#95 - Ramblings Aug2023

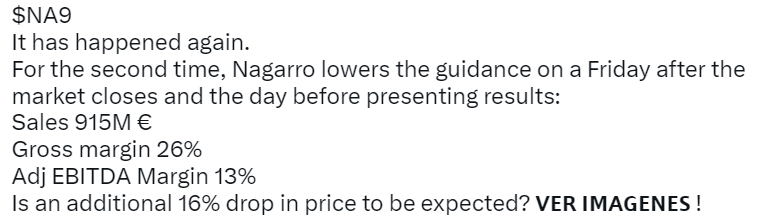

Last updated: Apr 30, 2024

Source: link

Source: link

It gets better:

Potential answera from reddit:

![ts][/images/ts2.png]

This game is not for me.

His reddit post on Sep 8, 2019: link.

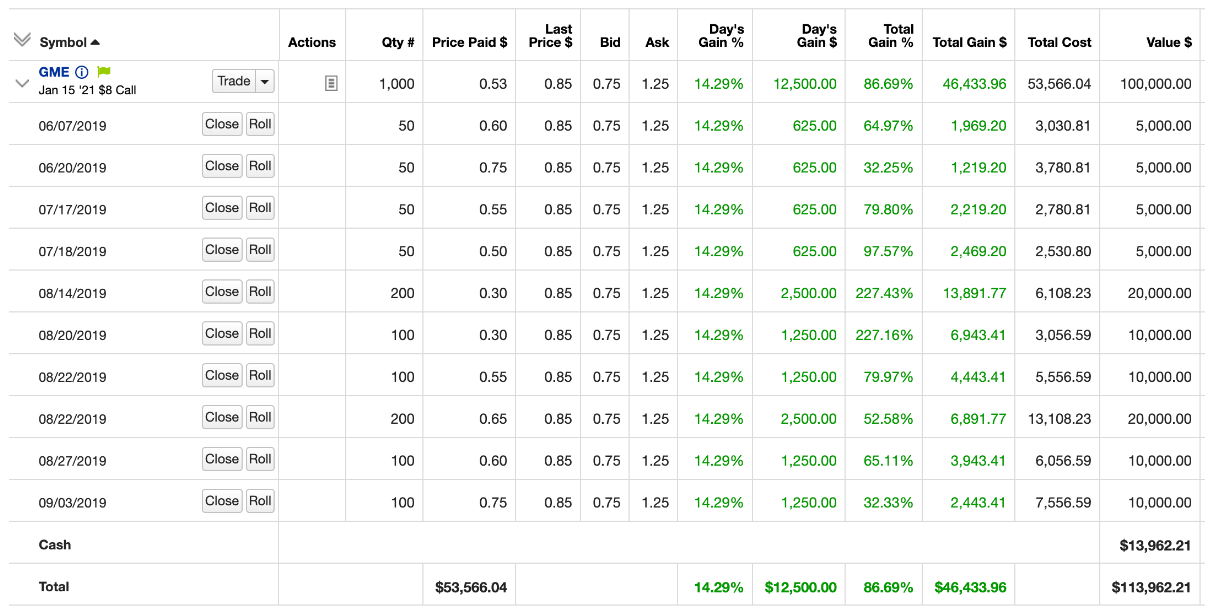

He (Keith Gill) bought a total of $53K worth of options between June 6, 2019 and September 3, 2019. All of them at $8 strike price, Jan 15 ‘21 expiration. And he was already up 87% by Sep 8th.

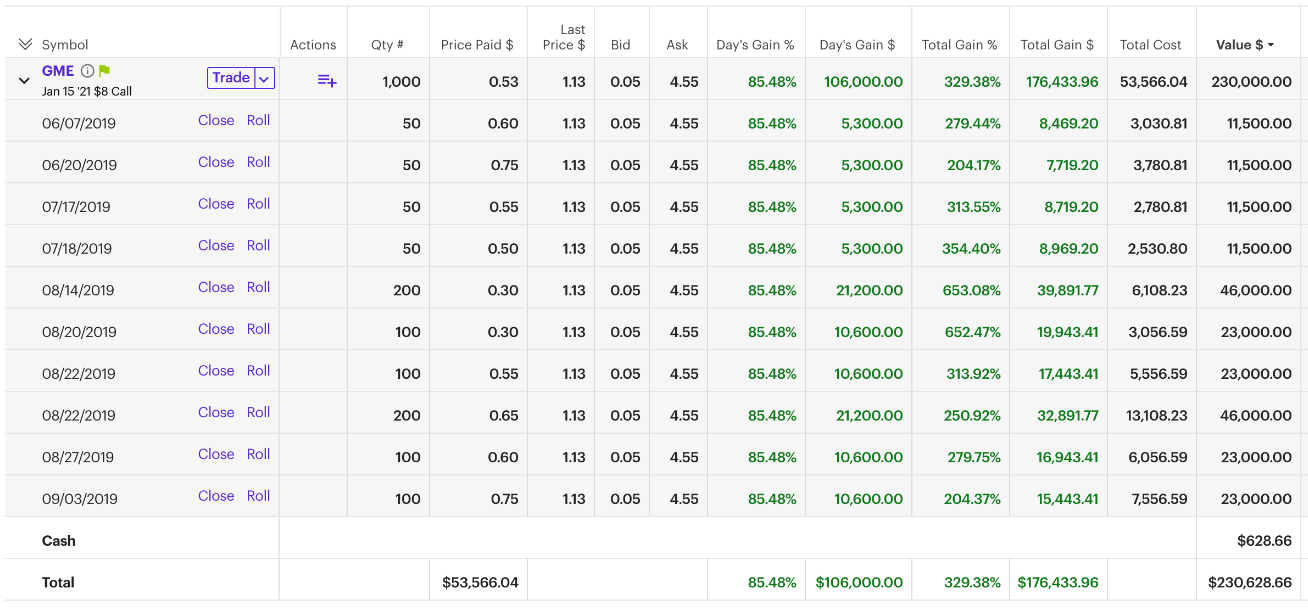

By November 2019 (end of month), he was up 329%.

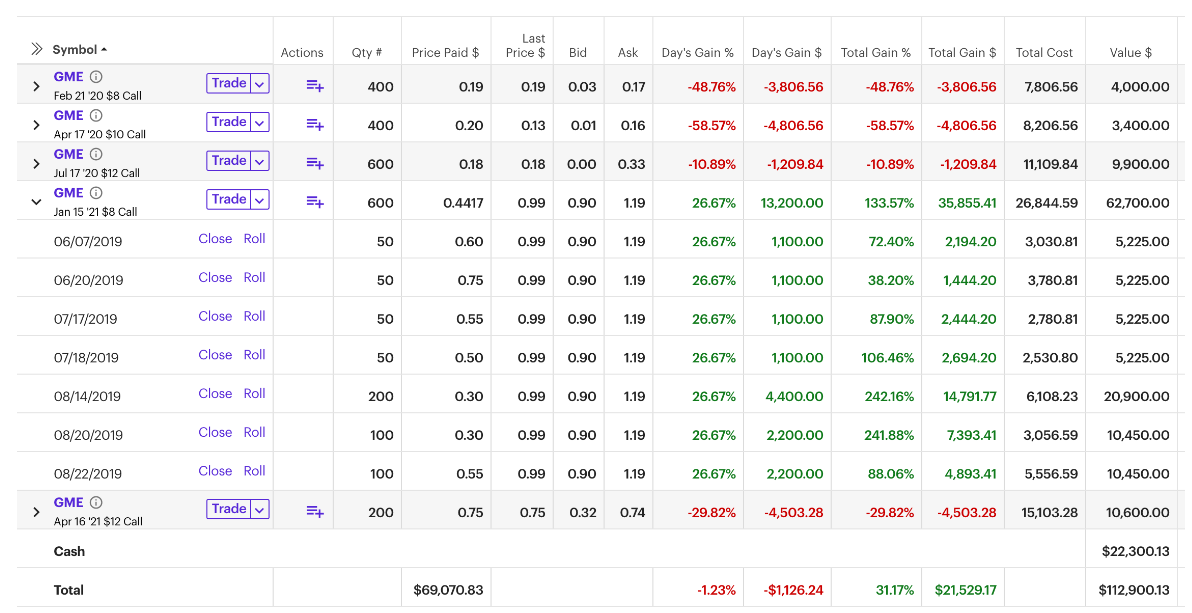

He bought a bit more in December 2019, after the Q3 earnings report. Then shortly after, he he doubled down by selling 400 of the options expiring Jan ‘21 and buying 1400 options expiring in 2020 February, April and July, with strike prices $8, $10 and $12.

Because of the 8-to-1 stocksplit that occurred on July 22nd 2022, $8 strike price is equivalent to $1 adjusted price.

Here’s the price chart for GME between June 2019 and June 2020:

Very, very close…

I think he added 200 very short-term and very cheap $7 calls for Jan 17 ‘20, not sure he made money with those.

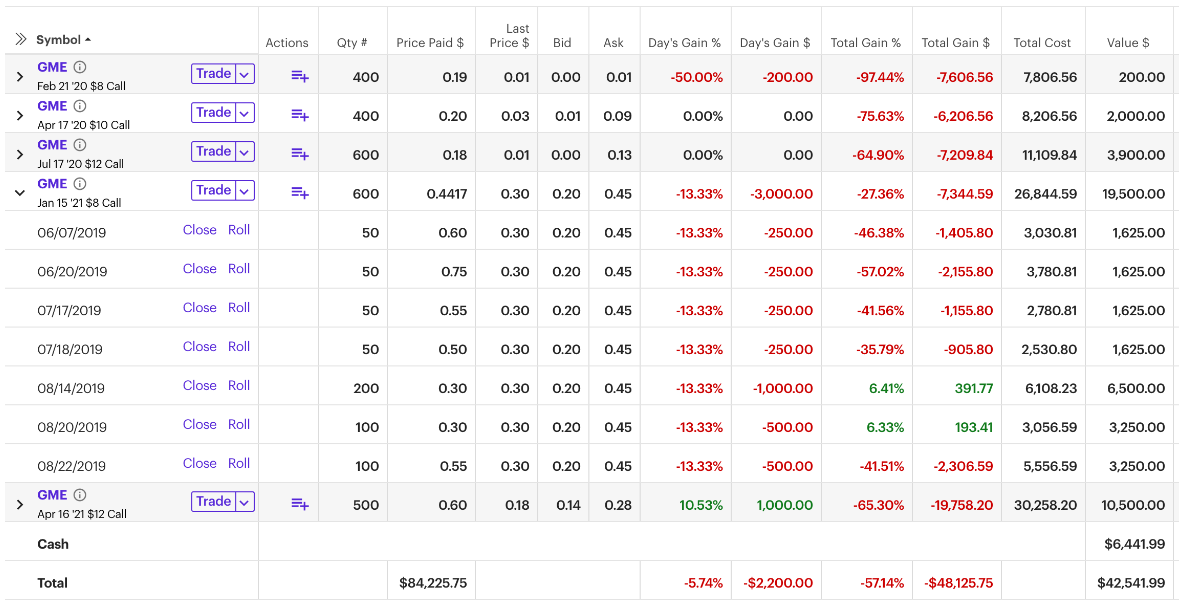

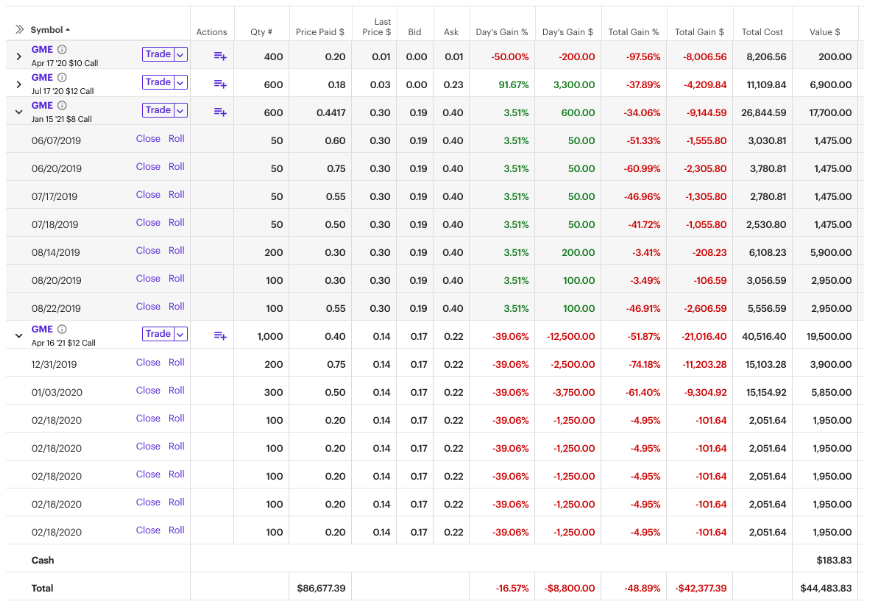

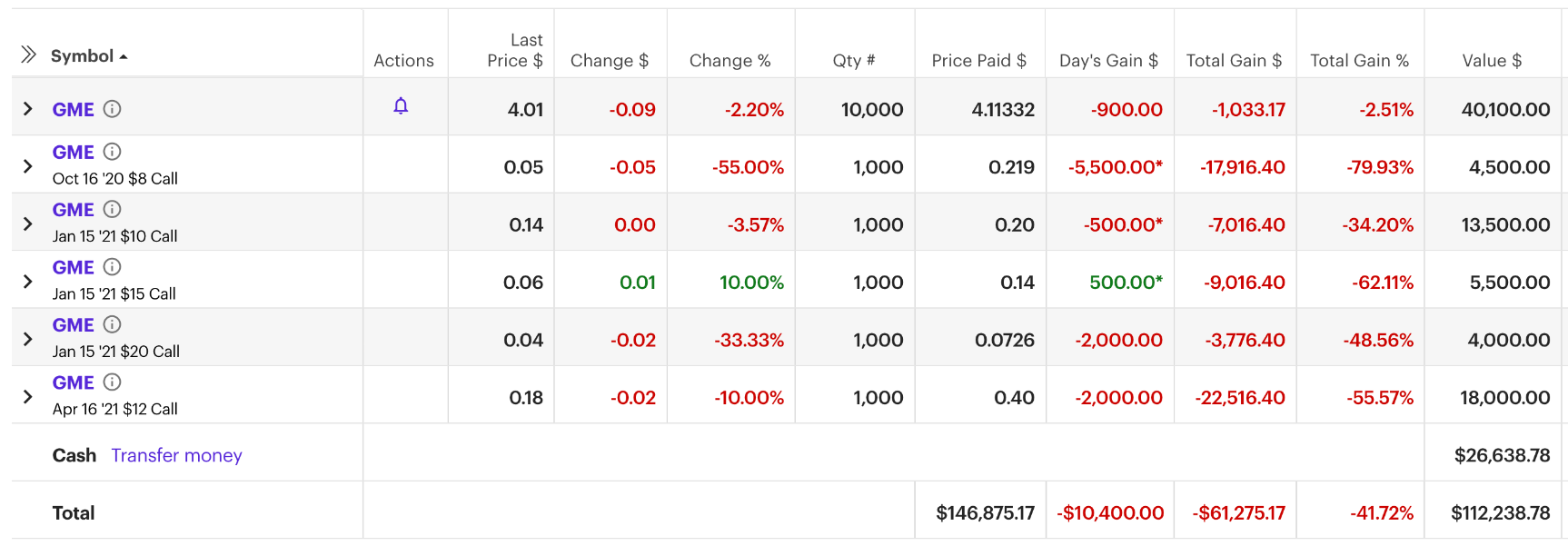

By end of January, he was down 57% on the remaining contracts, having invested $84K total:

I don’t know if the Feb ‘20 calls were profitable. During February, he bought 1000 Apr ‘21 calls for a total cost of $40K and he was down 51% on those by end of month!

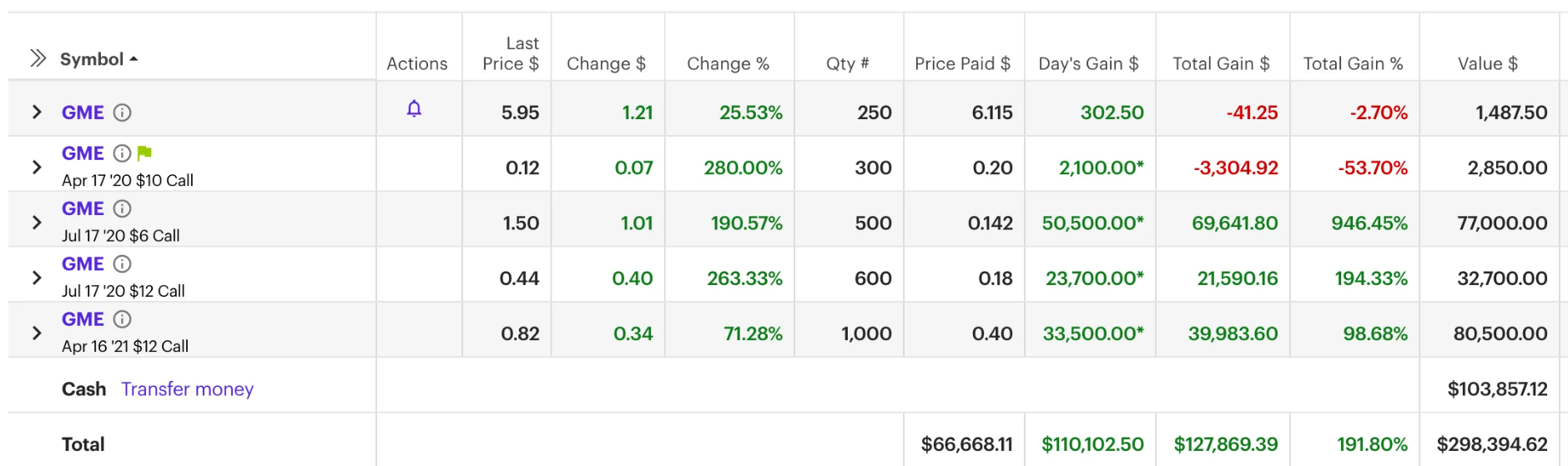

Then in March and April ‘20, I think he took profits from the Jan ‘21 calls following the price spike in the second half of the month. And he rebought some super short-term calls for July ‘20 (strike prices $6 and $12) for a totak of $18K. Initially he was up BIG on these:

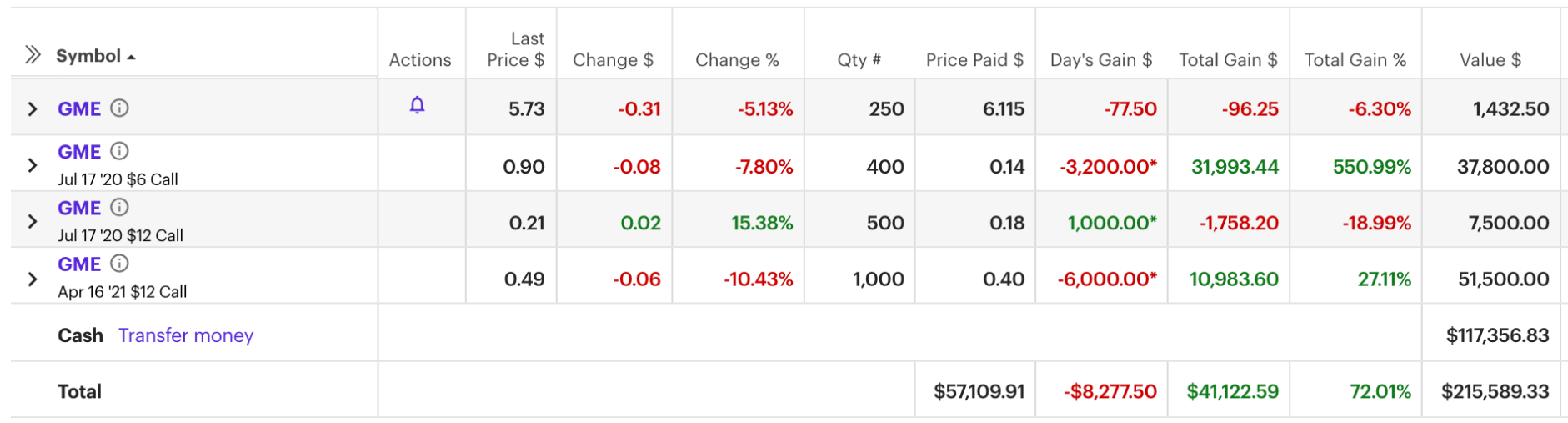

But by the end of April, they had given up a lot already:

By end of May, the price of the stock was not cooperating and he was in the red:

It kept getting worse until the end of July ‘20.

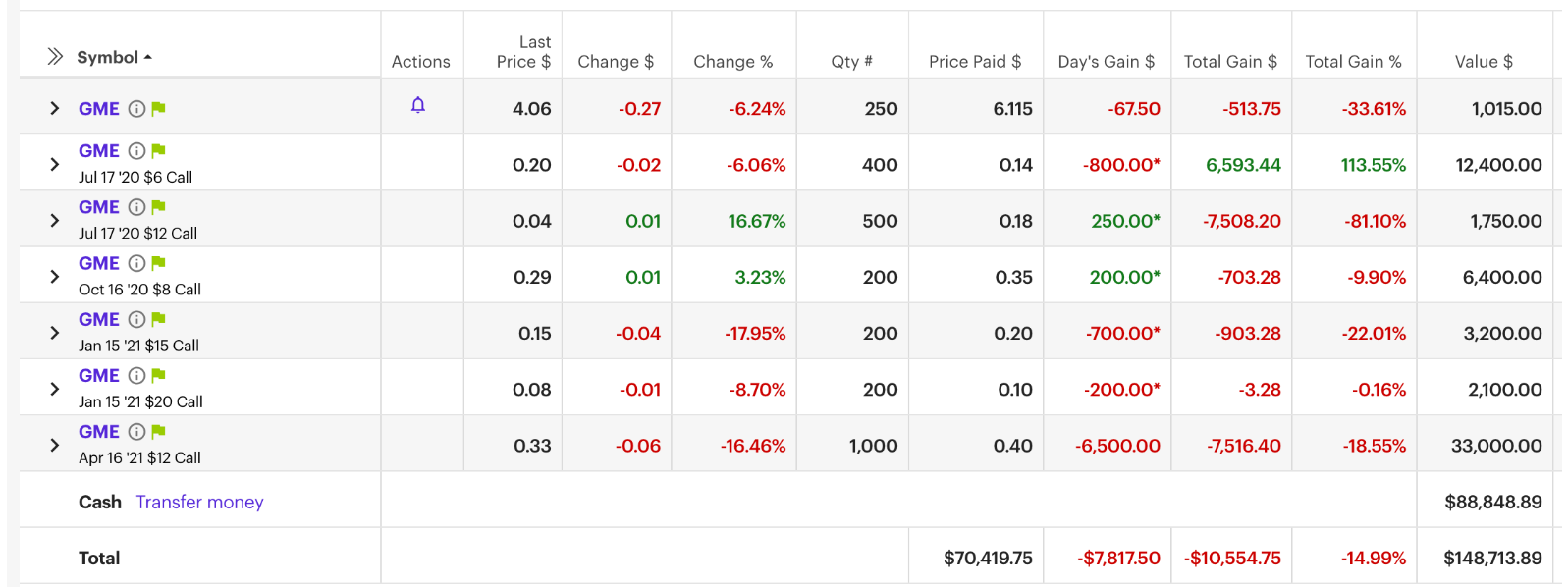

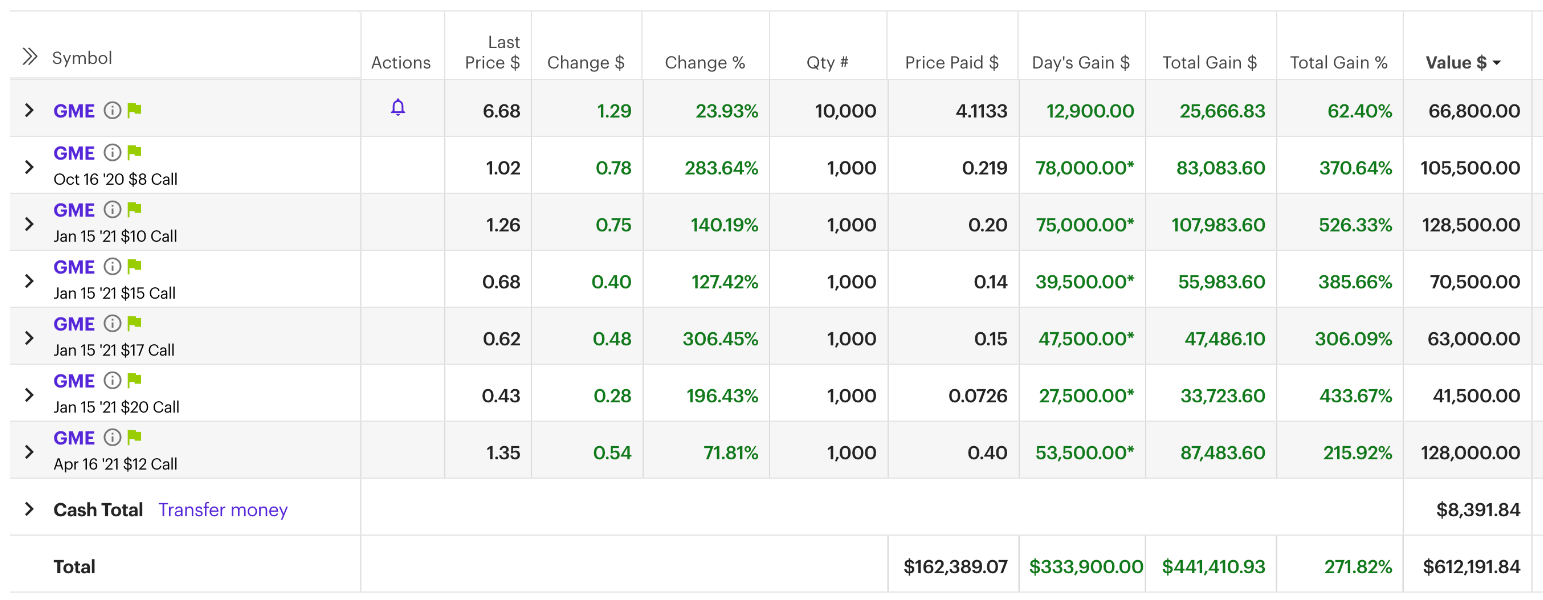

He then doubled down on the options and also bought 10K shares during this month:

Then in August ‘20, the fun part begun:

Here’s his 5-hour long live stream of Sep 21 ‘20: YouTube link.

From there, the gains reached:

- $1M in Sep ‘20

- $2M in October but back down to $900K before end of month

- up again to $2M in November ‘20

- down again to $1M in December ‘20 but up to $2M again by end of month

- back down to $880K on Jan 5 ‘21 most of it from the 1000 calls for Apr ‘21 at $12

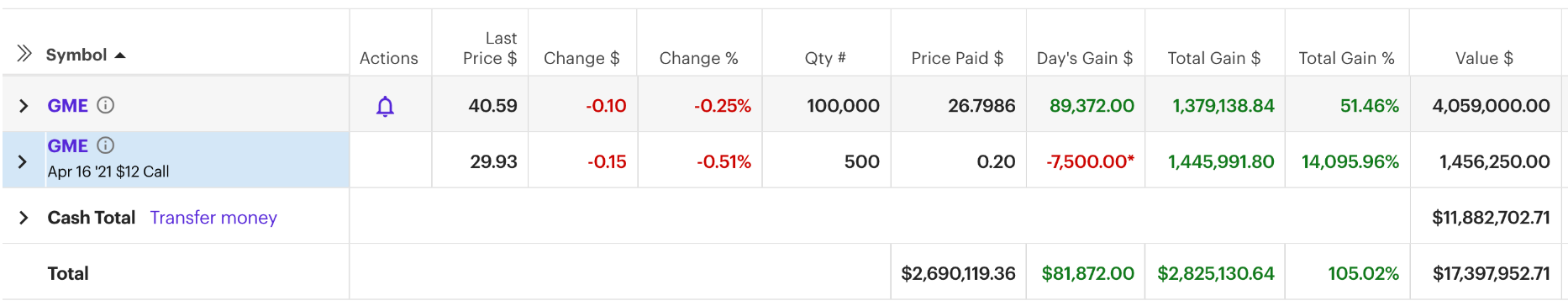

On January 5, things got really serious. By then he had quintupled his number of GME shares to 50K and the total invested amount was close to $800K. He did that by selling half of his Jan 15 ‘21 $10 calls (for a $430K prodit) and exercising the other half.

Then we entered crazy mode. From January 11th onwards, he was posting updates every couple of days.

On Jan 13, total gains reached $3,8M. The Jan 15 ‘21 $20 calls were in the money big time ($1.1M profit) and he sold those.

Jan 22: $7,7M (exlcuding the $1.1M above). This is the data of his last YouTube live.

Jan 26: $17M

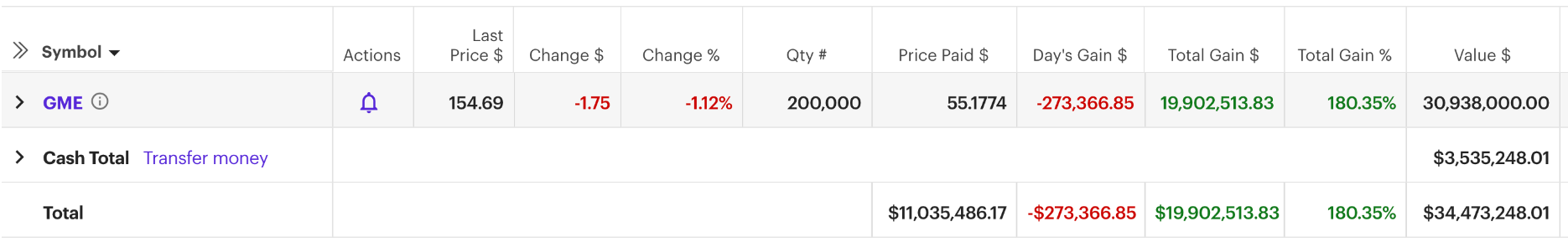

Jan 27: $33M. Half from the April options, half from the shares. I honestly don’t know why he didn’t sell then.

Feb 19: back down to $2,8M.

It kept bouncing around from there. Final tally after exercising the April options: $20M profit. I think he even purchased an additional 50K shares outright. Crazy dude!

For a recap of the entire story, this Medium article is good (archived here).

Link.

Tickers mentioned: $FXPO $TRT $MAD $9776.T $ZBRA $ESPR $GCT $SGMA $8371.HK $ACIC $HIHO $EDAC $RELL $ASHM $LPE $CPRT $SL $ONEW $CDON $690D $MEDI $CARD $MDU $ZM

Source from the company’s website: How we work

I just need to get it out of my chest.

I hate that I didn’t know about $CELH in 2020.

I hate that I wasn’t looking for 0.2 P/B stocks in 2022.

I hate that I missed $CDLX in 2023.

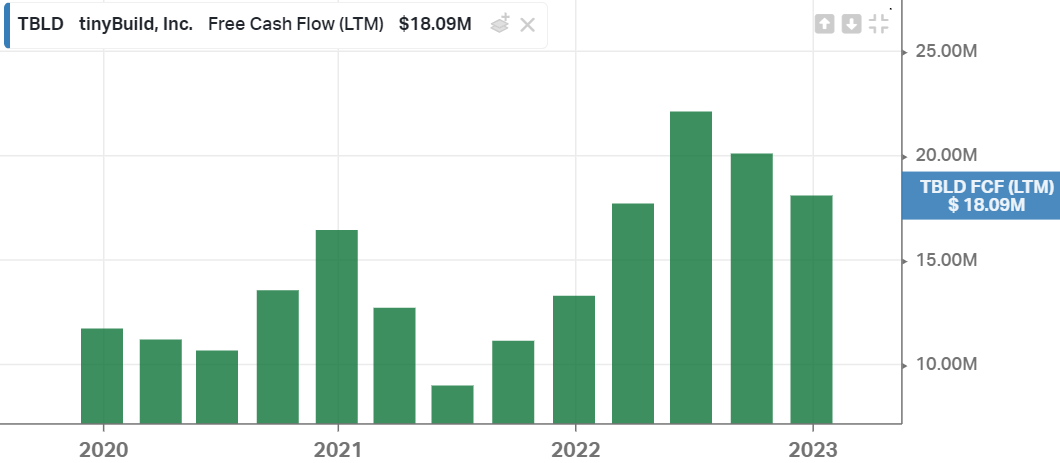

I hate that I haven’t bought $TBLD.L (8Z3.F) yet - that’s the only one I can still do something about. EDIT: I did do something about it and bought what I could - a small position now.

I need to be careful here. I’ve accumulated several “mistakes” if I can call them that. $UIHC was +13% when I looked and passed on it this morning - it is now +27%. I’m in the danger zone psychologically. Sleep has been very bad too.

From Rolling Stone magazine, archived here.

He knew the relief plan would be irresistible to scam artists and especially tempting to organized transnational criminal groups. “As soon as the CARES money was announced, we started seeing squawking on the dark web, criminal groups in China, Nigeria, Romania, and Russia — they see our systems are open,” Talcove says. He estimates that “the United States government is the single largest funder of cybersecurity fraud in the world.”

I mention Immersion Investments’ 3Q2023 letter below. Here’s an interview of David Polansky, co-founder and managing partner.

I like his framework where he categorizes stocks into:

- Underdog

- Babushka Doll

- Social Pariah

- Ugly Duckling

- Doubted Champion

Found on SeekingAlpha, archived here.

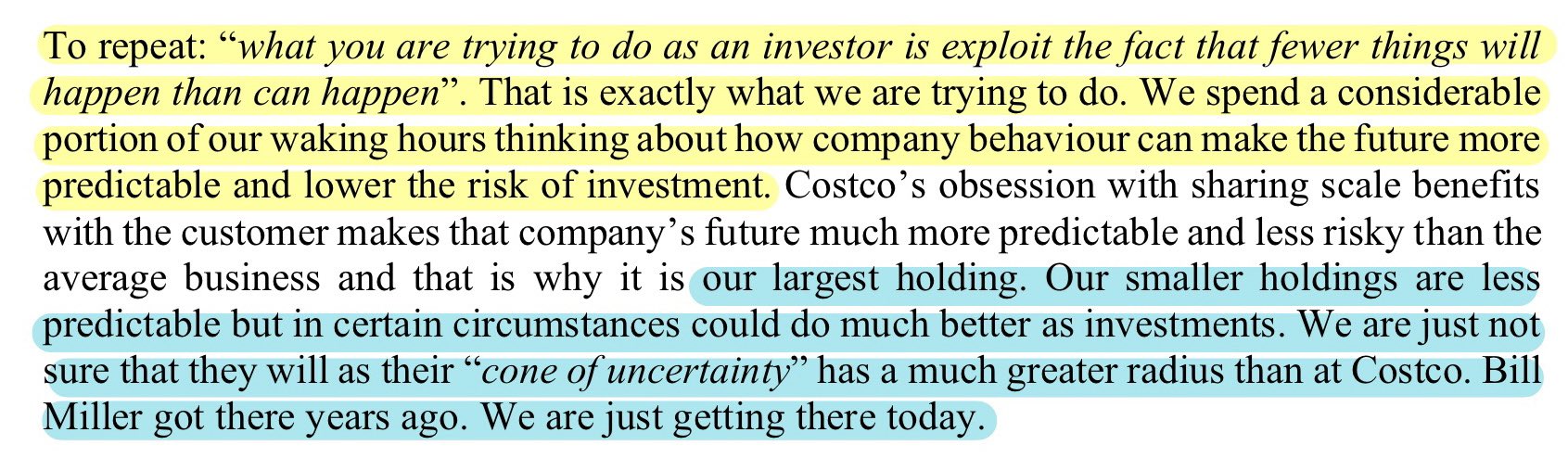

My favorite excerpts:

Warren Buffett in his 2022 annual letter to Berkshire Hathaway shareholders wrote that over Berkshire’s 60 years, about a dozen investments accounted for almost all of the excess returns. The rest of his investments did not contribute much to Berkshire’s returns as a group. **That’s one investment every 5 years.**

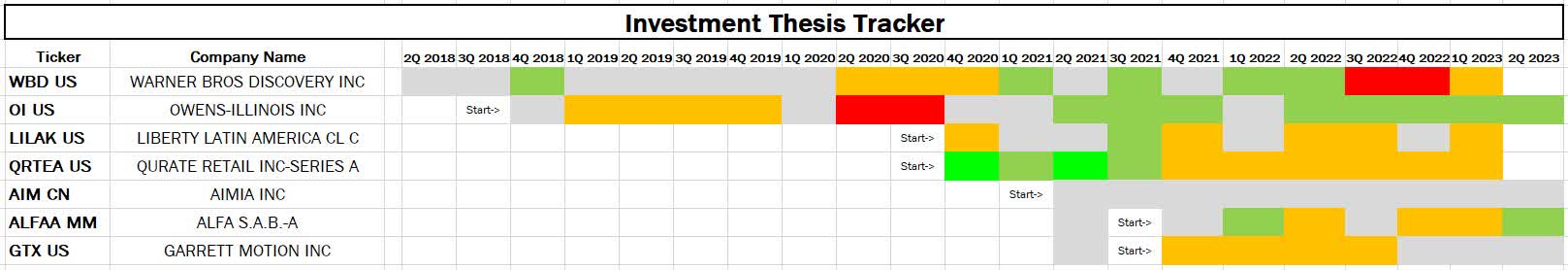

They use a system to track how their theses are evolving:

- Light Gray: thesis is tracking roughly in-line with my base case

- Orange: thesis is tracking somewhat below my base case

- Red: thesis is tracking significantly below my base case

- Dull Green: thesis is tracking somewhat better than my base case

- Bright Green: thesis is tracking significantly better than my base case

- White: No data

They also say:

The portfolio was priced at 74% of Base Case value and at 64% excluding cash at the end of Q1.

It’s a nice way to know where they stand! (that being said, their return since inception on 9/1/2016 is a crappy 7.7% before fees)

Their largest position is $OI O-I Glass.

- P/S ~ 1.0x

- P/GP ~ 5.0x

- P/B ~ 1.5x

Not sure what the thesis is over there but according to the chart above it seems to be on track.

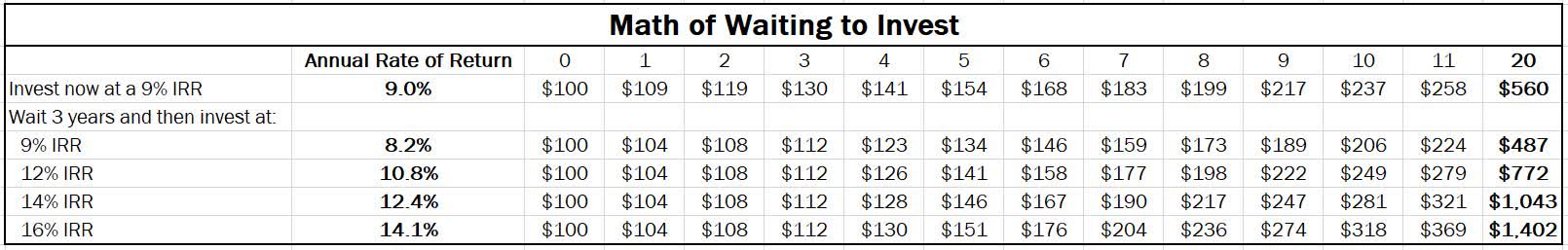

They show a very nice table describing The Math of Waiting to Invest, where you can either invest right now ay 9% forward yield, or wait 3 years (while investing in treasuries at 4%) and then invest at 9%, 12%, 14% or 16% (equiprobable).

Back to $OI:

Most recently, management raised EPS guidance for 2023 to a range of $3 to $3.50, up from previous guidance of $2.50+.

=> implied P/E of 6.5 at current price of $19.5

Here’s what I think is the most important part:

Historical balance sheet and cash flow statements aren’t representative of the current situation and the market still hasn’t caught up. Someone who doesn’t know the business and just looks at historical cash flow will see a very unrepresentative picture.

Historically the company had large asbestos-related payments which depressed its Free Cash Flow substantially. Last year the company resolved this issue by bankrupting the relevant subsidiary and settling with the plaintiffs. It has zero asbestos liability remaining and no future payments required.

Incidentally, they also own $GTX and they mention how sensitive that business would be to a global recession. I own a small piece too. Something to think about…

Finally, they mention another stock I’ve looked at in the past (negatively): $AIM.TO

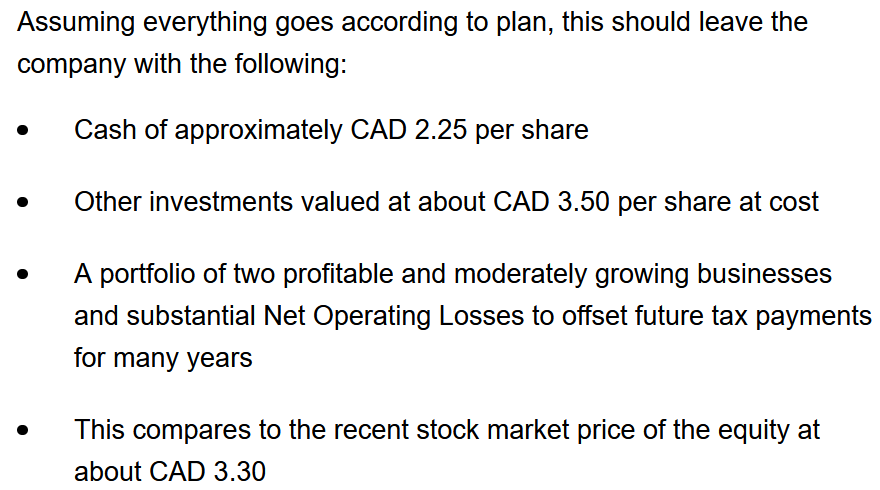

Here’s what they have to say on this one:

They mention that the recent acquisitions by Aimia’s board are less than stellar and might not work out as expected. Still, they pencil out a bear case scenario around CA$3 which is near where the stock is trading currently.

My only pushback to that is: never understimate how much value bad management can destroy.

Here’s a VIC thesis on Aimia, archived here.

Aimia’s largest shareholder is not so happy (archived here), so that could lead to something. Moe details on how it started can be found here (archive).

There’s even tension between the brothers, jeez: see here.

Yet another writeup from Superfluous Value, archived here.

OK one lsat writeup from McDonough Investments (@Jacob McDonough), archived here.

The most comprehensive writeup (compilation of posts) on Fairfax by Viking Vancouver: link.

[DELETED tweet of someone making fun of Mark Leonard flying in economy]

I vehemently disagree with the poster’s point of view (and most of the commenters).

Just this morning, I was complaining to myself about how big the book “Titan” is and how long it’s taking me to read it, but it has helped me understand (and be quite convinced of) the importance of these small details that might seem over-the-top to the casual observer.

While some of the other brewers did not fare so badly, the overall return on capital for the brewing sector declined steadily from 13 per cent in 2000 to 9 per cent in 2008.

Given all this, it may come as a surprise to some that we are overcoming our prejudice and have been increasing our exposure to the brewing sector, now owning positions in three of the four listed brewers – Heineken, Carlsberg and AB Inbev – in European portfolios, and in the other – SABMiller – in UK-only portfolios.

Taking all these things together – the emphasis on pricing, the focus on cost reduction and balance sheet efficiency – an improvement in both margins and return on capital was to be expected.

Pretty amazing website: netnets.finance.

Haven’t yet found something I like.

@TrentBlair19 mentioned it and also mentioned that he owns: $TSSI, $MPH.V, $WSTL.

From @safalniveshak to his daughters: link.

My favorite one:

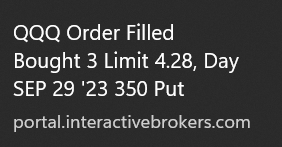

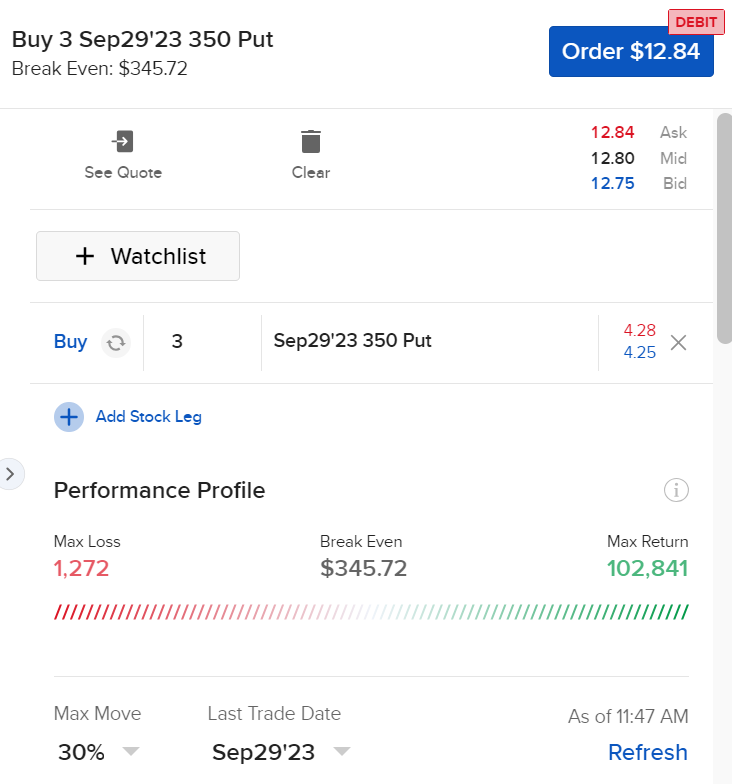

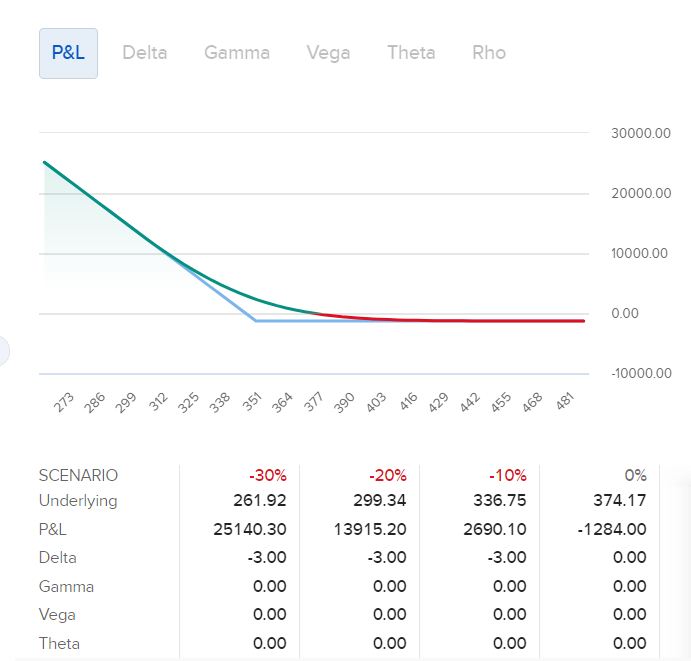

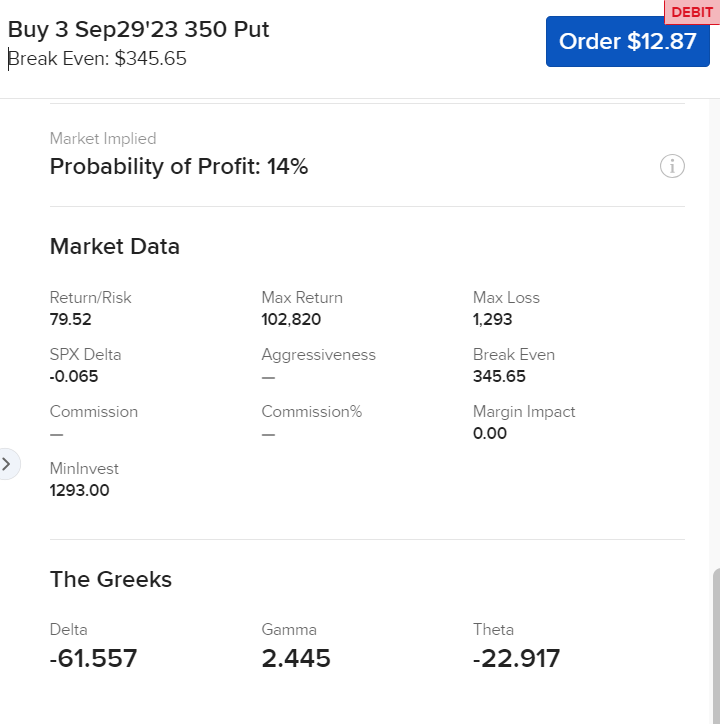

Out of the money (current QQQ price: $374.80).

My gut tells me this market rally is due for a snapback.

Very small amounts, just to experiment:

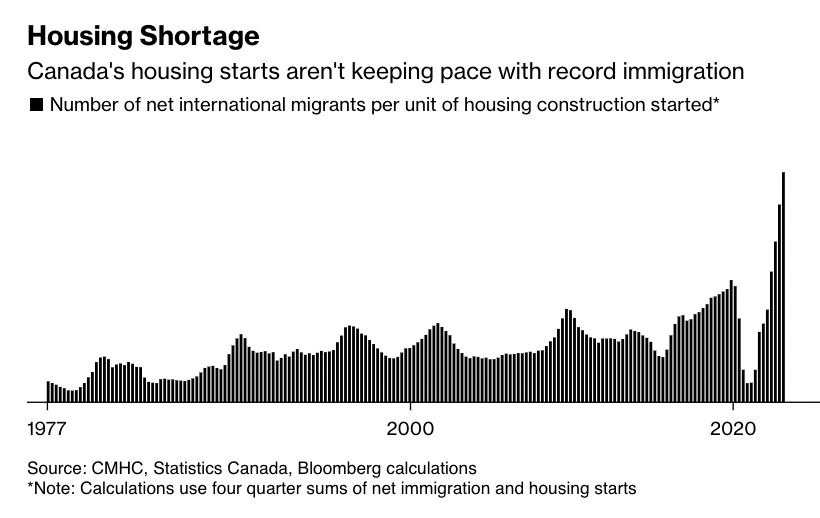

Article from the National Post, archived here.

It’s true that the Canadian federal government does not have direct control over the usual levers that drive Canadian housing construction. Zoning and permitting are generally decided at the municipal level, but they can be overridden by provincial mandate. Last October, for instance, the Ontario government proposed the More Homes Built Faster Act, which would kneecap the ability of cities to deny building permits.

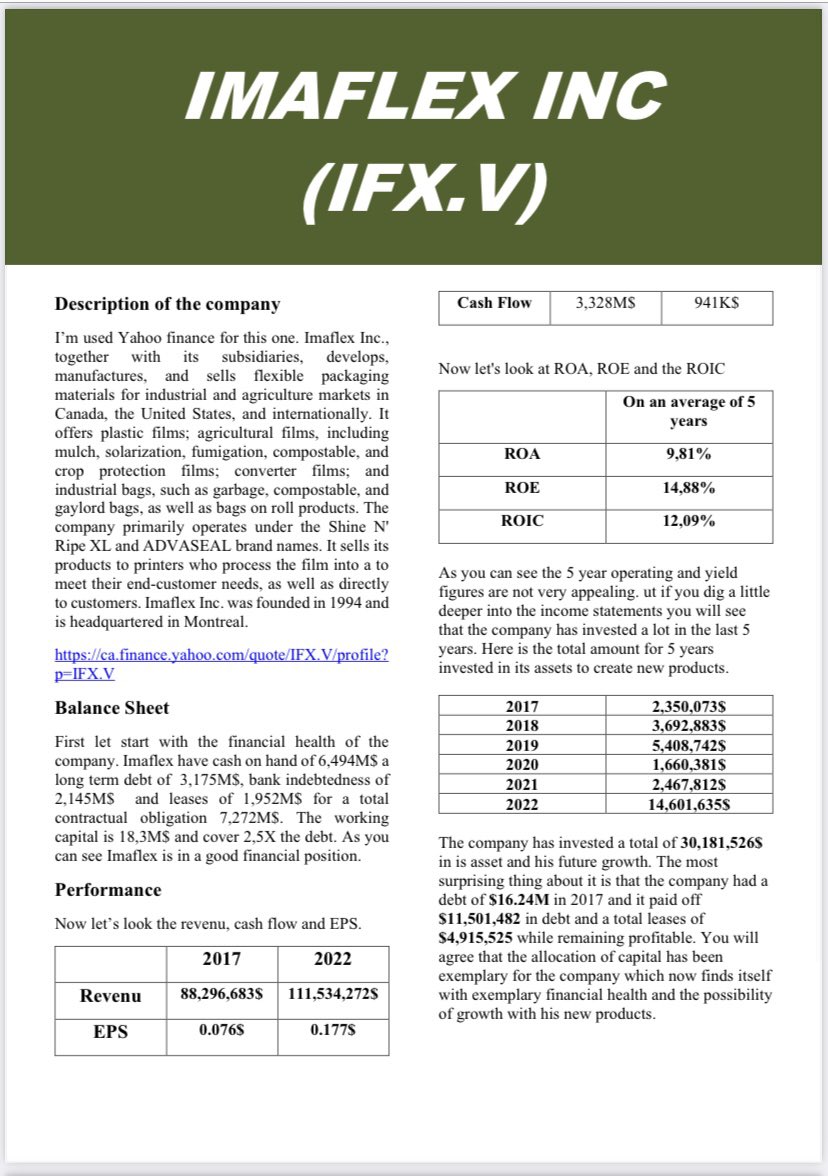

I came across this stock last month.

Came across it again: new writeup, archived here. Twitter thread here.

My issue is, I don’t like companies/CEOs that issue shares for compensation. Even if it’s little bit.

This one might be compounder though, I shouldn’t be narrow-minded.

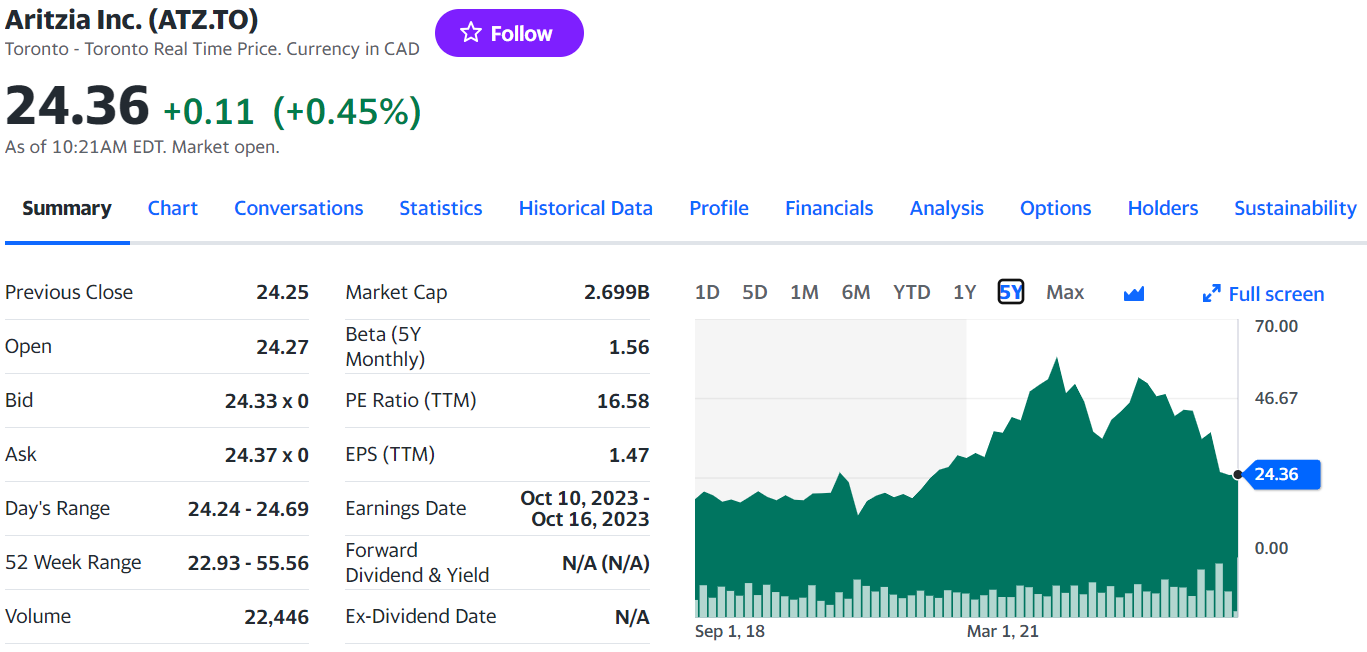

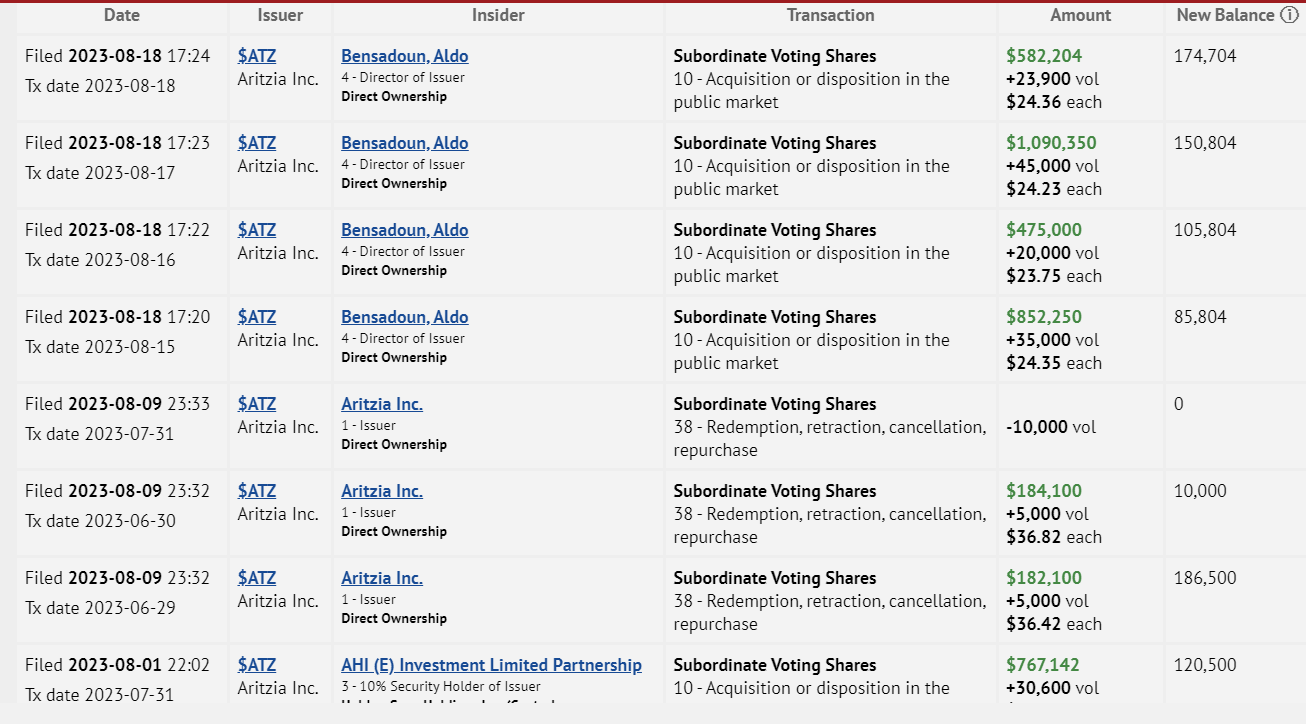

Insiders buying like crazy on this dip (C$47).

I don’t get it to be honest. C$60B net debt and growing. Very weak free cash flow profile. Very low FCF/EV yield.

Meh. I don’t see it.

George Weston Limited, from wikipedia: owner of Loblaw Companies Limited and the Choice Properties real estate investment trust. Retail brands include President’s Choice, No Name and Joe Fresh. The company is controlled by the Weston family. Other controlled companies: Shoppers Drug Mart and Holt Renfrew.

The company has been buying back shares through a NCIB. It has announced that it will allow Wittington Investments, Limited (controlled by Galen Weston Jr.) to participate in the NCIB in a fixed proportion of 50% of Wittington’s pro rata share of the issued and outstanding common shares of the Company. Wittington holds approximately 57% of the Company’s issued and outstanding common shares as at July 21, 2023.

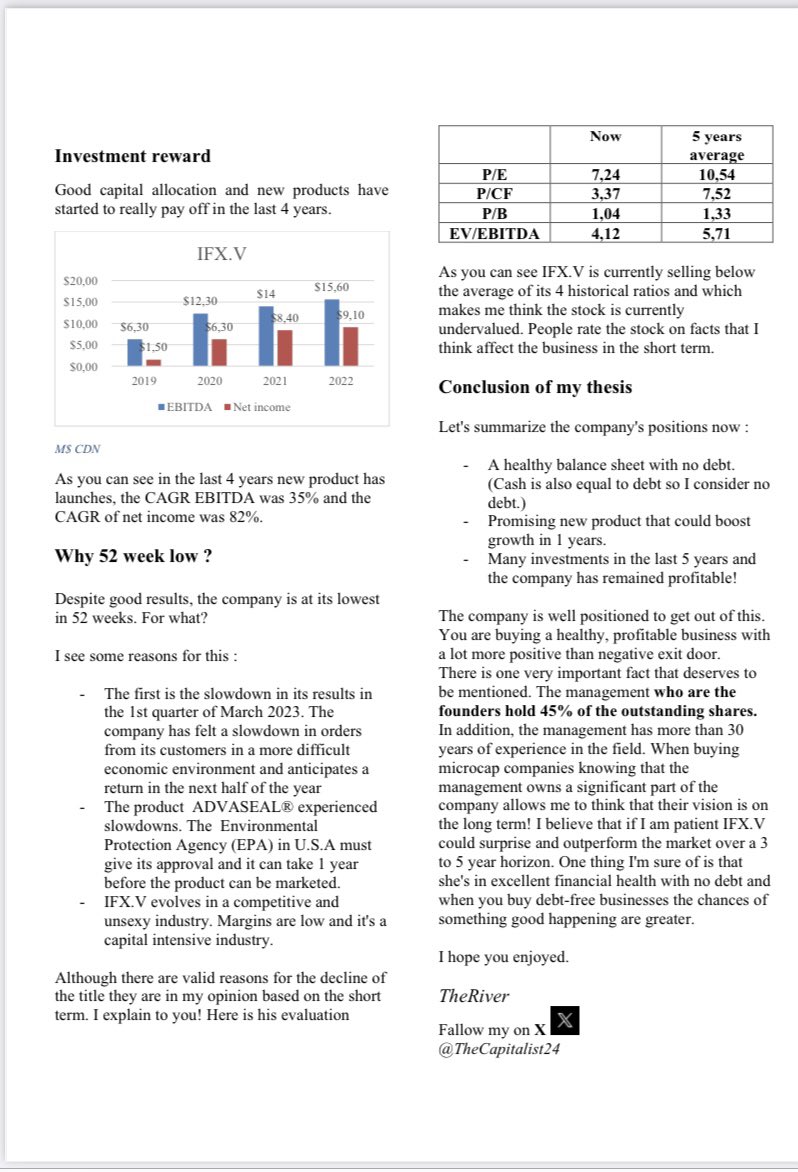

From Atai Capital Management Q2-2023 letter.

Apparently they think it’s cheap and that EBIDTA will double in the next year or two.

Shelly Group

A nice writeup here.

High growth company. Not cheap.

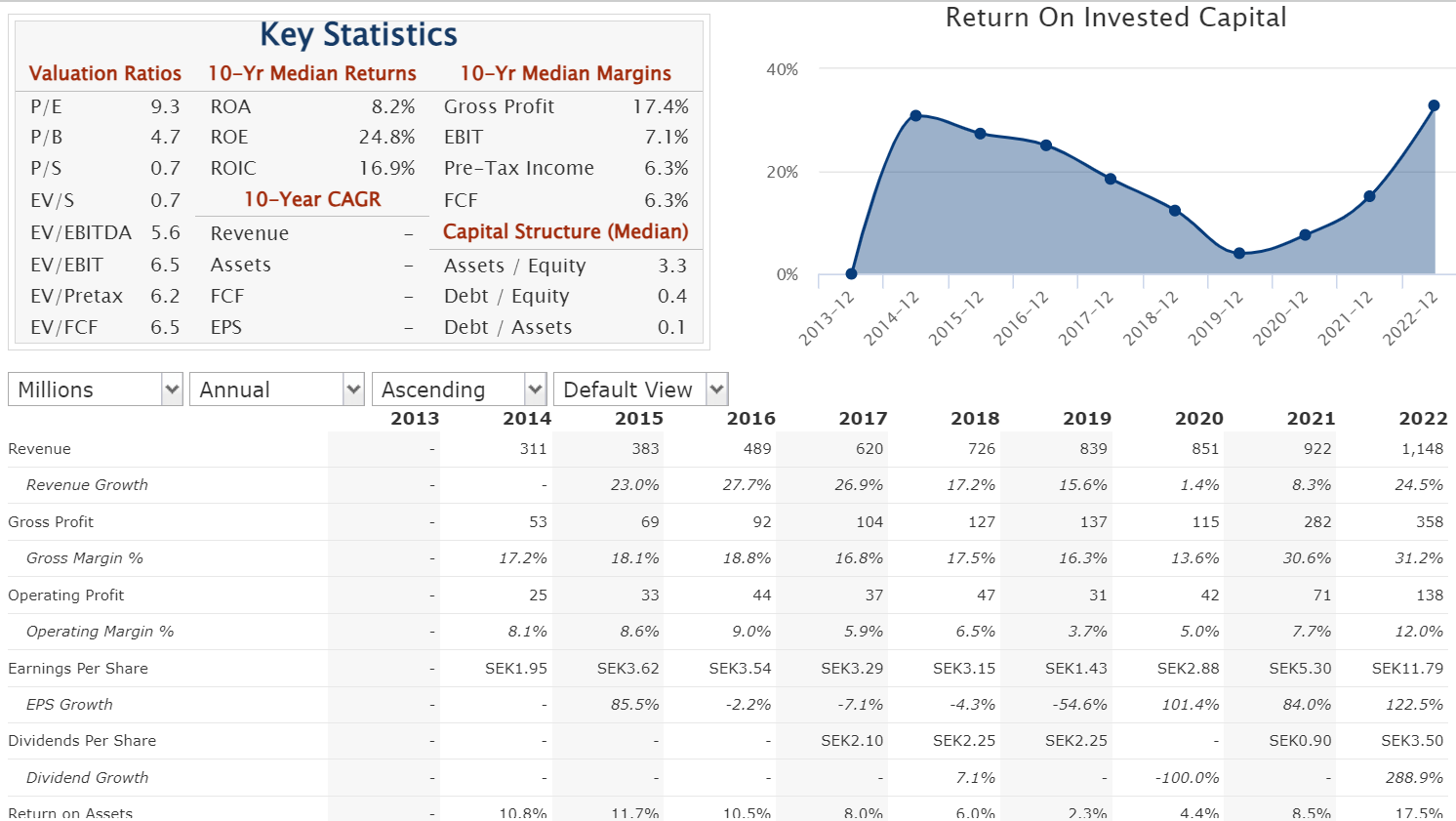

Telekom Austria

Thesis found in Palm Harbour Capital letter to shareholders, archived here.

The crux of the thesis:

Excluding any value realization from the tower business divestment, we estimate that Telekom Austria trades at a 12% free cash flow yield, which for a stable and growing business with improving margins should be considered a bargain.

Additional notes from SeekingAlpha: article, archived here.

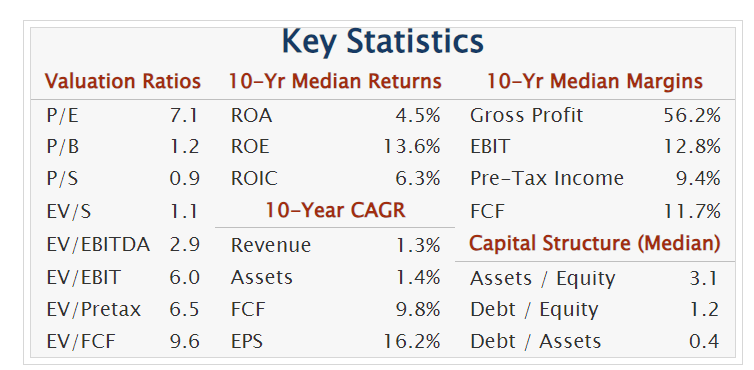

From QuickFS:

Seems cheap enough.

Someone on Twitter posted a link to this marketing campaign:

Pets at Home is touring the UK with a new doggy ice cream van stocked full of free frozen treats for pooches and the Norfolk town is the next stop.

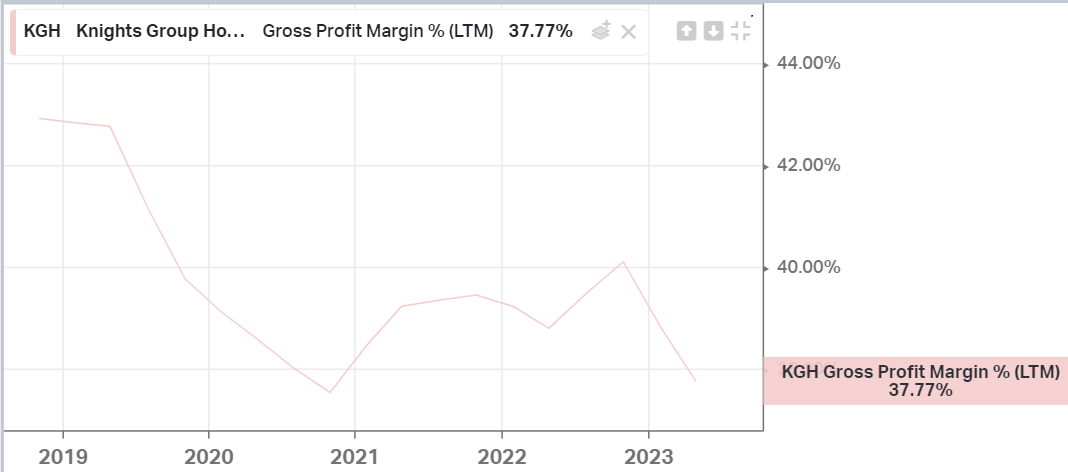

✅ Shares outstanding decreasing

✅ FCF/EV yield ~ 8%

✅ Growing revenue (50% over 5 years or 8% CAGR)

❌ P/E ~ 19

❌ Decreasing gross margin

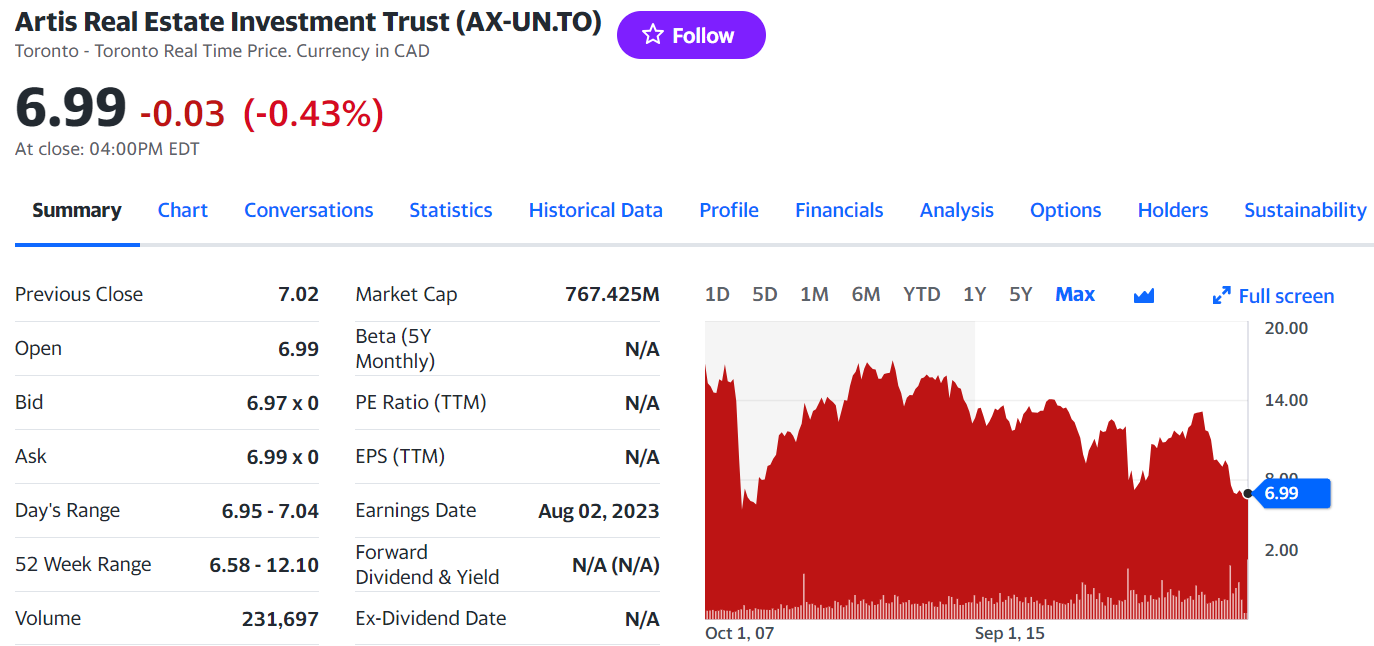

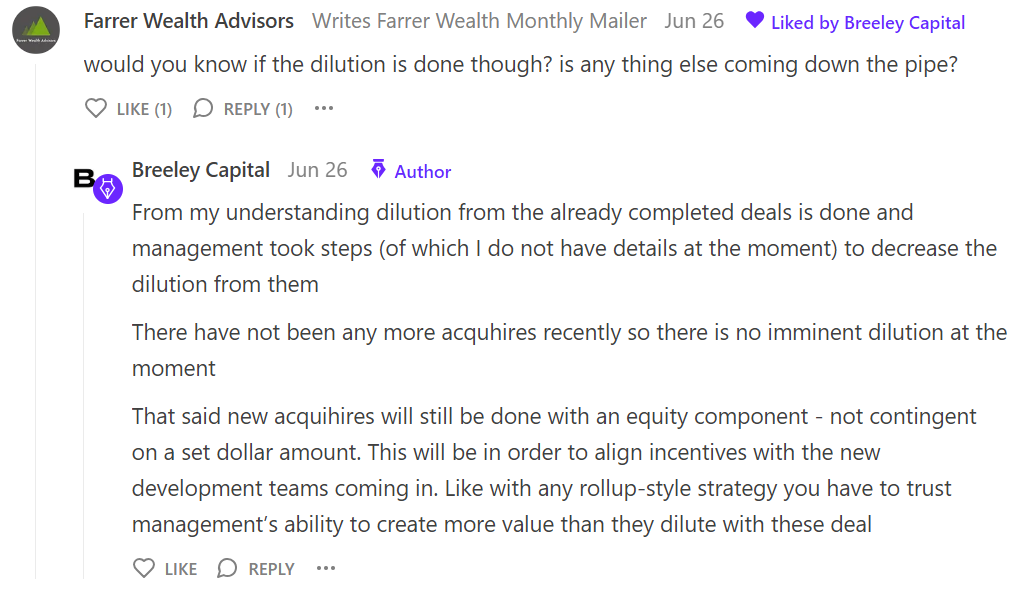

Oufff this is a brutal chart:

But…from a P/B perspective, this has barely ever been so cheap:

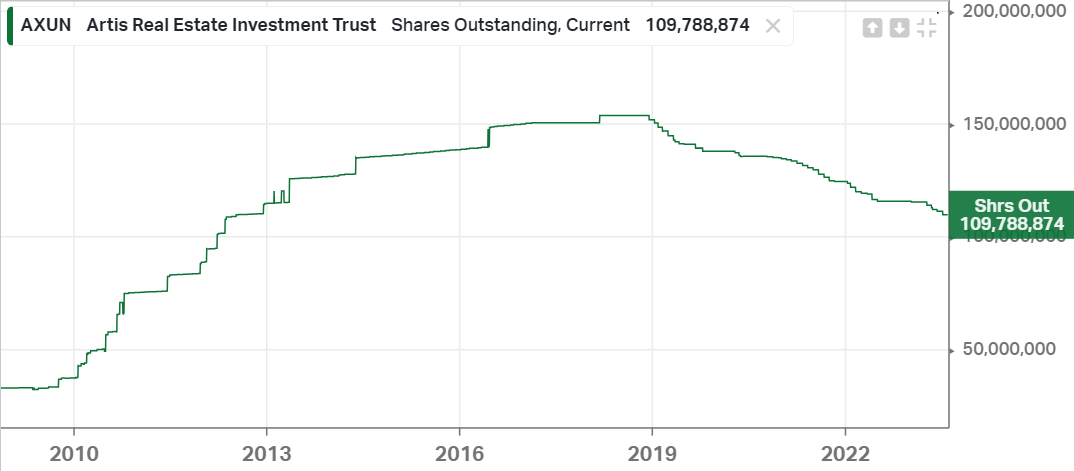

Buying back shares at a healthy pace since 2019 (doesn’t mean it’s wise, just point out the fact):

Current P/E ~ 6.

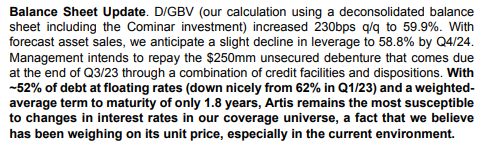

TD is not bullish on the name:

Obviously it’s a risky bet (interest coverage ratio ~ 1.3 as per Stratosphere.io, exposed to office, etc.). But worth at least a listen to the earnings call.

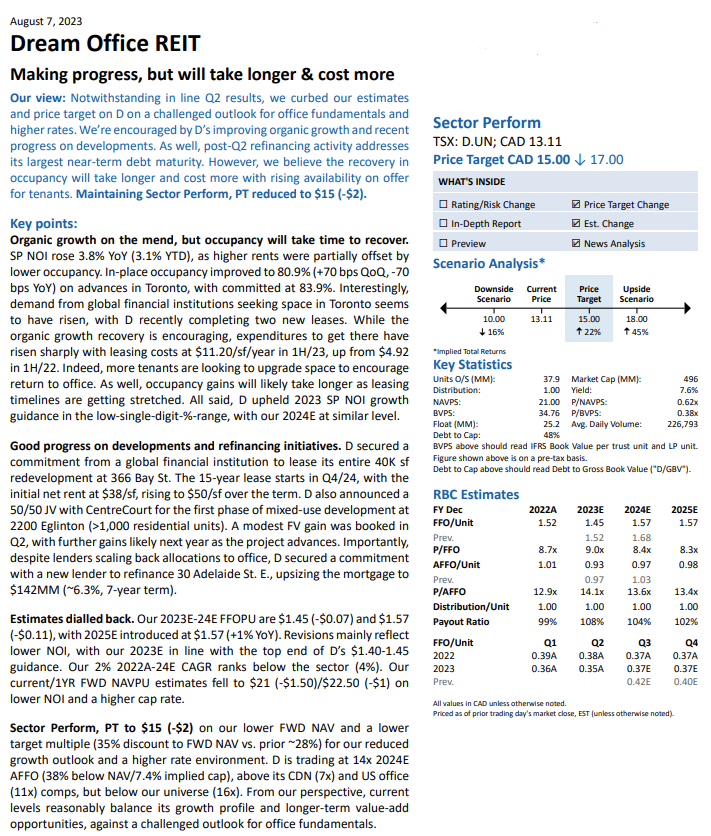

Having already a sizeable position in $DRM.TO, does it make sense for me to spend any time looking at this one? BV/share has been flat here for the past 10 years where as $DRM.TO’s BV/share has grown close to 7-fold in the same period…

Still from TD:

A deep dive from Part-Time Investing’s YouTube Channel:

A lot to like here (e.g. EV/EBIT ~ 3x) but it is a cyclical and both revenue and gross profit will drop. The question is: what do trough earnings look like?

An interview from the same investing YouTube channel:

Focused compounding also had a bit on this company back in June 2022:

Next, a fireside chat in Jan 2022 with the then-CEO Nick Devlin: link.

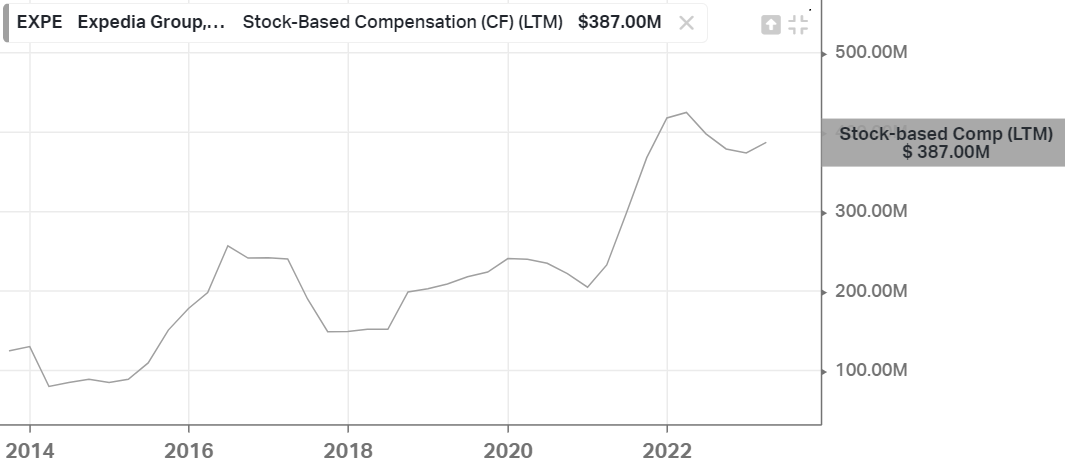

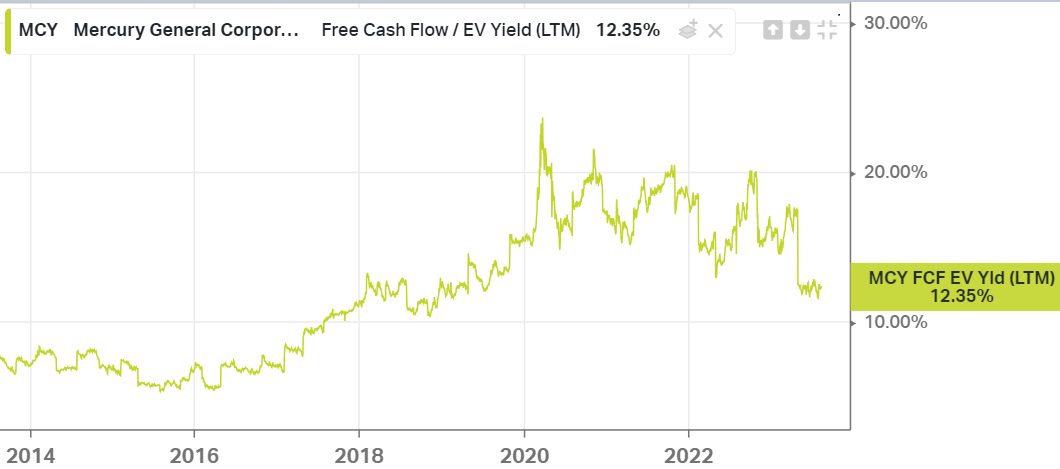

I took a (small) position this morning. Snap decision, based on FCF yield:

Even taking into account the disgustingly high SBC I arrive at 15% FCF yield:

(2870-387)/2870*18% = 15.5%

Net debt ~ 0

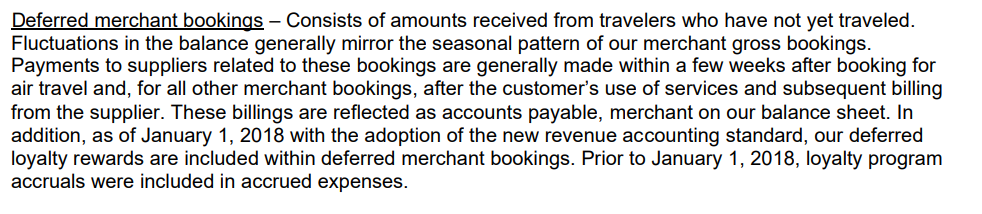

Someone pointed out that: “A lot of free cash flow is deferred merchant bookings so it’s a liability on the balance sheet. Not sure how to value it”.

And I found an old article from SA referring to this issue (archived here).

Aaaaaaaaand…I’m out.

$11.5b in deferred merchant bookins, versus $6.2b in cash. Should travel slow down in the next quarters, they’d be in a world of hurt (hit by a double negative whammy).

A new SeekingAlpha article: Extreme pessimism price in archived here.

The article goes over some of the details of the pending lawsuit.

Important to note:

1. The proposed Settlement does not settle or release any claims brought by Lead Plaintiff against non-settling defendants Howard Jonas, The Patrick Henry Trust, or IDT Corporation (together with its parents, affiliates, subsidiaries, officers, directors, predecessors, successors, and assigns, “IDT”) (collectively, the “Non-Settling Defendants”). Lead Plaintiff continues to prosecute her claims against the Non-Settling Defendants.

2. the class action is chasing is the full amount of the Straight Path fine by the FCC for $614 million - more than the current market capitalization of IDT.

I’m actually flabbergasted that this lawsuit was not mentioned in many of the prominent theses I’ve read.

For more details, see:

Other write-ups on $IDT:

If you ask me, there was wrongdoing on the part of Howard Jonas. The fact that there has been a settlement already (from his son, then CEO of Straightpath) kindof confirms it.

I had bought a small position but I think I will GTFO.

Or…I could protect with some short-term (Sep15) puts @19 for $0.25.

0.25 / 23.55 ~ 1% (cost of insurance). This sounds reasonable. Still thinking through it.

Here’s yet another mention of $IDT in Immersion Investment Partners 2Q2023 letter. They’ve exited their position due to the upcoming litigation verdict but also due to weak prospects for the coming quarters:

We substantially reduced our position in IDT in May, due to the upcoming Straight Path litigation verdict. The stock was sized at nearly 10% of NAV, which we felt was imprudent. Subsequently, we exited the stock shortly after the company announced its fiscal third quarter operating results in early June, which were mediocre.After conducting further diligence, we concluded that the next few quarters could be very weak. We moved down our profit estimates materially, no longer believing that NRS can continue its torrid pace of growth, coupled with accelerating declines in the Trditional Telecom business. Additionally, the company’s tone and commentary regarding the monetization of its growth businesses subtly shifted.

We now think that management wants to hold on to net2phone and NRS for longer than we initially anticipated. These negative incremental developments, paired with the coin flip of the Straight Path Litigation outcome gave us no reason to continue holding the stock.

Other tickers mentioned in that letter below.

From Immersion Investment Partners 2Q2023 letter:

Motorcar Parts of America is a leading manufacturer of aftermarket auto part and the largest supplier of aftermarket starters and alternators in the U.S., with a 50% market share.

MPAA has historically been a subpar business, at a constant negotiating disadvantage with their customers who can force them to buy back inventory and accumulate substantial working capital. Cumulative operating cash flow over the past ten years is negative $32mm. Net margins are typically very low – low single digits in a normal year. They rely heavily on short-term debt to fund operations, currently carrying a $176mm net debt balance, which is reasonable from an EBITDA perspective but considering that almost all their cash is consumed by working capital, it is a tenuous position.

Meh. Pass for now.

It is a fool’s errand to fight the European investor market where each argumentseems to start and end with “Does it pay a dividend?” Our conversations with buy-side and sell-side participants in Europe have been some of the strangest and lowest-IQ interactions we’ve ever had.” 😂

Around ~5x EV/S and 6x EV/GP growing revenue at 20% 5Y-CAGR. I’m seeing elevated debt levels though…

Might want to listen to one of their earnings calls and/or go through their financials.

Potbelly sandwich shops in the United States. Seems to be recovering from Covid lows, now trading around ~6x EV/EBITDA.

Could be worth a look. Still from Immersion’s letter:

As of the latest business update provided in June, annualized revenue per location is tracking to $1.35mm vs. pre-COVID levels of $950,000 and restaurant-level profit margins are rebounding very quickly to ~14% (vs. 15% pre-COVID). Over the last twelve months the company has announced the signing of 96 new locations and the sale of 20 company-operated locations to new and existing franchisees.

A writeup from Under-Followed-Stocks (@mavix), archived here.

A look at the metrics on QuickFS:

Looks decent to me!

A nice Reddit thread on r/Valuenvesting.

https://www.youtube.com/watch?v=pUrCiCoEoAg

https://www.youtube.com/watch?v=w0SWw16d6Zc

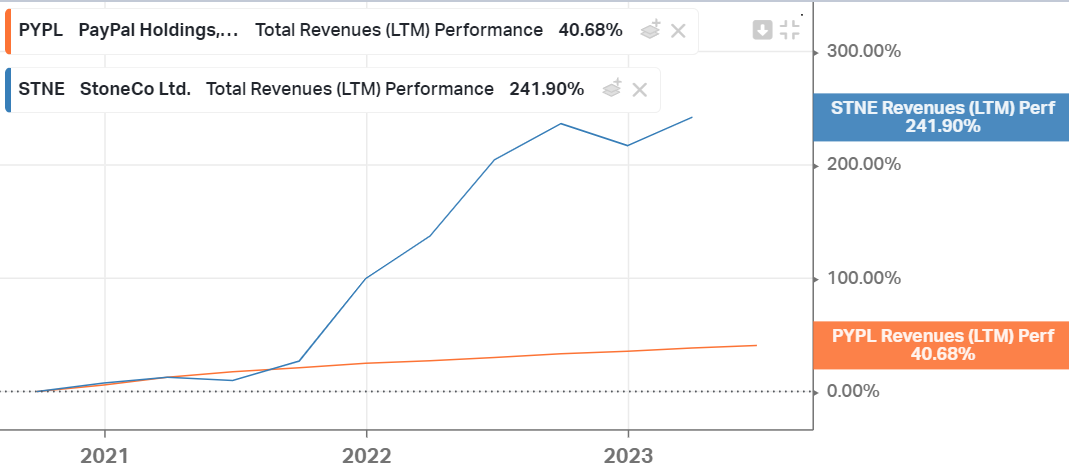

https://braziljournal.com/brazils-stone-ipo-more-like-square-than-pagseguro/ (printed)

https://www.reddit.com/r/stocks/comments/gfn9jd/brazilian_ecommerce_stoneco_vs_pagseguro/

https://oscar100.substack.com/p/pags-brazil-lowers-interest-rates (printed)

By far the most thorough writeup on PagSeguro can be found on VIC (archived here).

StoneCo’s F1 form, very informative: link

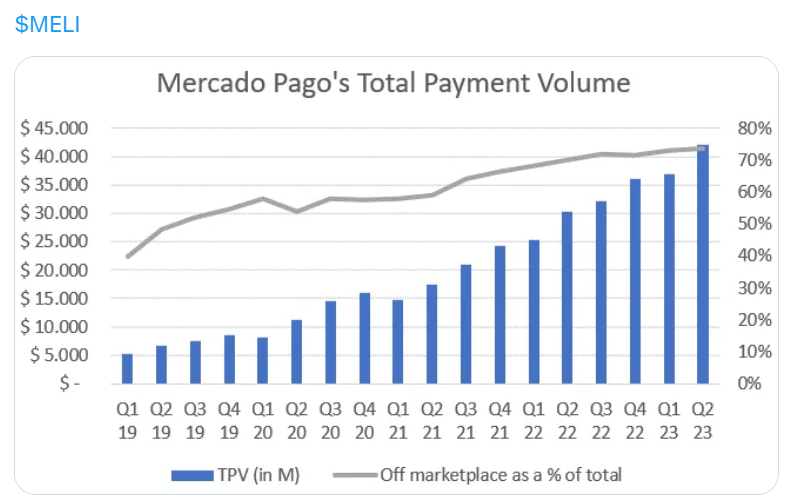

The payments business is a shitty business. Meli is a competitor, among many others.

https://www.youtube.com/watch?v=Gj2NXpfODFM

https://www.youtube.com/watch?v=te6aYsvomuQ

Why do I not own this one?

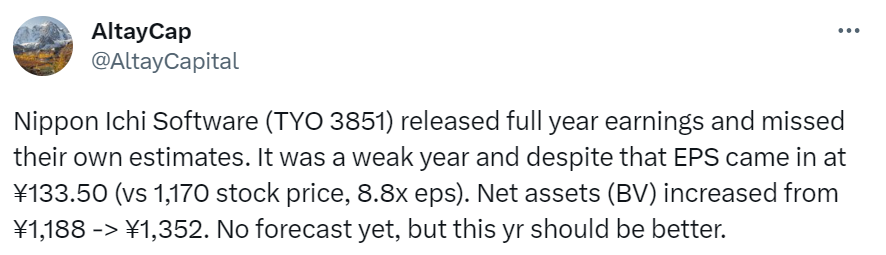

https://twitter.com/AltayCapital/status/1646766450559029248

This is the clip featuring Mohnish Pabrai:

Here are two clips from @LunchInvesting:

A thesis from SeekingAlpha archived here.

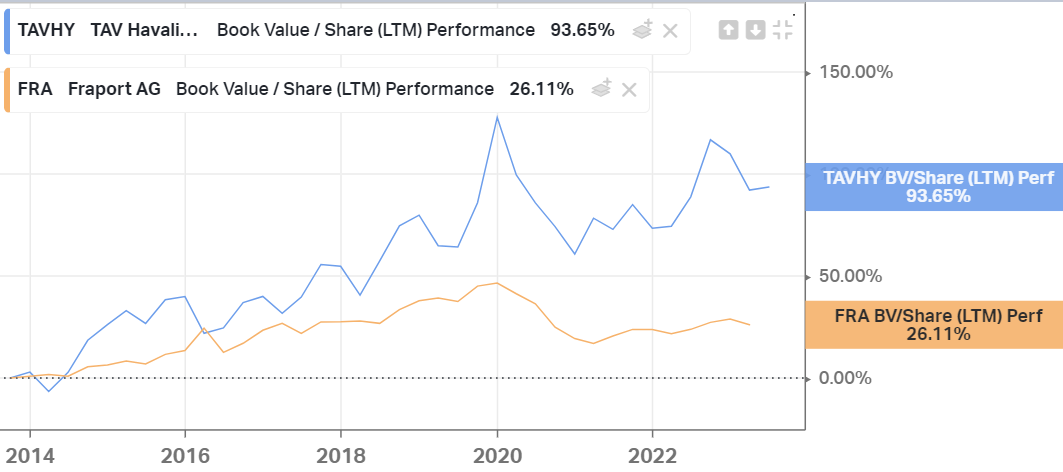

I also looked at $FRA.DE Fraport AG which owns and operates airports in Germany, rest of Europe, Asia, and the United States. See Sven’s video here.

They’re also trading for cheap ~1.1x P/B (but 25x EV/EBIT), with a book value per share that has been growing very slowly since 2004.

So my question is: what makes TAV better?

TAV is trading for 1.2 P/B, 11x EV/EBIT and 12x P/E but book value per share has been growing much faster than $FRA.DE since 2014 (a double in 10 years i.e. ~7% CAGR, on top of around 4% dividend yield)

A fantastic Nintendo 2023Q1 summary here by @DomsPlaying (archive).

My main concerns would be the decreasing gross margins and return on capital:

A writeup by Asian Century Stocks on L’occitane: link.

I’m saving these posts from the substack (private access):

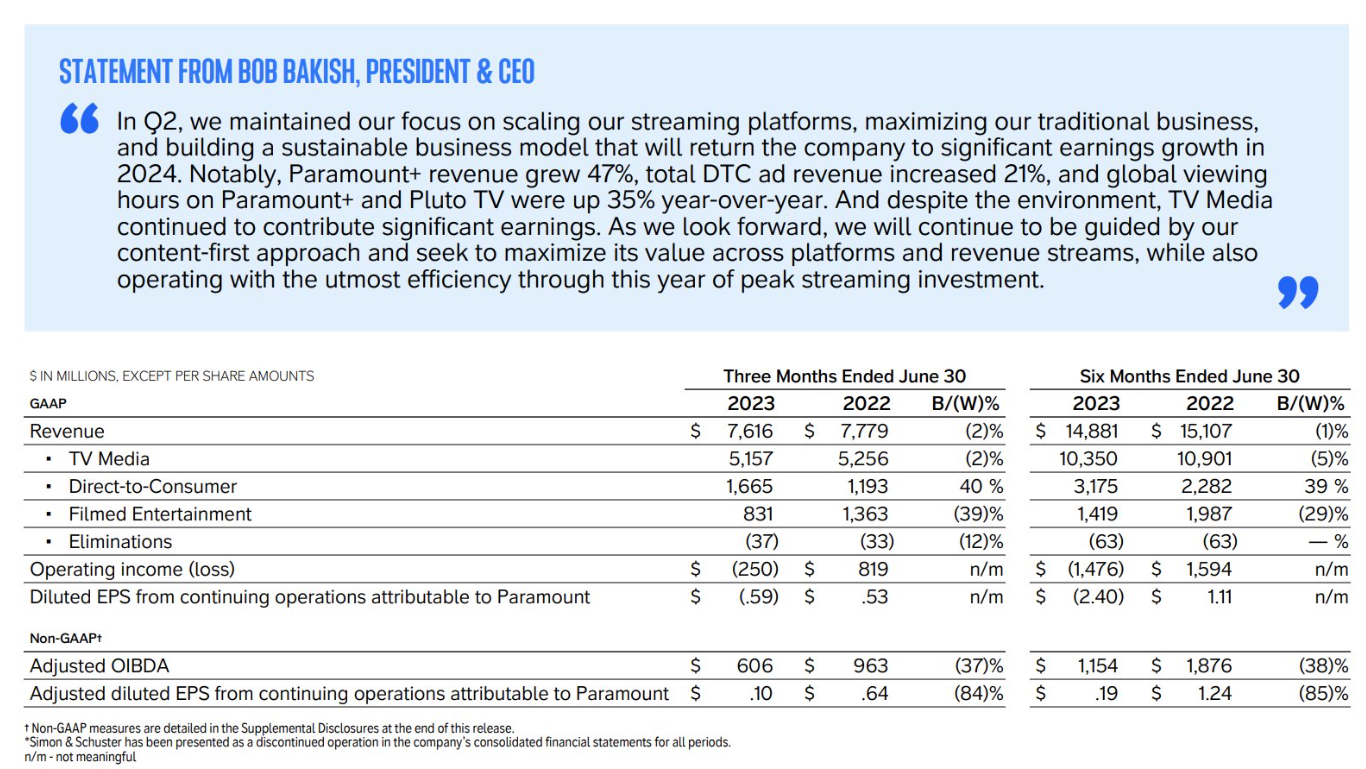

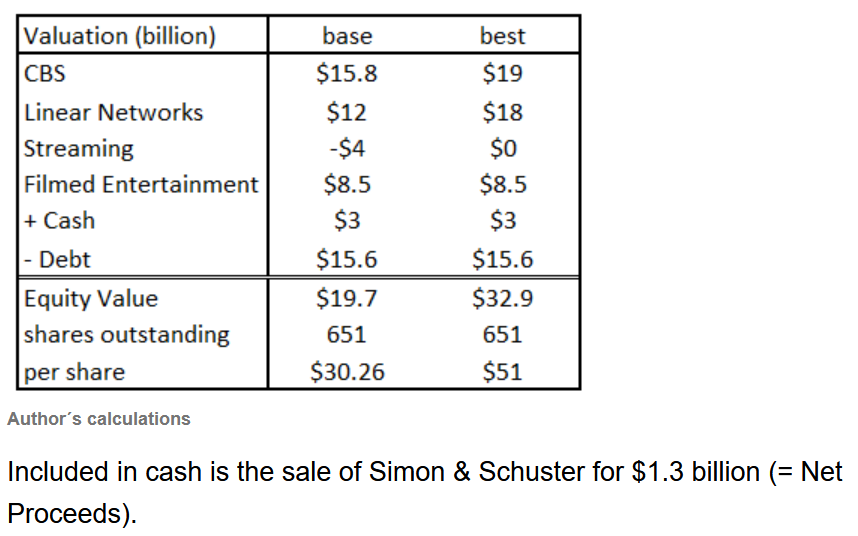

Paramount Sells Simon & Schuster to Private Equity Firm KKR for $1.62B.

And from today’s earnings call:

Picture of the current situation:

A thesis for $PARA from SA, as a sum of the parts (the comments section is interesting): link (archived here).

Reminder of some of the assets that Paramount owns:

- CBS (Sports, News, etc.)

- Nickelodeon

- MTV

- BET

- Comedy Central

- Pluto TV

- Paramount Studios

- Showtime

There’s an interesting subreddit dedicated to Paramount: r/paramountglobal.

I wrote two (lazy) sentences about it in July as part of a basket of UK stocks.

This threads make me rethink:

- the situation

- my ability to pick stocks

- the usefulness of aggregators such as Koyfin (the data seems off for this stock)

Of course, it had to be up 7.76% today, just to take the piss.

Here are my take-aways from the approach:

- ROIC on organic growth:

- calculate incremental ROIC as incremental EBITA from growth / required capital

- inc EBITA = inc rev * gross margin (30%) - [SG&A + Depreciation] (10%) => 20% drop-through

- tax the EBITA

- calculate required WCAP (% of rev, 18%) and PP&E (probably fixed)

- taxed EBITA / required capital => inc ROIC

- acquisitive growth:

- (a) total paid for acquisitions

- (b) total profits from acquisitions

- (b)/(a) = ROIC on acquisition spend (e.g. if they paid 5x earnings => 20% return)

- how much profit do they need to buy (and how much do they need to pay) to grow x% from acquisitions? have they been able to do that historically?

I don’t remember if I linked to Wes substack already, but here it is anyway: link (archived here).

Still monitoring this one, price has dropped just a tiny bit (pun intended).

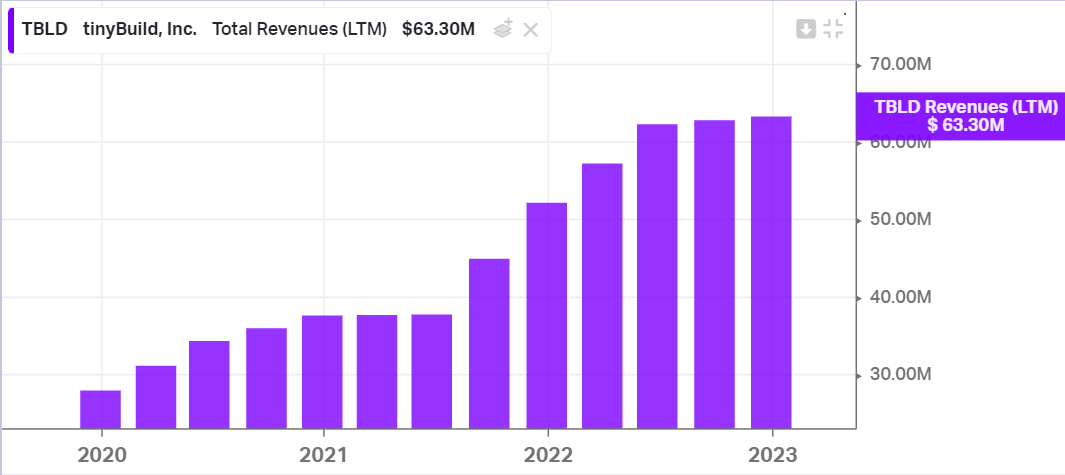

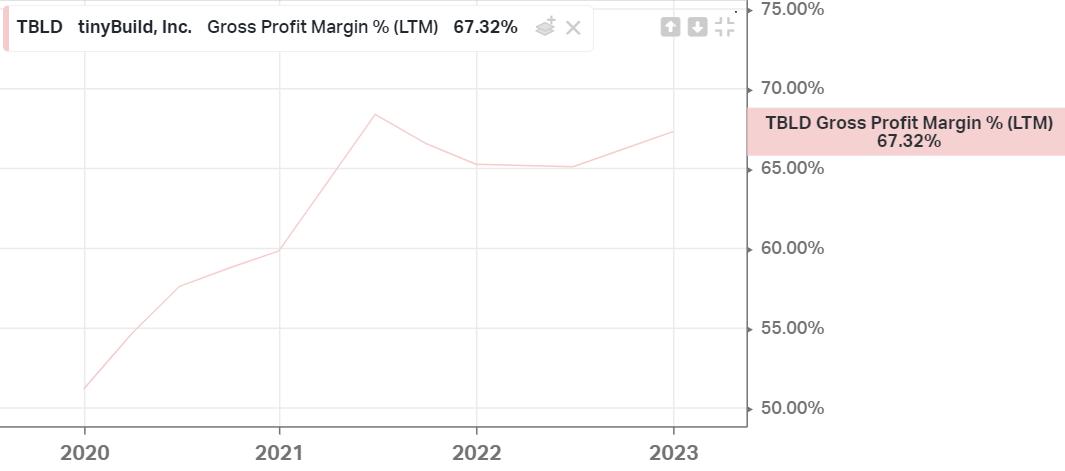

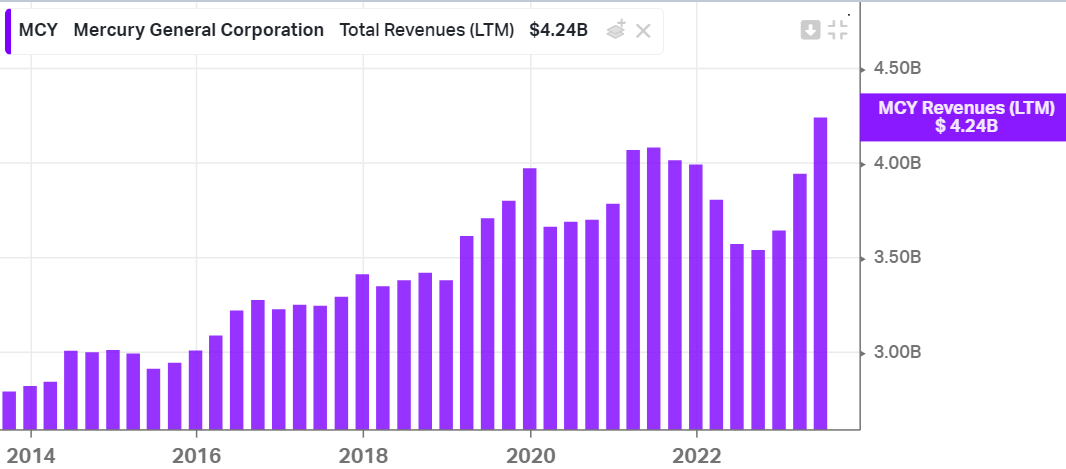

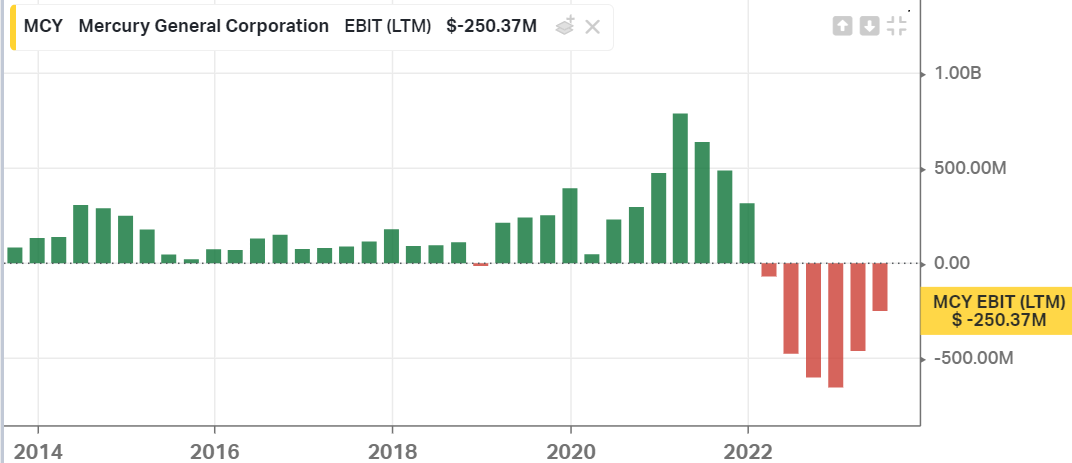

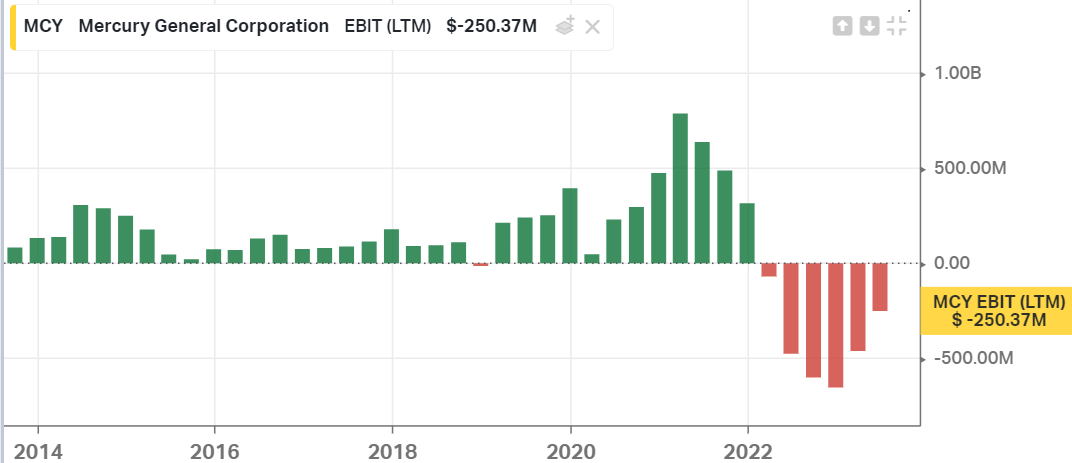

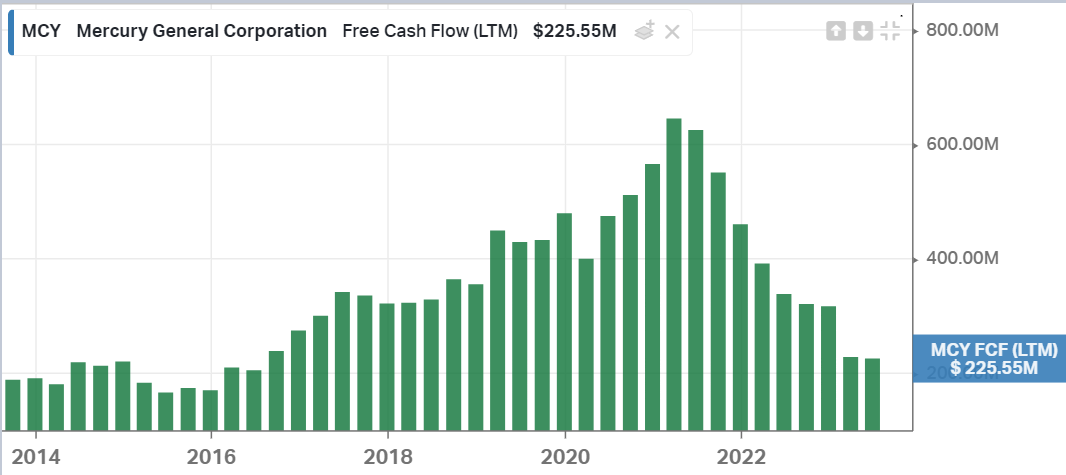

Let me first share a few charts:

@BreeleyCapital has a shared a new write-up: link (archived here).

And just reference, here are two clips from @FirmReturns where he talks about $TBLD.L:

Reminder: the tweet that caused me to pay extra attention, and the related update from FirmReturns:

I was looking for a podcast or an interview with the CEO, the substack above gave it to me: link.

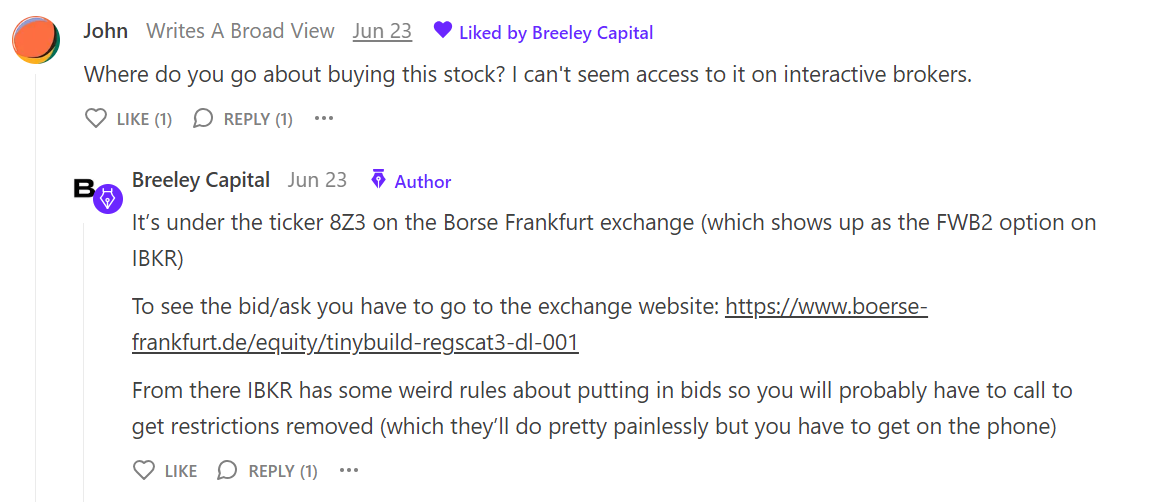

To buy it on IBKR, one must buy the ticker $8Z3.F:

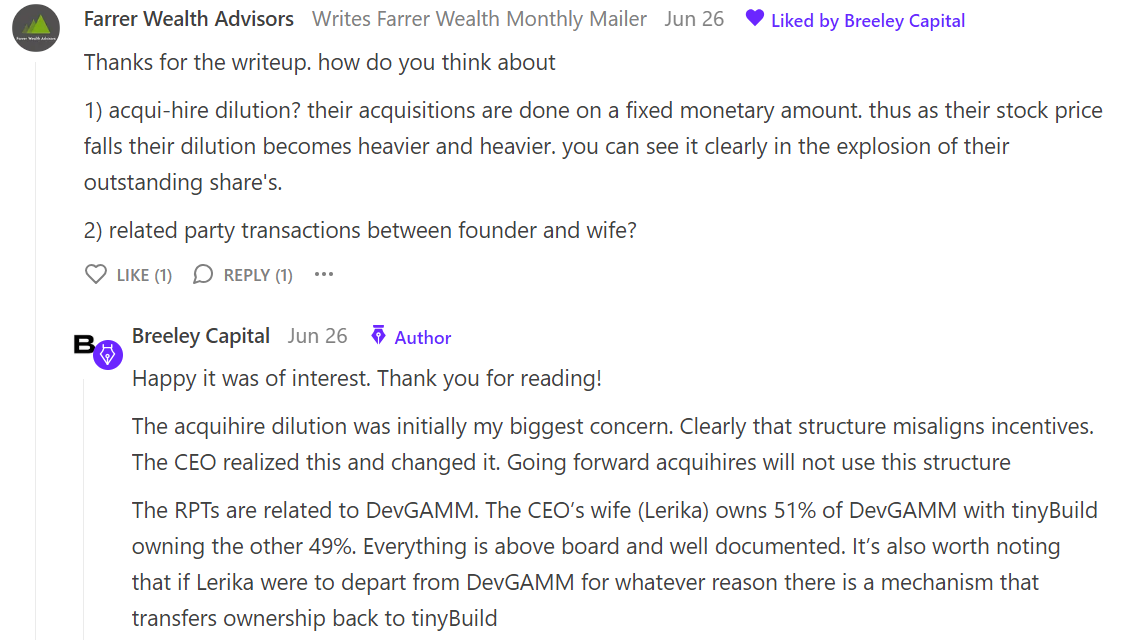

The following comments adress my #1 concern when I looked at the stock (dilution from acquisitions):

[Side note] The author shared the following quote, which I loved:

On the subject of seeking shares at the IPO I encourage you (or anyone else) to consider this quote from the book Lessons from the Titans: “My aha moment came during a meeting with former CEO Nicholas Howley and a Trans Digm investor. In an effort to knock Howley off balance, the investor forcefully asked him why he should believe in the company following Howley's recent sale of millions of dollars of stock. Howley stunned me when he sat up in his chair, put his elbows on the boardroom table, looked the guy in the eye, and said: `This may come as a surprise to you, but I'm in this for the money. I haven't had many chances to sell stock under private equity ownership, and now I do. My wife wants a beach house. So we're gonna get a beach house. You can believe what you want, but I'm not going anywhere. I've got more money to make, and if you choose to, you can make it with me.’”

More comments that rub me the right way…they just keep coming:

Checkout tinybuild’s website here, their blog here and their investor center here.

Steam offers a free service to track daily stats: Steam DB.

An article on a recent launch: link (archived here).

Alex Nichiporchik (the CEO) just published a new article called :Chasing the Thousand-Hour Game (arhived here) which also has a link to the following YouTube presentation:

Interview with Michael Cooper: link from the Commercial Real Estate Podcast.

“We don’t know where we are […]. Everything we’re using to measure could be wrong.”

On Dream Office:

Also, a quick valuation of $DRM.TO by CIBC found on stockhouse:

Our view of intrinsic value (and, indeed, the discount thereto) is based on: 1) an implied value of $85,000 per acre for DRM’s ~9,000-acre Western Canada land bank; 2) a 12.5x multiple on its asset management platform given the higher proportion of external third-party managed assets; and, 3) a 1.4x multiple on DRM’s development assets to reflect the nearing of completion and a heavy GTA focus

I keep staring at these two charts and wondering what I’m missing:

For old time’s sakes, a TD research note from May 2022: link

TL;DR I went back and forth on this stock multiple times. Now at small enough size (2.2%) that I wouldn’t be too bothered if it didn’t work out, but would be very happy if it did.

Maybe I am the Michael Scott of investing.

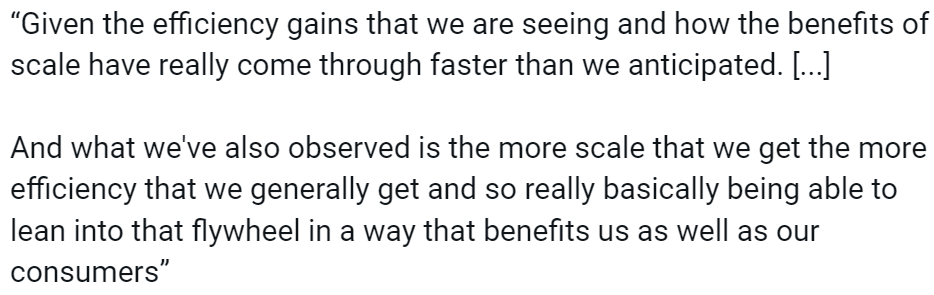

Anyway, back to Hims…does it have any kind of moat?

Listening to the earnings call (written form here), I’m seeing a few things that I like: high retention rates, sharing economies of scale, etc.

Also found a bearish research note from Spruce Point Capital Management.

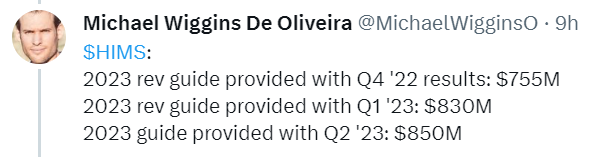

Him has a habit of beating guidance:

On the other hand, SBC is uncomfortably high ($54 ttm or 3.5% of the market cap).

I’ve acquired a position nonetheless.

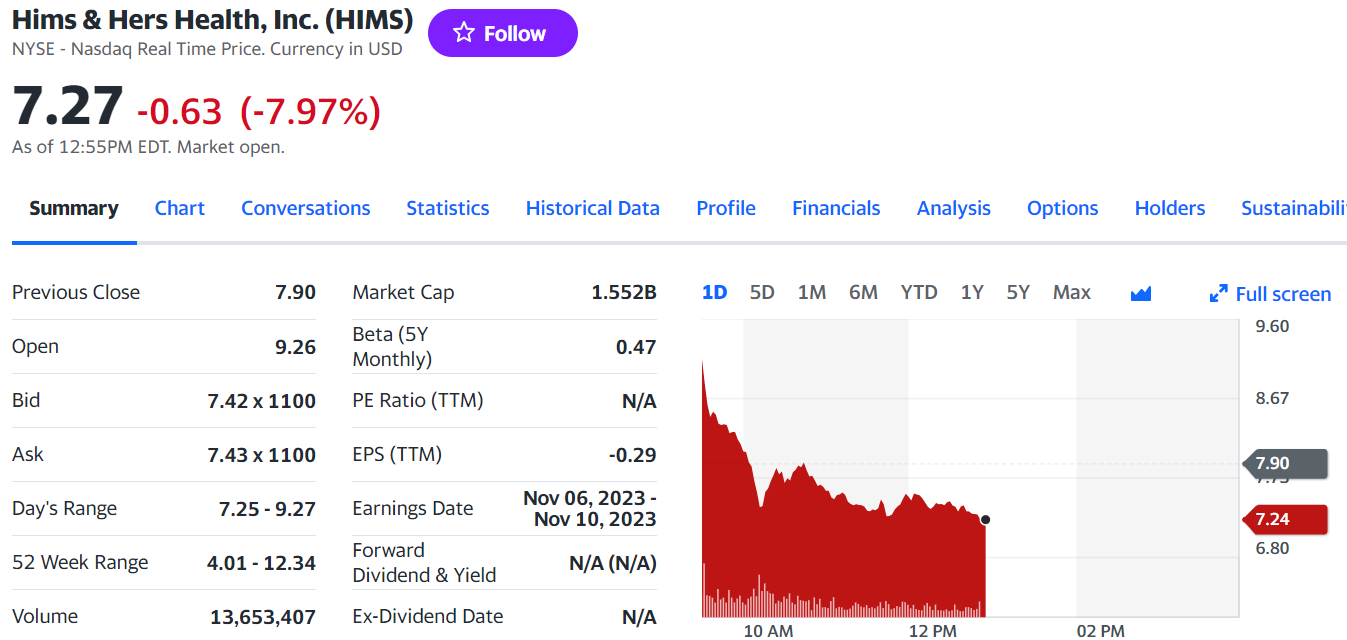

The price is still dropping like a stone 😭

⚠️ It does feel like I’m trying to have my $CVNA/$CDLX moment here. Maybe I’m also still pissed that I haven’t been able to buy $TBLD.L or $B3.ST.

While we’re talking about the cons negative, I didn’t like their 2Q2023 presentation. Felt obnoxious.

I also noticed that their adj. EBITDA in Q3'21 was -$9.8M with stock-based compensation of $11.9M, so “real” adj. EBITDA of c. -$21M, versus $10.6 - $16.8 = -$6M this past quarter.

So it’s getting better, but still negative and still very high SBC at 8% of revenue (though I should count myself lucky, I just looked at $SOFI and they’re at $305M SBC / $1.8B Rev or 16.9%!)

Overall, their presentation (inclduing the appendix) is very light on financials.

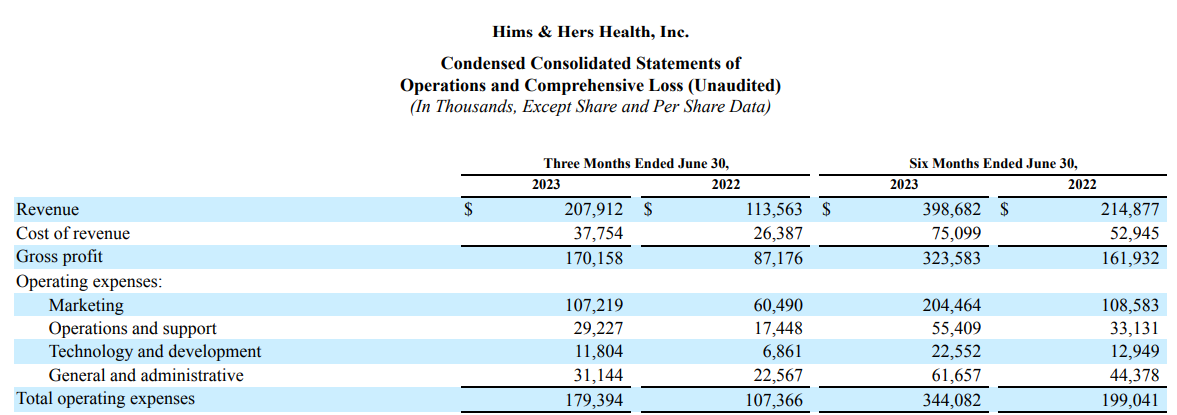

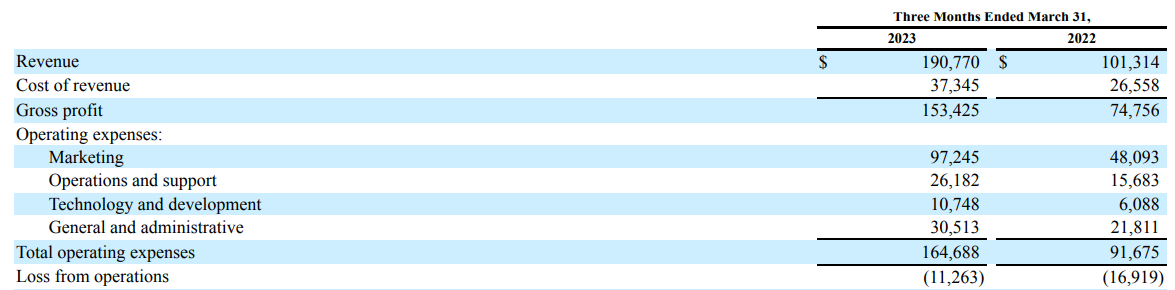

Here’s a portion of their income statement from their 10Q:

Marketing as a % of revenue is still around 51%.

For the sake of completeness, here’s Q1:

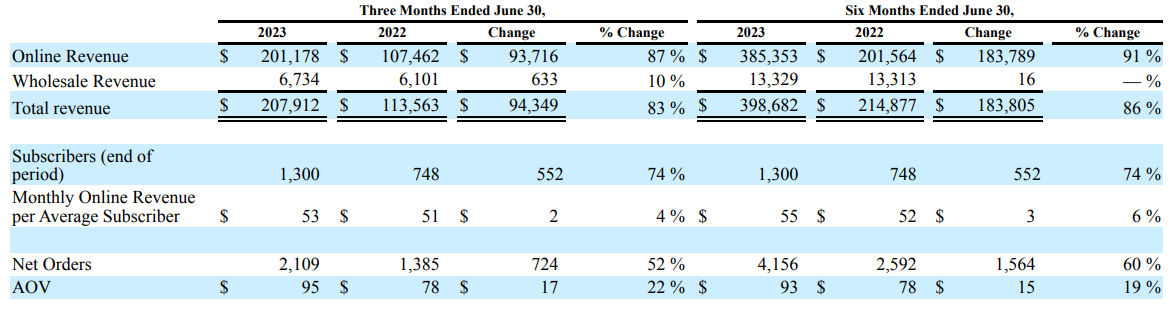

And here are some key operating metrics:

Now onto acquisition costs:

3 months:

The most significant component of marketing expenses is customer acquisition costs, which increased to $90.0 million in the three months ended June 30, 2023 , compared to $51.0 million for the three months ended June 30, 2022, an increase of $39.0 million.

6 months:

Customer acquisition costs increased to $174.0 million in the six months ended June 30, 2023, compared to $90.1 million for the six months ended June 30, 2022, an increase of $83.9 million.

To calculate the cost of acquisition per incremental customer since 2022Q2, I divide the cumulative acquisition spend in 2022Q3, 2022Q4, 2023Q1 and 2023Q2 by the number of net new subscribers between 2022Q2 and 2023Q2.

-

Cumulative acquisition spend:

- 2022Q3: $67.3M ($187M for the 9 months)

- 2022Q4: $43.4 (230.4 - 187)

- 2023Q1 + 2023Q2: $174.0M

Total = 284.7M

New new subscribers: 1300 - 748 = 552 (K)

284.7M / 552K = $515.7/subscriber

To do the same exercise between 2023Q1 and 2023Q2, we need the number of subscribers end of 2023Q1, which was 1209.

$90.0M / (1300 - 1209) = $989.0/subscriber.

So the short report was right. Customer acquisition costs did explode this quarter!

The absolute value of this number is shockingly high.

The gross profit run-rate is 170.1M x 4 = 680.4M. Let’s assume 95% is through subscriptions (in line with slide 20 of the presentation), so that’s $646M of gross profit through subscription.

646M / 1300K = $497 of yearly gross profit per subscriber, so again the short report is correct. The payback period for these new subscribers is 2 years.

So we really are spending more to acquire them - much more. What the heck happened?

The CFO called this out during the prepared remarks on the call:

Marketing investments were more heavily weighted toward the back end of the quarter, as a result of the timing of new product launches, strategic pricing actions and large brand campaigns.

Customer acquisition was slower at the start of the quarter, as a result of those dynamics in a somewhat more challenging marketing environment, relative to the first quarter. We expect that investments made at the end of the second quarter, will provide meaningful customer acquisition tailwind in the third quarter.

Just for the sake of the example, let’s say retention is 75% (the company has indicated that long-term retention for 2+ year subscribers is 85%), i.e. churn is 25%.

To retain flat gross profit and assuming 2x payback period, we’d have to spend 50% of gross profit (2 x 25%).

Current operating expenses ex-marketing (operations, tech, G&A) are 43.1% of gross profit.

So with 75% retention, we can spend 50% of gross profit on marketing, retain flat gross profit AND have an operating profit of ~7% of gross profit (or 8.8% of revenue, assuming 80% gross margins).

And just to go all the way, on $830M revenue (guidance), that’s $73M of operating income. Give it a 5x multiple (no growth) => $365M market cap or ~24% of current $1.5B.

So ~75% of the current price is hidden in:

- retention

- CAC (or payback period)

- growth

I generalized these simple calculations here. Playing around with the numbers, it seems that if:

- we reach $1.2B of revenue

- gross margins are 75%

- retention is 75%

- payback period is 1.35

- other op expenses are 40% of GP

- desired growth is 10%

Then we’d get $120M in operating earnings at a 9.5% operating margin, and the stock would be fairly valued with a 13x multiple of operating income (note: I forgot to account for dilution).

Also interesting is that with the assumptions above, the maximum achievable rate of profitable growth is 19%. But at 19% I get a crazy high multiple of 277x. On the other end of the spectrum, if we require no growth at all, the company would be trading at a 6.4x multiple.

I should listen to this podcast with the COE Andrew Dudum.

Also found this fascinating perspective on the success of Hims: link.

By the way, looking at the CEO’s twitter account, I found a lot of anti zionist and anti Israeli apartheid tweets. Could that explain the high short volume on the stock? Generally, Andrew seems to be tweeting a lot of political stuff. Is it a risk to the business?

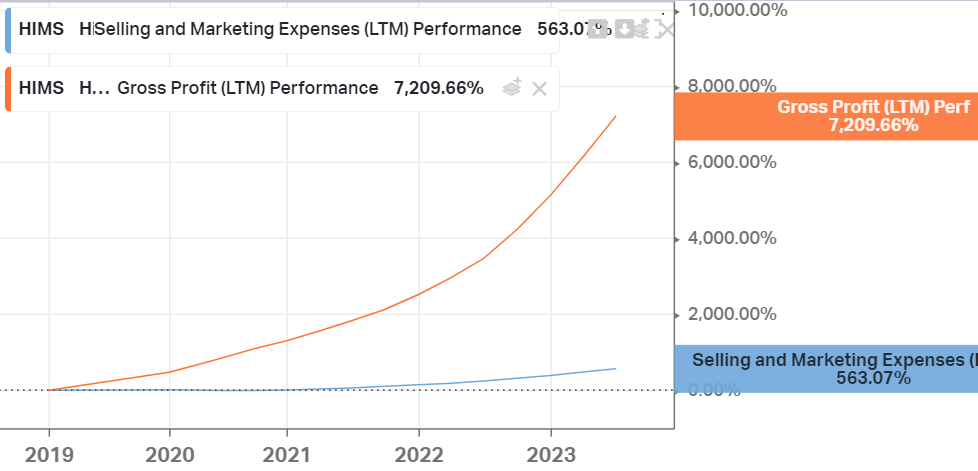

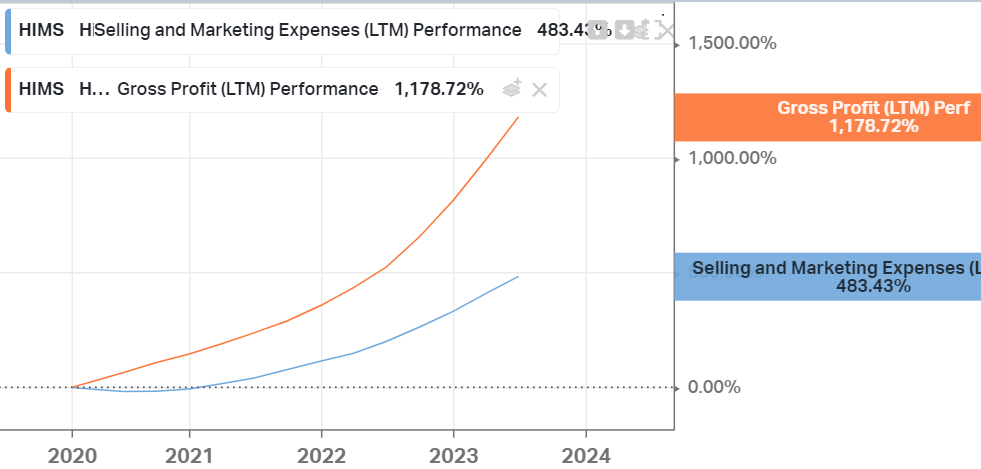

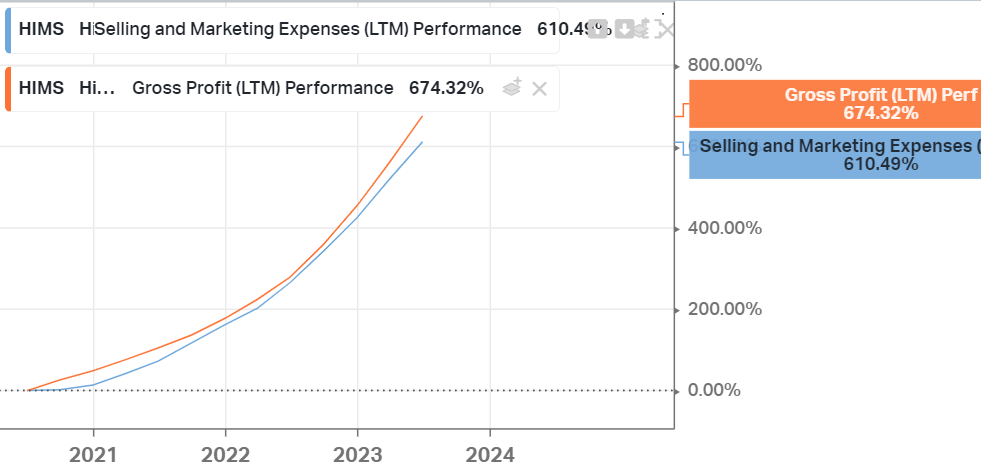

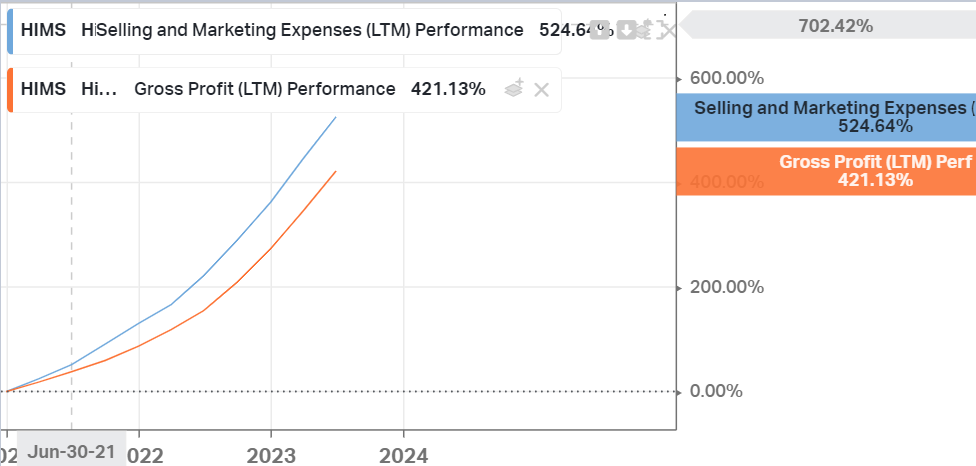

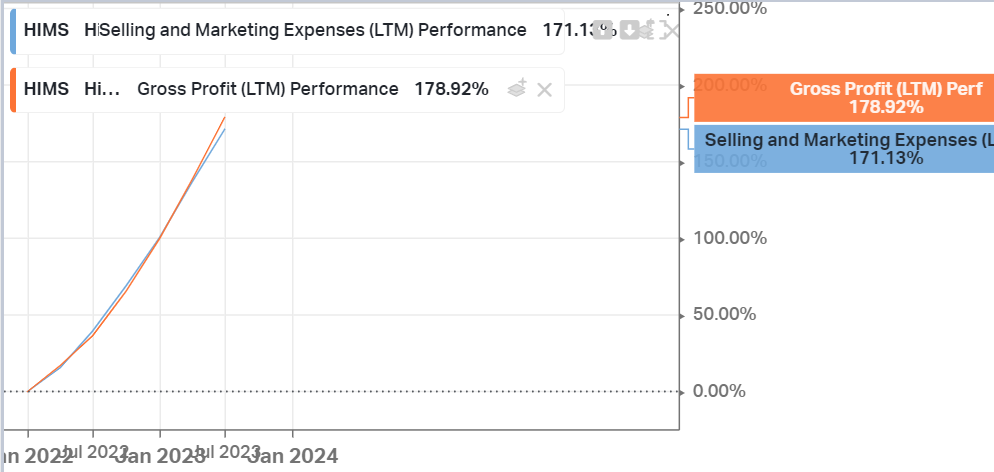

Here’s the evolution of gross profit vs marketing expenses:

Gross profit growth has stopped outpacing marketing growth recently, and that is concerning.

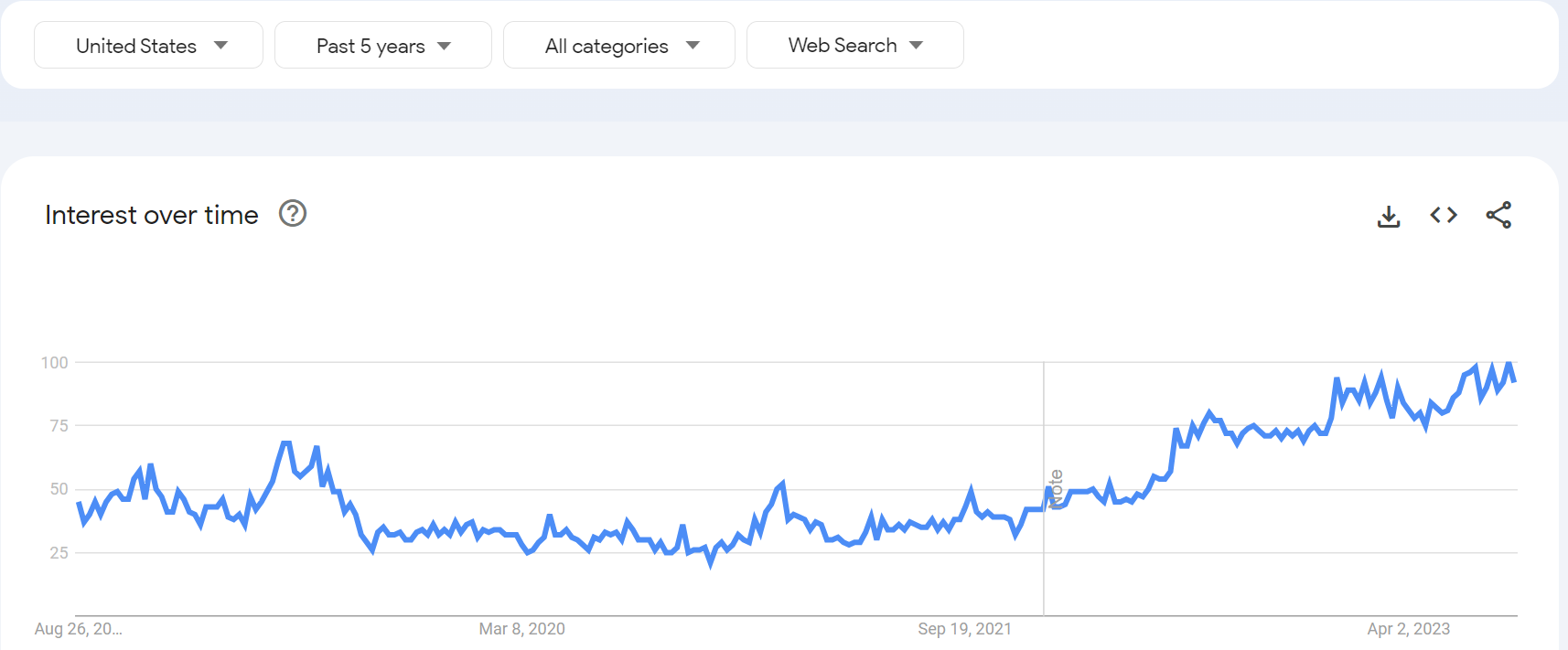

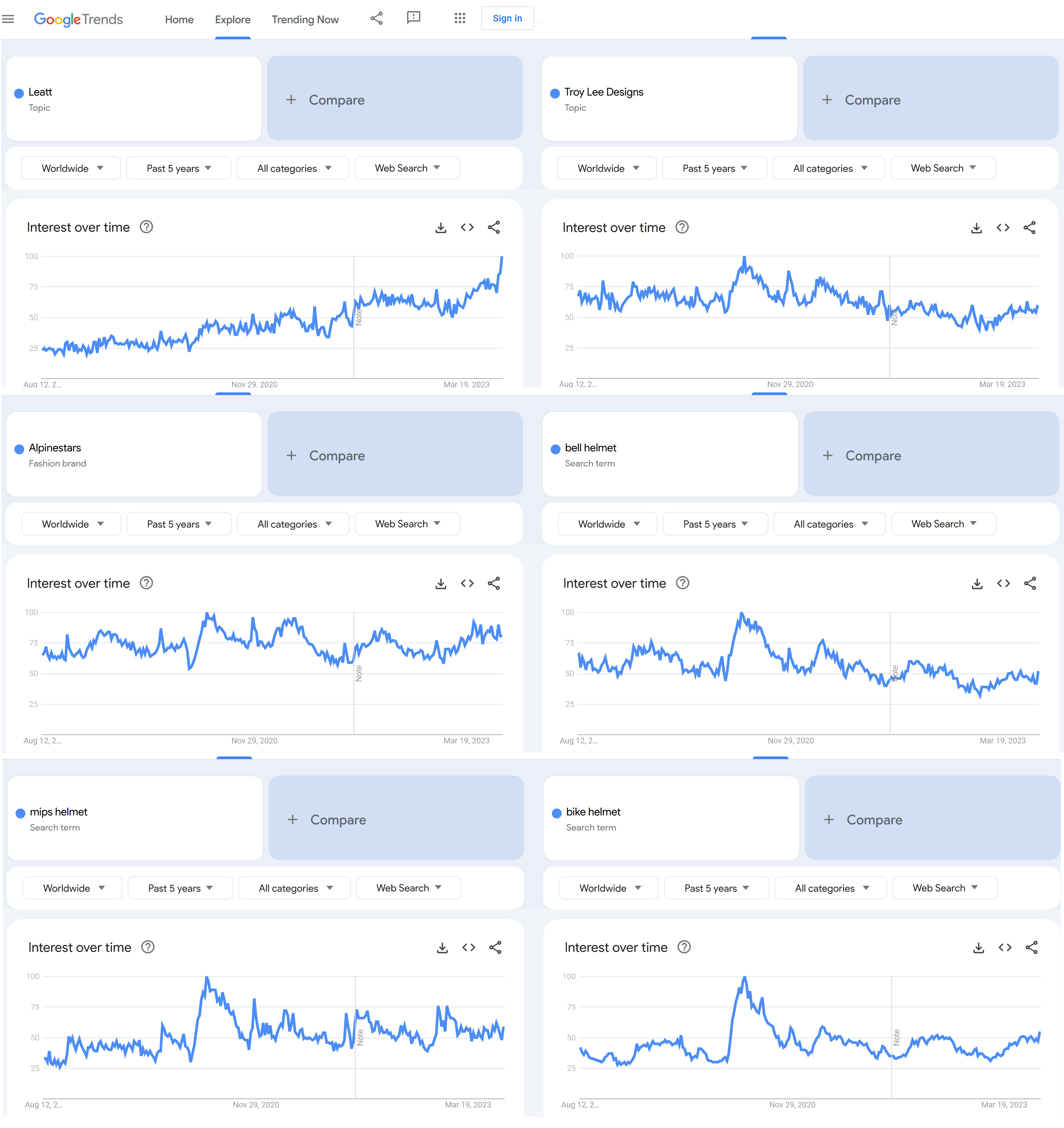

On the other hand, this Google trend is reassuring:

Here are the stats of forhims.com on SimilarWeb for the month of July'23:

- category rank: #29

- total visits: 8M

- bouce rate: 59%

- pages per visit: 4.93

- Avg visit duration: 00:01:58

All in all, three key metrics I want to track going forward are:

1/ Gross profit margin: target 80%+

We’ve been able to meaningfully lower prices in the last couple of months and aim to continue to do so for some of our higher value product bundles, while still maintaining and expanding to record high 82% gross margins.

2/ Payback period: target ~1y

Our expectation is for continued investment in marketing, as we launched new personalized offerings throughout the year. Similar to prior periods, we intend to do so while maintaining a one-year payback period.

I’ll note that one of the analysts (Jack Wallace) did ask about the difficult marketing environment but the CFO completely avoided the question. I’m not super pleased with that.

3/ Marketing expenses as a % of gross profit: target below 50%

Highest conviction of @DeepValueStonks.

Two articles from SA, following 2022Q4 and 2023Q2 earning calls: article 1, article 2.

Unfortunately, I’m not able to get excited about this. Maybe I’ll revisit later.

Note: he also owns $DK, which I remember Andrew (YAVB) pitching:

Crazy high-quality research note from Sohra Peak Capital Partners (archived here):

Note to self: this was trading at a P/B of 0.2 just a few months ago. The truly insane returns start with truly insane valuations and develop thanks to a compelling thesis.

Seems to have had a bad quarter. Need to look into it.

A thesis from SeekingAlpha: link.

Getting cheaper again?

For an intro to the idea, here’s Bill Ackaman explaining his thesis (May 7, 2022):

Another clip about Howard Hughees:

For a more in-depth report, see this one from Boyar Research: link (archived here).

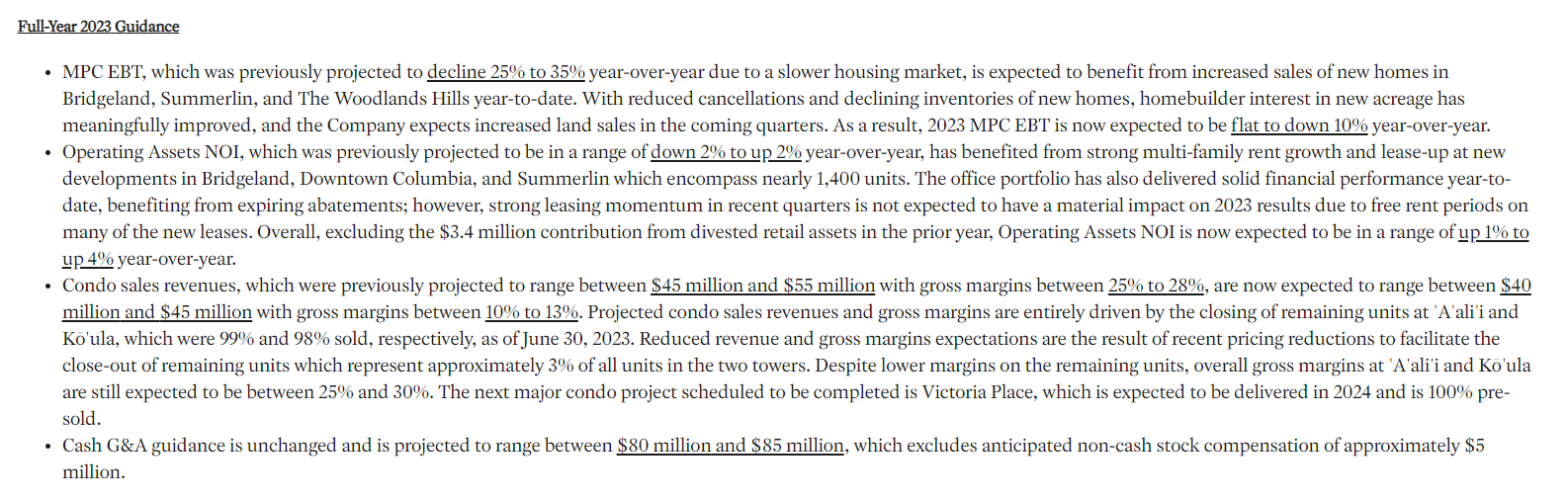

Here’s the guidance from the most recent ER:

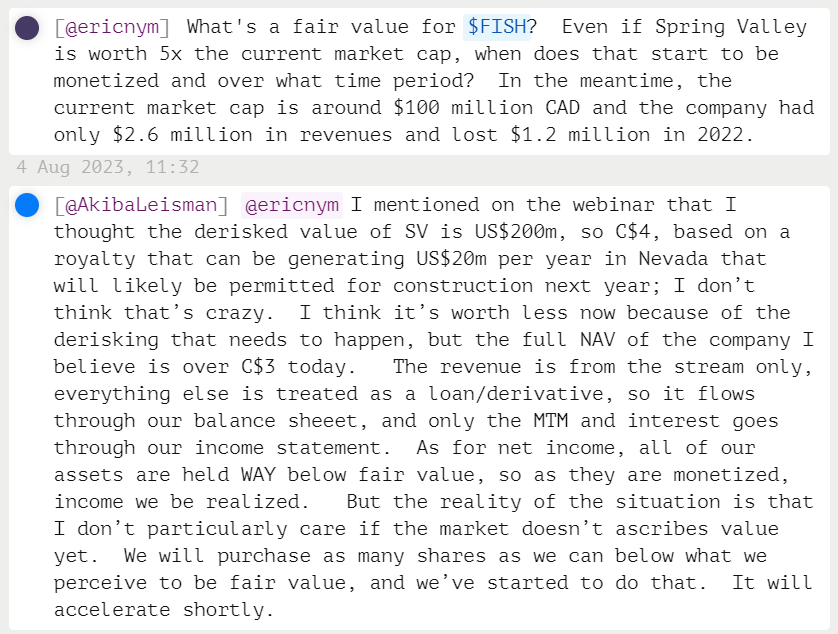

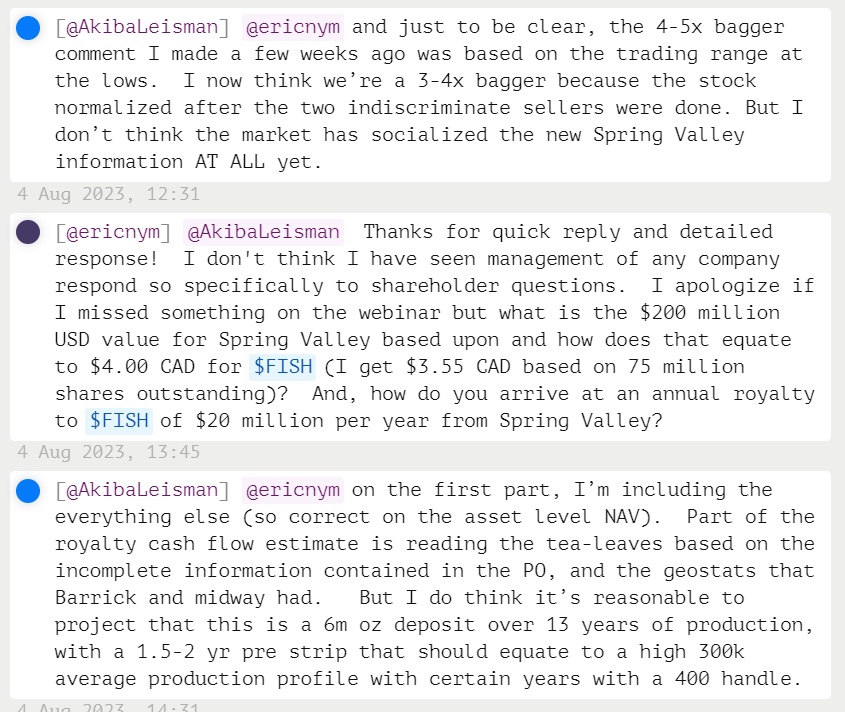

A Q&A sequence with Akiba:

I’ve added a bit.

Kingdom Capital Co-Founders join SumZero CEO to discuss their investments in PLCE.

And they had published their thesis on SA: The Children’s Place Is A Free Cash Flow Machine (archived here).

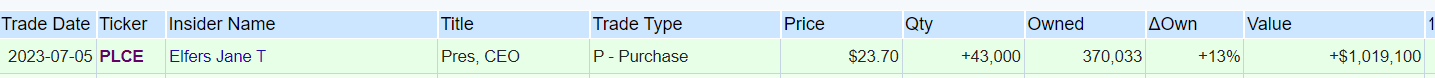

The CEO bought $1m worth of shares in July, at a slightly lower price point:

I bought some but sold after the earnings call. It’s probably a good (not greatbet).

(from this tweet)

(from this tweet)

Competitors: MIPS, Signa Sports, and Thule

$2.50 dividend in each of Q4 and Q4.

Writeup on VIC" link

Let’s remember to avoid this one.

Mohnish went heavy on this one.

Trading for 2-3x FCF with no debt.

Share count down significantly in the past year.

Long-life assets.

12% (2nd position) of Seth Klarman’s tracked portfolio on Dataroma - whaaaat?!

HUUUUGE Capex - but what happens whn/if it stops?

I think it’s time we listen to those earnings calls.

p.s. wow Klarman owns some $GTX too?!

A thread on the latest earnings call (archived here).

The Q1'24 shareholder letter: link.

Meh I think this is too complex for me.

A couple of buys from insiders. Nothing huge but it’s something.

P/B ~ 0.7x lowest historically.

I think I want a position here.

Klarman and Nygren own this too.

(thread)

(thread)

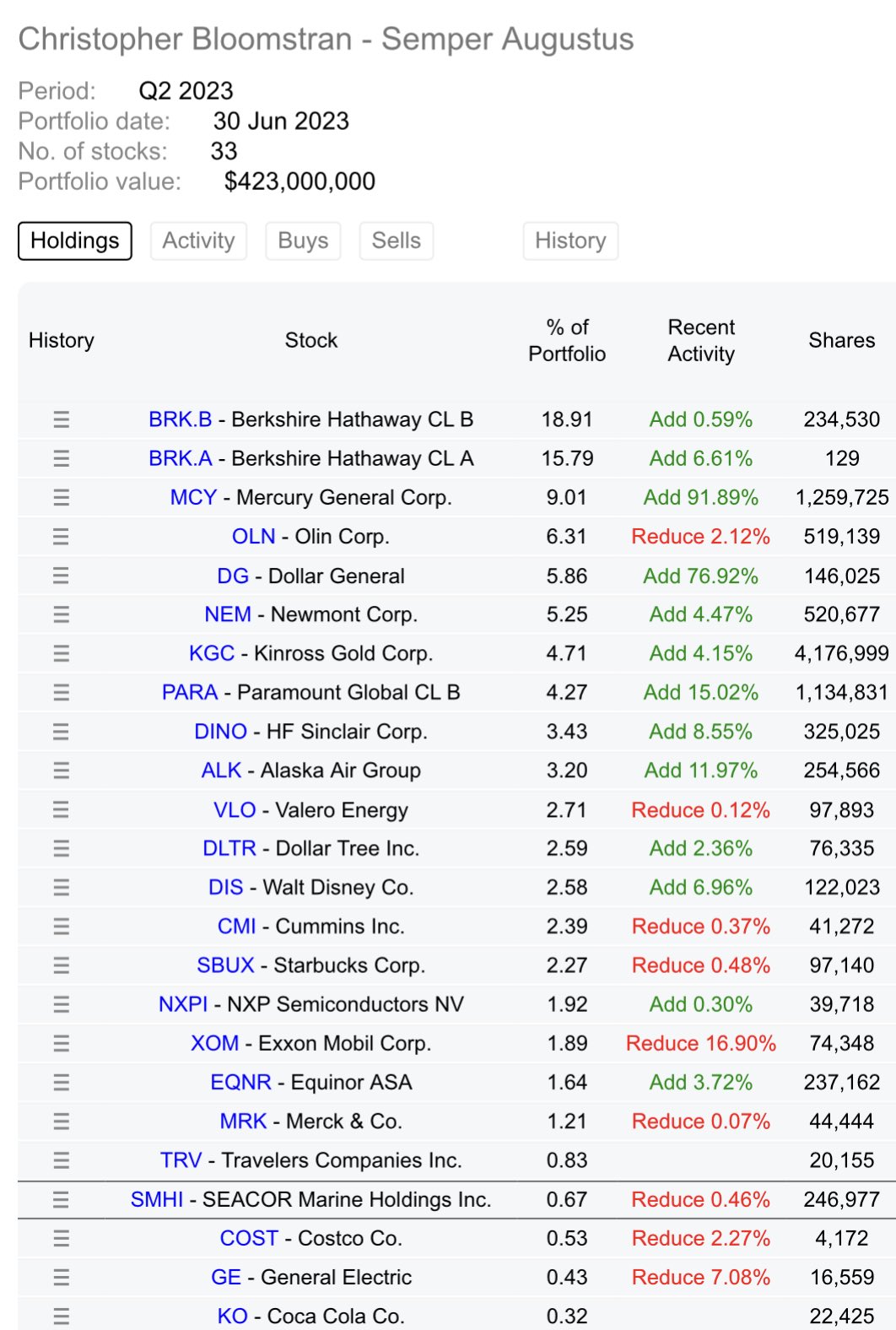

Part of the (updated) Semper Augustus portfolio:

Interesting profile:

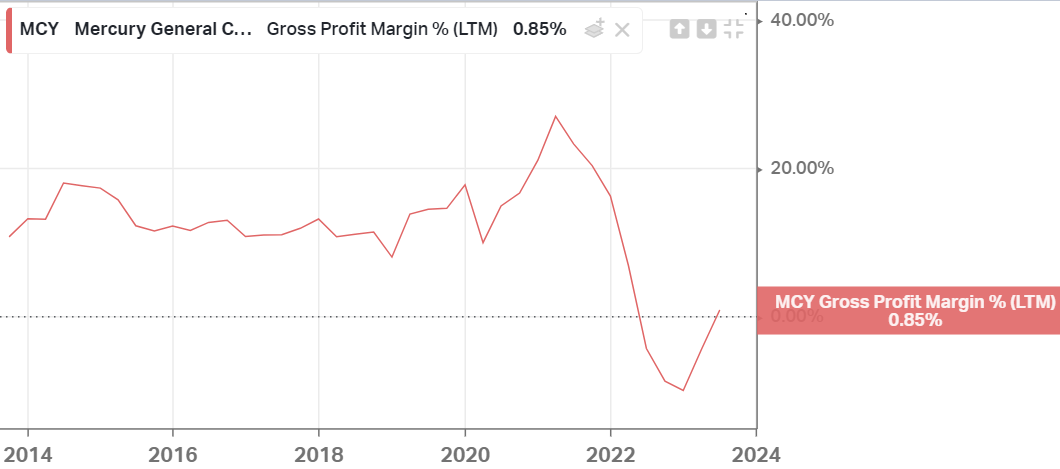

WHOA! What happened to gross margins?!

Been meaning to look again at this one.

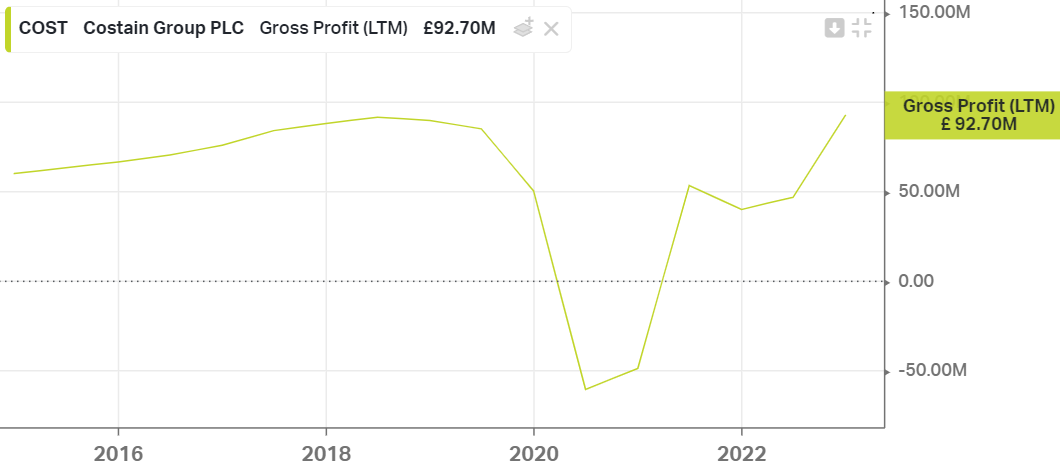

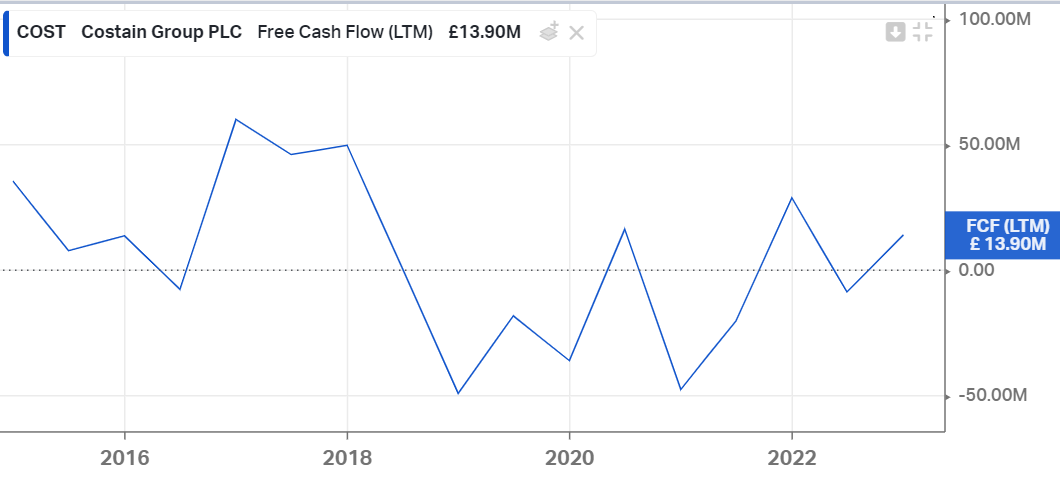

I mean it is a shitty business but they don’t have to do anything exceptional for this to work out reasonably well.

Some recent news about the company: link, including a New transport framework signed by Costain and the Department for Transport:

Costain, the infrastructure solutions company has been selected by the Department for Transport (DfT) as one of the key suppliers on the department’s latest Specialist Technical and Commercial Advice for Rail and Other Transport Modes (STAR Three) Framework. The framework, worth up to £600m in total, will run over an initial three-year period with an option to extend by a further year.

And a note on Costain’s exit from A66 scheme in July'23. More details here as well: link.

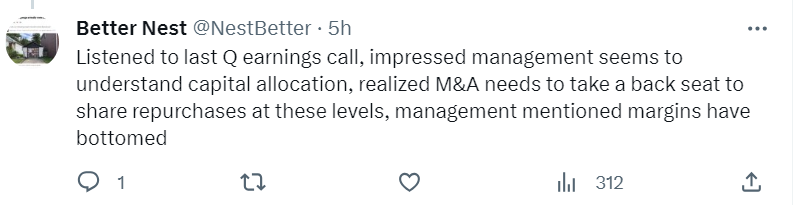

An old friend of mine. This tweet made me want to take another look:

(link)

Two small caps in Steve Cohen’s portfolio: decription.

$AGEN in particular is up big since this article was published yesterday.

Not much I can understand about these plays unfortunately, and a bit late to jump on the hype.

The best writeup I found on Trisura comes from The Questionable Investor, archived here.

A stock owned by Daniel Soak from Soak Capital. Read their 2Q'23 letter here.

Here’s the ER for the Fitlife’s 2Q'23 results: link.

Presented as a cigar butt by @chasericker3.

I think cigar butt bets work well when there is a catalyst, i.e. something or someone that will unlock the value.

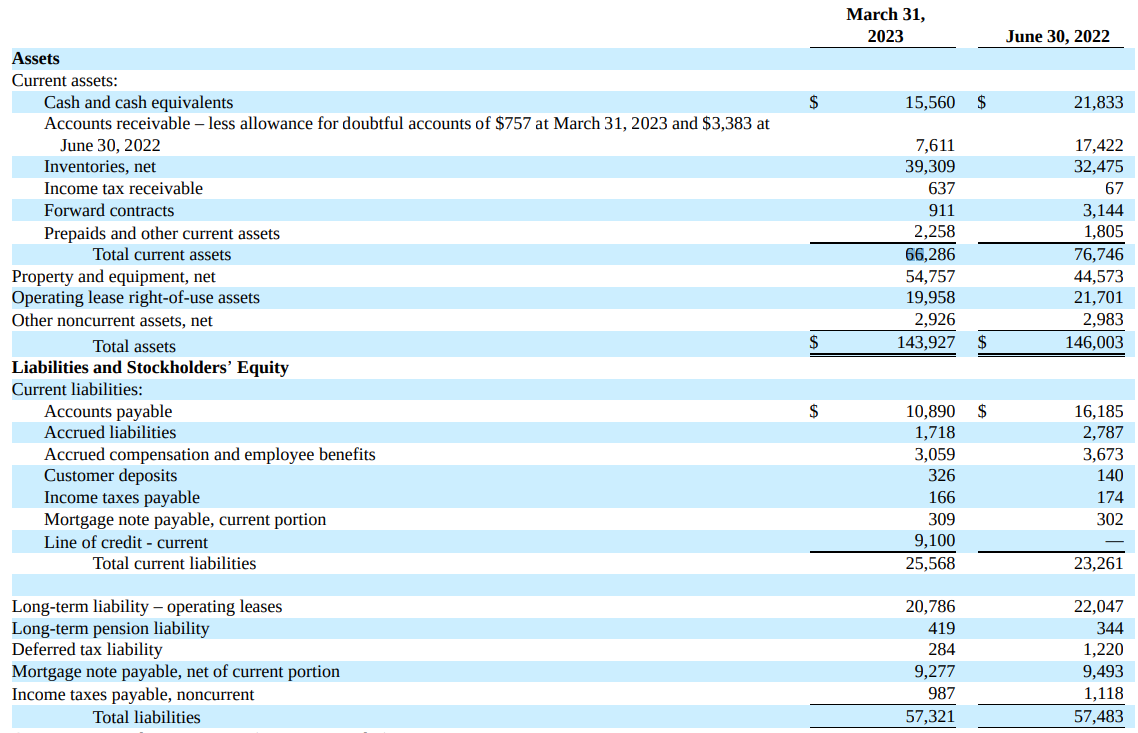

I listened to the video again with the 10Q open and here’s how I understand it now.

- market cap: $33M

- NCAV (current assets - all liabitlies excluding operating lease): $30M

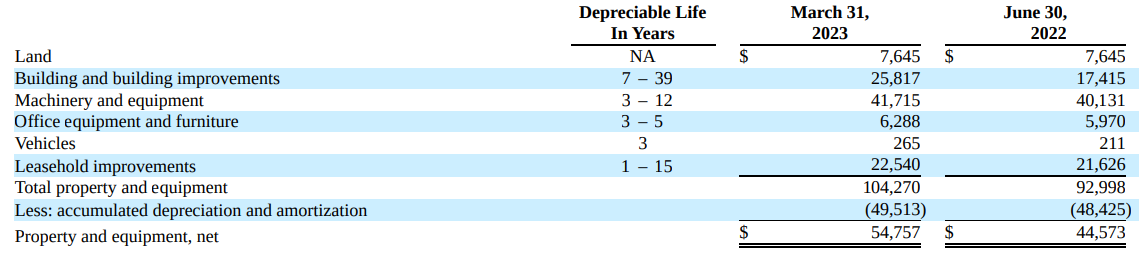

So it’s almost a net-net.

But for $3M, we get about $55M of property & equipment, net of depreciation. $7.6M of this $55M is land.

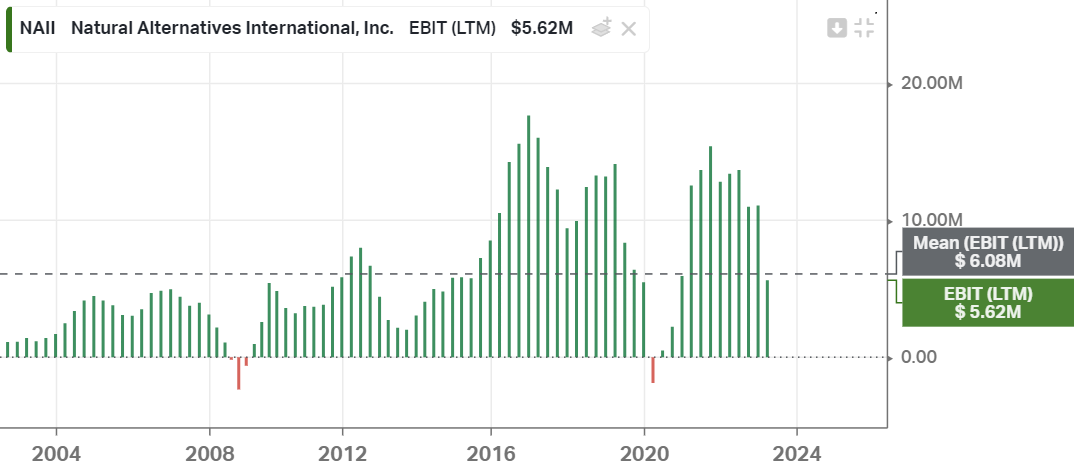

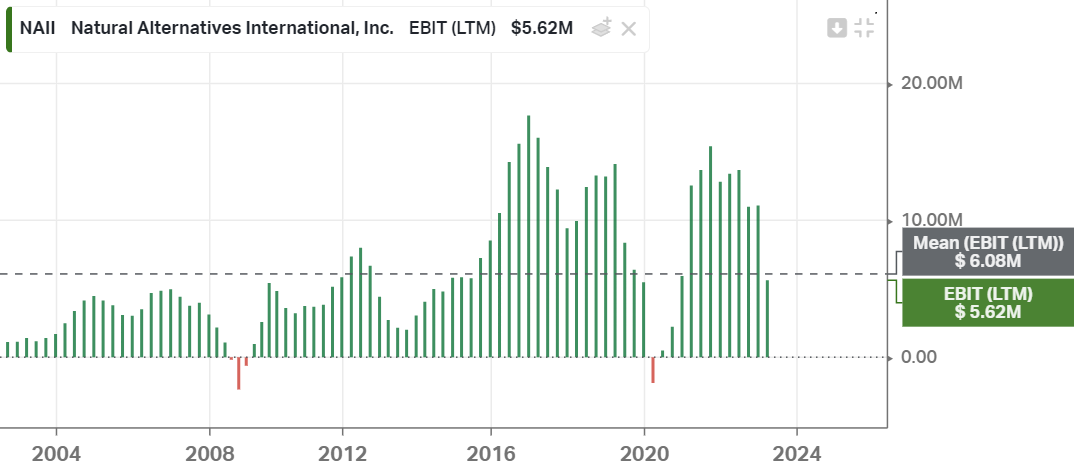

The company has been profitable for a long time:

It’s a capex super-heavy business though…

But if the capex expenses were to slow down…things could get interesting!

Maybe it’s time I find out what this business actually is about.

Let’s take a look at the price chart:

Here’s what caused the recent drop on August 16:

temporary closure of its new facility in Carlsbad, California, opened earlier this year to expand NAI’s production and add high-speed powder blending and packaging to its manufacturing capabilities, with an initial objective of handling current and estimated orders from one of its largest customers.

Due to this customer’s efforts to rebalance supply and demand, it is temporarily ceasing purchases from Natural Alternatives. As a result, NAI has determined to temporarily close its new high-speed powder blending and packaging facility.

Some serious buying from one specific insider (Aldo Bensadoun is the founder of Aldo Shoes):

From this tweet:

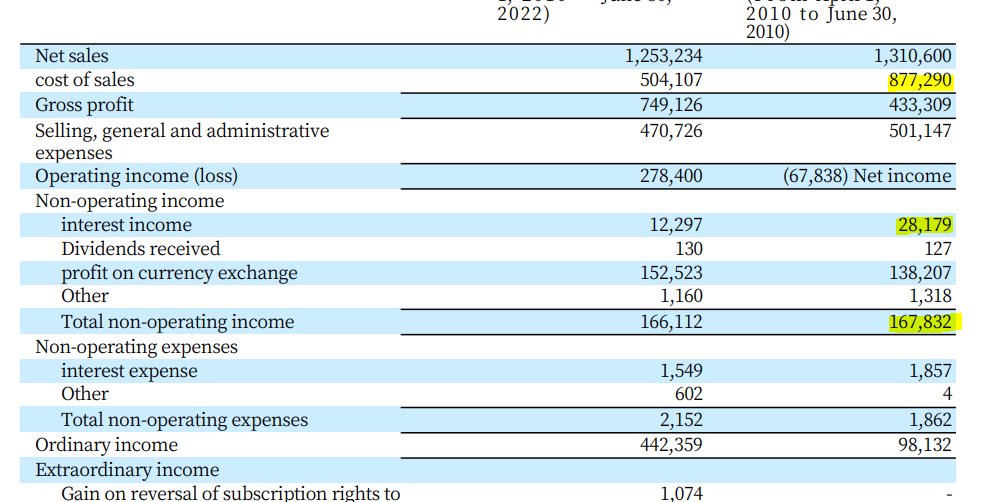

Was just reviewing the numbers from the latest earnings results (numbers in ‘000). It was a bad quarter:

For the full year prior to the quarter shown above (link):

Their next release will be Disgaea 7 (Oct 3rd). It better be good!

Yet another sum of the parts valuation: pdf.

Disqus comments are disabled.