#72 - On a Personal Note

Last updated: Nov 1, 2022

It's not about how hard you hit. It's about how hard you can get hit and keep moving forward. How much you can take and keep moving forward.

Pain is a teacher

This past year has been rough. I lost more money than I could ever have imagined.

I lost more than a downpayment on a spectacular house.

Which is ironic, considering how badly I wanted to be able to buy a house for my little family.

If this continues, I fully expect that I’ll wake up one day and puke my guts out in the toilet out of shame and guilt.

Thankfully, what ends up happening as the portfolio goes down in value is that the worst businesses in it go down in size too, and hopefully, at a faster rate than the good ones.

Moreover, I do not water the weeds. If anything, I try to cut them, and to my flowers.

This slow process should position me better for the future.

I own some good businesses, led by leaders that I admire. There are many more spectacular companies that I would love to own.

It’s all relative

At the same time, I feel grateful. For my health, for having a job and a rook over my head, and for the family that God gave me.

I’m not a religious person but I think it’s useful to have an external, fixed reference point.

I’m happy to have a good wife and three beautiful daughters. Money or no money, they bring me a lot of joy and happiness.

I mainly want the money to be able to give them a good living environment, protect them from the vicissitudes of life, and spend more free time with them.

Still, I am extremely lucky already. I’m having a blast.

What I’ve learned

1. Stick to what you understand and what you enjoy

Both are necessary. That’s just the way it is.

Some earning calls, I can’t listen to for more than 5 minutes before falling asleep.

Others, I could listen to every day.

That has an impact on how much understanding and conviction I will eventually have in a business.

The type of investment also matters: is it a cigar butt? A quality compounder? A special situation? I can’t be good at all of these. Heck, I don’t even want to.

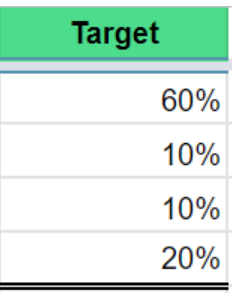

I’ve decided to use a blend, heavily weighted towards quality compounders, with some space for cheapos and speculative bets to satisfy my gambling tendencies. But I don’t exclude reducing that space slowly as time goes by.

My target (on a cost basis) is:

However, if all goes well, my quality compounders should eventually dominate the portfolio. We’ll see.

2. Nobody knows shit

Except for Warren and Charlie. No, I’m serious. Everyone else is just throwing darts in the dark

Moreover, talk is cheap. Whether it’s a CEO or an investor, proven track records of ACTIONS and RESULTS are all that matter.

3. Size according to the downside

I think it’s Joel Greenblatt who said it, but it would have been a much safer and rewarding approach to make the size of my positions proportional to how much certainty I had in the margin of safety, rather than proportional to the potential upside.

4. The biggest advantages are: size and time

A small market cap and a very long time horizon might be the only (not just the biggest) advantages I have.

Sometimes, things work out JUST because they are small and cheap.

Other times, things work out JUST because other investors have a short time horizon.

It does not need to be more complicated than that.

5. Stay chill

Don’t rush. Stay chill and study non-stop. Small increments. Find good companies, learn about them, do nothing.

Then when the opportunity comes, pounce like a lion.

Disqus comments are disabled.