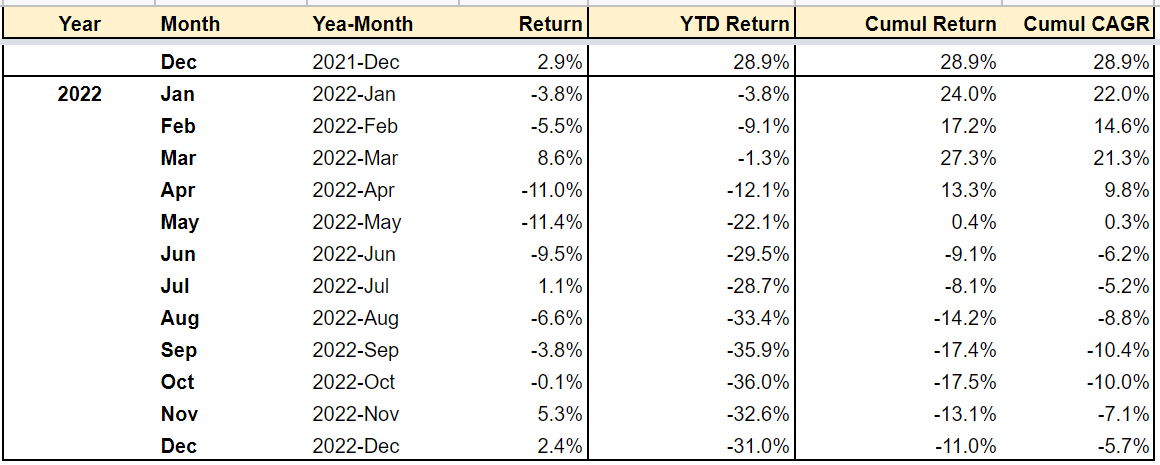

#79 - Portfolio Update, December 2022

Last updated: Jan 4, 2023

Stabilizing…

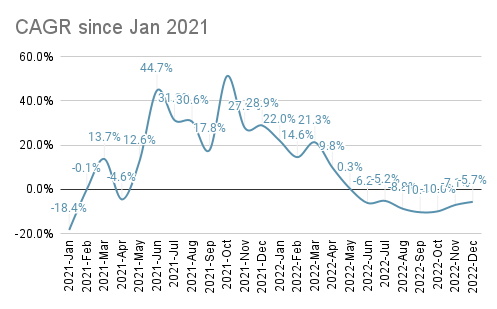

I’m obviously not proud of my CAGR, but I include the chart because one day it’ll turn positive and I’ll be happy.

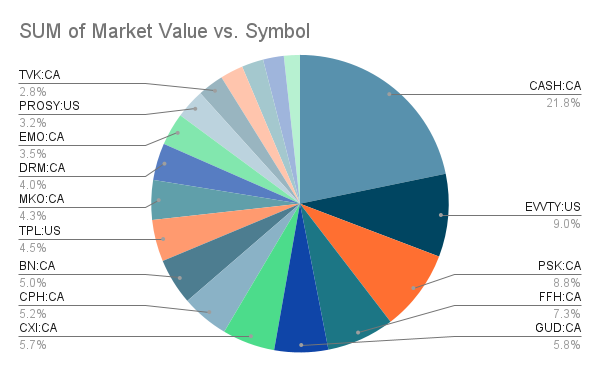

Biggest negative contributors:

- $MKO.V

- $DRM.TO

- $EVVTY

Biggest positive contributors:

- $CXI.TO

- $CPH.TO (again)

- $PROSY

$MKO.V being a penny stock, the % variations are amplified. I’m not worried about it. Ultimately the stock is undervalued. I’m also not worried about $DRM.TO and $EVVTY.

$CXI.TO had a strong month, exceeding the previous 52-week high. I’ve been traveling lately, and anecdotally at least, it seems that revenge traveling is indeed a thing. With China reopening, it bodes well for this company.

$CPH.TO is also flirting with 52-week highs. Not much to say on this one, it’s a boring cashflowing business. As long as they don’t make any stupid acquisition, I’m happy.

$PROSY is cheap.

A brutal year. My underperformance was mainly driven by greed. I had huge positions that were bad gambles ($NUR.CN and $EMO.V). Both of them got crushed. Good lesson. Gamble responsibly - or don’t gamble at all.

I learned a lot this year, and I think my portfolio composition reflects that. I am invested in more quality companies, I hope at a good price.

As a consequence, my portfolio feels easier to manage. For a few of these companies, I don’t feel the need to be up to speed with all the recent developments. Strong businesses led by strong managers - I’ll just let them do their thing and I’ll stay tuned because I enjoy it, not because I’m worried about them.

- New:

- $BN.TO/$BAM.TO

- $TVK.TO

- $ASRT

- $PBR-A

- Added:

- None

- Trimmed:

- $PSK.TO

- $GUD.TO

I’m happy to be a new shareholder of Brookfield Corporation. This one I hope to hold for a long, long time.

I’m feeling reasonably comfortable with $TVK.TO and $ASRT, but I need to do a bit more work to improve my understanding of these two.

$PBR-A was a gamble. As such, not sure it’ll pay off. I bought it at $8.31 so I’m currently break-even.

Overall, I made too many moves for one month. I gotta chill and do more work before acting.

I trimmed $PSK.TO and $GUD.TO because the positions were a bit too large and I wanted to buy some $BN.TO with the money.

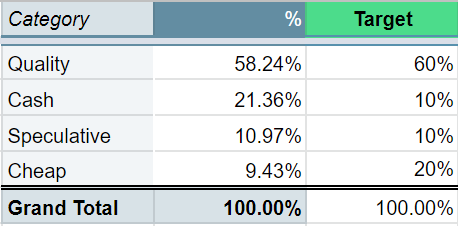

Here’s my current portfolio composition by stock category:

I am pretty much on target, except that I should use some of the cash to buy into cheap stocks. That being said, that’s OK for now, as I might look for a place to buy in 2023.

Disqus comments are disabled.