#49 - Thoughts on Mako Mining

Last updated: Nov 1, 2022

I was prompted to write this after listening to this report from KER.

Mako is my #4 holding by size (at cost, since the stock hasn’t rerated yet).

At some point in the future, I might ask myself: “How could you invest in a small & unknown mining operation, when you had no knowledge whatsoever about mining, let alone gold mining?”

I want to preemptively address that question here, and my answer is: “I was able to do it because I knew nothing about mining.”

Akiba Leisman could have been selling gold-flavored popcorn for all I care.

What I saw was a CEO that had a plan and was executing on it. When I made my first investment in Mako, he was about a third of the way into the 5-year plan and it was going well, despite the pandemic and other unexpected turns.

I also saw a CEO that is very aligned and transparent with his shareholders.

Finally, I detected that he was not the most popular CEO in this particular industry, which signaled to me that there was a chance for the stock to be undervalued.

I was not encumbered by knowledge about how a mining operation should run and more importantly, be marketed. Apparently, it is customary in this space to spend money (a lot of it) defining the resource before you start mining it. It’s like the polite thing to do or something.

Akiba did NOT do that, for a simple reason: it would have cost too much, due to the geology of the land package. Basically, my very limited and amateurish understanding of the situation is that the veins they’re dealing with over there are too shallow and “horizontal”, meaning if you wanted to estimate the total resource, you’d have to drill all over the entire land! You might as well just mine the fucking thing, which is what they’re doing.

Currently the business is cashflowing nicely (~$9M of adjusted EBITDA in Q4, where adjusted means excluding exploration costs) from the San Albino mine.

The cashflow run rate should approximately double by the end of next year thanks to an expansion in Las Conchitas. The expansion program is planned to cost a bit less than $20M (I rounded up).

Annualized, that should bring us to a round $80M/year of run rate EBITDA. Current market cap is ~$200M. The 2021 annual statements show net debt around $20M or so but it’s less now as they’ve been repaying it aggressively in 2022Q1. Not much cash. So EV is about $220M.

I mentioned that Akiba was shareholder friendly. At the current cashflow levels, there will be no dilution. Debt will repaid. After that, shares will be repurchased. After that, a dividend will be considered (a few years from now).

I usually don’t venture into stock price predictions but in this case why not, I think the stock is likely to be somewhere between x2 and x3 in the next 5 years, barring…well barring a lot of stuff to be honest, but that’s just how she goes!

Special shoutout to Akiba “over here” Leisman, CEO of Mako Mining and semi-decent guitar player.

Update (2022-05-08)

Here is a link to Mako’s investor presentation, it’s worth a look!

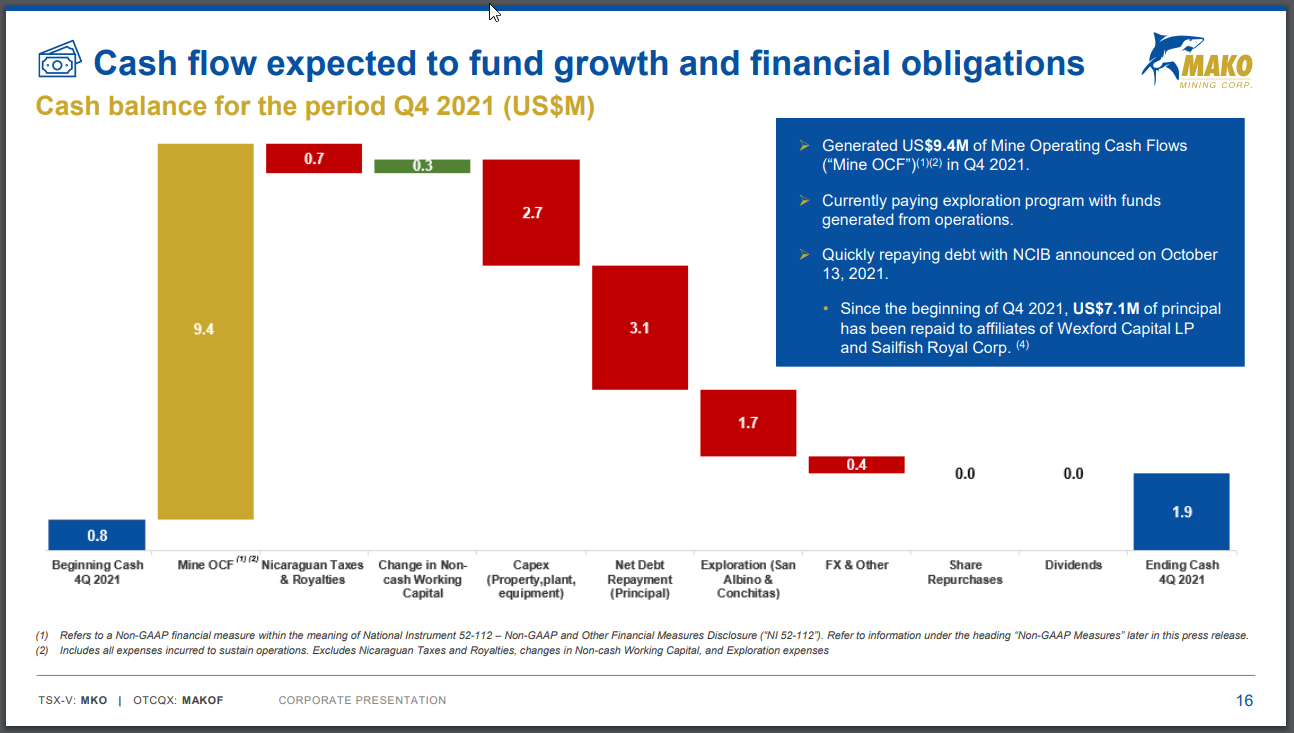

I like slide 16 in particular:

This slide tells me that the company has generated 9.4 [mine OCF] - 0.7 [royalties & taxes] - 2.7 [Capex] = $6M of unlevered (before interest payments) free cashflow.

With an EV of ~$220M, that’s an annualized unlevered FCF yield of about 11% as of the end of 2021Q4.

The company is currently using this cash flow to finance exploration and (quickly) repay debt. Once the mine throughput is doubled, the yield will be too high to ignore and I also expect Akiba to boost the share repurchases to give us some additional torque.

Fingers crossed, good days ahead.

Update (2022-06-01)

For the first quarter of 2022, the company generated: 8.7 [mine OCF] - 1.1 [royalties & taxes] - 3.1 [Capex] = $4.5M of unlevered (before interest payments) free cashflow. Taking the average of the last two quarters, that’s $5.25M of FCF per quarter, or $21M per year.

The new debt is $16M after repayments to Sailfish and Wexford. Current market cap is $198M. So EV is about $214M, so the business is yielding me 9.8%.

Disqus comments are disabled.