#6 - Aimia Inc

Last week, I looked at Loyalty Ventures Inc, the AirMiles company. While the company itself was not attractive for me as an investment, I learned a thing or two about the customer loyalty space. One of these learnings is that frequent flyer points are much more valuable within an airline company than outside of it.

From there, a bit more research online has led me to an interesting event-driven situation and potential investment opportunity that involves an airline in trouble and its frequent flyer points.

The Story (short version)

OK so this one is bit weird, I have to admit. But the interesting kind of weird!

I think I first heard about it on a space hosted by George Noble. Several stocks were pitched, you can find the list here.

I’ll try to tell the simplest version possible of the story, which is basically that Aimia holds about 49% equity stake in PLM, the operator of the Club Premier loyalty program in Mexico, while the remainder is owned by Aeromexico.

But in June 2020, Aeromexico, reeling from the impact of the pandemic, filed for Chapter 11 and started putting together a financial restructuring plan.

And it just so happens that as part of the bankruptcy proceedings, Aimia and Aeromexico have initiated discussions related to a potential transaction whereby Aeromexico would acquire Aimia’s stake in PLM. And this where it gets interesting.

Much smarter people than myself have dug out the potential details of this arrangement.

For example, here’s an excerpt from a letter of Laughing Water Capital:

that Aeromexico had previously agreed to pay Aimia the greater of $400M USD or 7.5x EBITDA (plus balance sheet adjustments) for its stake in PLM.

Elsewhere on twitter, Wabbufo’s conservative guess (marking Aimia’s other investments at their cost value) is that the transaction amount would be somewhere between $375M and $425M USD, equivalent to a range of $5 to $5.60 CAD/share and in line with the $400M USD figure above.

The current price of $AIM.TO shares is $4.89. So it looks like just the payment for PLM would be more than the entire market cap. So the question is, what’s the enterprise value, and what else is there within Aimia?

Valuation

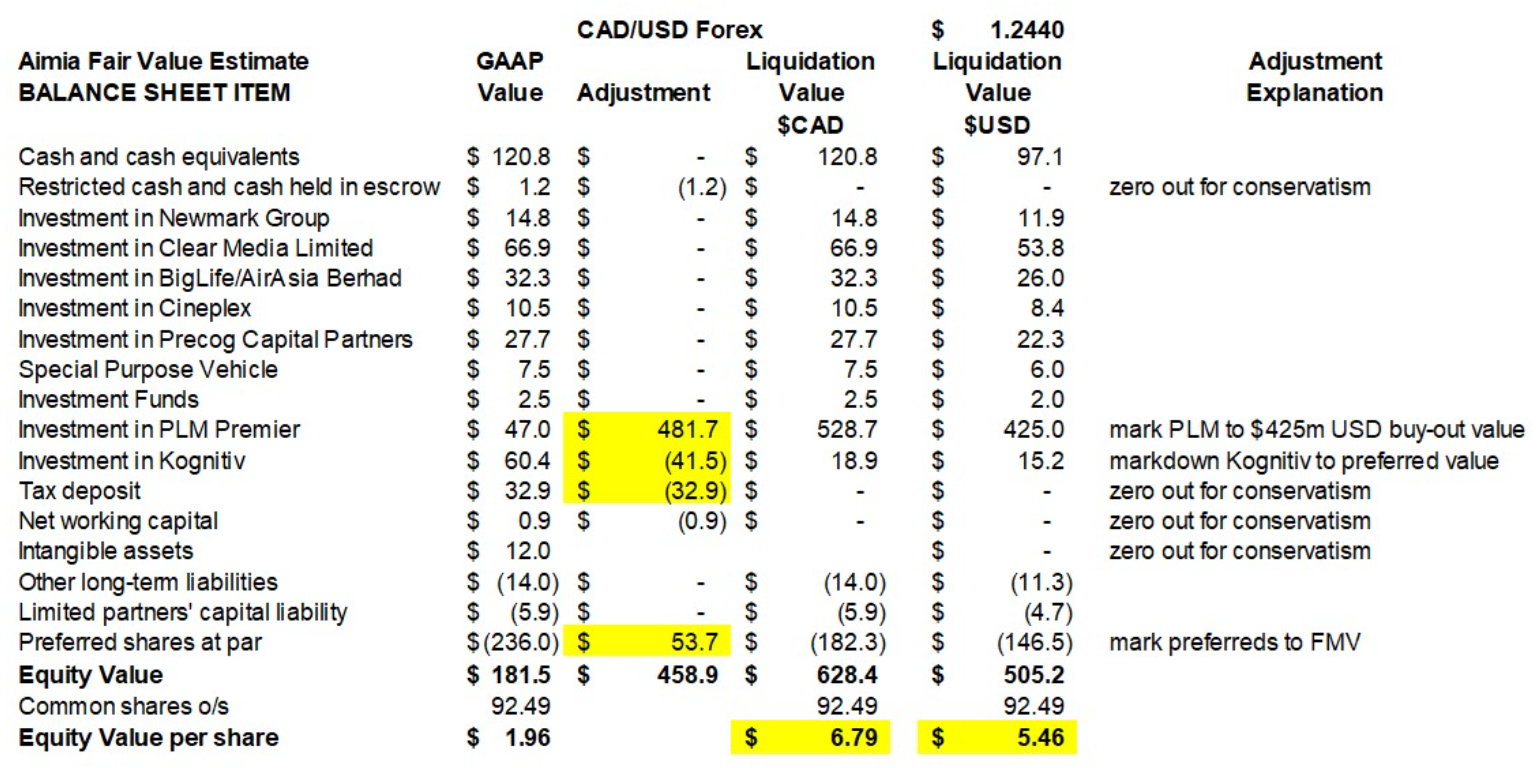

Again, Wabbufo comes to the rescue in this tweet:

Assuming the deal goes through, the conservative SOTP enterprise value would be ~6.79$ CAD. Let’s be even more conservative and use $400M instead of $425. That gives an equity value of $5.19 USD, or $6.49 CAD (using $1.25 CAD/USD).

According to these calculations, the current price is at a 25% discount of the theoretical sum of the parts value.

At this point, a few questions remain pending:

-

are the other businesses inside the holdco worth anything?

-

what are the odds of the restructuring plan going through?

-

if something goes wrong and Aeromexico doesn’t buy out Aimia, what happens then?

These questions will have to be answered in a separate post.

There’s no guarantee that the restructuring will go through smoothly, so I’m not in a rush to jump in here. I have to do a bit of work, especially on the first question above.

However this is interesting enough to stay on my radar. One of the reasons for this is that Aimia is led by the Mittleman brothers. I’ve just listened to an interview of Chris Mittleman on The Acquirers Podcast, and he made a very positive impression on me.

Part of me also wonders: what if the whole bankrupcy is aborted, and Aeromexico resumes business. Does it even matter whether or not they buy out Aimia?

Recent Developments

Some of the creditors have complained that the exit financing Reorganization Plan favors company insiders, including Delta Air Lines and certain Mexican sharesholders and directors. I believe the creditors had until January 7 to vote in favor or against the Plan, and the confirmation hearing is scheduled to take place around January 18th. Therefore I will probably post a follow-up very soon.

It’s worth noting that Mexico air travel has recovered 95% of its pre-pandemic traffic numbers and Aeromexico closed 2021 carrying almost the same number of passengers it had in 2019.

Links

Chapter 11 Bankruptcy Reorganization FAQs