#74 - Portfolio Update, October 2022

Last updated: Nov 1, 2022

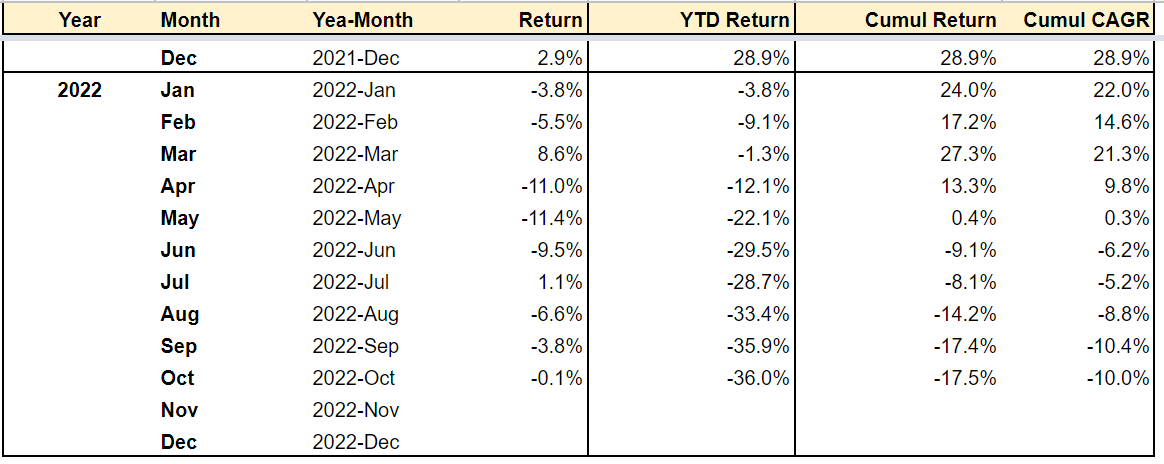

Hallelujah! It’s a miracle!! I didn’t lose money this month!!!

Performance update

.png)

Commentary

Biggest negative contributors:

- $MKO.V (by far)

- $BABA

- $OM.V

Biggest positive contributors:

- $PSK.TO

- $EVVTY (again)

- $TPL

$MKO.V lost like 25% of it’s value after fucking Joe announced sanctions against Nicaragua.

Who knows what the impact will be…but I pretty much did nothing with the stock. Just holding for now.

There might be a silver lining to this situation though…in the sense that Akiba probably won’t dare raise equity now, which I was very worried about.

$EVO had another amazing quarter. Winners win.

Moves

Mostly nothing, except for:

- a new small position in $DRM.TO

- a new micro position in a Canadian nanostock that I will disclose later

About this micro position: the first time I came across it, I dismissed it because of the industry. Once again, that arrogance on display. “Nah - who would buy this shit, why would I waste my precious time on it?”

I don’t know why or how it got on my radar again yesterday evening. In any case, I watched the presentation, and I was blown away!

This thing is a legitimate business, growing, cheap, and with a moat (at least temporarily)!

They reported earnings yesterday too. First profitable quarter.

I bought about $10K in the morning, despite the stock being already +8%. I wasn’t sure what the right amount was - the balance between being too greedy and too timid. I think $10K is fine. Plus it’s really all I had in my non-taxable accounts, so it’ll just have to do for now.

The stock ended the day up 22%.

Outlook

Here’s my current portfolio composition by stock category:

.png)

I’m almost on target for quality, very happy about that.

The speculative bucket is still too big. Either some of them can move to the cheap category, based on concrete results, or I need to trim (or…nature will take care of them if they don’t deliver).

I also have some extra cash that I should put to use.

Disqus comments are disabled.