#50 - Portfolio Update - Apr 2022

Last updated: Nov 1, 2022

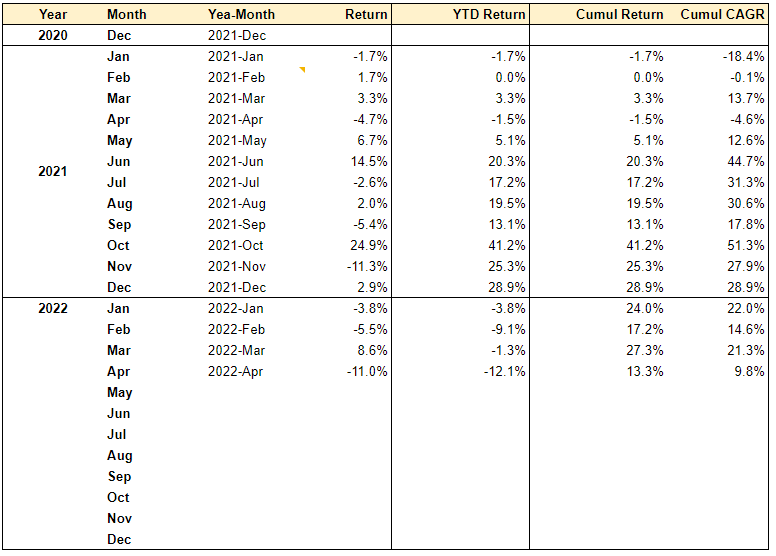

Performance Update

Worst month in a while, maybe since I started investing.

Commentary

While this was a particularly bad month performance-wise, it strangely didn’t feel like it, at all. And I’ve had less brutal months feel weigh much heavier on my morale.

I’m not 100% sure what to attribute this to, and while I’d love to believe that I’ve grown to become a more mature investor in the span of a few months, I think a simpler explanation might be related to the weather.

We are getting out of the brutal winter months here in Canada and the days are getting sunnier, allowing us to take the kids out to play in the park. I’ve also been able to run outside a few times, which felt good.

The other thing that was very different this past month is that it was Ramadan, so I’ve been fasting for a whole month now (it’s just a coincidence that Ramadan started at the beginning of the month). It might have played a role too by slowing the metabolism a bit. I don’t know if there’s any validity to this, maybe I’m imagining stuff, but it could be interesting to see if this pattern of “zenitude” reoccurs on every Ramadan.

I have to say, I’m getting more comfortable with some of my holdings as well. Just off the top of my head, I don’t really care about the short-term stock price fluctuations of $AEP.V, $MKO.V, $PROSY, or even $EMO.V. My conviction in the underlying value has remained stable, and eventually I believe they will all be fine.

I’ve also started and finished reading Chris Mayer’s book, 100 Baggers, which I enjoyed much more than staring at the screen watching those stock prices. Maybe I’ve extracted a tiny bit of wisdom and patience from the book.

I’m not feeling twitchy, worried, or stressed. Quite the opposite, my excitement has been creeping up lately as I’ve been watching some good businesses get decimated on the public markets. There are a few that I intend to dive deeper into during the month of May, such as $IAC on the US side and $PBL.TO in Canada. I also have a backlog of Fund letters to read from 2022Q1.

Moves

I’ve been dabbling in fertilizers this past month. I’ve bought two tickers: $IFOS.V and [$ERTH.CN], but I was only able to get excited about the latter business, so it’s the one that stayed in the portfolio. I might have mentioned it before, but I feel that the runway here is decent. There is a short-term catalyst (big expansion) and an underlying trend that I like (regenerative ag) in a favorable macro setting (high fertilizer supply due to multiple factors). Management seems competent, and the price seems OK to me. So I’m willing to sit on this one and see what happens. I must say, I loved learning about fertilizers and how important they are for our ability to feed ourselves.

I also danced a little bit with Aimia, ticker $AIM.TO. I was really close to putting in a buy order, but at the last minute, after listening to their latest earnings call where they suddently announced that they’d give the Mittleman’s investment firm $25M to manage, and an older interview of Chris Mittleman where he said that he would NOT be investing Aimia’s money, I got cold feet. I mean, the numbers are attractive, and I was really starting to like their TradeX holding. But this little move they made annoyed me. It’s not a huge deal per se, it’s just a little thing that’s not 100% pristine, you know. Like, they didn’t need to do that, the optics are not good, and it makes me substract some points on the trusting front, which is one of the most important criteria for me (not just for performance reasons, but also for my peace of mind). So, in the spirit of my 1st principle (“I don’t need to buy this piece of shit”), I’m passing for now.

The last move I made was to purchase $XX.V. I’m tempted to say: “price was my due diligence here”, but the setup is attractive here as well (in a different way):

- a butchered acquisition, likely stopped by a big shareholder (in this case, none other than Fairfax, which I’m happy to have as co-shareholders)

- a management revamp (CEO unceremoniously kicked out, original founder brought back in)

- hopefully, cuts in spending to make up for the decreased scale of the business

- I was looking for a way to play the “social unrest & increasing inequality” theme, and this fits the bill

- recurring (and I imagine, sticky) revenues

So all in all, it looks like I had three “new” ideas, and I acted on two of them. Between work and family, I think that’s OK.

Disqus comments are disabled.