#89 - Ramblings, May 2023

Last updated: Aug 4, 2023

Archived here, just in case.

The crazy thing is we are fine giving up on ourselves. God tries to show us over and over what we should be doing with our lives and over and over we say no.

Fear will always try to convince you to stay where you are. Fear will always try to convince you it’s too late. Fear is a liar.

Requires google translate, but still useful.

A list of 20 1-pager bull thesis on Japanese tech companies here.

Commentary from Pillars and Profits substack here.

It was great to hear market participants start to validate what we have always valued as a leadership team and have attempted to achieve in all our businesses, which is growing after-tax cash flow over a long-time horizon.

Original thread: link.

The study covered May 2012 – May 2022 and companies with a market capitalisation of at least $550 million.

Key take-aways:

- 49% had an EV/EBIT <10x in 2012.

That being said, having a low EV/EBIT is not enough, and future earnings growth must be present for long-term outperformance.

-

82% of the 446 outperformers were already profitable in 2012.

-

large caps (> $10B MC) only represented 7 (less than 1%) of the total 935 outperformers VS nanocaps (< $50M, 63%) and microcaps ($50M-$300M, 23.6%)

Y shares are ADRs (American Depositary Receipts). They are issued by a bank and they represent shares in a non-U.S. company. ADRs listed on an exchange must file quarterly results because they are registered with the U.S. Securities and Exchange Commission and are subject to U.S. accounting rules.

F shares are known as foreign ordinaries.

Both trade over the counter in the OTC market.

The Y shares tend to have more liquidity and lower commissions (but higher fees, from the bank who created the ADR).

Overall, if both are available, buy the Y shares.

Schwab has a good explanation of the differences here.

Fantastic interview of Anthony Deden.

Maybe not someone whose investing style I would clone, but a very interesting and intelligent person nonetheless.

Are you a microcap investor, who strives to find undiscovered gems, like Michael Liu from Intelligent Fanatics Capital Management?

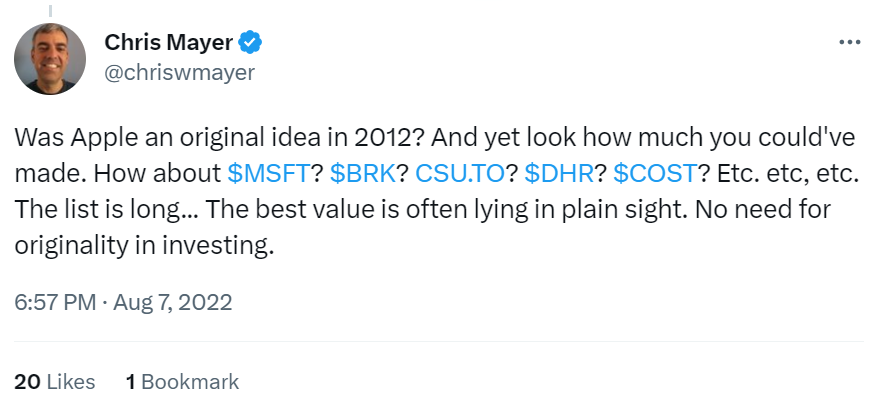

Or are you more like Chris Mayer who sees value hiding in plain sight:

Li Lu asks: are you a value investor? He urges us to understand who we are.

This clip has the best definition of what a value investor is: a minority owner in a business.

As a minority owner:

- you require a defensive margin of safety, because you don’t control the business, therefore whatever value you perceive might not be there.

- you don’t trade all the time, so you don’t care what other people think your business is worth.

- you care about the cash flows the business brings in.

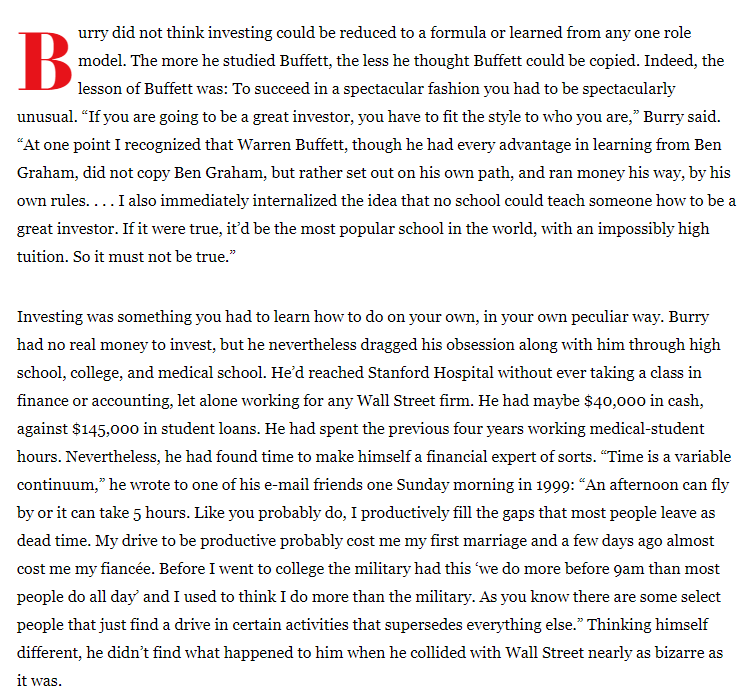

More generally, here’s what Dr Burry has to say on this topic:

IF YOU ARE GOING TO BE A GREAT INVESTOR, YOU HAVE TO FIT THE STYLE TO WHO YOU ARE.

(source)

To close this chapter, I’d like to give the last words to mister Pabrai. In this fantastic interview, he explains that finding and sticking to great businesses (competitive anomalies) is the best path to long-term wealth compounding:

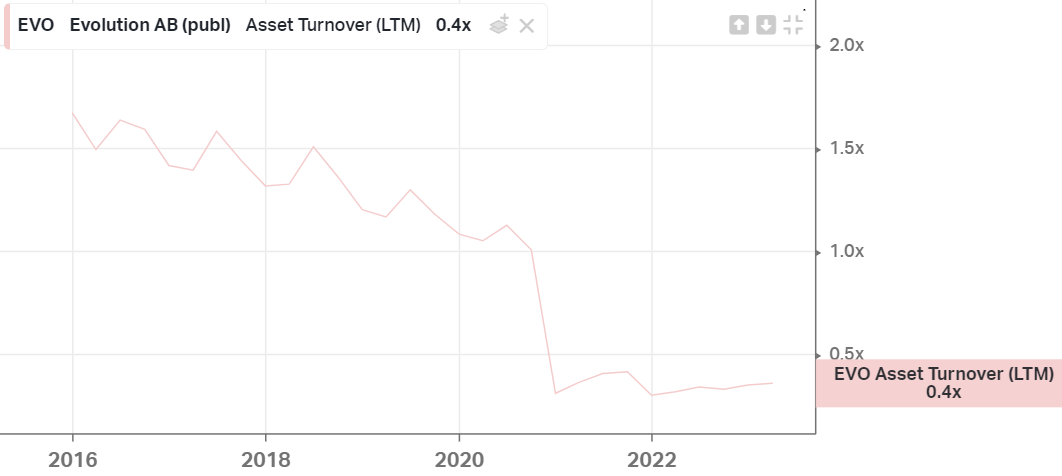

Geoff mentioned here that one of the metrics he likes to look at is [Gross Profit]/[Total Assets], which is the same as [Asset Turnover] * [Gross Margin %].

I love that metric as well. It allows me to judge how a non-profitable but growing company is doing, and to compare a non-profitable companies to a profitable one.

Let’s look at a few example. I’ll focus on Asset Turnover but gross margin should also be looked at.

The first two examples are good, the last one is bad.

For $EVO, we can clearly see two stages. In stage 1 (until the end of 2020), asset turnover is steadily declining, which probably just reflects that the company is generating more cash than they can reinvest. Then 2020 happens, and asset turnover takes a huge drop.

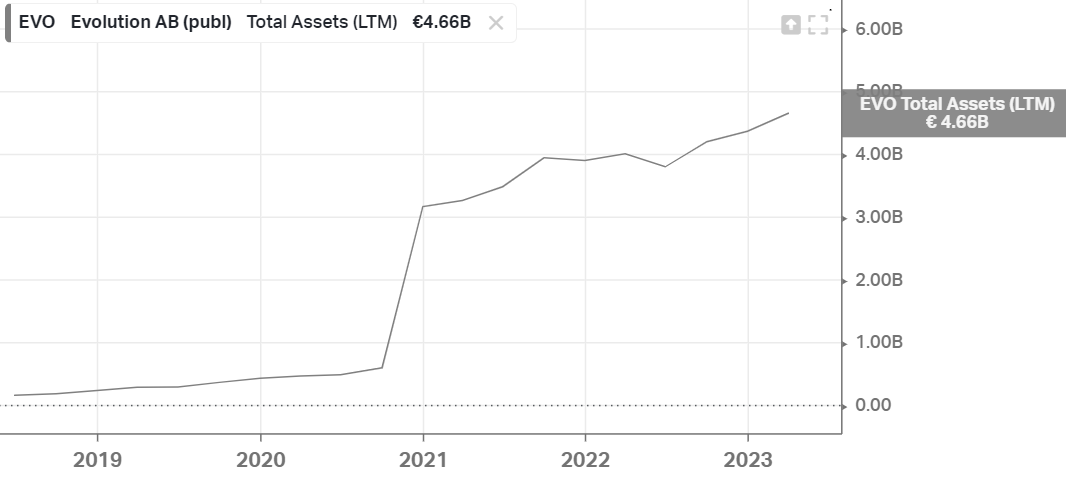

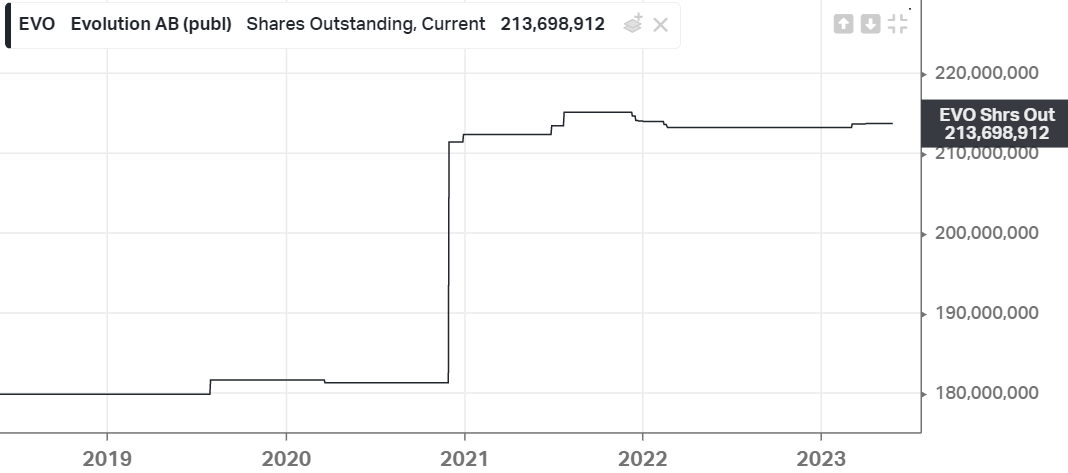

I know that $EVO’s revenue didn’t drop precipitously, so the assets must have increased drastically. Indeed:

We can even find out that it was through issuance of shares:

So this looks like an acquisition, and a bad one. Googling EVO’s acquisitions in the late 2020s, we find that Evolution acquired NetEnt (a leader in online slots) in an all-shares transaction of $2.1B.

I don’t even have to read the 10Ks to know that this turned out to be a dud. We know by now that slots aren’t growing nearly as quickly as Evolution expected. We can tell just from looking at the asset turnover.

Full interview: here.

I love this guy.

A few quotes:

I gravitate toward less competitive assets that are easy for a layperson to understand and then I try to apply an unusually long time horizon.

It's probably always a good idea to stick within one's circle, but I would suggest there's perhaps even less room for error dealing with concentrated illiquid positions.

I would say I’ve had the most success in businesses where declines in one segment or product have been offsetting another.

I often see opportunities present themselves simply because other market participants are waiting around for the WHEN, the catalyst if you will, whereas the ultimate WHAT is actually quite clear.

I rarely feel compelled to find a new actionable idea. You let them come to you on their own timeline.

My decision-making acuity fades with lots of cash. There is a compulsion to do something with a bunch of cash sitting around.

Before I buy anything new, or add to an existing position, I ask myself -- if this security goes up 30% or 50% next month on no fundamental change, would I consider myself lucky and sell?The very fact that I would run to the exit for a quick gain tells me I don’t have the conviction to hold this asset.

I would previously make several new investments every year but now I'll go years at a time without a change. I've really tried to restructure my investing processes to create a bias toward inactivity.

Certain industries require macroeconomic opinions. I never really have an opinion so I can't participate.

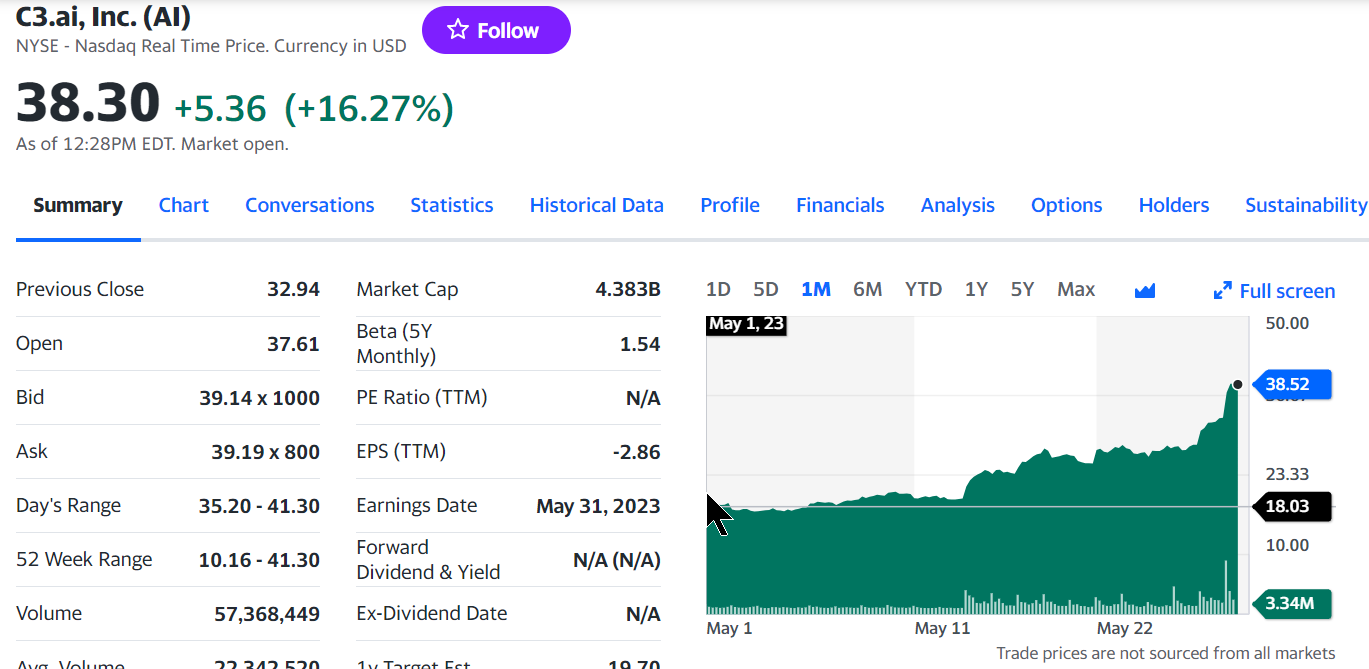

C3.ai: I have no idea what this company does, but it’s the kind of stock I normally wouldn’t spend more than 2 mins analyzing: over 10x EV/Sales, flattening revenues, negative and decreasing free cash flow…

And yet:

It has been a double in less than a month.

100% because of the AI hype, 0% because of any fundamentals.

Talking about the AI hype train, $NVDA has 10x in 4 years (tweet).

Carvana (not AI related, at least not yet) has tripled year-to-date.

It reminds me of the stock that made me the most money ever: $WELL.TO. I bet a significant amount of money on it at the beginning of the pandemic, and it went on to 3x. Back then, I was just gambling and wasn’t paying any attention to valuation.

It’s just astonishing how crazy (albeit temporary) of an effect strong tailwinds can have, no matter how irrational they are. I wonder if one should not be more open-minded to riding these bubbles, at least in small positions, a la Druckenmiller…

Maybe I’m just tired of watching paint dry. Even Aswath Damodaran had Nvidia in his portfolio up until a few days ago, when it went stratospheric.

Some guy on Value After Hours talks about a momentum strategy. Nothing wrong with that.

I’m not saying I’m ready to start chasing hot stocks trading at 40x earnings (to each his religion). But maybe incorporating a little bit of momentum or special-situation thinking into the value-based approach might not hurt.

Here’s a fund, aptly called the Optimist Fund, that is taking a fundamentally different approach to me. Their latest quarterly letter is here.

What strikes me is that they only invest in category-leader (or category-maker) businesses, yet I would not imagine myself buying any of these stocks, based on valuation. And I wonder whether I’m making a mistake.

Shouldn’t I own at least one potentially world (and life) changing business?

Just food for thought.

I’ve been looking at $KWS.L lately. I like the business, but I can’t bring myself to pull the trigger at a P/E of 37. Uncle Warren wouldn’t approve.

Just a few links that I breezed over. I can revisit this one later.

Link 1, link 2, link 3 (archived here), link 4 (archived here).

From Horizon Kinetics 2023Q1 letter.

From IPO (March 2014) to now (Apr 2023, so 9 years):

- 4 acres to 7.7 acres per 100 shares

- 24 to 28 barrels per 100 shares

- proved and probable reserves: 36 to 67 million barrels

A nice thesis on SeekingAlpha (archived here).

A few other posts:

Baskin’s thesis, BN is undervalued and so what, Once in decade opportunity and BN Transparently bullish.

Despite all of this, I ended up selling. Too complicated for me, and too similar to $DRM.TO which I own in good size.

A Hidden Compounder from Poland.

The numbers look appealing: 177% 5-year GP growth, trading at 11.3x EV/EBIT.

Unfortunately, the Polish Zloty (pln) is pretty expensive these days:

I found this gem in the 2023Q1 letter of Cedar Creek Partners:

In December 2022 the President signed the $1.7 trillion omnibus spending bill. Included in the bill (was) appropriations to replenish supplies used in Ukraine and to increase stockpiles. A number of programs are included in the spending, including two that represent Solitron‘s two largest revenue sources. The increased stockpiles program is a multi-year program that we currently expect to add approximately $20 million in total revenues starting in late (calendar) 2024 and running through 2028, or approximately $4 million annually. Actual contract awards are expected to occur by the fall of 2024.

Fiscal 2022 revenues were $12.3 million versus the prior years $10.5 million, which shows the significance of an expected $4 million annual increase. The press release also noted Solitron’s cost savings program is achieving or exceeding its targets. In addition, at the end of the fiscal second quarter and first part of the fiscal third quarter Solitron purchased 1.1% and 1.5%, respectively, of the outstanding shares of two small community banks that were recipients of the Emergency Capital Investment Program (ECIP).

Tim Eriksen is the founder and President of Eriksen Capital Management (owner of Cedar Creek Partners I guess), and the CEO of Solitron Devices.

As of Dec 2022, $SODI was the #1 position for the fund.

I heard that [forgot his name, the fund manager who had a position in Carvana, Wix, and Trupanion] acquired a position in this company. I am a customer of IBKR.

At first, I thought their UI is dog shit. But after a while, I got used to it. And…well I still think it’s crap, but it gets the job done.

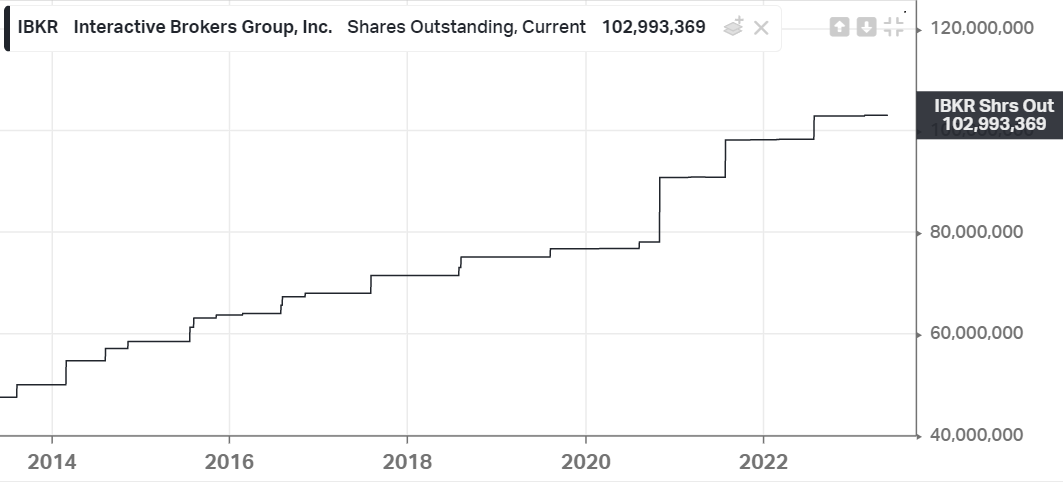

I think it’s a great company. Unfortunately, the stock dilution is severe. I ain’t buying any company with a chart like this, no matter how great it seems:

When asked about why his stake in the company is so low during an earnings call, the CEO answered that he isn’t motivated by money, that he loves doing his job and that was enough.

PASS.Stock analysis here, from Firm Returns.

It’s an acquisitive game developement company. Just with that, I’m tempted to pass, but the numbers on Koyfin don’t look that bad - far from it.

I’ll update my decision after reading the above writeup.

Disqus comments are disabled.