#93 - Ramblings July2023

Last updated: Apr 30, 2024

Turned rocks: 44

Purchased: 1

Hello! Are you awake?

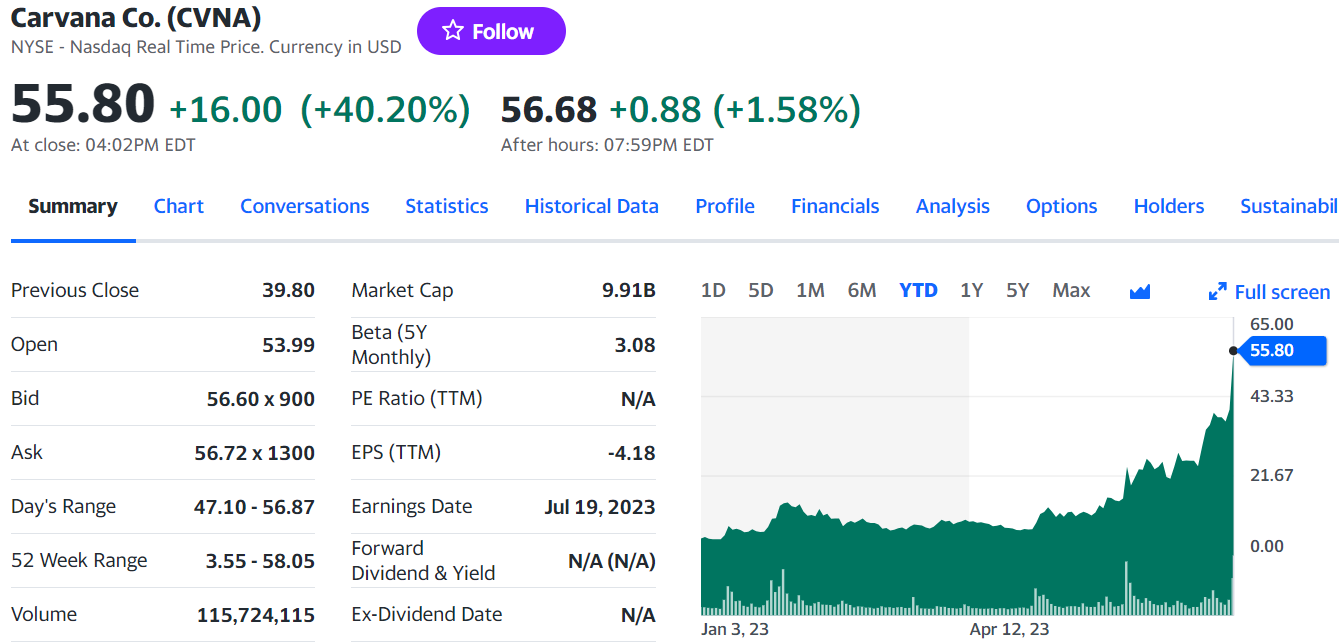

So this happened:

and this:

Not that I feel 100% entitled to these gains, nor do I think I should have bet big on these two companies.

But I distinctly remember listening to Cliff Sosin talk about them and thinking that he was a smart guy with an interesting thesis.

So why didn’t I make a bet? Any bet?

Part of it is that the macro context scared me off. In the specific case of Carlytics, the stock was objectively cheap (EV/GP), macro or no macro.

The other reason was that both companies were (still are) unprofitable, and I didn’t think investors would reward unprofitable companies so generously in 2023. Both companies also had a lot of hair and a lot of real balance sheet risk.

But I could have looked deeper and I didn’t.

And the main reason is: lack of energy, lack of discipline, lack of focus.

It is also for this reason that I did not swing at $GSY.TO (goeasy) which I consider an absolute error of omission. I knew enough. There was a clear opportunity when the government regulated on the maximum allowable annual interest rate for such lending companies, which gave them a clear scale advantage. Now the stock has ran up significantly, following their earnings call. I had time to buy, I was just not sharp or fast enough.

This goes back to the critical need to be in shape. I need to fix my sleep, my health and my energy. Only then can I start working on my discipline.

If I only implent that, I’ll be wealthy & happy.

THAT BEING SAID…let us not forget about hindsight bias. The fact that something happened does not mean it was likely to happen or even that its likelihood of happening could have been predicted with any degree of confidence.

And when it comes to highly indebted companies facing a tough macro environment…maybe they should legitimately go to the too hard pile. And maybe they should legitimately have massive returns if the outcome is positive, BECAUSE it was unpredictable (just like a lottery ticket).

So I don’t want to overcompensate or learn the wrong lessons here.

I just want to be ready to spring into action.

Semper Augustus Letters

This month, I’m reading the letter from 2021. In particular, the section title “BROWN SUGAR”.

Here’s a quote to set the stage:

The traditional capital cycle, of profit creation and destruction at the hands of overbuilding and then underbuilding is being distorted by policy, towing the law of unintended consequences in its wake. As investors, said law introduces one of the most interesting and perhaps profitable investment opportunities we’ve seen.

Then on the refining stage specifically:

We are creating scarcities in the ability to refine adequate product. Opportunity knocks.

The fund owns (as of the time of this letter) two low-cost refiners: HollyFrontier and Valero. Looking at their latest 13F, I see that Valero represents 3.5% of the portfolio, but I can’t find HollyFrontier.

Interestingly, the 2nd position in the portfolio (after $BRK) is $OLN.

Chris goes into more detail on Olin in the 2022 letter:

“Olin the number one global producer of chlor-alkali with the largest chlorine production capacity, membrane caustic soda and chlorinated organics, epoxy materials, and, in North America, the number one producer of chlorine, bleach and hydrochloric acid.”

I remember this part had piqued my interest:

Following the company for a few years, it became evident that little, if any, new supply would come online over the next decade.

Some more details:

The pandemic allowed for the permanent closure of some assets, accelerating the evolving supply and demand imbalance. Maintenance capital expenditures run just north of $200 million against depreciation charges of $600 million.

The stock used to trade at a 20% earnings yield:

Right now it’s a bit more expensive. I’ll keep watching it. Here’s another reason to like the stock:

There is no internal reinvestment opportunity that should be pursued. There may be room for some merger activity but at a 20% earnings yield, “Buy the gosh durn stock,” as Coach Prime would likely say. I don’t want more dividends on which taxable investors pay taxes. Management is executing the playbook to perfection. The share count is down by more than 20% in the last two years, with most of the reduction in the last year.

Canada: Boost immigration or face even higher interest rates

Bank of Canada governor Tiff Macklem wants the country to bring in even more immigrants to fill the jobs going begging for a lack of workers – and has warned even more interest rate increases could be in store without those extra workers.

source: link

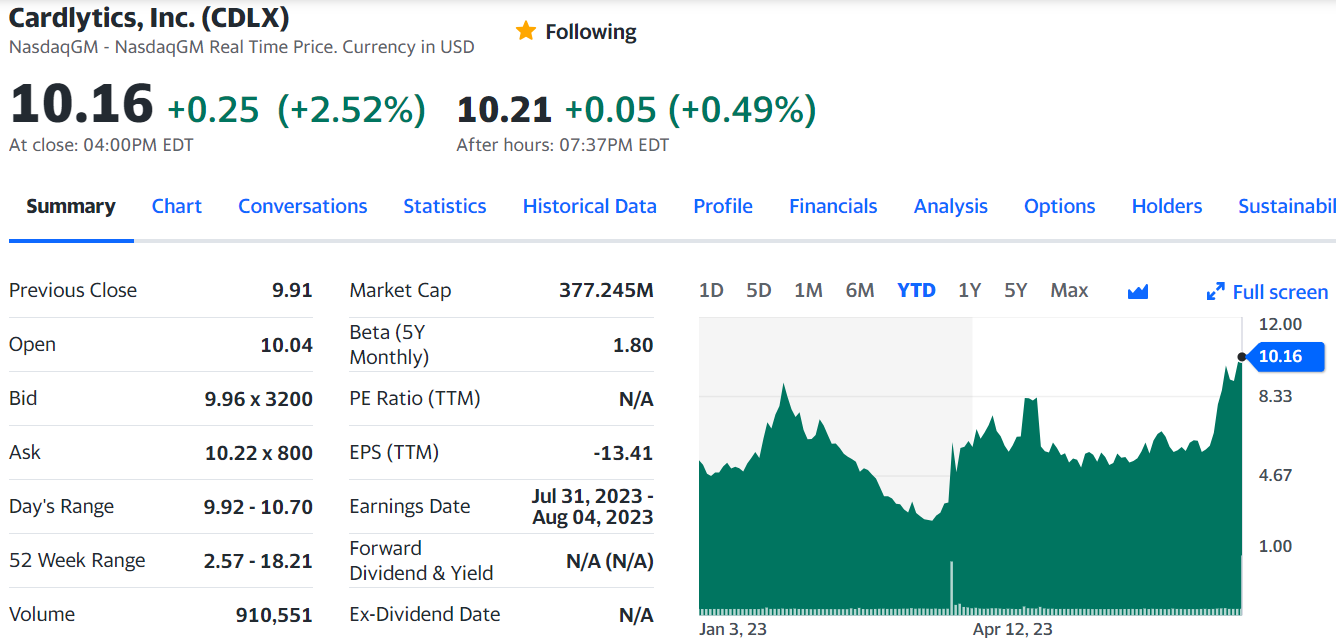

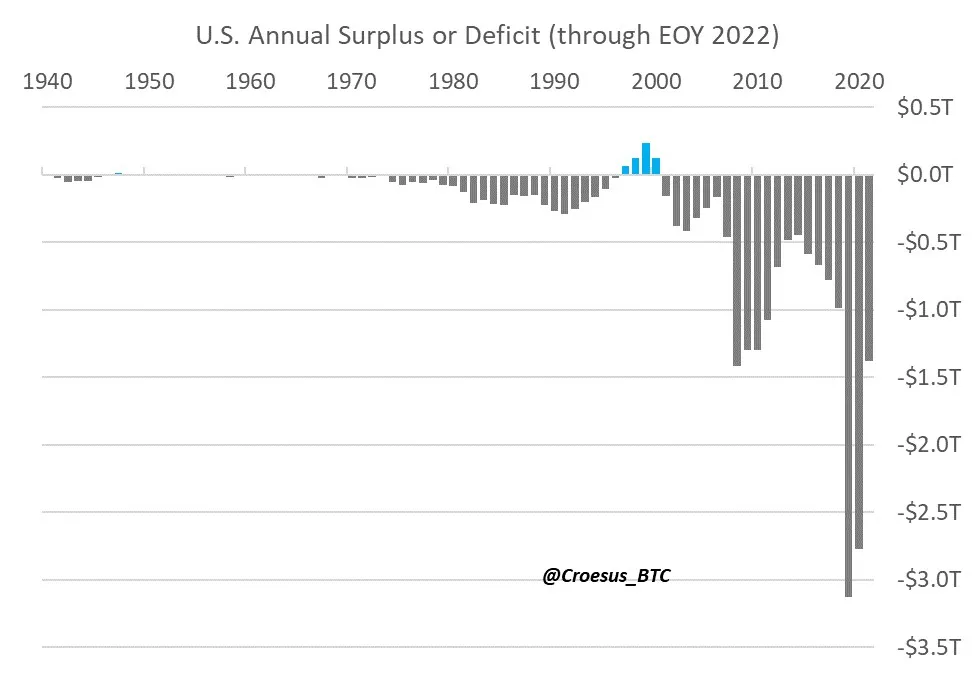

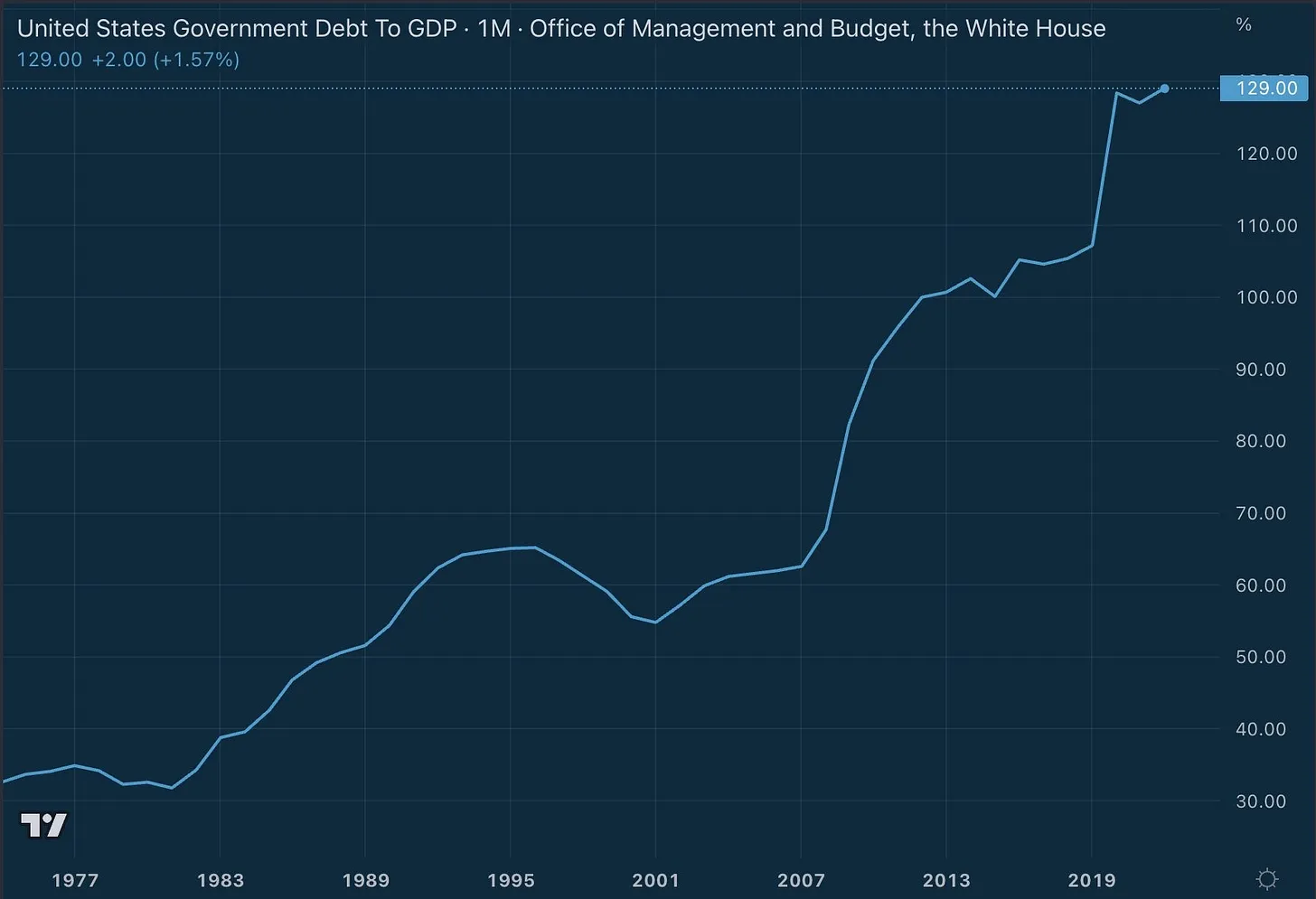

The Bondholder’s Burning Platform

A couple of scary charts from Once-In-A-Species substack.

Amazing quote from John Maynard Keynes

The Universe speaks

Sometimes I feel like the Universe is speaking to me. Whenever it happens, there’s always a specific message that hits me multiple times during the span of a a few days through different channels.

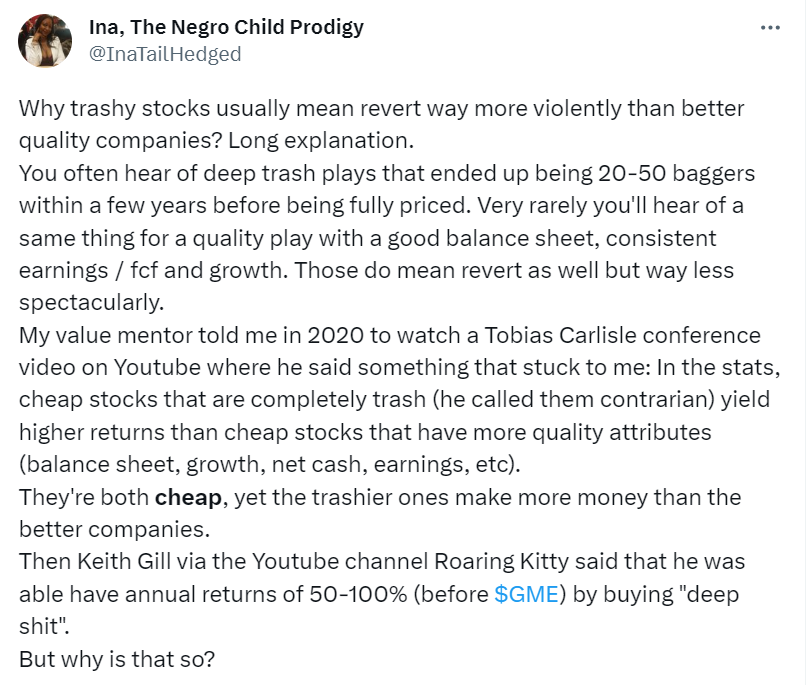

Today, the message I’m hearing louf and clear is: “Deep Value”.

It started with the $CDLX and $CVNA price explosions. We can argue all day whether these can be considered value stocks (let alone deep value). But what is Deep Value?

My interpretation goes like this:

A deep value situation is one where the price has drifted far below the expected intrinsic value.

And in that respect, $CVNA might have been a deep value situation, depending on the estimated likelihood of bankrupcy. $CDLX creating a real high-tech advertising business probably was a deep value.

That was the 1st signal. There were others.

For example, there was the 2Q2023 letter (archived here) from Cedar Creek Partners, managed by Tim Eriksen, where he explains how he found a potential 10-bagger that was left for dead.

We’re not talking about a good business humming along and compounding over time. We’re talking about a violent repricing stemming from a price that was deeply dislocated from the correct expectation.

Finally, there’ Roaring Kitty. I started listening to him again. I intend to listen to every available minute of his streams. He’s a deep value investor who was able to pull off 50%-100% returns by focusing on the extreme anomalies of the market.

Which reminds of $TBLD. That was a deep value opportunity. Might still be as we speak.

Deep value can be created when the floor unexpectedly falls under investors’ expectations, which causes them to jump out of the nearest window.

So the next time you see people running out of a building in a panic…go there. Look around. You never know what you might find. But be ready to act quickly.

Here’s an excellent tweet from @InaTailHedged (link):

One caveat remains: it is not clear to me that I’m smart enough to pull off deep value investing. If I can just be more decisive…I might have a shot.

Comfort and convenience rarely reverse

A super interesting thread:

Had a conversation with one of the smartest business people I know. I asked him:“Is work-from-home to stay and what does that mean for the office?”

His answer:

“In any business, comfort and convenience usually never reverses. Once a level of convenience/comfort is normalized, it’s here to stay. I image the work from home trend does not reverse itself.”

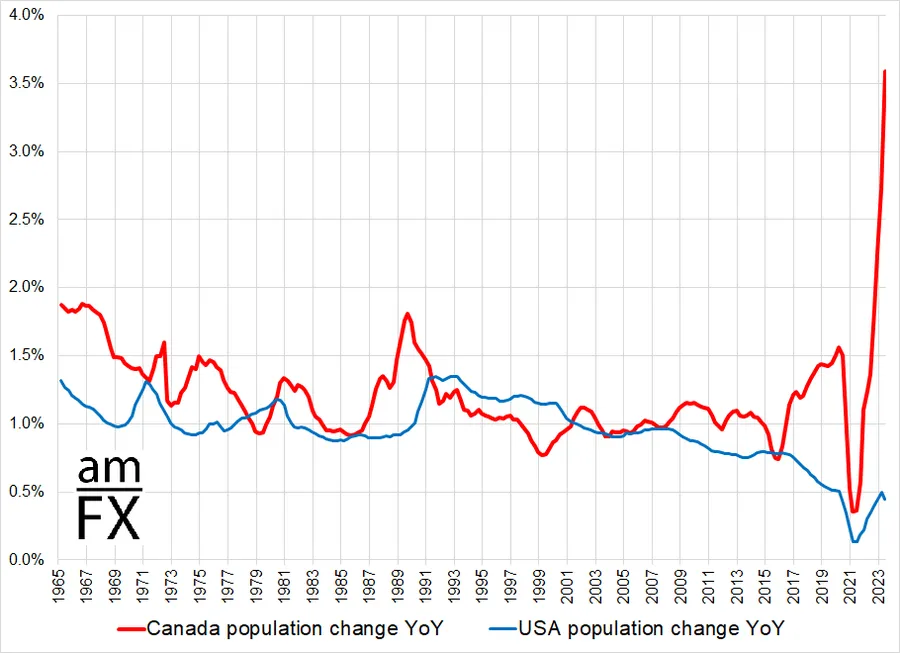

Canada has a nation-building population strategy. Does America?

An article titled Maximum Canada is happening from Noah Smith.

in recent years, the Canadian government has begun to set hard targets for immigration, such as last year’s target of 1.5 million more by 2025. And the country is deliberately encouraging more people to come, with one of the world’s most aggressive recruitment strategies.

A reminder of the recent population growth in Canada:

The author writes that _“Canada has a clear vision for itself as a multicultural mecca for all of the world’s smart and hard-working people”.

I think I’ll withold my judgement on that for a couple of years. I simply wonder where is the housing to suppy to absorb all these people, an issue the author acknowledges, to this credit:

If you let in tens of millions of people, you must house them; there is simply no other option, other than to let rents continue to skyrocket until the people revolt.

Turning stocks

$STG.CO

An interesting thesis in the Invariant substack, from Devin LaSarre (archived here).

Yet another thesis on tobacco and $BTI (from the same substack), archived here.

And here’s the previous author’s thesis on BTI, from 2022 (archived here).

The guy knows his nicotine, here’s a broader thesis (archived here).

$ERF.PA

Founder-led leading testing laboratories, struggling with high-base effect following COVID.

A sector analysis on Life Science Tools and Services, archived here.

$GTX

My take-away that this is either a short-term investment or a “too difficult” one to make.

I will probably use any price pop to unload. Surely, I can find an easier (or longer-term) investment.

$ATKR

Seems like a solid, cheap company. I’ve collected a bunch of material that I can come back to if the price drops again:

Seeking Alpha:

Other:

-

$ATKR : A Hidden Gem at the Intersection of Proficient Management and Electrification? (archived here)

$IDT

Back of the napkin calculations:

$632m MC $242m cash + investments = $390m EV

NRS ttm adj EBITDA = 21.4; say 10x EBITDA => ~ $200m (~ 2.7x ttm revenue)

Fintech: I’m gonna ignore entirely. I don’t like that business…

But let’s just say annual revenue is 19x4=$76M and growing, I guess it could be worth something…

net2phone not profitable but growing slowly, let’s say 2x GP.

GP ttm ~ 58m => 2x 58m = 116m

Trad comm dying biz, meh maybe 2x EBITDA.

EBITDA ttm ~ 80m => 2x 80 = 160m

Corp expenses ~ 8m capitalize x10 => 80m

TOTAL VALUE = 200 + 116 + 160 - 80 = $396m

In other words: I’d be the entire business for $638 MC, having marked the fintech biz at 0.

Link to spreadsheet with calculation of discount using real-time price.

A few links for DD:

-

Alta Fox thesis from 2021, archived here

-

IDT Investor Presentation March 2023, archived here

-

Graham & Doddsville, Fall 2022, archived here

-

Sawbuckd post, archived here

$DRM.TO

Calgary real estate market sizzles as newcomers flock to Alberta: link

The frenzy in Calgary – the city set an all-time record for home sales in June, up 11 per cent year-over-year, with apartment sales alone up an eye-popping 48 per cent – flies in the face of what’s happening nationally.

This is bullish…right?

$SKY

Started with a screener that yielded $CVCO. Interesting company, cheap. With long-term tailwinds.

https://seekingalpha.com/symbol/CVCO

Also written up on VIC: https://www.valueinvestorsclub.com/idea/CAVCO_INDUSTRIES_INC/4134501734#description

Then someone on Twitter mentioned $SKY as a competitor: https://twitter.com/ArbitragingTime/status/1677857090918907904

Looking at the numbers on Koyfin, $SKY just looked better, except maybe on the capital allocations plans.

From this writeup’s comment section: https://www.valueinvestorsclub.com/idea/SKYLINE_CHAMPION_CORP/4271902661#messages, on Sky vs CAVCO:

“They have similar models but CAVCO’s retail presence is spread throughout the US while SKY is concentrated in Texas and the Southeast. CAVCO also originates loans while SKY does not; that said not bearish on CAVCO…”

Favorite writeup: https://seekingalpha.com/article/4590173-skyline-champion-capitalizing-on-the-unaffordable-housing-crisis

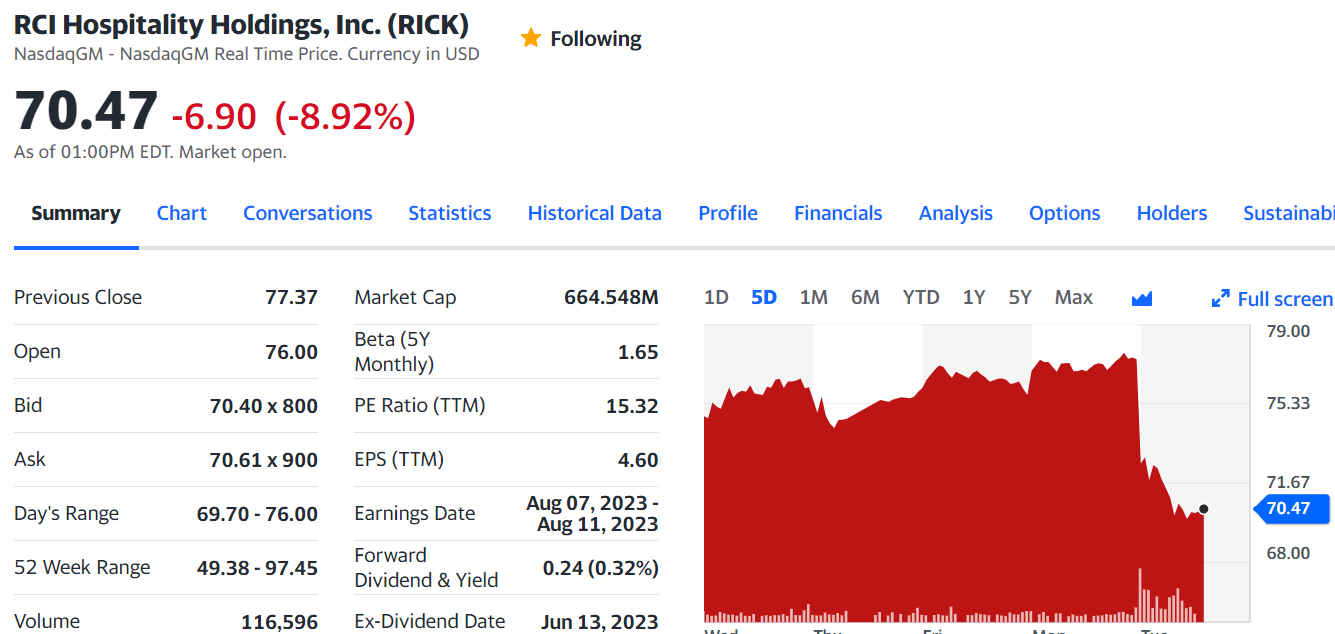

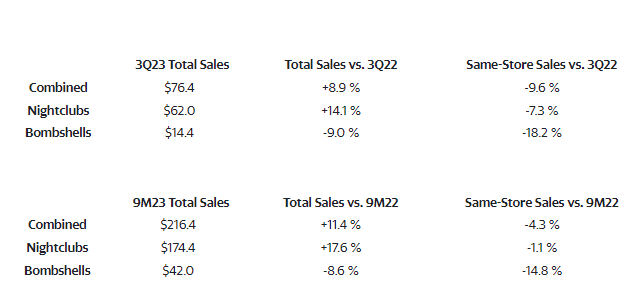

$RICK

Sell-off following Q3 earnings results:

$QIS.V

I read somewhere that the son of Mark Leonard (Damian Leonard) and manager of the Pinetree fund has a big stake + board position.

When I looked at the numbers, it didn’t hit me in the face.

Here’s an interview of the CEO:

$DIS

A rather gloomy piece by zerohedge: https://www.zerohedge.com/markets/where-everyone-disney-world-just-about-empty

Despite all their foolishness regarding LGBTQ-related issues, this is a business I’d love to own.

We’re going to Orlando in a couple of weeks and I’m having a very hard time trying to convince my wife that we don’t need to go to Disney.

$DOO.TO

A new writeup: link, archived here.

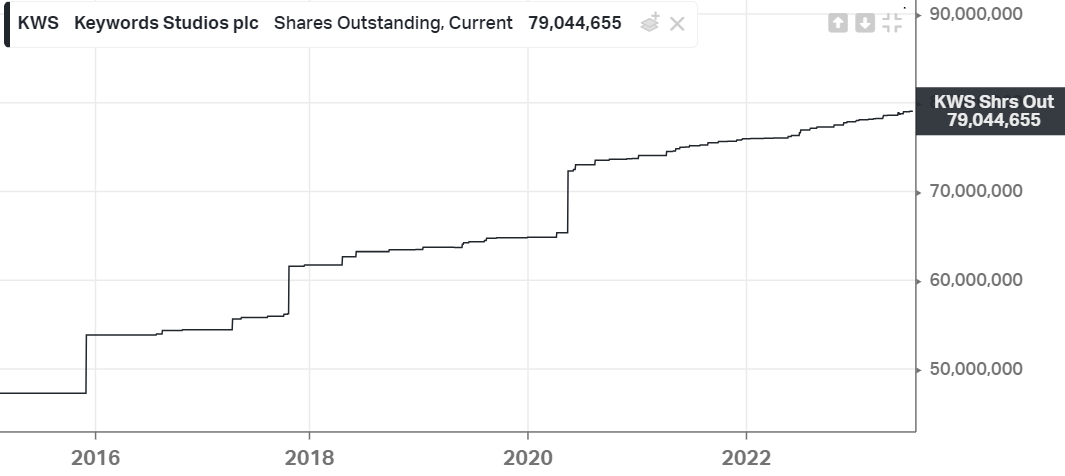

$KWS.L

Getting on my radar…not yet in the strike zone but I see you!

Can debate how much of a business risk GenAI is.

The only thing is…this dilution - omg why??! 😥 I doubt I can overcome my visceral distaste for it…

$PBIT.CN

I listened to a podcast on Planet MicroCap with the CEO of POSaBIT.

Impressive what the COE has been able to build. Very impressive.

As long as the regulatory environment doesn’t change, they have fantastic moat.

If/when the environment changes, he predicts many bigger companies will be interested in the space, and some of them might want to acquire POSaBIT.

I haven’t made up my mind on this.

$MAD.AX

Unfortunately, too expensive for me at EV/GP=11.8 and EV/EBIT=26.8, with negative free cashflow.

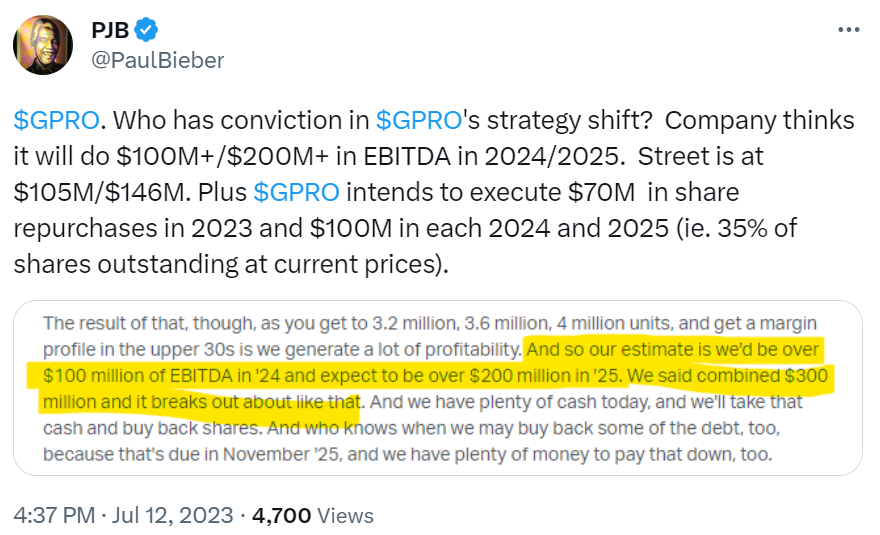

PASS.$GPRO

Price:

- EV/EBIT ~ 10.2x

- EV/GP ~ 1.5x

- EV/S ~ 0.5x

I learned from Paul not to underestimate EV/S if management is willing and able to improve the business margins.

Assuming that is the case, this business looks optically cheap. My strike zone is (generally speaking) EV/S between 1 and 2, EV/GP between 2 and 3.

I will listen to the earnings calls next.

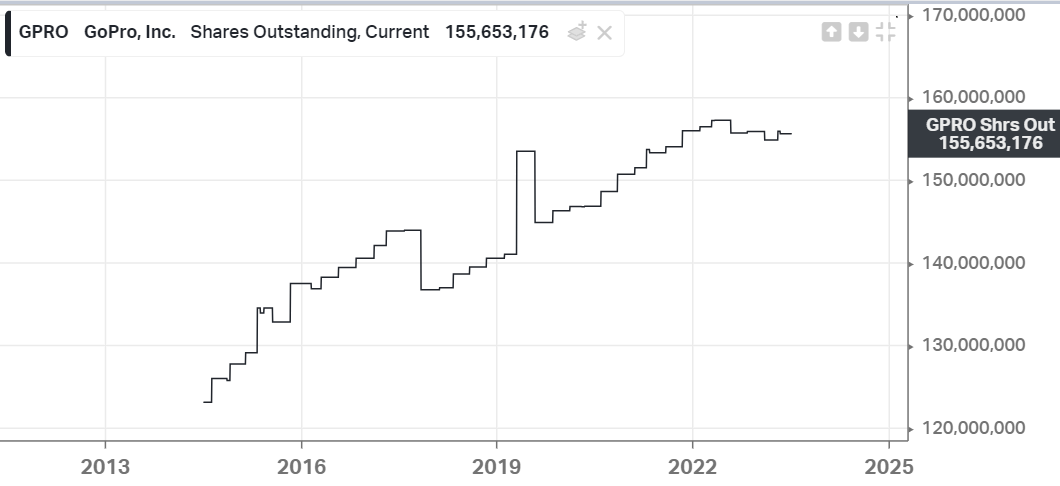

Then again…this horrible dilution:

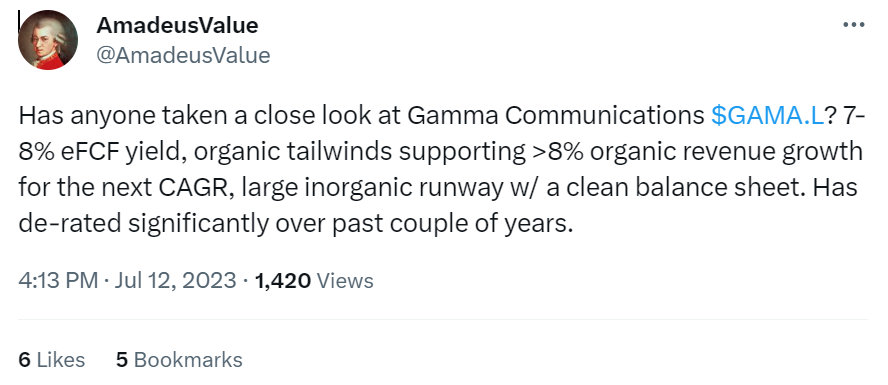

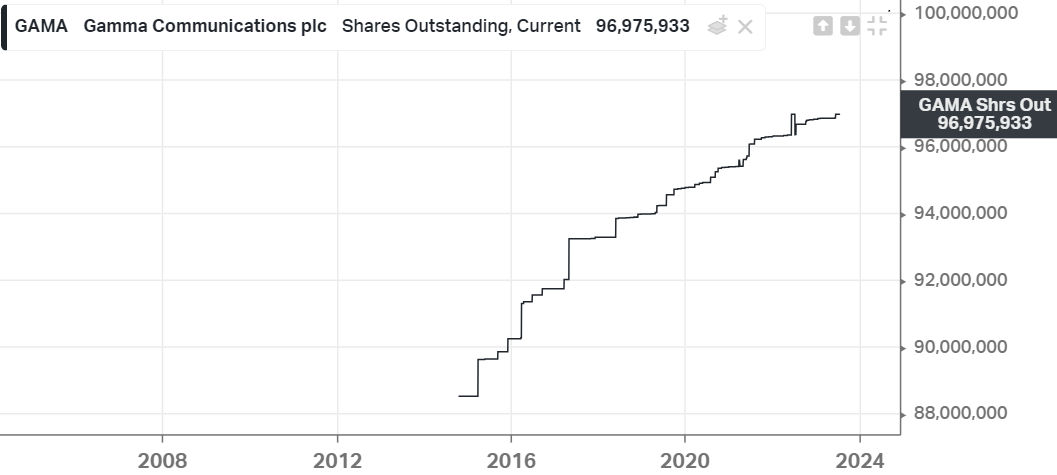

$GAMA.L

Price:

- EV/S ~ 2.0

- EV/GP ~ 3.9

- EV/EBIT ~ 15.1

- FCF/EV ~ 8%

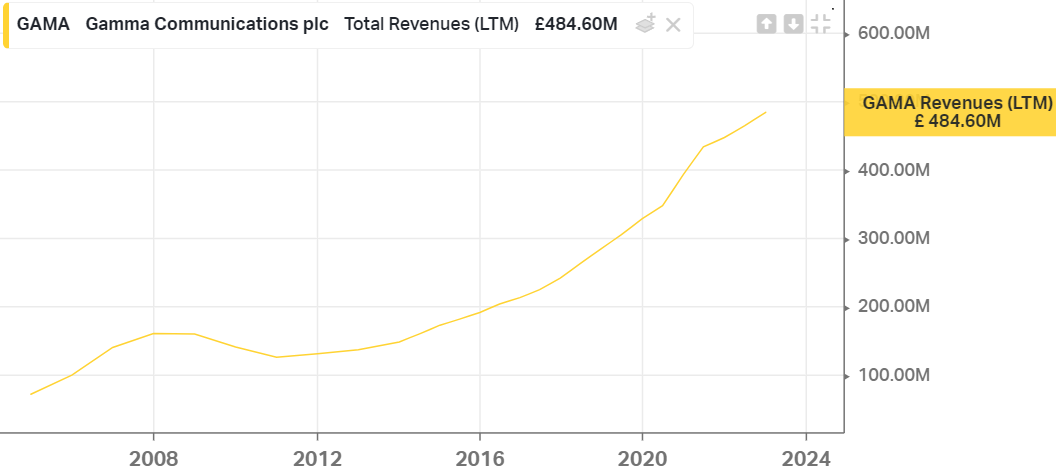

Revenue growth:

Share dilution - not as good, but not obscene either:

I might be interested. Here’s what they do:

Gamma is a leading supplier of Unified Communications as a Service (UCaaS)

Ugh…not my favorite kind of business. Undecided at this point.

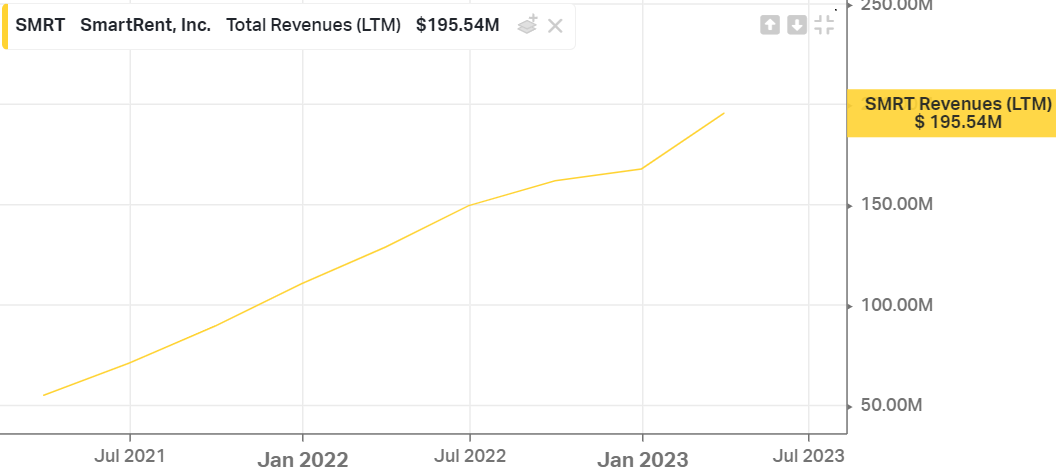

$SMRT

An interesting idea from a great fund letter, archived here

Here’s a funny bit from the letter:

On the recent Kroger conference call, the CEO mentioned AI eight times. Mind you this is a supermarket chain, and there was zero mention of AI on their previous call.

Now on SmartRent $SMRT:

SmartRent is the leading smart home technology company focused on rental housing in the U.S. Multifamily owners and operators love their products which include smart access keyless entry, water leak detection and smart thermostats/climate control. They also offer self-guided tours for prospective tenants to see units, resident and staff management software and parking flow optimization.

Haldeman [the CEO] owns $15 million of SMRT stock, ranking him as the company’s largest shareholder.

Over the past five years SMRT has attracted the top multi-family operators in the country as customers, including the top seven apartment REITs.

EV/Sales ~ 3.0; slightly above my strike zone.

But revenue have 4x in 2 years!!

Now I need to understand what’s going on with the gross profit margin:

Hmm wait a minute…EV/GP ~ 38.4 according to Koyfin?! Can’t be right…I need to investigate.

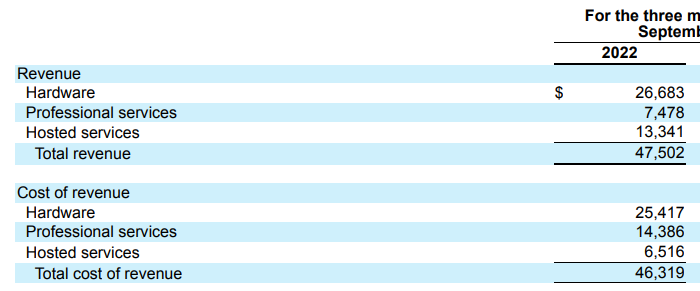

Here’s a screenshot of the 2022Q3 income statement:

Most of the revenue comes from the hardware sales, which have razor thin margins. Professional services have negative margins. Hosted services have nice gross margins (around 50%). So it looks like the company is willing to run the hardware and professional lines at a loss to grow the hosted services.

Indeed, hosted services are growing very fast ($34,068 in 2022 vs $12,172 in 2021).

The gross margin for this segment was even better in 2023Q1 (61%) on ~15M revenue (almost half of 2022 revenue in a single quarter).

Hosted services represented 23% of revenue in the quarter. Assuming they hit their forecasted revenue of $240M for 2023, that would be $55M of revenue and $28M in gross profit for that segment (assuming same % of total revenue and 50% gross margin).

Enterprise value is $581M.

I think it’s too expensive for me right now.

$INTRUM

EV/EBIT ~ 10.5 FCF/EV ~ 9%

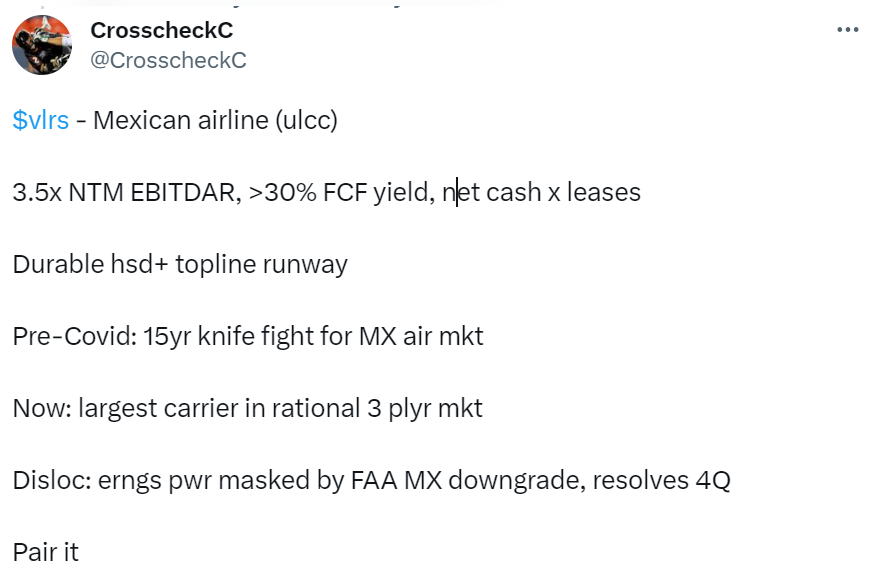

$VLRS

(tweet)

FCF/EV ~ 14% !!

Volaris Corporate Presentation May 2023

UK Stocks

$TBLD.L $WISE.L $DBOX.L $COM.L $FUTR.L $SUP.L $GMS.L $BLTG.L $DUKE.L $WOSG.L

Rapid fire:

-

$TBLD.L: US$30M MC, $1.45M EV?! Good thread here. CEO has skin in the game. It was a fantastic buy 5 days ago (up 17% yesterday). I wasn’t paying attention, a big miss on my part. Could still be a great buy. There was a trading update that caused a huge drop on June 29th. Most likely an overreaction. Interesting.

-

$DBOX.L: a digital media business. I can’t understand or build conviction in these. PASS.

-

$COM.L: Restaurant owner & operator (Comptoir Libanais) in the UK. 26 restaurants, 6 of which are franchised. I’m not impressed by the growth and the profitability profiles. PASS.

-

$FUTR.L: a US$1.2B MC; an international multimedia company owning brands such as TechRadar, PC Gamer, Tom’s Guide, Tom’s Hardware, Marie Claire, GamesRadar+, etc. See Wikipedia page. Historical ROIC has been choppy. Share dilution has been extreme, up 440% since 2016. PASS.

-

$SUP.L: Europe’s leading Manufacturer, Brand Owner & Distributor of fast-moving staple products. So many different products, it’s hard to tell where they’ll be 10 years from now. PASS.

-

$GMS.L: another one that I wish I had discovered 5 days (or 5 weeks) ago. GMS operates a modern fleet of highly versatile self-propelled lift boats, across international markets, primarily for the offshore oil, gas and renewable energy sectors. Would have been a cool trade. PASS.

-

$BLTG.L: provides data erasure and mobile lifecycle solutions; pretty horrible track historical business track record to be honest. PASS.

-

$DUKE.L: investment firm specializing in royalty financing, focusing on intellectual property assets and stable, cash flowing businesses with positive EBITDA. Meh. PASS.

-

$WOSG.L: looks like a very good business (numbers-wise). Once again…it has gained 20% in the last few days. Very annoying. Interesting.

-

$SAFE.L: same as $WSOG.L, numbers look OK-ish. Nothing that grabs me though. PASS.

In the end, none of these is qualifies for an immediate buy for me.

However, today I stumbled on a really good candidate $SOM.L:

Once again, what a buy it would have been 10 days ago!

I might wait for a pullback and learn more about the business in the mean time.

Here’s a writeup from 2020: link, archived here.

-

$AJB.L: Whoa, the numbers here look fantastic. It’s one of the UK’s largest investment platforms. I need to know more about this business. But why has the stock price barely moved in the past 5 years? The P/B is very high at 9x. Interesting.

-

$FAN.L: Volution Group plc…why do I feel like I’ve heard that name before? Anyway, the numbers here look good too, but the returns are not as good as $AJB.L. PASS.

$AAF.L

Turns out the most interesting UK stock I’ve found so far came from a YAVB podcast: YouTube clip.

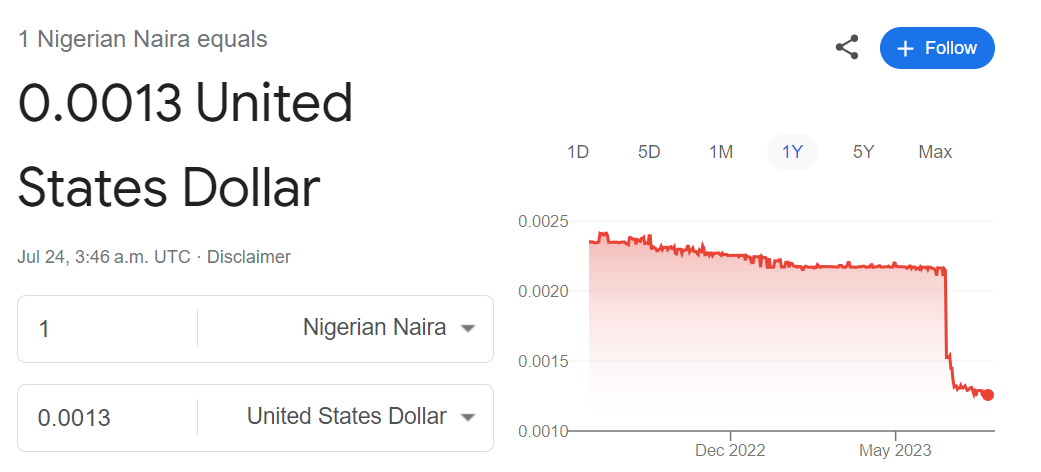

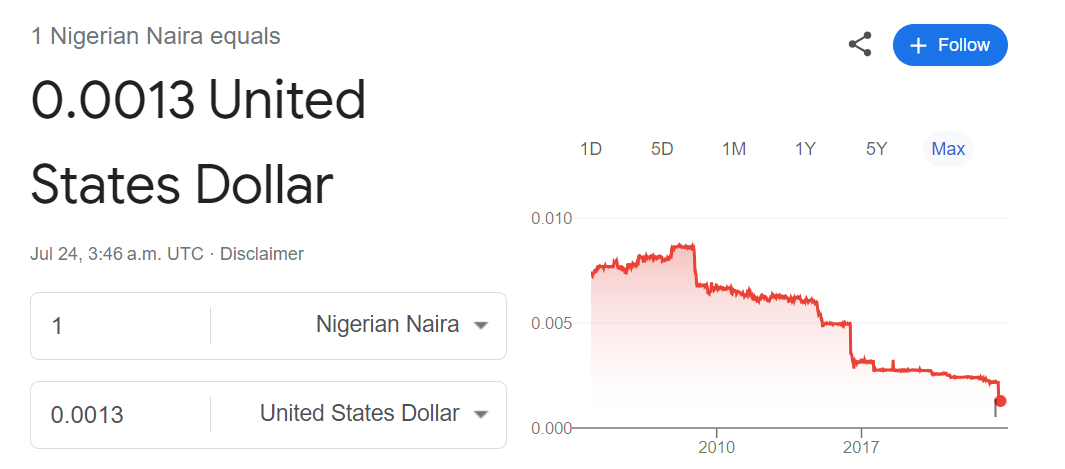

It’s Airtel Africa, a telecom operator in Africa. I’ve been looking for an intelligent way to invest in Africa for some time, but due to the currency exchange risk (on top of the political one), I had not been able to.

For example, I had looked at $MTN before, but once you convert their revenue to USD, it’s not that enticing.

$AAF.L however has been able to grow at a low double-digit CAGR. Valuation-wise, it’s currently trading under 6x EV/EBIT and 16% FCF/EV yield.

Aside from the interview linked above, I’ve also printed the following write-ups from SA:

I think Africa has the strongest and longest demographic tailwind in the world, and I’m interest to ride that tailwind.

On the other hand, I remember Buffett at some point in the past (in 2003 actually, here’s the clip) saying that he wouldn’t be interested in Telecom stocks because he couldn’t understand the competitive dynamics (and he couldn’t predict who’d be able to come out on top).

However he did buy a stake in 2020…only to sell out not long after. And Verizon is a much shittier company than Airtel (growth and margin wise).

There was another telecom company I was looking at a few months ago, $TIGO Millicom International Cellular. I never pulled the trigger, as the valuation seemed OK not great. It currently trades around 12x EV/EBIT and 4% FCF/EV yield. I think there is (or at least was) a tie with Airtel where Tigo sold Airtel their African business, something like that.

Another cool writeup from Wesley Chambers: link.

Is this a buy & hold stock? Maybe not. Should it give decent returns over the next 5 years? I think there’s a decent chance.

On the currency exchange risk, it is not just theoretical. Here’s a pretty lengthy and detailed rundown of the impact on revenue & earnings from a recent devaluation of the Nigerian Naira (found on stock investing forum):

Here are some thoughts on the Naira issue - I have shared things as best I understand them, but I may be incorrect on some of the issues.Airtel Africa earn money in Nigeria in the local currency: Naira. They then report that profit in USD in their annual report: so when the Naira depreciates by e.g. 20% vs the USD, their USD profit in Nigeria will decrease by 20% also - but this size of this effect depends on the exchange rate in effect on the balance sheet date. In the last annual report for the year ending March 2023, operating profits from Nigeria were $719M.

If we assume that earnings remain constant in Naira (Nigeria earnings are actually growing at 20% per year in constant currency) then for example, a 30% Naira depreciation would also lead to a 30% reduction in reported USD operating profits, or $719*30% = $216M lower. However, since Nigeria is only one part of Airtel’s business, the overall Airtel Africa reported profits would decrease less than this. Airtel Africa Mar-2023 reported operating profits were $1759M, so if we assume that Airtel’s overall earnings remain flat Year on year (they are actually growing 20%-30%), the reduction in operating profits would be 216/1759 = 12%. Airtel’s margins don’t change, since the ratio between revenues, costs and profits does not change when the Naira depreciates - because as revenues when converted to USD reduce, so do costs by the same percentage, so the percentage of profit remains the same.

However, there is also the value of the assets held in Nigeria, which is also affected by the exchange rate, e.g. their cash, debt and tangible assets. Airtel Africa has been shifting its debt to its subsidiaries, moving it from US dollar debt to local currency debt, because then when the local currency depreciates, their debt becomes worth less in USD. So in summary, the final impact to Airtel Africa of the Naira depreciation, will be a combination of 1) changes in the value of their Nigerian earnings in USD, and 2) the USD value of their assets and liabilities in Nigeria. A final factor to consider is whether Airtel is moving money out of Nigeria into USD, and when it does this (therefore what rate it achieves). In the past, it has been difficult for Airtel to take money out of Nigeria since US dollars were scarce at the official rate (because people could sell them at the unofficial rate and get more Naira for them), but now it should be much easier to move money out of Nigeria since there is no difference between the official and unofficial rates - it’s just that less USD will be obtained for the Naira when sold.

I do not know what the Naira will do before the end of FY 23/24 in Mar-24 - except that it will probably stabilise a new level lower than it was in Mar-23. The difference will affect the reported earnings of Airtel Africa. Nigeria grew 20% in FY22/23 in constant currency, so if Airtel Nigeria repeats the same growth in FY23/24, there can be a 20% depreciation in the Naira to achieve the same earnings for Airtel as 22/23.

For more context, here’s a chart of the USD/NAIRA exchange rate:

It’s not the 1st time that something like this happens either:

This stuff has stopped me in my tracks.

$ENX.PA

Oakmark Funds have initiated a position in Euronext, see short into here.

There’s also a writeup in this substack, archived here.

$ESON.LS

Market cap is €90M. EV is €-8.4M.

Float is 1.082m shares, out of 11.993m outstanding (9%).

For the year 2022 (see annual statements here):

- cashflow from operations was €56.4m. Total capex was €112K. Cash and cash equivalents at the end of the year: €112.7m. No debt.

- revenue: €208.9m

- operating income: €43.1m

- EPS (diluted): €2.75

Current share price: around €8

Not clear to me whether it pays a dividend. Approved share buyback of up to 10% of the share capital.

I can’t buy it on IBKR (restricted trading). Can’t find it on Questrade.

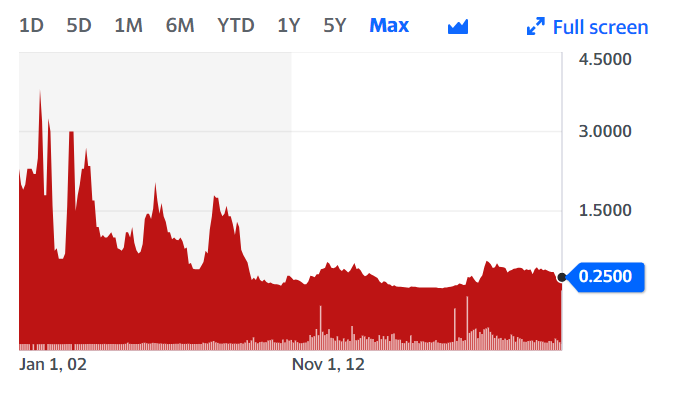

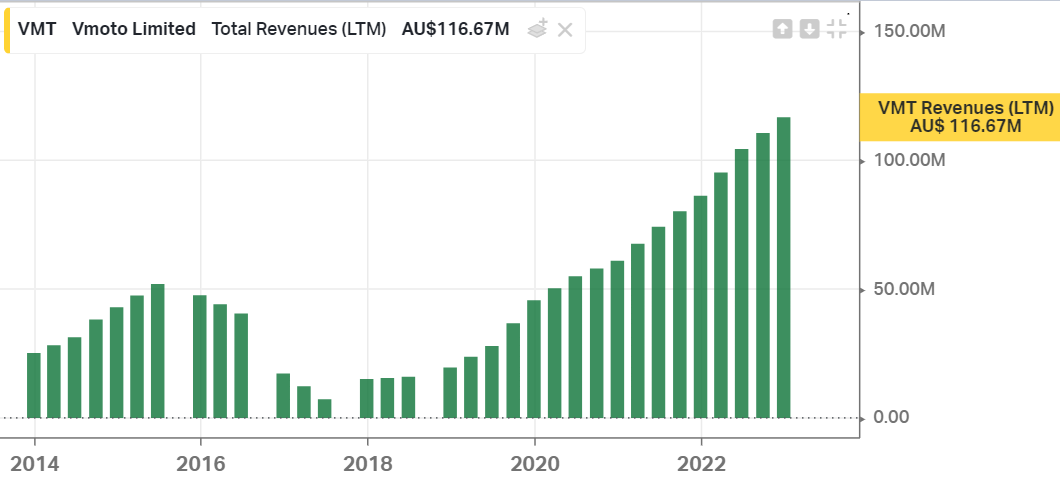

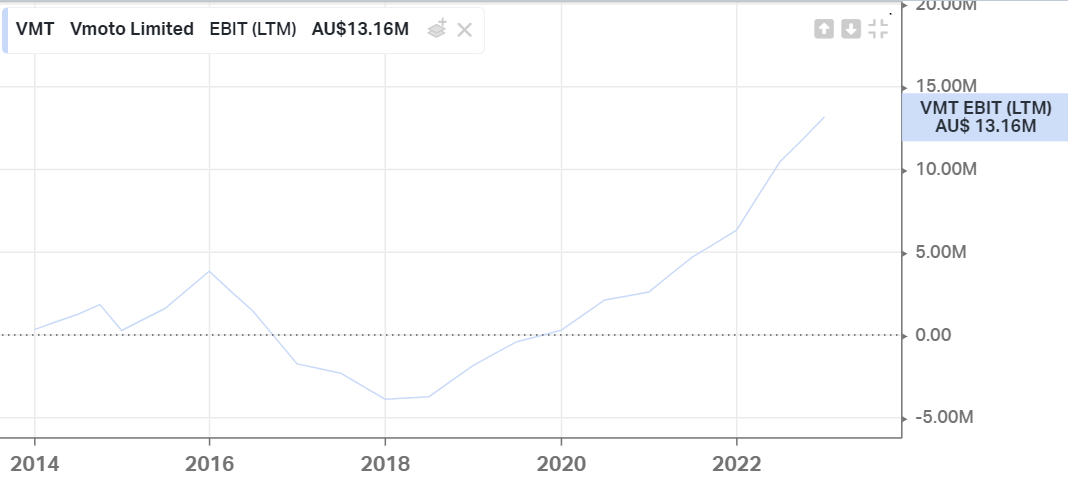

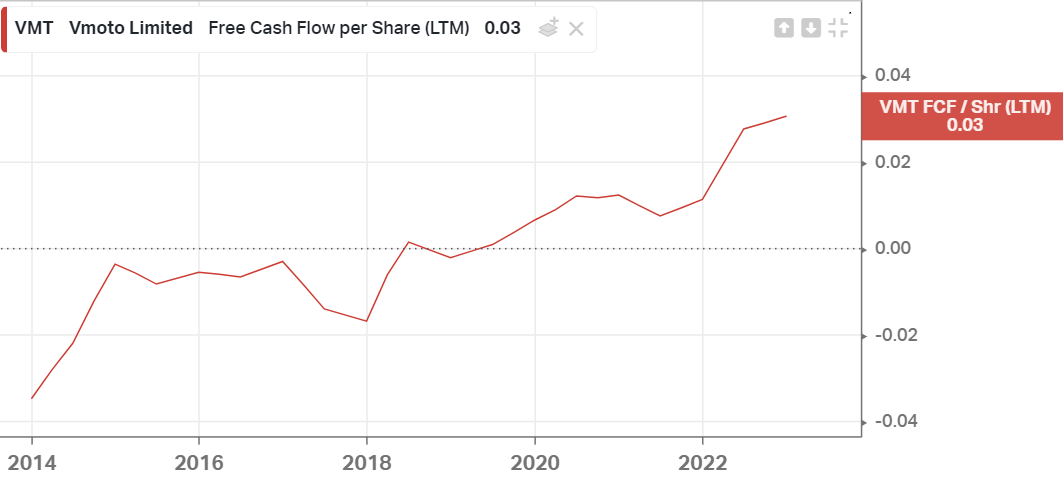

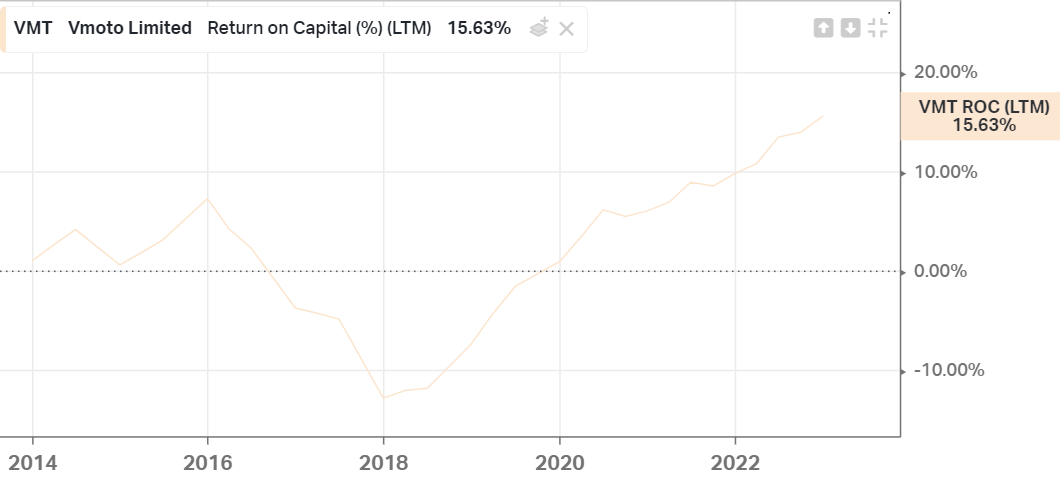

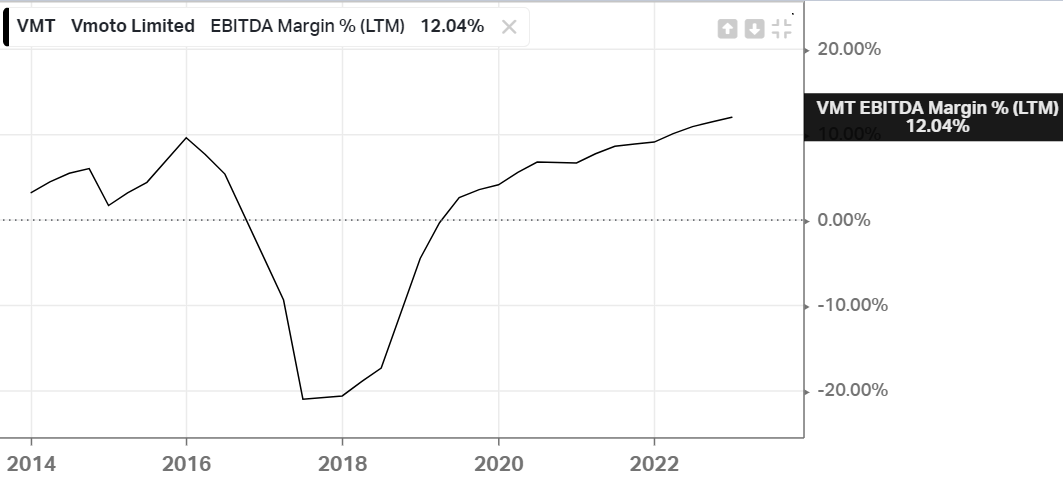

$VMT.AX

Vmoto limited. Manufacturer and distributor of electric motorcycles, based in Perth, Australia.

MC: AU$74M. EV: AU$36M.

Sales ttm: AU$116.

GrossMargin: 28%.

EV/EBIT: 3.5x. FCF/EV: 18%. P/B: 1.3x.

5-year price chart:

Full history price chart:

CEO Yi Ting (also known as Charles) Chen owns 12%. AU$1.2M salary. 11y tenure.

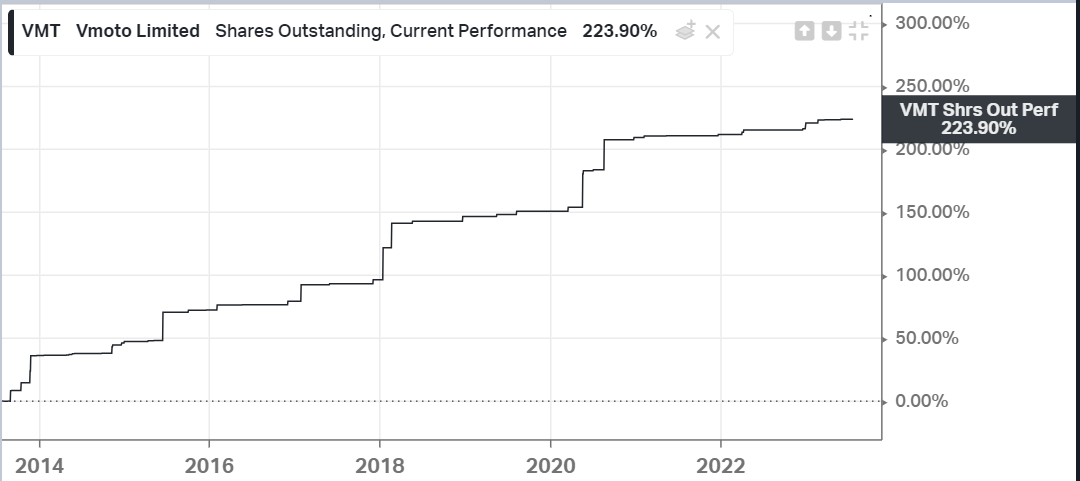

Less pretty:

Share dilution is a problem with this stock, and there’s a significant amount of options waiting to be exercised (see the writeup below).

Finally, a quality writeup from Nick Maxwell’s substack, archived here.

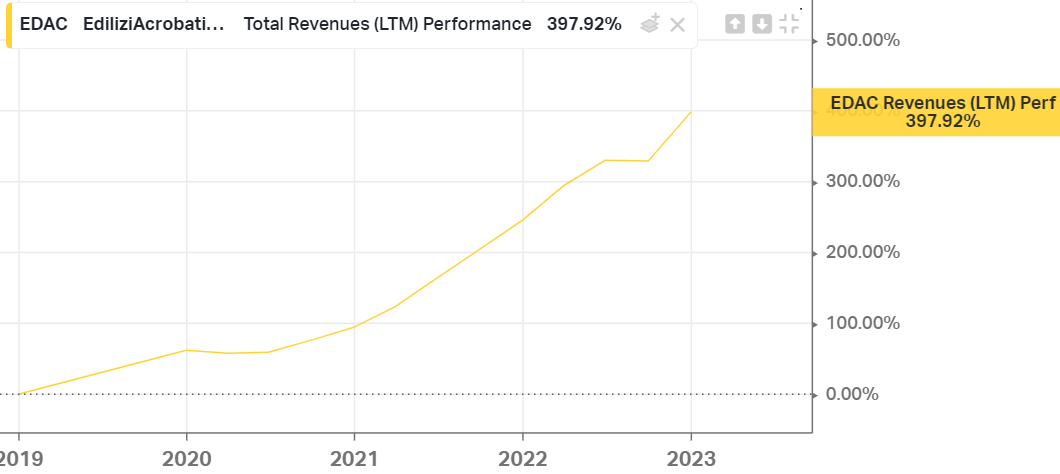

$EDAC.MI

Good looking charts:

A writeup: link

A bearish point of view from @capital_rainbow: “I am invested. Past CAGR of sales is not expectable in the future, though. How do you see sales and earnings in the future with the ending Italien ecobonus?”

Note: he has an interesting blog here.

$THEP.PA

A very solid company at a decent price (EV/EBIT ~ 9.7x). Free cash flow not looking awesome though, because of growing net working capital.

A detailed deep dive (in French): YouTube clip.

Compared to another French darlking (Robertet SA $RBT.PA) it has similar (if not better) growth but trades cheaper.

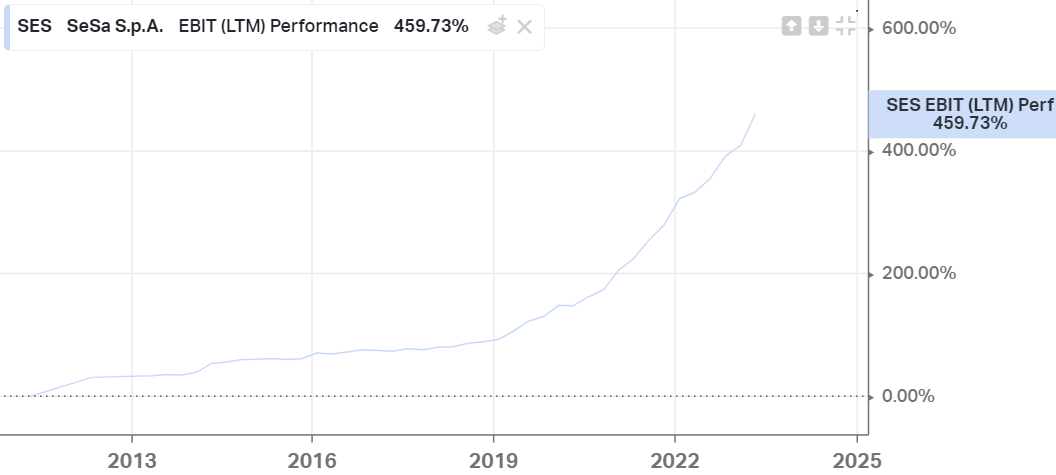

$SES.MI

EV/EBIT: 11x, FCF/EV: 6%

$TMV.DE

TeamViewer. Explosive revenues. Decreasing shares outstanding.

EV/EBIT: 20x; FCF/EV: 7%.

P/B: 22x!!

Debt/Equity: 439%!!

$RBL.AX

I don’t know who is bidding this up all of a sudden or why, but it is absolutely unreal that it is happening the day JUST AFTER I decided to look at it.

I didn’t instantly pull the trigger. Maybe I should have? I mean I just wanted one day to think it over 😅. Apparently that’s too slow.

So now it ran up 18%…then 25% the following day! What am I supposed to do now?! I know it’s still cheap, but this is so annoying. I’m not gonna buy after a 50% rally…

$PLUS.L

I’m tempted to invest here based on the numbers only. QuickFS is showing me EV/FCF ~ 1.2.

Koyfin is showing me -20% shares outstanding in the last 2 years, and $900M of cash (no debt).

WTF is going here?!

I found this stock while searching for $IGG.L on twitter. They have similar products (online trading).

Listening now to their latest earnings call, I appreciate the CEO spending time talking through the capital allocation strategy.

They’ve been buying back shares on the market. The share buyback program (purchase a total of up to $70.0 million of the Company’s shares, or ~5% of market cap) was announced on February 14th, 2023.

Dividend yield is around 4.6%.

So I’m getting an immediate yield of almost 10%.

On the other hand, found this on the lse.co.uk forum:

Turns out, in May 2023, 13k shares were gifted to the Chair of the Board, Jacob A. Frenkel:

In December 2022, the company issued 389K shares form the treasury for RSUs and other bonus payments. For context, as of July 27th 2023, the company held 32.7m shares in treasury and since Dec 2022, shares outstanding went from 93.3m down to 82.1m.

The CEO enjoys a fat salary (US$4m/year) and only owns 0.1% (~ US$1.5m, i.e. peanuts). That’s a bummer! The CFO owns a bit more (0.39% or $4.8m). And according to Simply WallSt, insider buying is pretty weak as well.

By the way, it’s not much better over at $IGG.L, the insider ownership is laughable.

Disqus comments are disabled.