#81 - Ramblings, January 2023

Last updated: Apr 28, 2023

As I’ve said in my monthly update, I was pretty lazy this month.

This month’s ramblings will be even more scattered than usual.

- CEO: Ed Wegel

- New addition in January 2023: Glen Gates

- US$5.0M Financing (Jan 2023). Six month facility. Unsecured, not convertible, no warrants and will bear interest at the rate of 20% per annum, accruing monthly and payable upon maturity.

- Comps: CargoJet (34 Aircraft - $949M Rev - $2.1B MC), Sun Country Airlines Holdings (48 Aircraft - $840M Rev - $1.1B MC).

- EV/S = 1.0 and EV/GP = 33.4, with gross profit margin of 3%, according to Koyfin. Assuming the figures are correct, seems expensive to me. Then again, I wonder if I shouldn’t be looking at the unit economics instead, given that this is a startup that seems to have just reached the break-even point.

- As of Sep 30, 2022, the company had a working capital deficit of $15.5M.

- Flies only one (single-aisle) aircraft family: Airbus A320 + A321 as of January 2023.

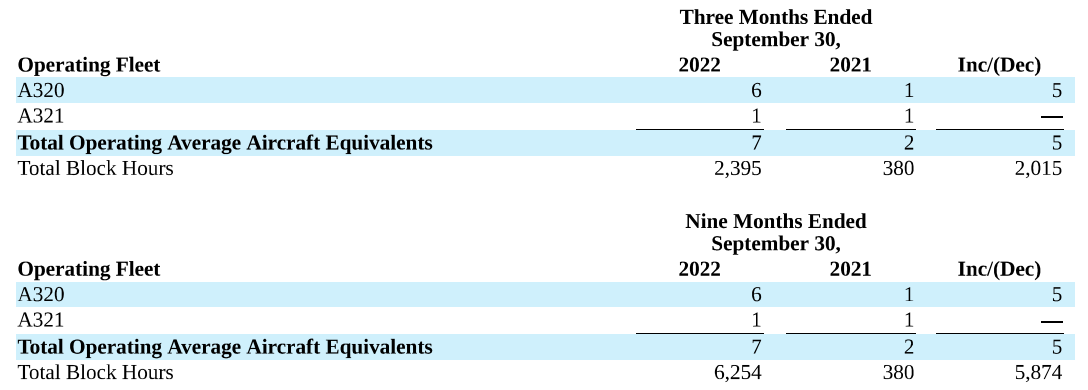

- Fleet & Block Hours:

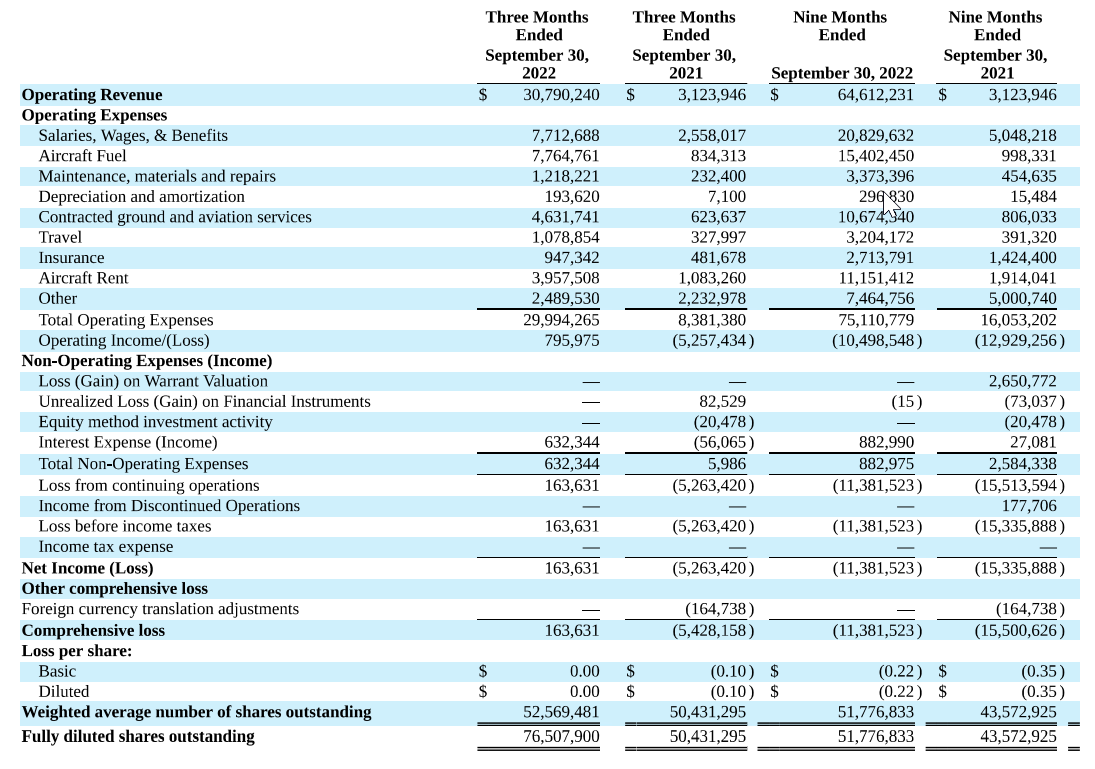

- Statement of operations:

Links:

- Global Crossing Airlines Group Presents at MicroCap Leadership Summit 2022

- GlobalX Management Update, May 17/22

- Global Crossing Airlines - November 1, 2022 Q3 Shareholder Update

- Why We Own Global Crossing Airlines Stock

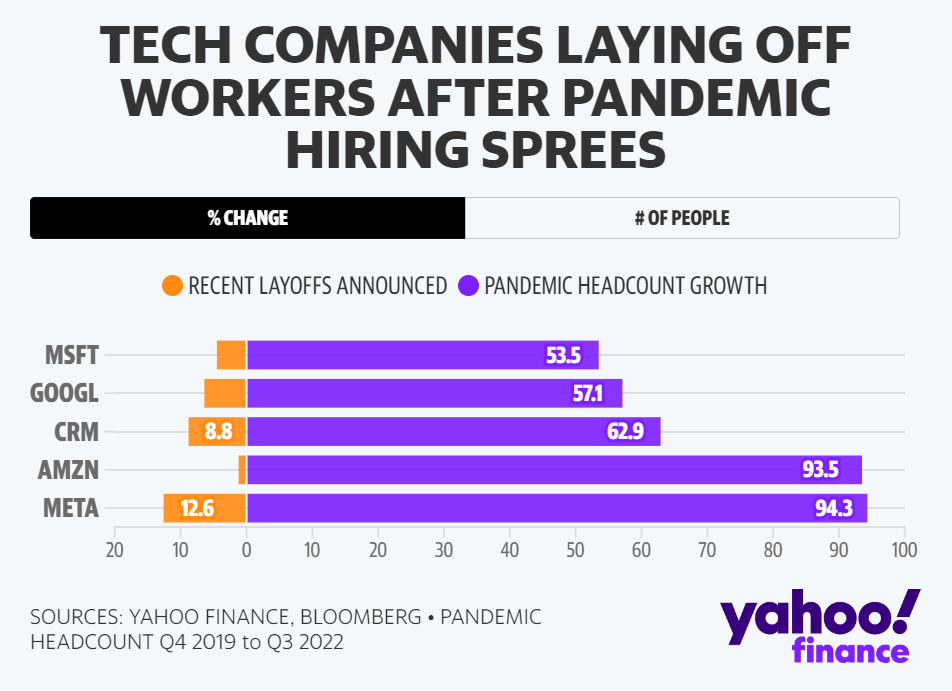

Ripped +17% after hours on their 2022Q4 earnings with expectations of reduced spending and increased share buybacks in the near future.

$META is a now double since its November lows. Fascinating what can happen when so much negative sentiment is baked into the stock price.

Evolution requires: 1) randomness, 2) a clash of worlds, and 3) a forcing function.

Wisdom and intelligence are two different (and uncorrelated) concepts. Same goes for being busy and getting shit done.

Everything is energy.

-

I bought and sold $PARA around $15. I didn’t write about it so I’m not sure why I sold (doh!) but I guess it did not look like an amazing company to me after all. Current price: $23 (+53%).

-

I sold $AEP.V some time ago, in the summer of 2022 (I wrote about it here). The price was around CA$0.50, versus CA$0.93 now (+86%).

-

$CVNA has more than doubled YTD. I won’t claim that it crossed my mind to buy it at the low of $5 (I don’t really like the business) but I remember wondering where the stock would end up if/once the bankrupcy fears subsided.

-

$QRTEA is another one that had me hesitating. Again, maybe not an amazing company, but +60% YTD.

-

$VXTR also up 62% YTD. Andrew Brown just did an interview with chairman Gary Yeoman. It’s not my kind of management, but could do very well.

-

$TEQ.ST - I was hoping to get this one in the in $100s, but alas it never went down there. As well, I don’t understand what their secret recipe is. Maybe they’re just more disciplined than their competitors.

All in all, I wonder if I have become too narrow-minded (interested in high quality only), too slow (to do the research), or too demanding (with management).

source: link

Disqus comments are disabled.