#8 - Oil (part 2)

After saying last week that I was spending too much time thinking about energy and oil stocks, I pretty much spent the weekend thinking only about that.

I was mainly thinking about the current global situation we’re in.

I read a lot of articles and listened to several interviews, and I got the feeling that most if not all of the individuals who follow the sector closely do so because they understand how fundamental and ubiquitous energy is to our everyday lives, in a way that most of us don’t. I think we sometimes forget what a miracle fossil fuels are.

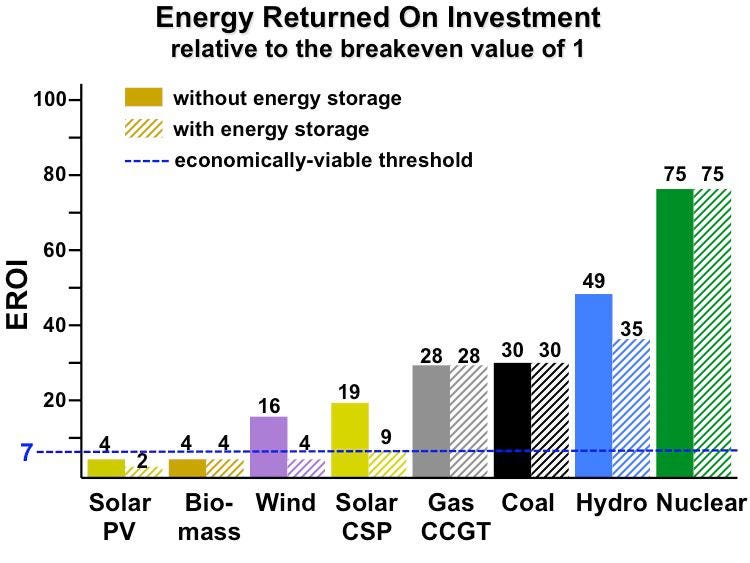

A fascinating concept I read about is that of Energy Return On Investment (EROI).

From Investopedia:

Energy Return on Investment (EROI) is a ratio for describing a measure of energy produced in relation to the energy used to create it.

We can think about that concept on an individual level, but it’s more interesting (for our current discussion) to think about it on a societal level. How much energy is returned to us, as a ratio of the energy we spend to extract, deliver and use it?

Closely related to the concept of EROI is that of Energy Surplus, i.e. how much energy is left after accounting for the costs of obtaining it.

Here’s where it gets interesting: one could argue that everything that is beautiful in our civilization, and maybe our civilization itself, has been made possible thanks to the accumulation of energy surplus. As Trader Ferg said in this interview, if we had to spend all our time chasing rabbits because our EROI is too low to accumulate surplus, we’d probably still be living in caves (I highly recommend watching the interview and following him on twitter, he’s a smart and knowledgeable dude).

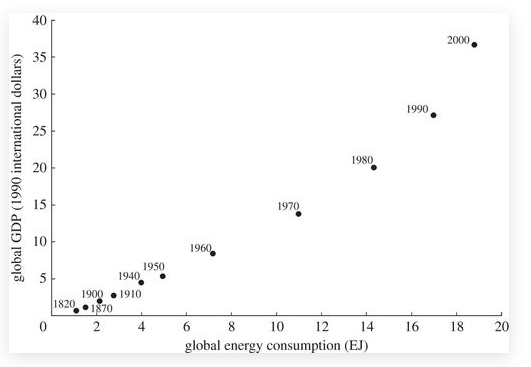

Here’s a beautiful chart, from an article titled The implications of the declining energy return on investment of oil production:

Higher EROI allows higher GDP, which enables research to unlock better ways of extracting energy and hence higher EROI. Unless “better” starts meaning something else…

If you find the topic interesting, you can read this other paper on the topic called What is the Minimum EROI that a Sustainable Society Must Have?.

Back to the people who are investing their money in energy, I found that they all share a certain down-to-earth, no bs attitude. Whether it is Kuppy, John Polomny or the aforementioned Trader Ferg, they’re not your typical New York hedgy. To me at least, they just call it like they see it.

And what they’re seeing is that…

It is time to pay the piper.

We have been comfortable for so long that we have forgotten the basic rules of life. Except for hydropower, the green sources of energy don’t have (as of today) a high enough EROI to sustain the world by themselves.

I was surprised not to see oil in the picture above. I guess there isn’t one single type of “oil” and oil-related EROI. I found this article there the author considers several oil companies and comes up with an average EROI of 15, which not higher than that of renewable energy sources. In this other article, is is explained that:

Oil is an energy-dense fuel. If it can be obtained with relatively little energy expenditure, it can yield a big return in EROI terms. But as it gets harder to extract, and more energy is required for the process, the return on that energy investment diminishes — and at some point, this process may yield oil that’s not worth the energy put into it.

I have more work to do on this topic, which I will dive into in a subsequent post.

As you probably know by now, I’m a generalist and I have zero edge whatsoever in this sector, but I might be able to paint a high-level but low resolution picture of the situation. In the specific case of the oil sector, it seems to me that there is a confluence of circumstances taking place.

From the perspective of human psychology, I think people have had it with the lockdowns, the isolation, and the restrictions on life. While some masochists have been celebrating having their freedom stripped from them, life always wins. And it is about to come back with a vengeance. Nothing will stop the tsunami of movement and life that is coming. I have to caveat this with the omicron wave and its consequences. Many people believe it could have catastrophic consequences on the economy, at least in the short term. As always, nothing is certain and the future is hard to predict.

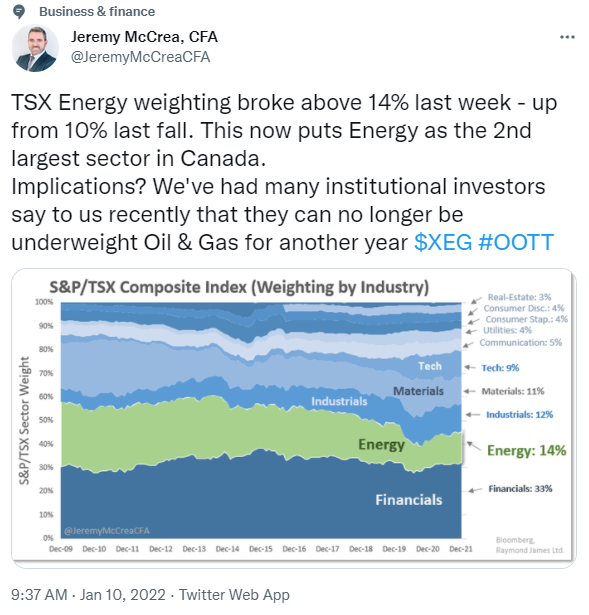

From the perspective of game theory, I think the oil producers are currently in a Nash equilibrium. They’re not idiots; they remember what happened the last time they overextended and overspent on CAPEX, as well as the negative oil prices in 2020 when there was an oversupply. Their creditors and shareholders remember it too. More to the point, they have realized that they can print money and return it to themselves and their investors by just staying in this equilibrium. Even if some of them wanted to go out and start expanding, it’ll take time to do so, given the staff shortages, equipment shortages, government ESG mandates that might limit liquidity, etc. Of course, this will not last forever. At some point, oil will go high enough to break the equilibrium but until then: money will be returned to shareholders.

Still on game theory, some players who had left the game might be tempted to rejoin it:

Finally, from the perspective of risk theory, the geopolitical system seems so tense and fragile that any random event anywhere on the planet (such as what’s happening in Kazakhstan) could worsen the supply issues.

I’ve never used a top-down approach before in order to decide where to invest my money. Buffett and other value investors I respect made me believe it wasn’t kosher.

No matter.

Links

Update (2021-01-11)

This tweet makes me think that it’s possible I am completely wrong and understand nothing about human psychology (at least when it comes to Canadians):

'Should governments lift all restrictions related to Covid?'

— Polling Canada (@CanadianPolling) January 11, 2022

Total:

No: 73%

Yes: 20%

Fully Vaccinated:

No: 79%

Yes: 16%

1 Dose:

Yes: 43%

No: 27%

Unvaccinated:

Yes: 66%

No: 26%

Leger / January 9, 2022 / n=1547 / Online

Update (2022-01-23)

The energy fintwit is starting to feel a bit volatile and bubbly. Have to stay cool and keep calm. The exchange here was interesting:

I think most quoting $80-$100 see it as a temporary thing. It’s all about mid-cycle, which I think has creeped up from $55 WTI to $60-$65 WTI. The mid-cycle price moves equities, spot not so much.

— Pelican (@Pelican26590324) January 24, 2022

I think a case can be made for $70WTI mid-cycle.