#91 - Ramblings June2023

Last updated: Apr 30, 2024

This is the fund of Christopher Bloomstran. The main website is here. This Youtube comment (from this interview) sums up my opinion on the author: “Listening to Chris is a better learning experience than most business courses at University.”

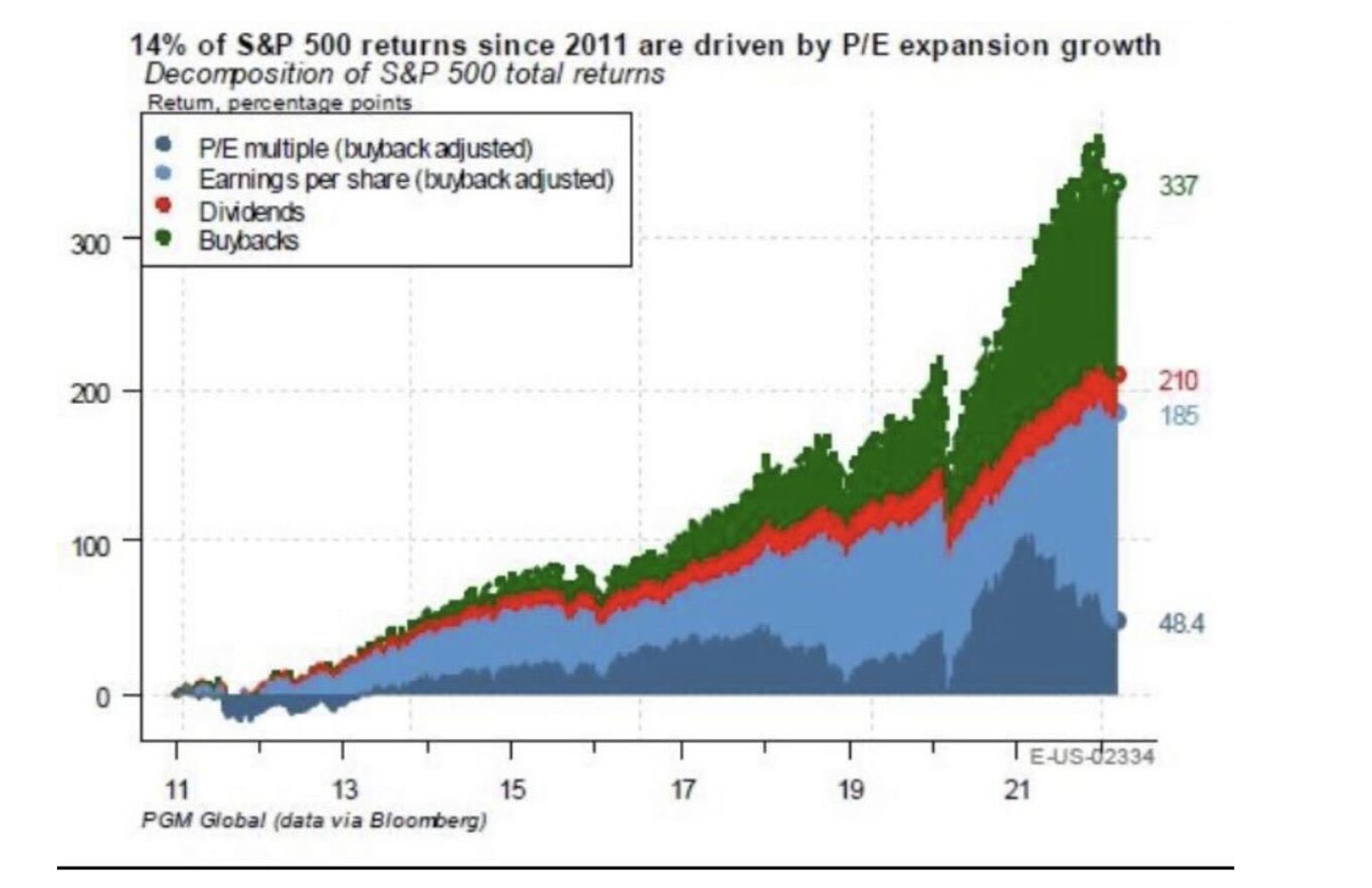

From the 2022 letter:

The equity investor thinking about prospective investment returns considers dollar sales growth, changes in the share count, changes in the profit margin, changes in the multiple paid to earnings and any dividends to be paid. These five factors combine to produce return.

Total Return = (EPS Growth x Change in P/E Multiple) + Dividend Yield

EPS Growth = [Sales Growth] / [Change in share count] x [Change in profit margin]

One of the main take-aways from the 2022 letter is the following:

As painful as 2022 felt to many, stocks aren’t washed out at 19.2x earnings, and certainly not on a still-robust profit margin a mere 200 basis points from a record high.

From Nat Eliason’s Newsletter. Really enjoyed this post, lots of nuggets of wisdom:

-

It’s never the right time.

-

Err on the side of too early over too late.

-

Bad things happen fast, good things happen slowly.

There are many others…worth spending some time reading / thinking about.

By ROBERT G. HAGSTROM, original here, archived here.

The ability to say ‘‘no’’ unless all the facts are in your favour is a significant advantage for any stock market investor.

Available on Youtube here, archived here.

I guess now that the trans are turning on women (and eating their lunch), some of them are starting to wake up. Better late than never.

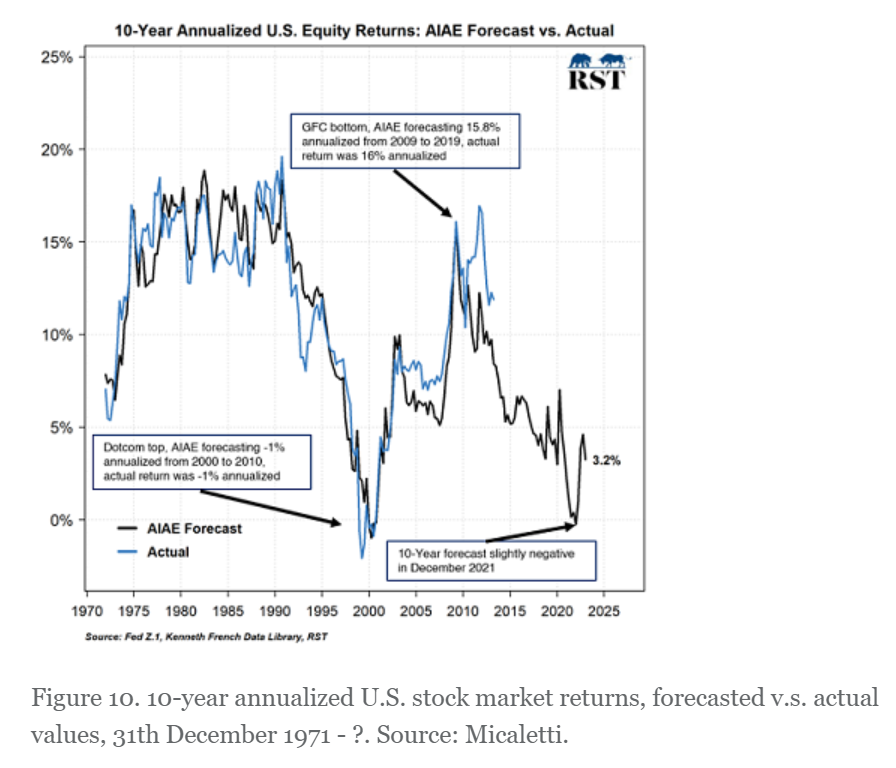

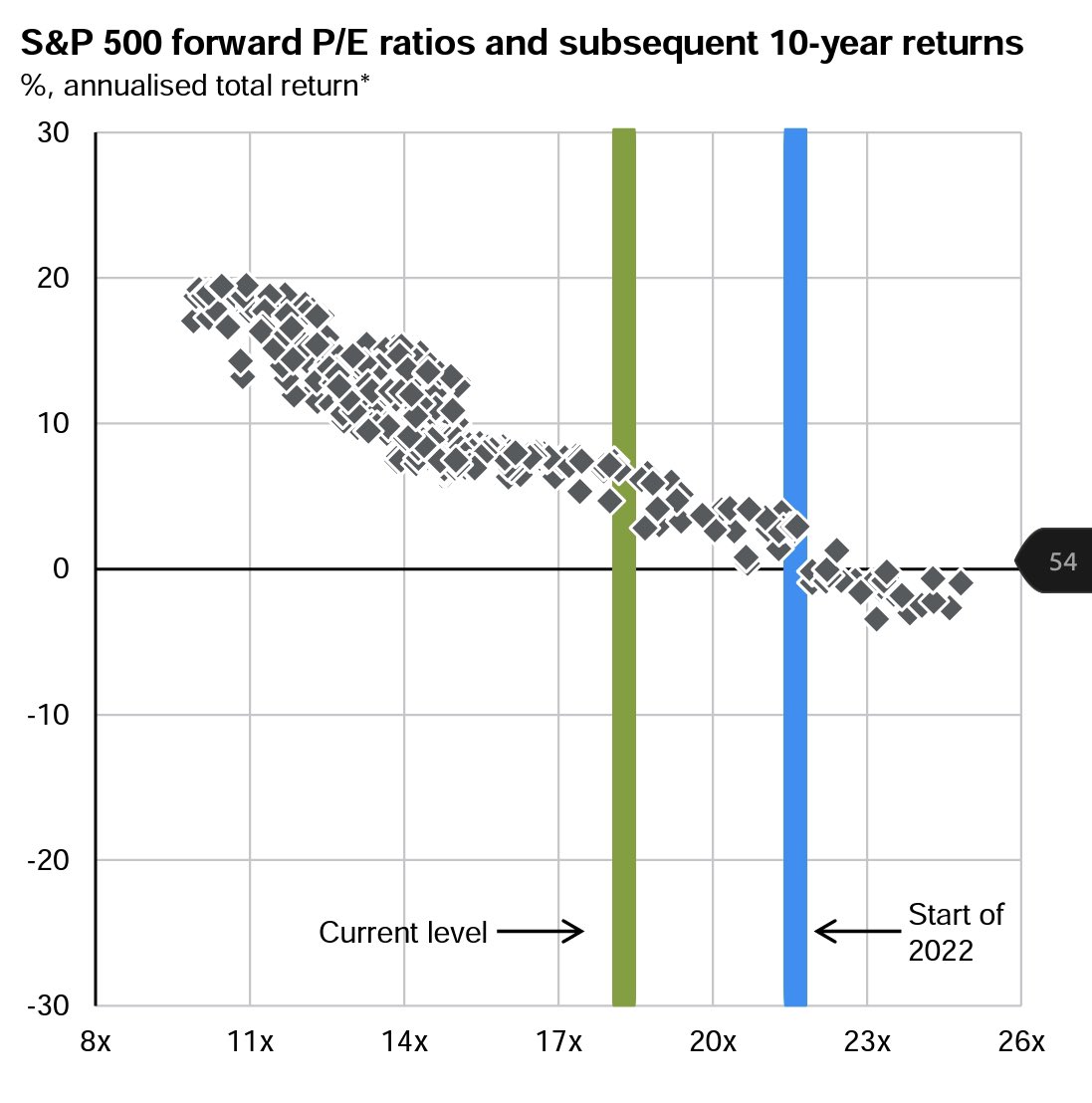

The Single Greatest Predictor of Future Stock Market Returns, Ten Years After.

It’s not looking good at this precise moment.

Whenever I feel confused about this game, all I have to do is look at the 3 charts below:

Fintwit can be amazing. Grateful for all the contributions I got here to my initial question (link)

I have trouble fully grasping the concept that your returns on a stock will approximate the return on invested capital of the business over a long period of time.Anyone has a link that explains it a bit, or maybe some math, or an example?

In Ottawa: “All staff at the @OCDSB received this email on May 31st, informing them that ‘2SLGBTQ+’ representation in the curriculum and classroom is ‘a fundamental human right,’ that opting out of ‘2SLGBTQ+ learnings’ is not an option, and that teachers who want to ‘foster inclusivity’ can ‘begin the school year using they/them pronouns for all,’ until students have specified otherwise” said former Ontario high school teacher Chanel Pfahl in a Monday tweet.

Watch this clip: link.

They asexualized the population so that there's no more desire, no more bipolarity [...] and then rather than turning towards one another, they turn towards the state

So the only thing left for me, as a child, to believe in is communism, and Mao as a God.

Poilievre, after Trudeau tried to deflect the question about inflation and interest for the billionth time:

“Has he really sunken to the low of exploiting these fires for political gain to distract from his inflationary and high interest rate policies?”

Full clip: link.

Why you should be in, around, under or on top of water: [...] settling down by the sea, in a so-called “blue space,” has been linked to a 17% reduction in mortality rate.

For instance: Nichols speaks about the “predictability” of waves crashing on a beach, how that sound (familiar, gentle, a little hypnotic) can induce a relaxed state. There’s a reason it’s easy to do nothing at the beach. Once cortisol drops, we find it easier to lean into our brains — to think without fretting.

Full article: link.

From this clip.

- Simple, predictable

- Cashflow generative

- Dominant companies with large barriers to entry

- High returns on capital

- Limited exposure to extrinsic risk we can’t control

- Strong balance sheets, don’t need access to capital to survive

- Excellent management

- Good governance

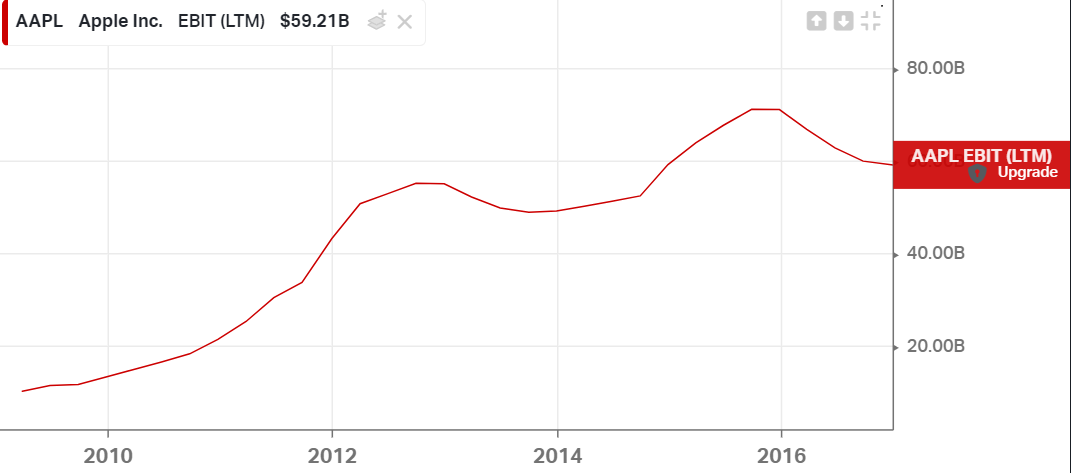

Related: Catch-’23: Canada’s Affordability Conundrum:

While most will argue for a supply-side fix, our longstanding view has been that it’s wishful thinking to believe that an industry, already running at full capacity, can simply double output in short order, flood the market with new units and bring prices and rents down.

Clip from twitter here.

In summary:

- Asset Manager growing

- Western Canada doing great (lost of new rentals in Saskatoon)

- Ski area doing great (March best month ever, February 2nd best month ever)

- Appartments becoming a big business; appartments + industrials ~ 75% of total assets

- Condo sales slow, house sales not bad

Cooper: If you don’t read the newspaper, Dream Unlimited is doing pretty well.

From this tweet:

An important chart:

Taken from this tweet.

Here’s a counter-chart:

Todd Combs also emphasizes the qualitative:

“When Warren [Buffett] and I are talking about stocks or acquisitions, it’s 95-99% qualitative, qualitative, qualitative. That comes down to … moats, barriers to entry — all the stuff you’re not getting [from] a filing or annual report.”

An interesting take (tweet):

New blog post from Chris Mayer: The Wisdom of K.

[...] he dreams he is before the gods and they grant him a wish. “What do you want?” Mercury asks. “Do you want youth, or beauty, or power, or a long life, or any of the other glorious things we have in the treasure chest? Choose - but only one thing.”“For a moment I was bewildered; then I addressed the gods, saying: My esteemed contemporaries, I choose one thing - that I may always have the laughter on my side […]”

“The ability to see the funny side of life, to laugh, is a great gift.”

Eliot entered a crowded NY restaurant and handed his hat to the doorman. After lunch, he goes to leave. As he came out he was astonished to see the doorman promptly pick out his hat from the hundreds that were there and hand it to him.“How did you know that hat was my hat?” Eliot asked.

“I didn’t know it was your hat, sir,” said the doorman.

“Why, then, did you hand it to me?”

And the doorman very courteously replied, “Because, sir, you handed it to me.”

President Eliot was delighted with this precise delimitation of what the doorman saw and what he assumed.

“Be humble and careful about what you think you know and what you assume.”

From this Medium post, archived here.

- Things Evolve In Cycles, Not In a Linear Way

- Human Nature Isn’t Good or Bad. It Is Good And Bad

- All Journeys Are Psychological Journeys

- Social Status Is the Oil in the Human Activity Engine

- Your Best Work Is Done in Flow

- 99% Of Problems on This Planet Would Be Fixed With Skin in the Game

- The Modern World Is Engineered For Addiction

- The Only Thing People Are Willing to Hear Is What They Already Know

- Originality Is Rare — Everyone Copies Everyone Else

- Your Life Is a Function of the Things That You Do

From Marcellus blog, archived here.

From The Generalist, archived here.

A Notion database, accessible here.

A post from Ian Cassel on MicroCap Club.

I love to invest with repeat winners. Their past successes has allowed them to form key relationships in business, industry, politics, banking ie funding sources, which increases their chances of success. Their past successes allow them to move quicker the next time. Key stakeholders, core investors, partners, already trust them. Repeat winners already know the right accounting software, CRM software, HR processes, marketing systems, incentive systems to implement. The know how to form win-win partnerships, structure contracts, and get things done the right way. They’ve already made the dumb mistakes. They know how to scale.

When I find this setup, it forces me to clear the calendar and dig in. It’s a race to find out the truth before someone else finds it. I try to get on a plane to meet them as soon as possible. Why? This type of management team isn’t going to tell you the plan over the phone or zoom. They aren’t talkers. They are doers. They don’t need your money. They are funding the company themselves. These quality individuals rarely pander to Wall Street – there isn’t a need for it. The only thing they respect are investors making the effort to truly understand them.

A Spanish thesis found on Youtube: link.

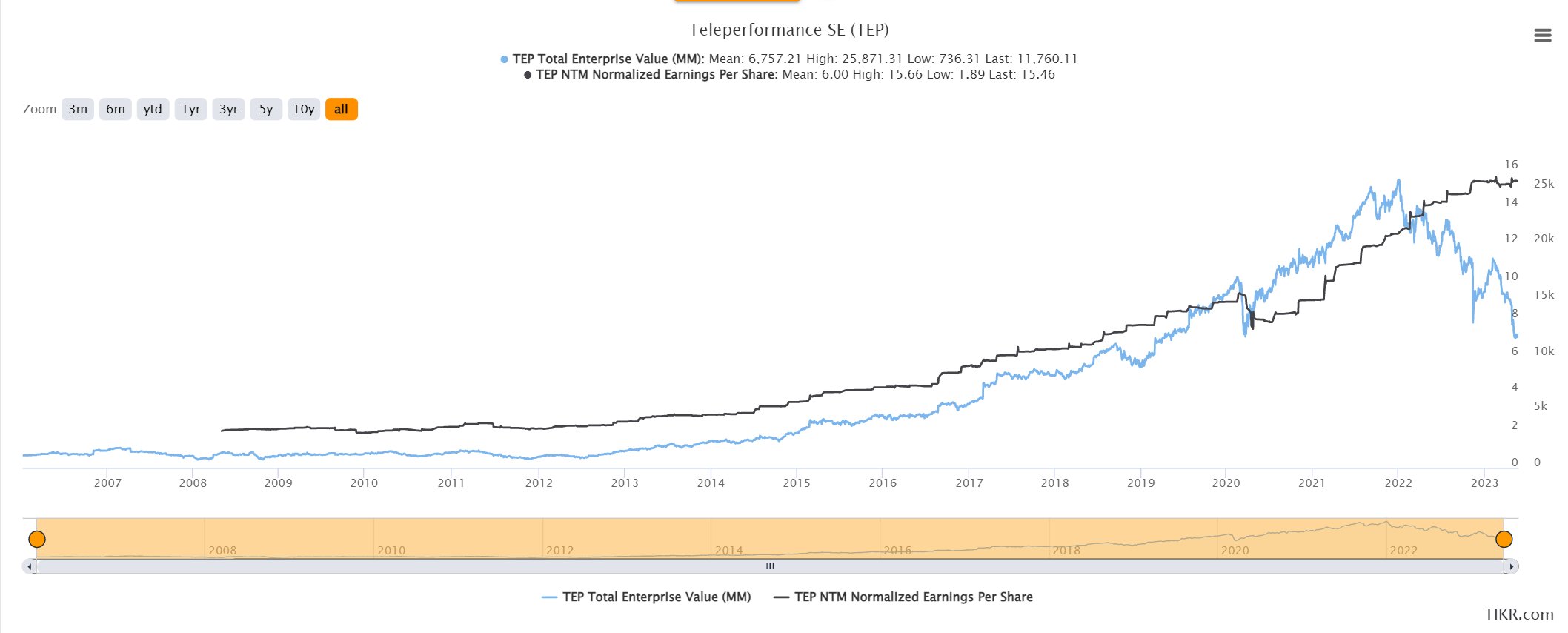

Price vs normalized earnings:

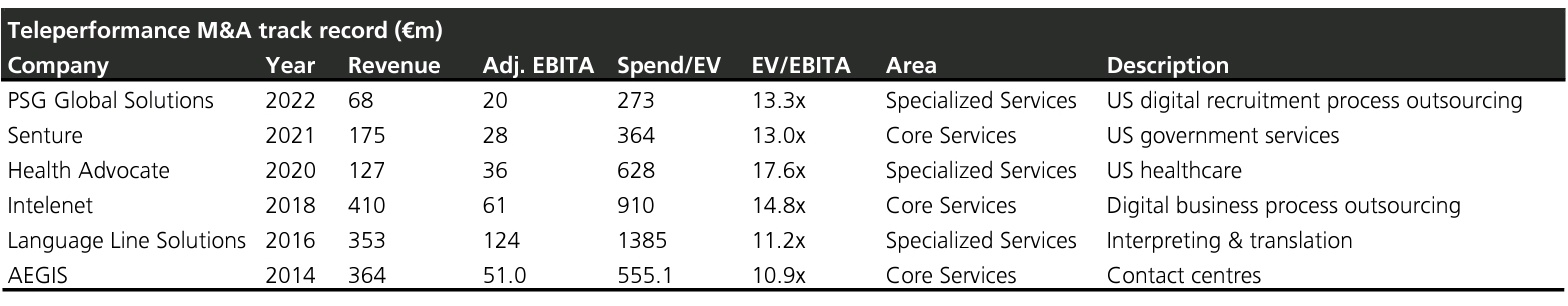

Acquisitions:

Comments on the most recent acquisition here.

This almost looks like the perfect opportunity to go contra on the AI hype train.

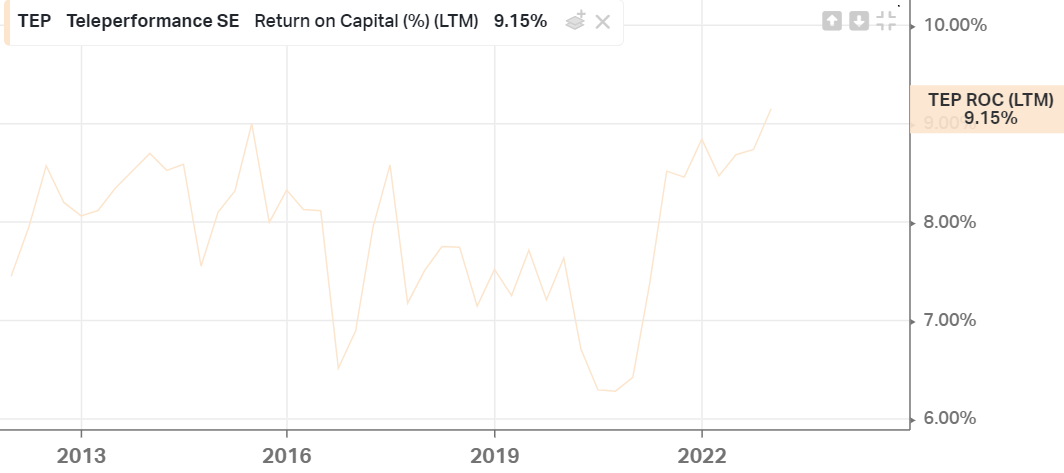

What makes me hesitate is the low return on capital:

As well as the massive amount of recent selling from the CEO:

On the other hand, it says here that this selling is for tax reasons, and I must acknowledge that other than the CEO, there was a decent amount of insider buying lately (see here).

The CEO makes a pretty decent salary: close to 20M euro. That’s not too far from Zuckerberg!

I bought…and sold two days later. Good luck to those who own it, it’ll probably do well.

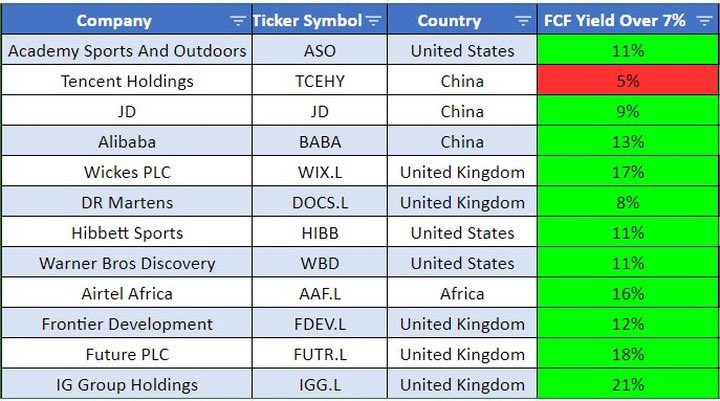

A list of tickers from QualityValue substack

- $ALBLD.PA Bilendi SA

- $DAVA Endava plc

- $$CYB.MI Cyberoo

- $ELIX.LN Elixirr International plc

- $EPAM EPAM Systems

- $RLT.MI Relatech

- $FTK.DE flatexDEGIRO

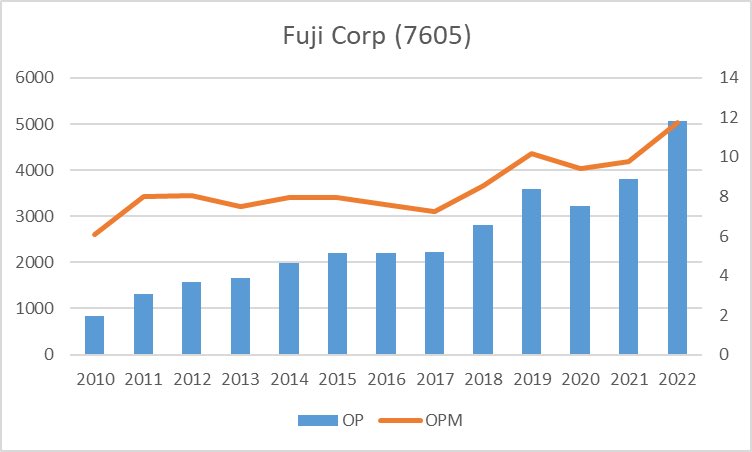

A Japanese compounder (tire retailer) trading for cheap: thread.

Funny thing: they also sell wine and food (wtf!) but I couldn’t find any info on that segment in their translated reports.

Disc: I now have a small position

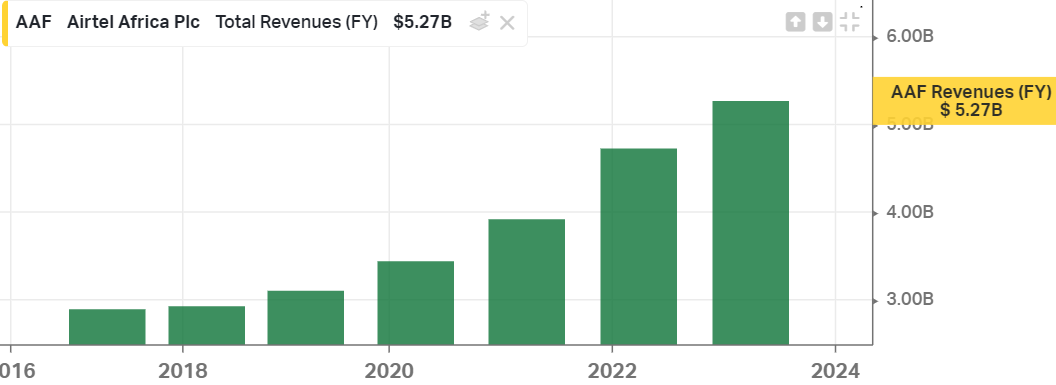

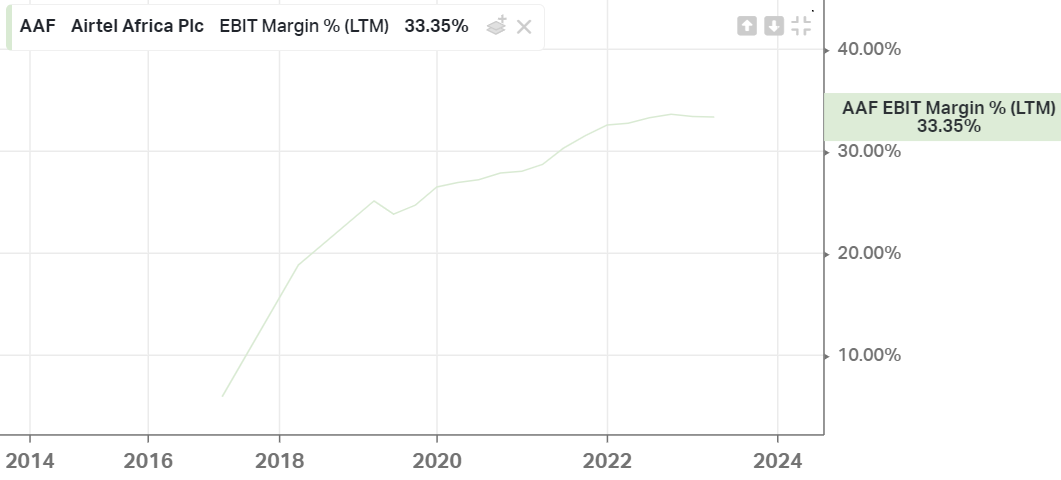

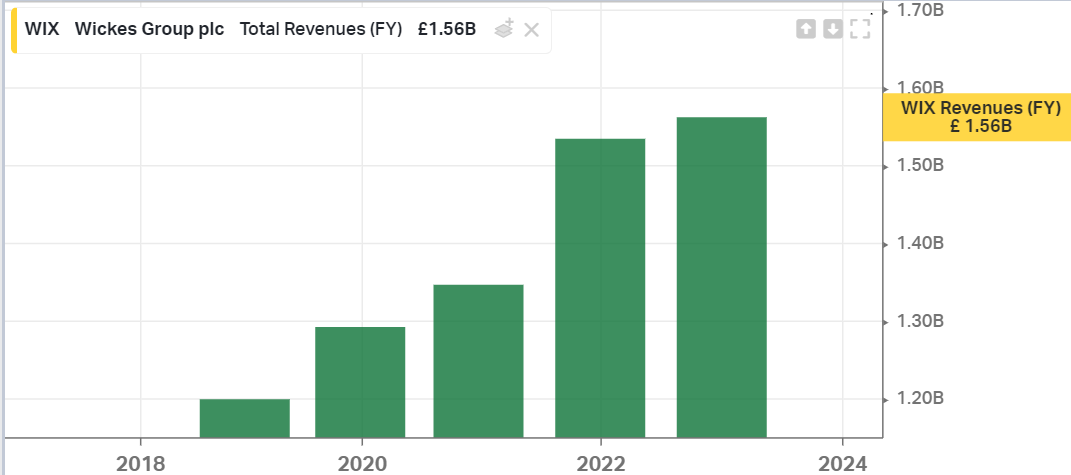

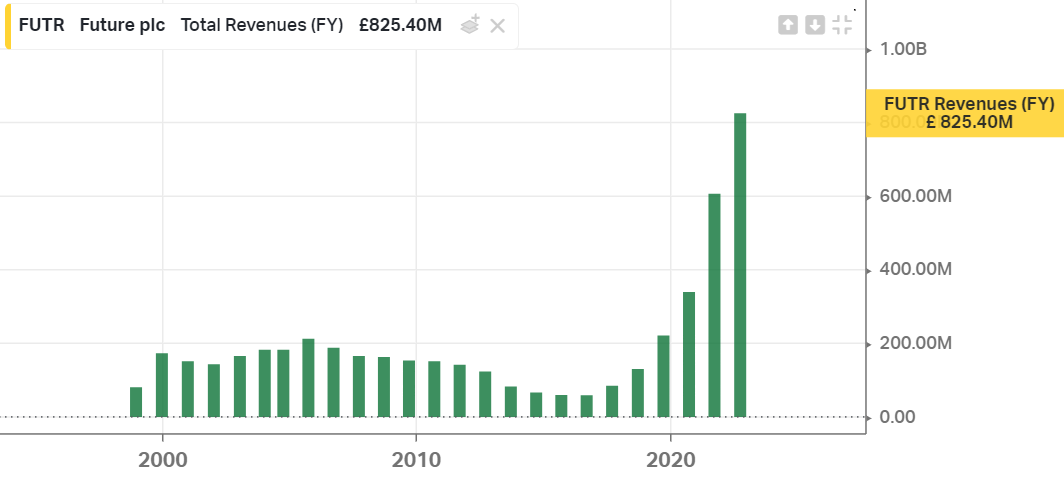

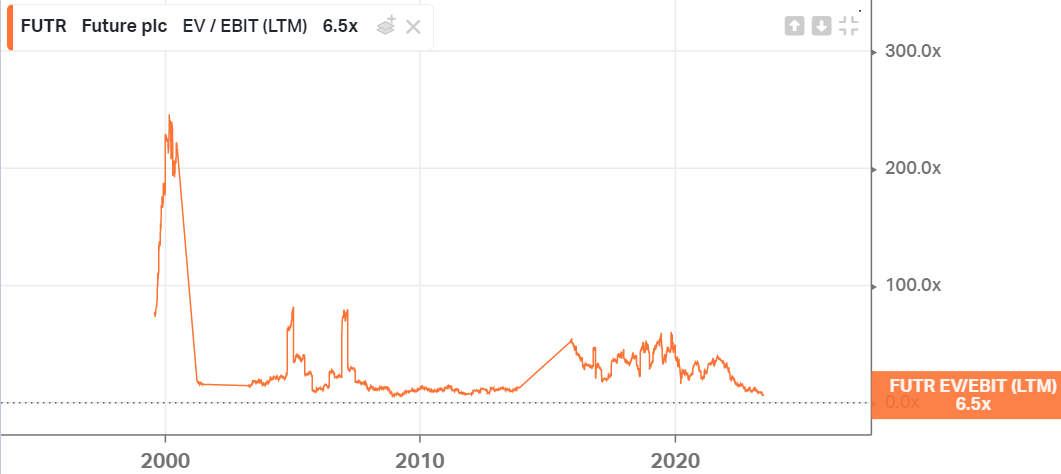

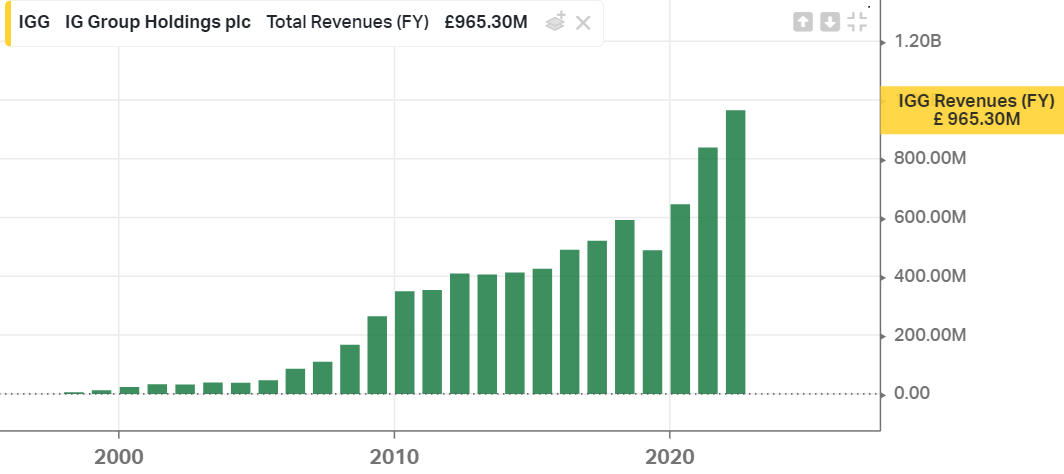

Some of these look pretty juicy!

- $AAF.L

- $WIX.L

- $FUTR.L

- $IGG.L

(EBIT not available on Koyfin)

Note: For some reason, looking at QuickFS is very helpful to stay grounded and unemotional, probably better in that respect than Koyfin. It might be the ROIC chart.

The one that looks really good on QuickFS is $IGG.L.

A thesis on IG Group from Investing With Wes substack can be found here.

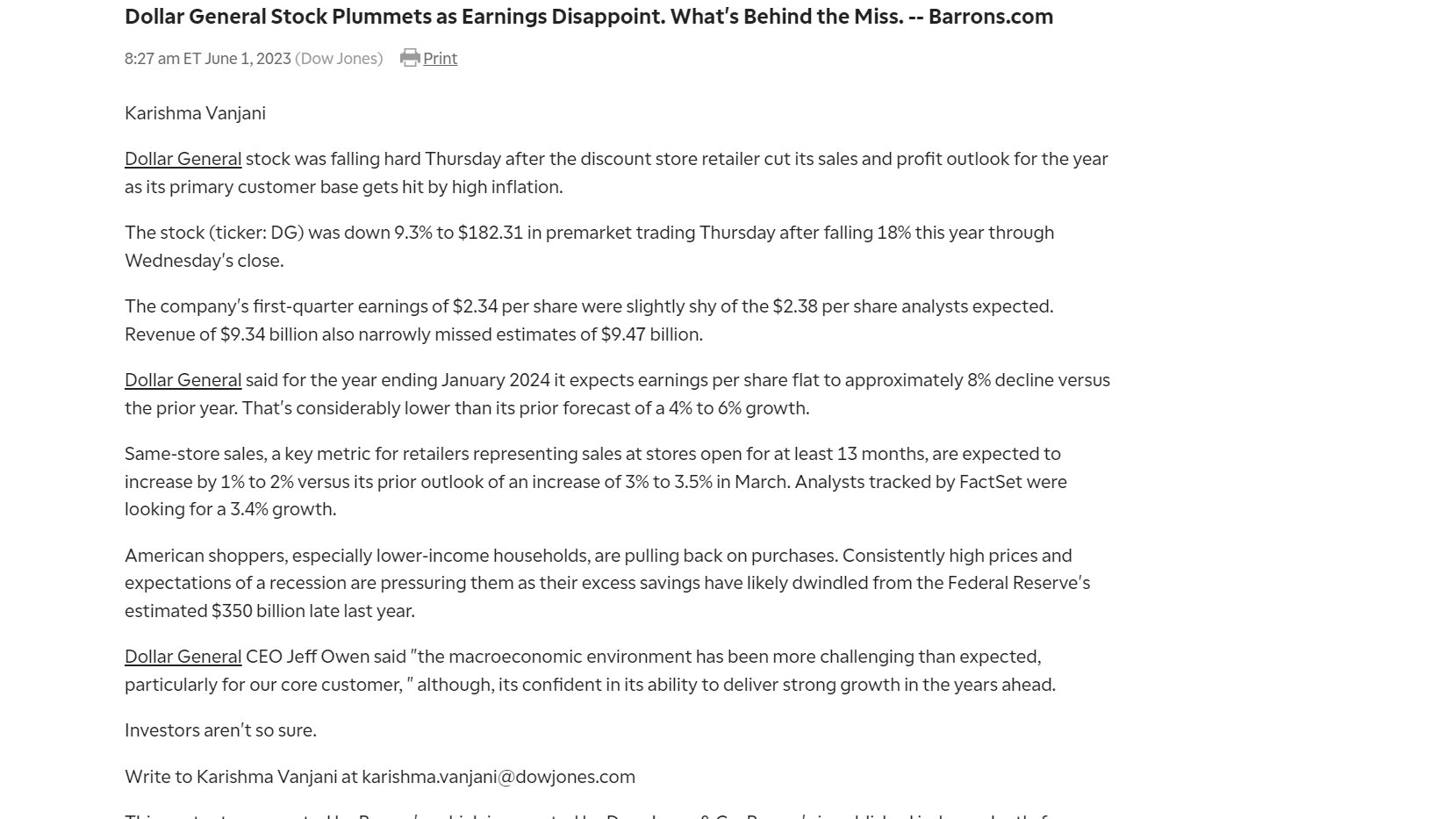

$34B compounder trading down to ~15x EV/EBIT. FCF has been anemic as of late and debt has skyrocketed (still under 3x Net Debt/EBITDA). Guided to EPS flat to 8% lower.

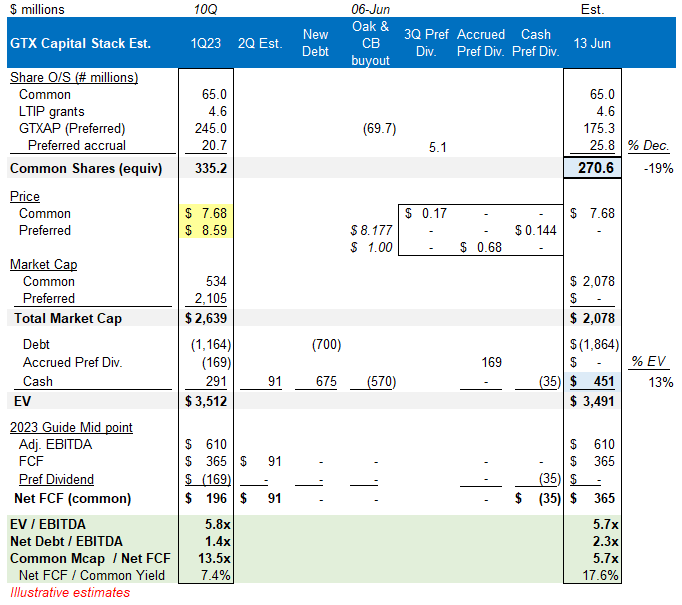

Update on the conversion and valuation (tweet):

Another writeup on Nihon Falcon. I have a very small position. I mentioned this stock previously in my April ramblings.

Well fuck…we buying a coal mining concession now?! 27M RMB, compared to 18M RMB for the 2022 dividend.

Goes to show: cheap is not cheap enough!

I listened to a podcast on Planet MicroCap with the CEO of POSaBIT.

Impressive what the COE has been able to build. Very impressive.

As long as the regulatory environment doesn’t change, they have fantastic moat.

If/when the environment changes, he predicts many bigger companies will be interested in the space, and some of them might want to acquire POSaBIT.

I haven’t made up my mind on this.

Unfortunately, too expensive for me at EV/GP=11.8 and EV/EBIT=26.8, with negative free cashflow.

PASS.Disqus comments are disabled.