#76 - Mako Mining 2022Q3

Publish date: Nov 30, 2022

Last updated: Dec 1, 2022

Last updated: Dec 1, 2022

2022Q3 results are out (link).

FCF breakdown: 3.8 [mine OCF] - 1.0 [royalties & taxes] - 1.7 [capex] = US$1.1M or CA$1.5M.

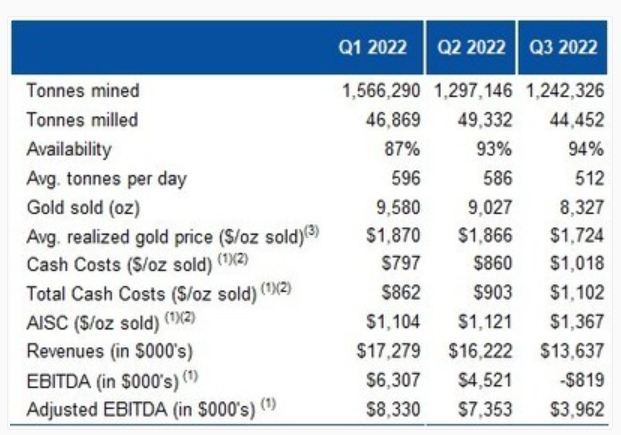

A very weak quarter compared to Q2, due to a combination of less gold sold, at a lower price, and higher AISC:

However, this bit is encouraging:

Now that the metallurgical issues have been resolved, we expect a very strong Q4, with an increase in throughput to 600tpd by the end of the quarter with no additional capex and minimal recovery losses. Additionally, the Company expects a significant reduction in AISC, higher net income and record gold sales in Q4 2022.I will update valuation after 2022Q4.

Disqus comments are disabled.