1.360M

==> total fully diluted share count = 27.85M

==> MC at current price ($0.94) = $26.2M

- cash = $2.845M

- debt = 8.598 (long-term) + 0.405 (short-term) = $9M

- deferred tax = $1.193M

==> net cash post-sale = 24 + 2.8 - 9 - 1.2 = $16.6M

==> EV at current price ($0.94) = $9.5M

- Avante TTM EBITDA = $1.86M

==> EV/EBITDA(ttm) = 5.1x

Now usually, I would have already jumped on this, based on the market reaction and the involvement of Fairfax (which by the way converted their debs at $1.56 allowing them to block the initial deal).

But, “I don’t need to own this piece of shit”. I’ll be thinking it over and watching the price movement. The next catalyst will be the 2022Q1 earnings report and I might wait for that before making my decision.

EV / EBITDA(ttm) @ sp=$0.87 = 4.1x

Disqus comments are disabled.