#80 - Ramblings, December 2023

Last updated: Mar 3, 2023

https://twitter.com/PhillipsRelic/status/1600266725760684050

https://twitter.com/uproarcapital/status/1600211976256307201

$DHT.un trades at 6x estimated 2023 FCF. It also pays a 5% dividend.

https://twitter.com/GardinerIsland/status/1600253685405126656

Revenue and earnings have cratered…buying back stock but cash balance is low.

All those little quarterly updates don’t matter very much at all.

It’s something you plan to own for a long time and sell reluctantly.

As an individual investor, […] you do need to resist the urge to trim winners - as long as the company is performing.

Link.

Link.

Very cool company; Mobile-based, digital lending platform in Africa. Started with ride hailing app drivers. Backed by the infamous Chamath Palihapitiya, among others.

CEO: Kaivan Sattar; most recently worked as a Data Scientist at LendingHome and previously as a quant at the Federal Reserve Bank of New York for 3.5 years. In university, Kaivan conducted field research in Ghana, Bangladesh, and India to better understand how the poor save and borrow money without access to banks.

Imagine an asset that returns 24% on book value, forever.

With a discount rate of 12%, if the income generated is taken out of the asset and paid to the shareholders, the fair price-to-book of that asset is $2.

If on the other hand, the net income is reinvested in the asset for 1 year, and then the stream of income is paid out, then the fair prie-to-book of the asset is (1.24 / 1.12) * 2 = 2.21 = 1.107 * 2.

So reinvesting 100% of the generated income in the asset for just one period while maintaining the same level of return on equity boosted the value of the equity by 10.7%.

Assuming we can reinvest for 10 periods and retain the same returns on equity, the value of the asset is multiplied by 2.77 and goes up to $5.56.

That is why returns on equity and opportunities for reinvestment are critical.

I like the company $TEQ.ST but Jesus…can you group think more please?!

https://twitter.com/lonewolvesfrank/status/1601476198282203136

Stumbled on this book on archive.org, where I was watching one of my favorite movies, called Les Bronzés font du ski.

Wonderful book, I saved a few quotes here.

On The Business Brew podcast. Very insightful episode, I highly recommend it. To tell you the truth, each episode of The Business Brew is like a masterclass in investing. Amazing that this stuff is all free…

Bob sees himself a growth investor, because he buys differentiated businesses run by smart owners in industries that have been hammered and battered down, when things look bleak - but when the environment improves after a long period of rationalization and competitor bankrupcies, these businesses come out even stronger than they were prior.

One of the difficulties of this approach is that you can’t time the turn-around, which means you have to be able to push through it and even add to your position as the stock price keeps going down, disconnected from future economic outcomes.

By the way, in this epsiode, Bob lays one of the best oil macro thesis I’ve ever heard. No numbers, nothing too complicated, just logical implications of the past and current events.

Archived news article here and YCombinator post here.

The comments on YCombinator are interesting. E.g.

I think Portal is a perfect example of how slow to adapt the company has become. It's a fantastic video conferencing device, certainly the best at its price point. We happened to enter the pandemic with this device already available for sale, but we completely failed to capitalize on it.

Is this a classic middle management malaise where everyone gets paid so well they don’t want to stir the pot? The bureaucracy and protection of today’s money cows which only clouds them from seeing tomorrow’s cows that will rescue them from certain obscurity?

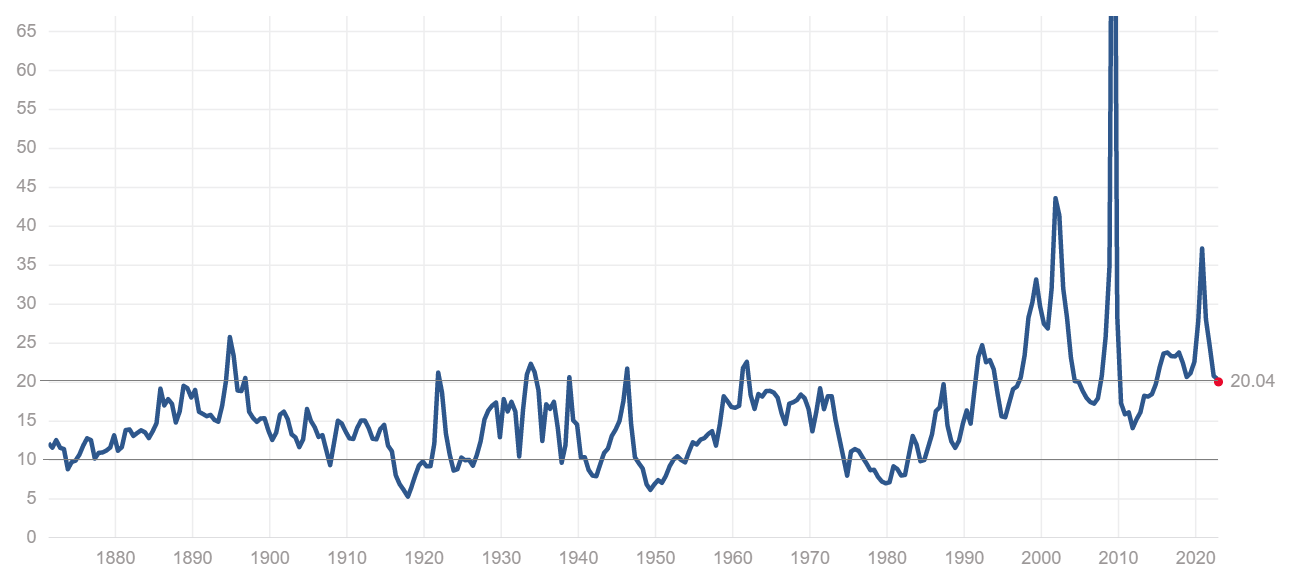

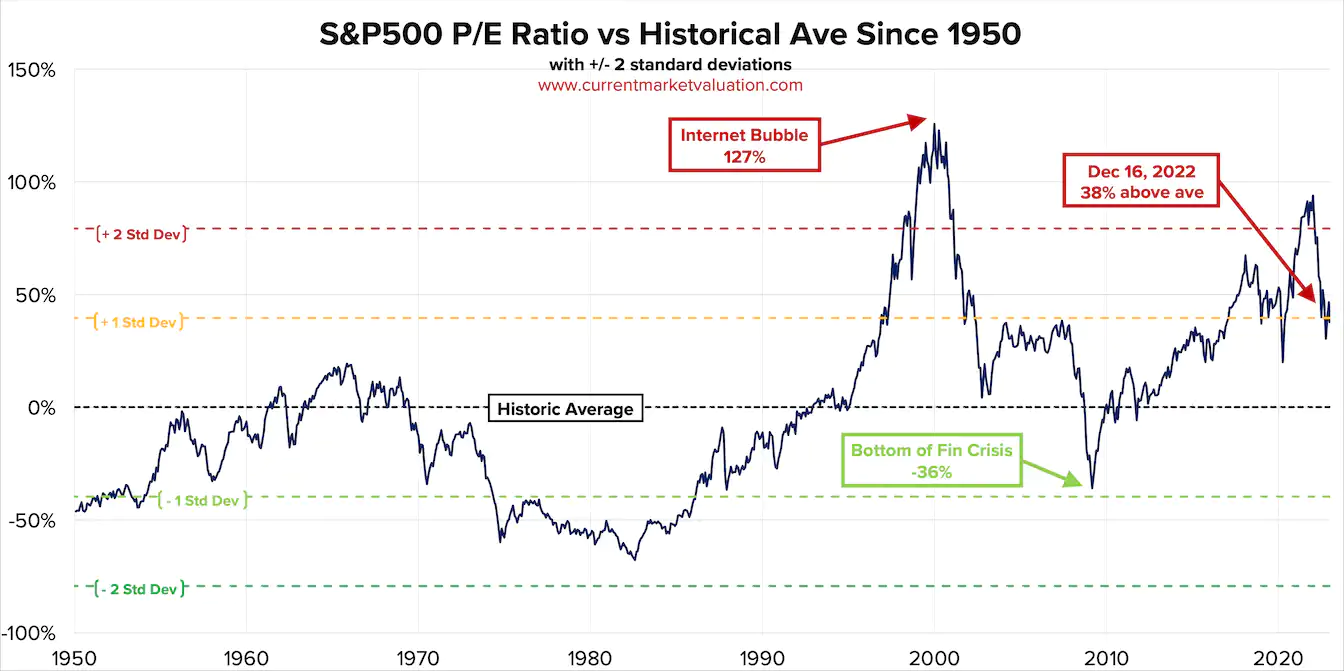

Source for the images below: multpl.com and Nasdaq Data Link.

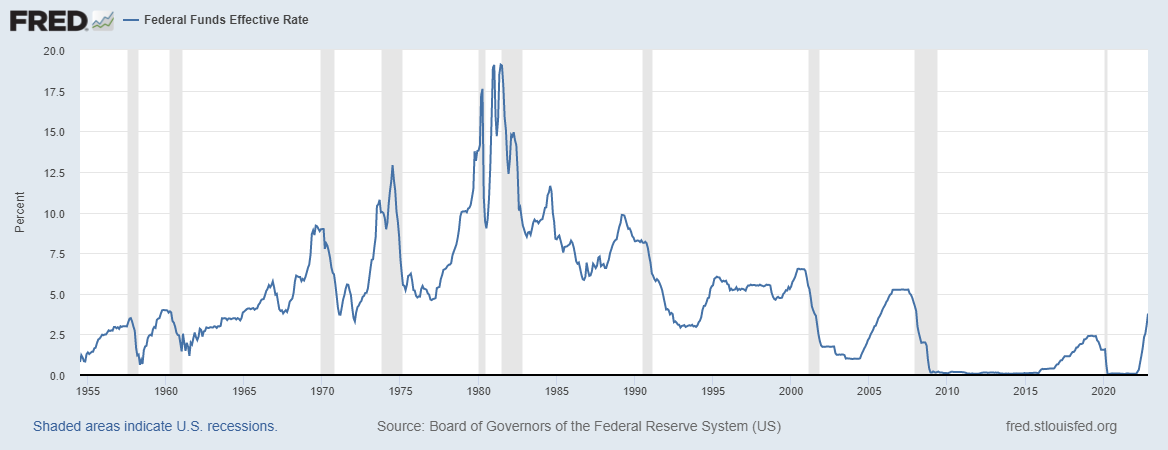

From a valuation perspective, it seems to me that we still have a ways to go in 2023.

From here, and given the macro context, David Rosenberg sees further downside and reminds us not to fight the Fed:

[...] the most skilled statistical baragain hunter ends up with a profit which is but a small part of the profit attained by those using reasonable intelligence in appraising the business chacateristics of superbly managed growth companies.

On timing, this is the type of setup we should be looking for:

More important, the company's future looks brillant, with every prospect that it will enjoy abnormal growth for years to come just as it did for some years begore the combination of unusual and temporary unfortunate occurrences produced buying points [...]

Jake doesn’t talk very often about his personal approach to investing, but in this interview I thought he delivered some gems, quotes or paraphrased below.

I think that most of the time, the market has the right price for most businesses. It’s actually really hard to find mispriced businesses. But every once in a while, there will be something that is just so obviously the wrong price, that if you can be patient enough to wait until those times come, then you actually don’t have to be this amazing all-star business analyst to recognize it and be able take advantage of it. You just have to be patient though as there are less of those ideas out there than we would want to admit. A lot of times it’s very easy to talk yourself into things. Opportunistically, every once in a while, there’s things are just no-brainers that you can take advantage of. That’s what I’m looking for and waiting around for.

Jake uses this concept of a “forcing function”. I like it a lot. He says:

There are different levels of forcing functions of learning something. There’s when you’re just kind of interested in it, you poke around, and read books about it. Then there’s teaching the subject. And finally there’s actually building something (product or company) in that area.

A tidbit on Journalytic, price & sentiment:

Price drives your sentiment like nothing else. If the price of whatever you bought is down, you feel bad about it, and every new data point that comes in, you kinda have a little bit of a negative tinge over it. Sorting that out and keeping reality coming in without being tainted by how you feel about it from recent price action is really hard to do unless you’re really cognisant of it.

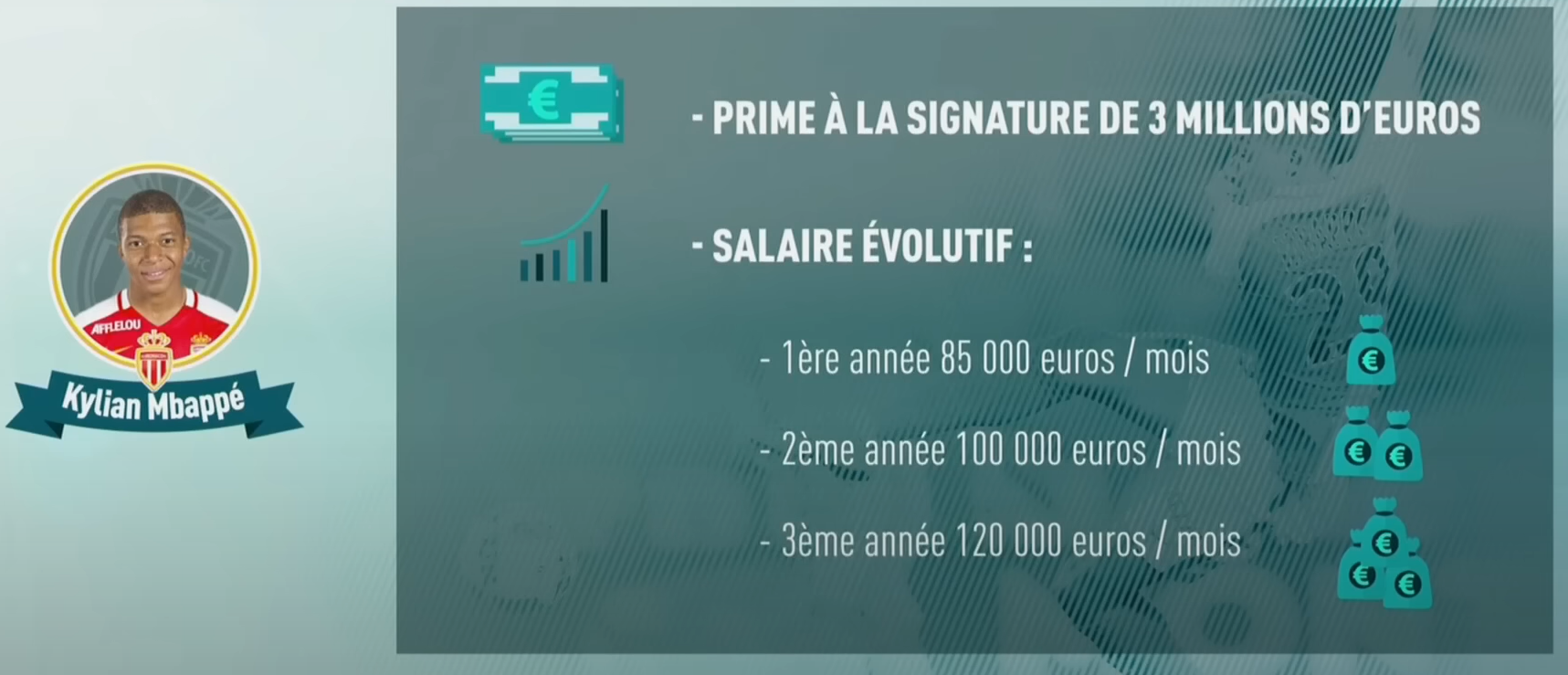

If you’re a fan of soccer (football in Europe), and even if you’re not but you watched the world cup, surely you’ve heard of Mbappé.

I’m not a harcore soccer fan by any stretch of the imagination. Still, I was impressed by his skills.

I just watched an amazing documentary about him:

What was impressive is how early in his childhood the dream of becoming a worldclass soccer player formed in his mind. And it was more than dream really, more than a wish. It was a prediction. We’re talking 4-5 years old.

when his parents offered him a miniature version of the Real Madrid stadium, his comeback was: >One day, I’ll take you there for real."

His conviction was obviously back by real talent, hard work and dedication. But it’s still inspiring to see this level of faith in a child.

I wonder if we can muster up this kind of conviction and powerful vision as adults…wouldn’t that be something?

It’s also funny how he didn’t give a shit about anything but soccer. Laser focused. Got close to being kicked out of many different schools, multiple times. Thankfully, he had strong support and oversight from his family. Interestingly, and seemingly in contradiction with his focus on soccer, his parents made him practice several sports and artistic activities. He was always restless, impatient, ambitious.

As a young teenager, clubs all over France, the U.K. and Spain were fighting over him.

What’s surprising is that several of the coaches who trained the teams he was playing for in the following years were NOT convinced of his talent and did not make any effort to nurture it. These are professionals with years of experience. Fascinating, how the incremental knowledge sometimes doesn’t lead to improved decision-making. And just as interestingly: even when you’re among the best of the best, don’t expect anyone to recognize it or give you credit for it - especially not the professionals.

No matter, because when he signed with Monaco a few years later as a 17 years old, he got a sign-on bonus of 3 million euros, with a monthly salary of 85,000 euros the first year.

And yet…it was still not a smooth ride from there. In fact, the critcisms were never too far away, even after winning the world cup in 2018. Analysts and so-called experts doubted him and put him down all along.

Things don’t always go as planned, up and to the right.

I found this one to be interesting as well (and more positive for smallcaps S&P600) from Yardeni:

Value also seems to be cheap compared to growth in the S&P500, but I don’t know how those are defined (so not sure it’s worth including the chart - see the link above if interested).

A pretty cool curated list of lessons learned in 2022: link.

- Tangible Book Value per share: 858

- Avg ROE minus 1 std deviation: 10%

- Normalized EPS: 86

- Price at 10x earnings: 860

- Current price: 1245

The market is pricing in some growth. Management has announced they want to pursue growth through multiplatform developments and more overseas translated games.

Their IP seems good and durable. I’d be interested around 900 stock price.

- Cool Lindy business

- Normalized average EPS: $0.5 maybe?

- No cash, no debt

Strong brand and people will probably always buy guns in the US. I’d be interested at $5.

Pass pending better price.

Nick Train (interview on master investors podcast) owns & loves it.

- EV/EBIT ~ 24.5

- Return on Equity ~ 15%

- P/B ~ 5.45

- P/E ~ 33

Long history of nice revenue growth…but too expensive for me.

Pass pending better price - which will probably never come.

- EV/EBIT ~ 10.4

- Return on Equity ~ 20%

- P/B ~ 2.2, so about fairly valued

- P/TBV ~ 2

- P/E ~ 13.5

The numbers look reasonable, valuation-wise. But this is a gizmo business, no moat whatsoever, can be competed into oblivion overnight.

Hard pass.

- EV/EBIT ~ 2.3!!! (WHAT?!)

- FCF yield ~ 55% (WHATTTTTTTTT??????)

- P/E ~ 3.6

- P/B ~ 0.8

- P/TBV ~ 2.8

- ROE negative until 2020, above 20% since

It’s an IDT spin-off. Revenue has exploded since 2020. The question is: is this revenue sustainable?

Michael Jonas and Old West fund are significant shareholders.

WTF does this busines do? They sell wallpapers and ring tones for iphone and android phones, including AI generated wallpapers from textual descriptions. It’s the kind of investment I’d be almost be embarassed to share outloud…which makes me want to dig deeper.

Apparently, their ringtones & wallpapers are shared on a freemium digital marketplace, with a premium version. They recently purchased GuruGhots with the goal of allowing amateur photographers to monetize their pictures through the marketplace.

About 70% of their revenue is from advertising. Their operating income for 2022 is a flabergasting 44.6%.

Surely, revenue will go down in the coming quarters. But how fast?

The explosive growth came mostly from a huge boost in ARPMAU, which sky-rocketed from $0.021 in 20Q1 to $0.050 in 21Q4.

I believe this surge in ARPMAU is a total fluke linked to the mania of 2020/2021. That being said, their ARPMAU was still up in 22Q4, which is kinda crazy in the current environment. In the earnings call, the CEO explained it by the transition from MoPub to Applovin. So I don’t know what the normalized ARPMAU on Applovin will be.

Their operating margin was negative in 2019, which makes it hard to underwrite this business.

The next earnings call will be on Dec 16th, 2022. I’ll be watching the ARPMAU trend.

Pass until I can get a sense of the stabilized ARPMAU.

From this twitter thread.

Acquisitive company, buys and monetized forums and websites.

Revenue growing, but gross profit per share decreasing. Not profitable.

Hard pass.

From the same thread.

SBC is 7.4% of revenue and increasing sharply over time, no thx!

Hard pass

From their website:

Record is a leading specialist currency and asset manager with $83.1 billion in Assets Under Management Equivalents (AUME) for institutional clients, with global offices across London, Zürich and Düsseldorf.

I’m still trying to understand exactly what their business model is, but the numbers look enticing. There was a recent CEO change, with the goal of diversifying and growing revenue.

- Revenue growth (LTM figures): $25M in Sep20, $30M in Sep21, $41M in Sep22

- EV/EBIT: 11

- FCF/EV: 7.3%

- No debt, 16M extra cash

- Growing asset turnover!

- Very high return on equity (typically in the 20% range, but recently up to 40%)

The numbers look good. This could be a great business, fairly priced. This blog author says that revenues are sticky and recurring. That’s interesting.

I need to do some more work to understand the business, but it looks interesting. This is the best one so far.

INTERESTING.

Similar to $REC.LN, but non recurring revs. $AGFX.LN seems to make their money from currency spreads when their clients trade (i.e. if clients trade less, revenues go down).

I also need to do more work to understand this one, but numbers look even more appealing than for $REC.LN, which would make sense if revenues here are non-recurring. In this clip in particular, the CEO lays out both the business model and some of the risks.

- Growing revenue ($46.2M in Sep22 vs $26.8 in Sep20)

- EV/EBIT: 6.7!!

- FCF/EV: 28%!!!

- ROE: 27%

- No debt, $45M in cash

- Profitable every year since inception in 2011

INTERESTING.

Notes:

-

both $AGFX.LN and $REC.LN have benefitted from the recent increase in FX volatility. Therefore the thesis on these names requires a view on said volatility. I think it’s here to stay (see this article.)

-

In the span of a week, between the time I look at these two stocks and today, $AGFX.LN has gained 15%. So annoying…

This is a special situation. See the rundown here.

I’m not smart enough, and that’s that.

PASS.

Thesis explained by @SemcoRealEstate here: YouTube clip.

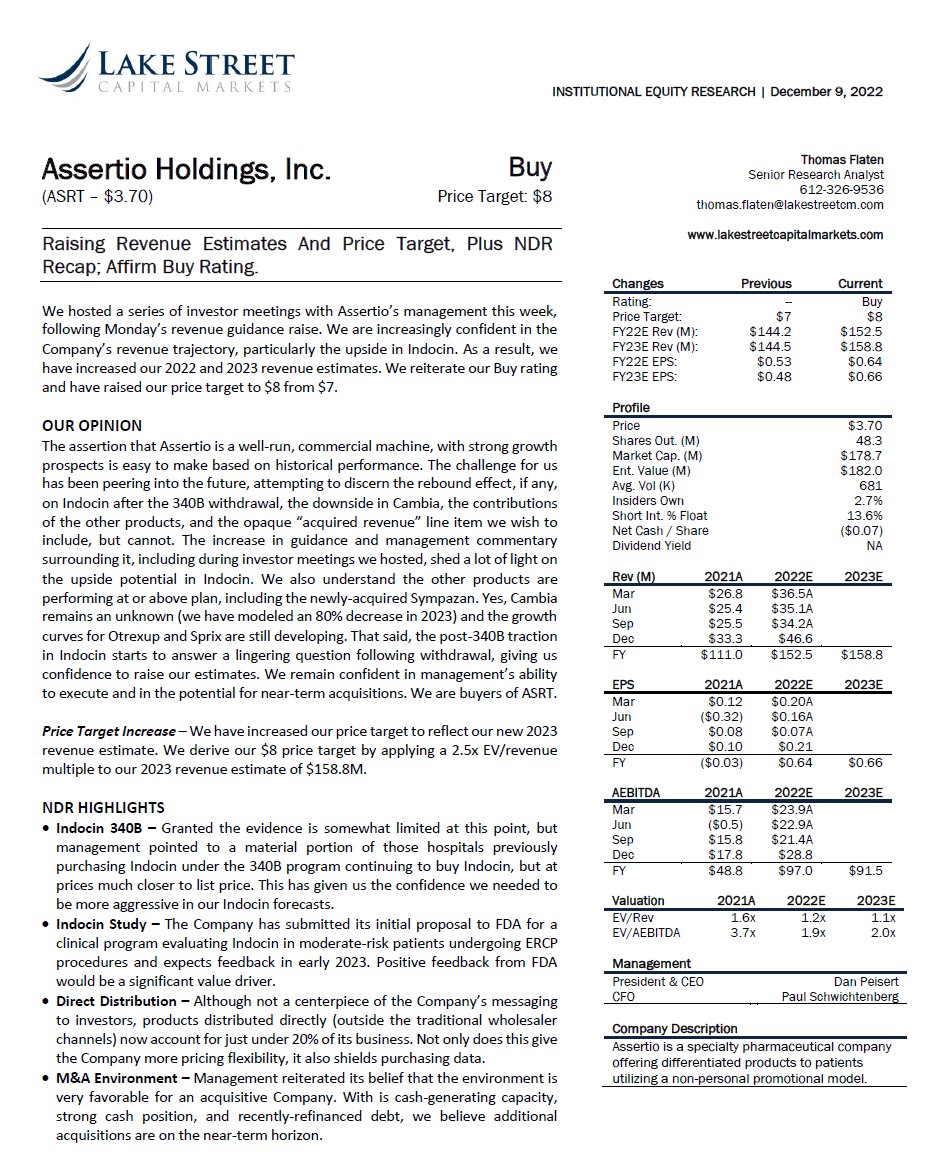

Here’s a one-pager summary from Lakestreet Capital, shared by @OlivierColombo:

I have nothing to add to his thesis.

I hate myself for being too lazy to act quickly on this one (I saw the thesis a few days ago).

The numbers add up. STILL cheap despite the recent run-up.

BUY!

This was written up on VIC in July 2018 by devo791 here. The thesis has worked out great so far.

- 24 employees

- growing revenue since Apr 2020, stable before that

- EV/EBIT: 2.6

- FCF/EV: 58% !!!

- Net cash: $6M

This is a head scratcher. Valuation is extremely compelling…but management seems to have no ambition (no offense). See presentation here.

PASS.

Oil & gas royalties.

Don’t know much more. I should look into it at some point, I’m just parking the names here for now.

https://www.youtube.com/watch?v=9_smMP5kRh8

Part of Focus Capital portfolio.

Another great overview from Caro-Kann Capital.

I understand the thesis. I think it’s probably a good investment. But for whatever reason, I just can’t bring myself to like it.

Awkward PASS.

(just to save you some time - this is a pass)

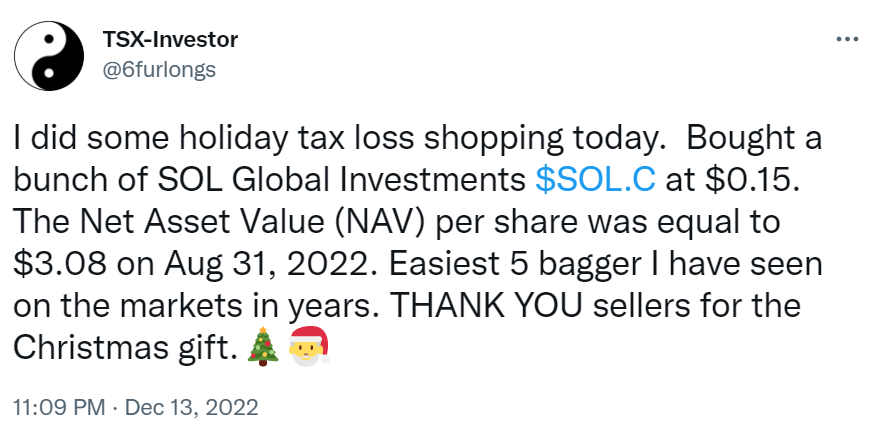

This tweet grabbed my attention:

I was expecting to find a total shitco, but I still headed to their website. What I found positively surprised me, to be honest. There are some legit companies under their umbrella.

Here’s the 2022Q3 earnings news release: link.

On the other hand, if the true Net Asset Value per share is really that much higher than the current stock price, then it is troubling to see absolutely no insider buying down here.

Not only that, on 2022-10-05, the founder and ex-CEO Andrew DeFrancesco received $1.8M in shares as “compensation for services” (we’re talking about a less than $10M market cap). He continues to be “working with management to transition responsibilities”.

Here’s something funny. The stock curently trades for $0.17. But in September 2021, the company repurchased $30M worth of shares by way of a “Dutch auction” at a price of not less than $4.05.

That $30M is now worth 3x the entire market cap.

OK with all that said, it’s not looking too good. Let’s just take a look at their Investments, marked in the books at $183.9M as of August 31, 2022, plus $8.5M in notes receivable and $2.6M in convertible debentures.

Of the $183.9M, $150.8 are common shares in public and private companies:

-

57.35% of the common shares of House of Lithium, valued at $42.4M. This includes:

- Damon Motors (electric superbikes), which on October 6, 2022, announced its order book had exceeded a $90M order backlog to date globally.

- Tevva Motors (electric powertrains and hydrogen fuel cells for vehicles and trucks)

- Revolution Brands (recreational electric vehicles)

- Navier (long-range, high-speed electric hydrofoiling boats)

- Arevo (3D printing with ultrastrong lightweight continuous carbon fiber)

- Switch Motorcycles (electric motorcycles)

- Kiwibot (a last-mile robotics delivery platform)

- Trevor Motorcycles ( electric motorcycles)

-

Casters Holdings, which operates through its subsidiary Fyllo Inc (compliance cloud software). Fair value of $18.1M.

-

Captor Capital Corp: this one did a reverse merger with Rimstock Holdings Limited. I did not understand the implications of this on first reading.

-

Simply Better Brands (plant-based and holistic wellness consumer product), small stake

-

Common Citizen, cannabis company in Michigan. Value: $17M

-

KWESST Micro Systems (intelligent tactical systems and proprietary technology for applications in the military and homeland security market). Not much worth today. 4.1M common shares or 8.2% of the $KEW.V. Current share price: $3.74, share price in Dec2021: $86.

-

Jones Soda (beverages in the United States, Canada, and internationally). Value: $6.2M. 14,796,380 common shares of $JSDA and 8,855,035 common share purchase warrants. The warrants have a US$0.625 strike price, and are exercisable until February 14, 2024.

-

Livwrk Wynwood (commercial property in the Wynwood area of Miami, Florida). Retail storefront, and an office building with associated land. Value: $29M. Two parcels/buildings. One parcel would consist of 420 multifamily residential units and 59,461 square feet of office space above 29,057 square feet of ground floor commercial space. The other parcel would be developed as an apartment/hotel with 122 units, atop 8,996 square feet of ground floor commercial space. In total, both buildings would collectively yield 922,466 square feet including 611,855 square feet of residential and amenity space, 100,220 square feet of office and commercial space, and a 210,361-square-foot parking structure for 564 vehicles and 50 racks for nearly 800 bicycles.

-

Core Scientific $CORZ (blockchain infrastructure provider and miner of digital assets in North America). Value: $19.1M. They say that they invested $11.5M in Sep 2021 and that it is now worth $19.1M? I have a hard time believing that given the stock price dropped from $10 all the way down to $0.17…

-

Andretti Acquisition Corp. $WNNR. Value: $13.8M.

-

Build A Rocket Boy, independent video game company based in Edinburgh, Scotland, founded by Leslie Benzies (Grand Theft Auto and Red Dead Redemption). Value: $2.6M.

So here’s the kicker:

In Dec 2018, date of the above tweet, $SOLC.CN was trading for $2.25 (versus $0.17 today). In other words, after 4 years of waiting, you lost 92% of your investment in this net-net.

So the question is: are we still in 2018? Or is there a catalyst that would get the market to recognize the NAV here?

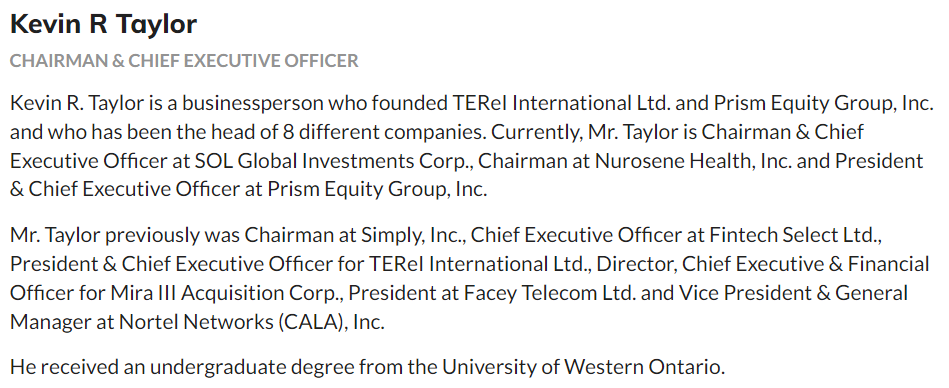

The ousting of the ex-CEO might be one. So who is Mr. Kevin Taylor, new Chief Executive Officer and Chairman of the Board?

The best I could find is this (source):

Doesn’t strike me as an A-player.

From [this] new release: “For the past 14 years, Kevin has served as the President and Chief Executive Officer of TEReI International Limited, a merchant bank focused on debt and equity opportunities in the small to mid-cap markets in North and South America. Mr. Taylor acts as a director for a number of companies listed on the Canadian Securities Exchange, Toronto Stock Exchange and the TSX Venture Exchange.”

Also from the same news release: “The Company, its board of directors and its management are considering potential strategic alternatives aimed at enhancing SOL Global’s growth and maximizing shareholder value. It is expected that the Company will review various strategies to close the gap between its stock price and net asset value (“NAV”), capital return strategies, potential strategic transactions and development of other strategic initiatives to complement SOL Global’s existing portfolio and overall business.”

The very weird thing about this one is, and I go back ot my initial comment, is that they have some decent shots on goal here, especially in the House of Lithium subsidiary, as well as the commercial development, and the Build A Rocket Boy game company.

Anyway…I have wasted too much time on this, and I could still be making the wrong call.

PASS for now.

The thesis boils down to this:

Just a tiny position, it’s a binary outcome but I think +EV bet.

BUY.

Heard about it here from Andrew Brown in this clip.

As well, a nice writeup from PartnershipInvesting here.

Here’s a quote from that writeup: “If I had to compare it, I would describe it as a combination of CSU’s VMS expertise and TransDigm’s (TDG) turnaround/improvement strategy.”

I will note that this type of comparison can be dangerous.

Looking at the numbers, decent growth but entered negative EBITDA and EBIT territory in 2022, and overall too seemingly too expensive for me.

The company went public in September 2020. It’s a bit too young for me to form a solid opinion. So nothing against this company, but I need to see more to be interested.

PASS.

Brought to my attention through this tweet:

Interesting company, but my God is it expensive. P/E of 70, EV/GrossProfit of 42, EV/EBITDA of 52, etc.

Plus, I’m not sure I’m attracted to the payments industry.

PASS.

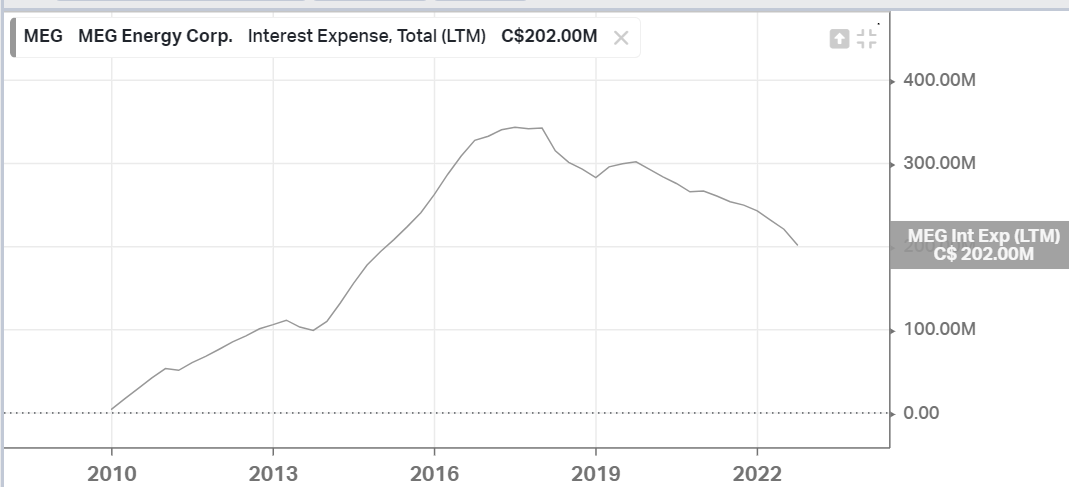

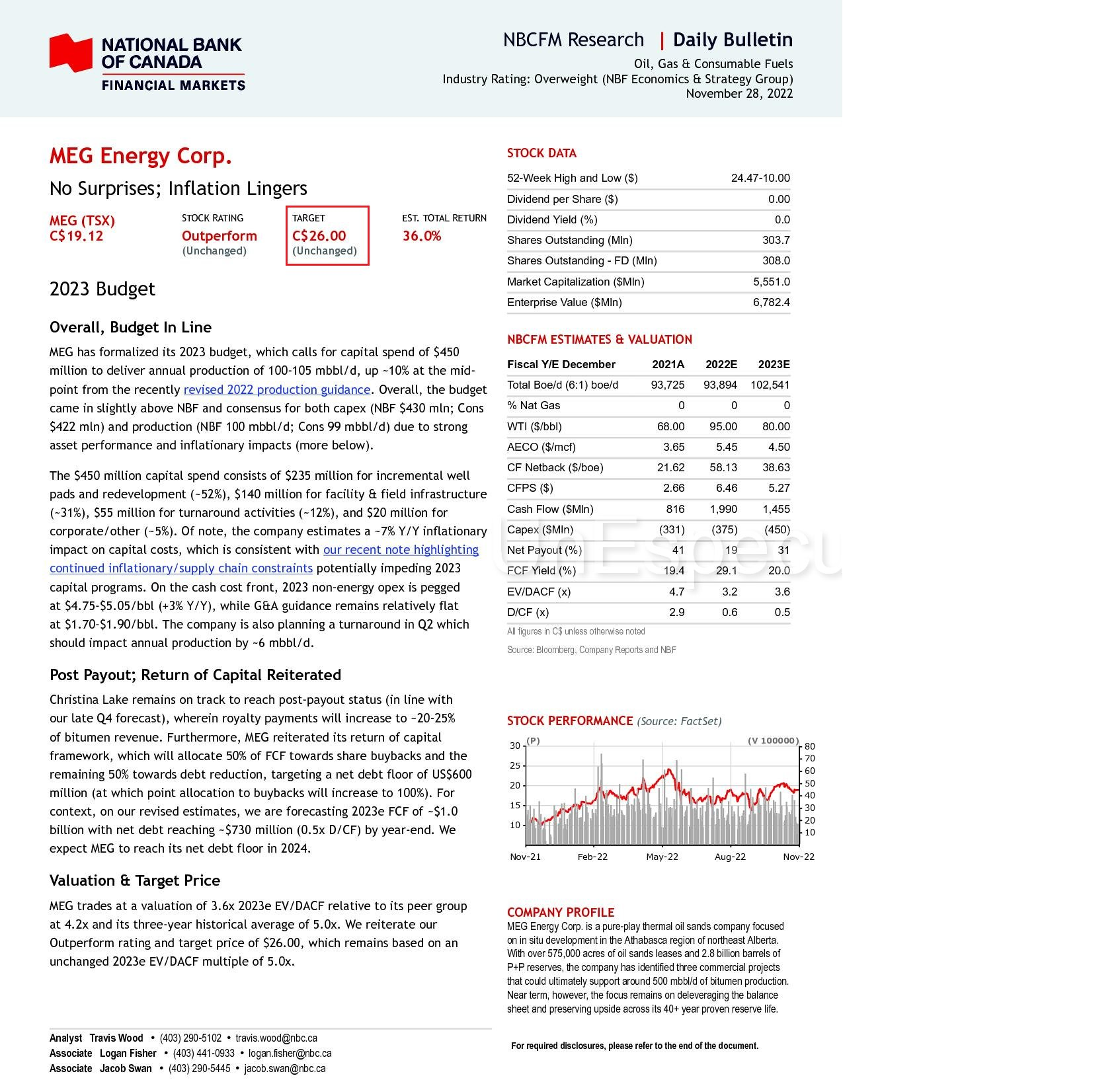

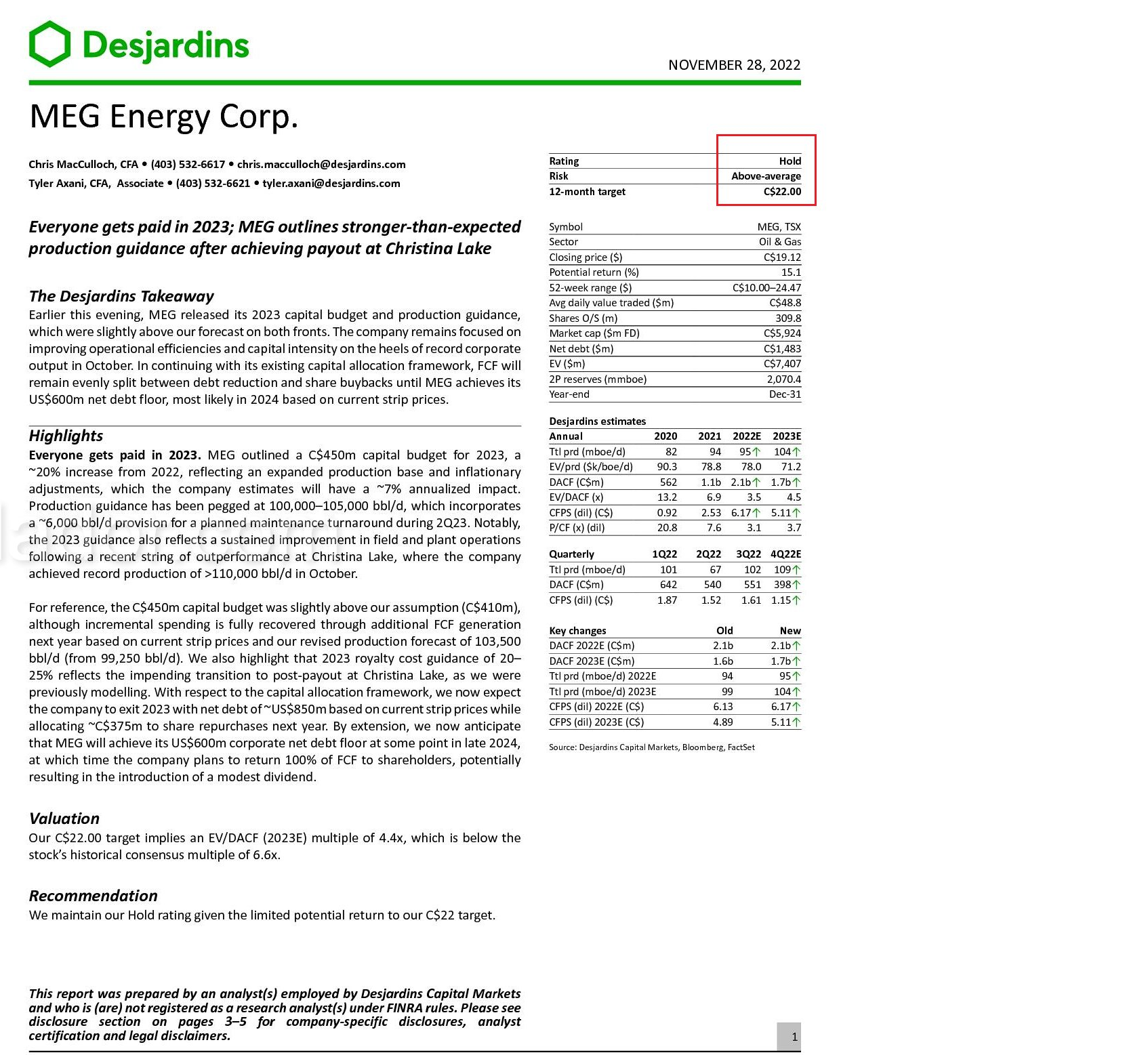

Why invest in oil to begin with? Mostly because there’s a LOT of uncertainty short-term, but less risk medium and longer term, due to the supply situation.

I like the consistency with which MEG has been paying down debt, allowing them to save on interest payments.

Overall, LTM FCF is $1.2B, and FCF/share $4, supporting a $32 price at 8x FCF and ~$80 WTI, or about a double from here.

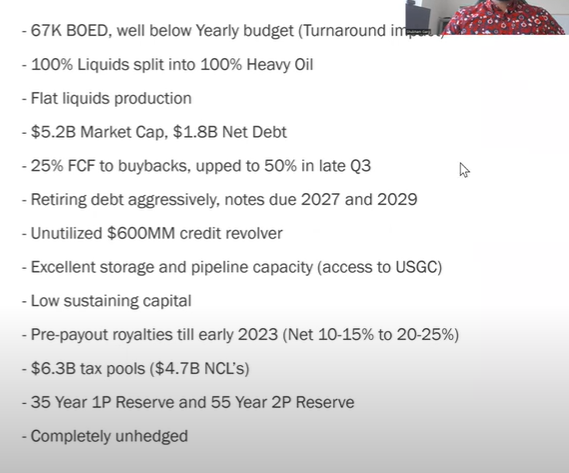

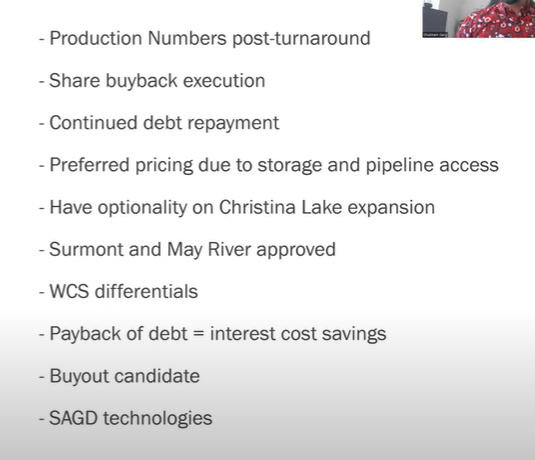

Shubham Garg did an excellent overview of oil & gas companies, including $MEG.TO where he highlights their 35-year 1P reserve:

Here are the highlights (screenshots from video above):

Here’s another video from Shubham on MEG Energy, from the asset value angle this time:

The most important take-away from this clip is that the NAV10 of the PDP reserves alone is $6.5B, compared to current EV of $7.0B, assuming conservative forward oil prices of less than $70 but ignoring inflation.

For context, MEG’s PDP reserve is 8.2 years, their 1P (PDP + PUD) reserve is 37.2 years (!), and their 2P (proved + probable) reserve is 58.9 years (!!).

Using the 1P reserve (and assigning no value to 2P), the NAV10 is $11.1B.

Yet another writeup can be found here, by Michael Blair.

Finally, here are one-pager bulletins from NBC and Desjardins, with price targets of $22 and $26 (versus $17 currently):

One of the most bullish voices on oil is Josh Young, CIO of Bison Investments. Here a few recent clips featuring him:

INTERESTING.

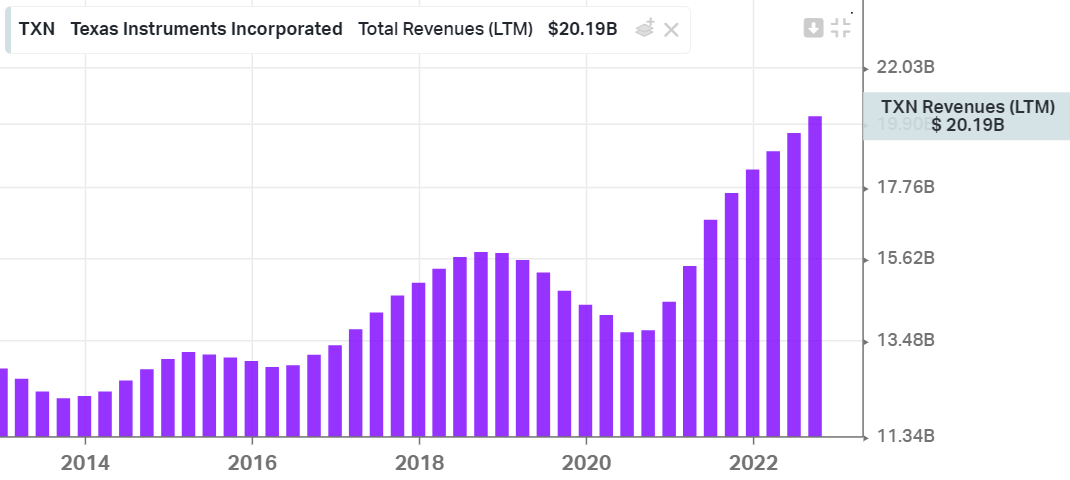

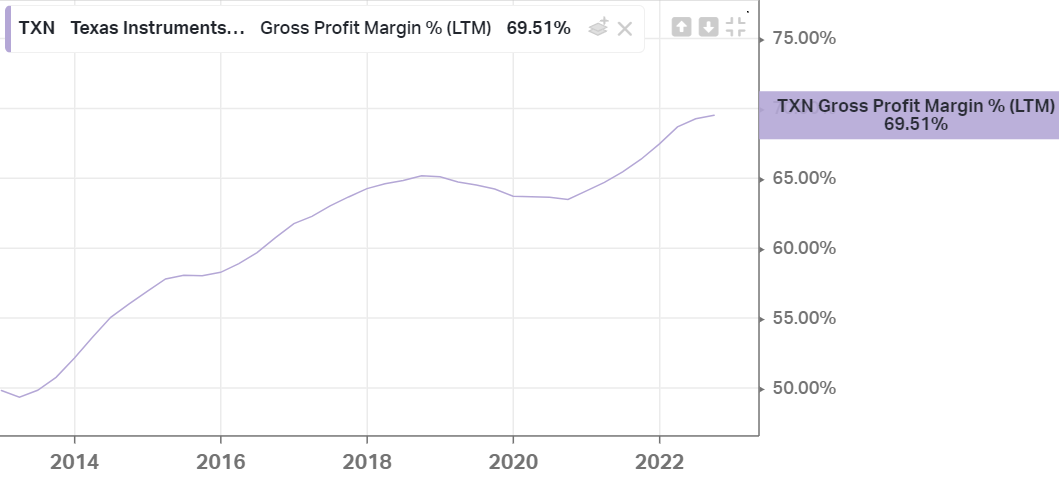

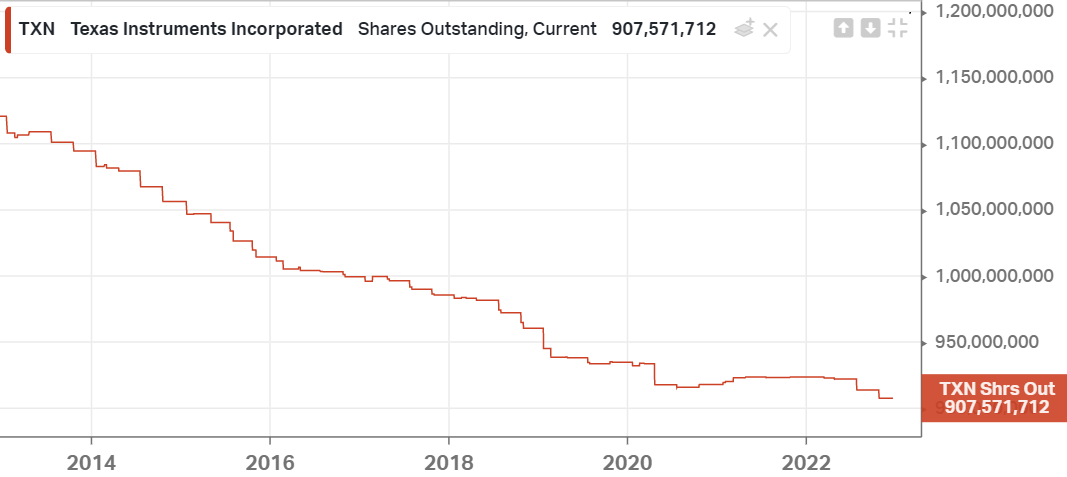

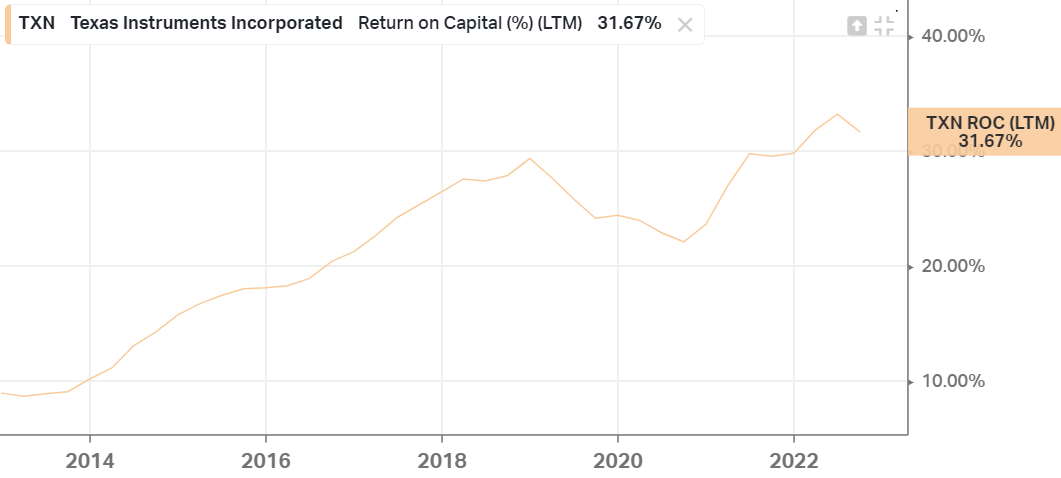

OK…this might be one of the highest quality companies I’ve ever come across. My God, what a beautiful beast!

I’ve known about it for a while, but a podcast from ChitChatMoney with John Rotonti. Here’s the podcast link.

A quote from the CEO, Rich Templeton:

The religion that we believe greatly in is to be successful and grow free cash flow per share over the long term.

And here’s a screenshot from the FIRST PAGE (after agenda & executive summary) of their capital day deck (2022 - link):

AMEN BROTHER!!!

Let’s look at some charts now, shall we?

Jeeeeeeeeeeeesus…❤️❤️❤️

INTERESTING.

https://www.businesswire.com/news/home/20221221005320/en/

Some numbers:

-

2022Q3

- Lumber segment net sales

- 145.8 MMfbm

- $127,397

- US$693/Mfbm for random length 2&better and US$637/Mfbm for studs

- Total net sales (+paper products)

- $153,424

- Cost of sales

- ($150,934)

- Duties

- ($12,970)

- SG&A

- ($5,916)

- Operating earnings

- ($12,366)

- Lumber segment net sales

-

2022Q2

- Lumber segment net sales:

- 142.8 MMfbm

- $191,828

- US$1,004/Mfbm for random length 2&better and US$1,001/Mfbm for studs

- Total net sales

- $214,564

- Cost of sales

- ($139,066)

- Duties

- ($22,314)

- SG&A

- ($6,927)

- Operating earnings

- $48,628

- Lumber segment net sales:

-

2022Q1

- Lumber segment net sales:

- 114.7 MMfbm

- $158,084

- US$1,391/Mfbm for random length 2&better and US$1,320/Mfbm for studs

- Total net sales

- $172,768

- Cost of sales

- ($110,581)

- Duties

- ($16,395)

- SG&A

- ($6,024)

- Operating earnings

- $38,969

- Lumber segment net sales:

Assuming lumber products represent the same % of cost as they do of sales, and using 1.25 USD-to-CAD exchange ratio, I find that the cost of producing the lumber products is ~US$700/MMfbm.

From 2022Q3 MDA:

In the third quarter of 2022, a US $10/mfbm difference in lumber prices would have impacted the Company’s operating earnings by approximately $1.4 million, assuming everything else remained constant. The Company currently does not have any hedges in place for lumber prices.

US$10/mfbm translates into US$10,000/MMfbm and $1.45M for the Q3 production of 145.8 MMfbm (1 MMfbm = 1000 Mfbm), so it checks out.

Combining it all, the easy mental model for $GFP.TO is that:

- US$700/Mfbm is the break-even lumber price, before duties and SG&A.

- Each US$10/Mfbm adds CA$5.6M to annual operating earnings.

- With current market cap of $CA270M and ~$50M net cash (approximately), EV is CA$220M. Targeting EV/EBIT of 4 requires lumber prices of US$800/Mfbm.

Compare with where we are currently:

Not that US$800/Mfbm is impossible (2021/2022 say it isn’t) but it’s hard to predict what the long-term average price will be.

PASS.

p.s. Saw this tweet, made me smile.

$GFP halted 👀

— Kyle Cerminara (@kcerminara) December 21, 2022

This is a Japanese profitable deep value net-net in the business of building, renting, and servicing apartments in Tokyo. A nice writeup here. It’ll probably do well. An easy statistical bet if you’re into that kind of thing (and if you don’t mind google-translating financial statements).

Here’s the original writeup on net-net-value.com: link.

For more info on the general approach, see here.

One should be aware of the geographical risk with this investment.

Also, note that the BOJ finally did signal a hawkish stance in their approach (post the writeup above). Not a thesis-breaker though yet but do note that the Yen is much stronger now than it was just a few weeks ago. For more context on What The Heck Is Happening In Japan?, you can listen to this.

I’m just not in a net-net mood at this time.

PASS.

Numbers-wise, looks like a great company at a fair price. I didn’t know about this company, but I’m interested.

Here’s a tweet from Quartr about them:

What I don’t like about the stock is the dividend yield of 4.4%. That signals a potential lack of reinvestment opportunities. But what if they don’t require reinvestments to grow their eanrings?

Here’s their eanrings news release for 2022H1: link. Revenues up 35% and earnings up 27%.

Their gross margin has been historically high (84% average), but their EBIT margin has been trading down lately (56%, down from average of 64%). Would be good to understand why.

Their EV/EBIT is ~19x, not egregiously expensive but not cheap either. It was around 10x in early 2019…so cheap!

Definitely worth adding to the watchlist.

INTERESTING.

Disqus comments are disabled.